0% found this document useful (0 votes)

1K views7 pagesOracle AR Invoicing & Accounting Rule

The document discusses invoicing and accounting rules in Oracle AR. Accounting rules determine the period when revenue for an invoice line is recorded, while invoicing rules determine when the receivable is recorded. There are different types of accounting and invoicing rules that can be used, including fixed schedule, variable schedule, and daily revenue rates. Invoices can be created using these rules, then revenue recognition and accounting entries are generated.

Uploaded by

سرفراز احمدCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views7 pagesOracle AR Invoicing & Accounting Rule

The document discusses invoicing and accounting rules in Oracle AR. Accounting rules determine the period when revenue for an invoice line is recorded, while invoicing rules determine when the receivable is recorded. There are different types of accounting and invoicing rules that can be used, including fixed schedule, variable schedule, and daily revenue rates. Invoices can be created using these rules, then revenue recognition and accounting entries are generated.

Uploaded by

سرفراز احمدCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- STEP 1: Create an Accounting/Invoicing Rule

- Introduction to Oracle AR Invoicing & Accounting Rule

- STEP 2: Create an Invoice Using the Above Rule

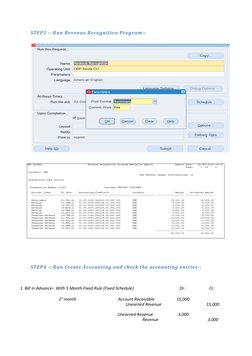

- STEP 3: Run Revenue Recognition Program

- STEP 4: Run Create Accounting and Check the Accounting Entries