Professional Documents

Culture Documents

Equity Invest - MC Quest.w Ans

Uploaded by

ElaineJrV-IgotOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Invest - MC Quest.w Ans

Uploaded by

ElaineJrV-IgotCopyright:

Available Formats

Multiple Choice.

Investment in Equity at FVPL and FVOCI

1. Which of the following are reported at fair value?

a. Debt investments.

b. Equity investments.

c. Both debt and equity investments.

d. None of these answers choices are correct.

2. Which of the following is not correct in regard to trading investments?

a. They are held with the intention of selling them in a short period of time.

b. Unrealized holding gains and losses are reported as part of net income.

c. Any discount or premium is not amortized.

d. All of these answer choices are correct.

3. Equity investments acquired by a corporation which are accounted for by recognizing

unrealized holding gains or losses as other comprehensive income and as a separate

component of equity are

a. non-trading where a company has holdings of less than 20%.

b. trading investments where a company has holdings of less than 20%.

c investments where a company has holdings of between 20% and 50%.

d. investments where a company has holdings of more than 50%.

4. Unrealized holding gains or losses on trading investments are reported in

a. equity.

b. net income.

c. other comprehensive income.

d. accumulated other comprehensive income.

5. Polska, Inc. purchased 400 ordinary shares of Millay Manufacturing as a trading

investment for P26,400. During the year, Millay Manufacturing paid a cash dividend of

P6.50 per share. At year-end, Milay Manufacturing shares were selling for P69 per

share. On the income statement for the year ended December 31, what is the total

amount of unrealized gain/loss and dividend revenue reported by Polska, Inc.?

a. P2,600

b. P1,200

c. P1,400

d. P3,800

6. Dumar Corporation purchased 800 ordinary shares of Viking Industries as a trading

investment for P14,880. During the year, Viking Industries paid a cash dividend of P3.20

per share. At year-end, Viking’s shares were selling for P17.40 per share. On the income

statement for the year ended December 31, what is the total amount of unrealized

gain/loss and dividend revenue reported by Dumar Corporation?

a. P1,600

b. P2,560

c. P960

d. P3,250

7. Loire Corporation purchased 1,600 ordinary shares of Comma Co. for P52,800. During

the year, Comma paid a cash dividend of P13 per share. At year-end, Comma shares

were selling for P38 per share. Loire Corporation purchased the shares to meet a non-

trading regulatory requirement. What amount of total income will Loire Corporation report

in its income statement for the year?

a. P-0-

b. P20,800

c. P8,000

d. P28,800

8. During 2016 Logic Company purchased 4,000 shares of Midi, Inc. for P30 per share.

The investment was classified as a trading investment. During the year Logic Company

sold 1,000 shares of Midi, Inc. for P35 per share. At December 31, 2016 the market

price of Midi, Inc.’s shares was P28 per share. What is the total amount of gain/(loss)

that Logic Company will report in its income statement for the year ended December 31,

2016 related to its investment in Midi, Inc. shares?

a. (P8,000)

b. P5,000

c. (P3,000)

d. (P1,000)

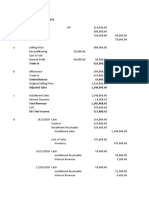

Use the following information for the next three questions.

Instrument Corp. has the following investments which were held throughout 2015–2016:

Fair Value

Cost 12/31/15 12/31/16

Trading P300,000 P400,000 P380,000

Non-trading 300,000 320,000 360,000

9. What amount of gain or loss would Instrument Corp. report in its income statement for

the year ended December 31, 2016 related to its investments?

a. P20,000 gain.

b. P20,000 loss.

c. P140,000 gain.

d. P80,000 gain.

10. What amount would be reported as accumulated other comprehensive income related to

investments in Instrument Corp.’s statement of financial position at December 31, 2015?

a. P40,000 gain.

b. P60,000 gain.

c. P20,000 gain.

d. P120,000 gain.

11. What amount would be reported as accumulated other comprehensive income related to

investments in Instrument Corp.’s statement of financial position at December 31,

2016? P60,000

12. At December 31, 2016, Atlanta Co. has a share portfolio valued at P40,000. Its cost was

P33,000. If the Fair Value Adjustment account has a debit balance of P2,000, which of

the following journal entries is required at December 31, 2016?

a. Fair Value Adjustment 7,000

Unrealized Holding Gain or Loss-Equity 7,000

b. Fair Value Adjustment 5,000

Unrealized Holding Gain or Loss-Equity 5,000

c. Unrealized Holding Gain or Loss-Equity 7,000

Fair Value Adjustment 7,000

d. Unrealized Holding Gain or Loss-Equity 5,000

Fair Value Adjustment 5,000

13. Kramer Company's trading investments portfolio which is appropriately included in

current assets is as follows:

December 31, 2016

Fair Unrealized

Cost Value Gain (Loss)

Catlett Corp. P250,000 P200,000 P(50,000)

Lyman, Inc. 245,000 265,000 20,000

P495,000 P465,000 P(30,000)

Ignoring income taxes, what amount should be reported as a charge against income in

Kramer's 2016 income statement if 2016 is Kramer's first year of operation?

a. P0.

b. P20,000.

c. P30,000.

d. P50,000.

14. On its December 31, 2015, statement of financial position, Trump Co. reported its

investment in non-trading securities, which had cost P600,000, at fair value of P550,000.

At December 31, 2016, the fair value of the securities was P585,000. What should

Trump report on its 2016 income statement as a result of the increase in fair value of the

investments in 2016?

a. P0.

b. Unrealized loss of P15,000.

c. Realized gain of P35,000.

d. Unrealized gain of P35,000.

On its December 31, 2015 statement of financial position, Calhoun Company appropriately

reported a P10,000 debit balance in its Fair Value Adjustment account. There was no change

during 2016 in the composition of Calhoun’s portfolio of equity securities held as non-trading

securities. The following information pertains to that portfolio:

Security Cost Fair value at 12/31/16

X P125,000 P160,000

Y 100,000 95,000

Z 175,000 125,000

P400,000 P380,000

15. What amount of unrealized loss on these securities should be included in Calhoun's

equity section of the statement of financial position at December 31, 2016?

a. P30,000.

b. P20,000.

c. P10,000.

d. P0.

16. Valet Corp. began operations in 2016. An analysis of Valet’s equity investments portfolio

acquired in 2016 shows the following totals at December 31, 2016 for trading and non-

trading investments:

Trading Non-trading

Investments Investments

Aggregate cost P90,000 P110,000

Aggregate fair value 65,000 95,000

What amount should Valet report in its 2016 income statement for unrealized holding

loss?

a. P40,000.

b. P10,000.

c. P15,000.

d. P25,000.

17. At December 31, 2016, Jeter Corp. had the following equity investments that were

purchased during 2016, its first year of operation:

Fair Unrealized

Cost Value Gain (Loss)

Trading Investments:

Security A P 90,000 P 60,000 P(30,000)

B 15,000 20,000 5,000

Totals P105,000 P 80,000 P(25,000)

Non-trading Investments:

Security Y P 70,000 P 80,000 P 10,000

Z 85,000 55,000 (30,000)

Totals P155,000 P135,000 P(20,000)

All market declines are considered temporary. Fair value adjustments at December 31,

2016 should be established with a corresponding charge against

Income Equity

a. P45,000 P 0

b. P30,000 P30,000

c. P25,000 P20,000

d. P25,000 P 0

You might also like

- Transfer PricingDocument20 pagesTransfer PricingRia Gabs100% (1)

- Week 1 .04 - Philippine Budgetary ProcessDocument70 pagesWeek 1 .04 - Philippine Budgetary ProcessElaineJrV-Igot100% (1)

- John Dee - Sigillum Dei Aemeth or Seal of The Truth of God EnglishDocument2 pagesJohn Dee - Sigillum Dei Aemeth or Seal of The Truth of God Englishsatyr70286% (7)

- Examination About Investment 12Document4 pagesExamination About Investment 12BLACKPINKLisaRoseJisooJennieNo ratings yet

- Mas Problems 2018Document30 pagesMas Problems 2018Christine Ballesteros Villamayor75% (4)

- Mas Problems 2018Document30 pagesMas Problems 2018Christine Ballesteros Villamayor75% (4)

- 62230126Document20 pages62230126ROMULO CUBIDNo ratings yet

- Prelim Review Docx 427399963 Prelim ReviewDocument42 pagesPrelim Review Docx 427399963 Prelim ReviewMarjorie PalmaNo ratings yet

- The University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16Document5 pagesThe University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16ana rosemarie enaoNo ratings yet

- MCQs - TAX - General PrinciplesDocument24 pagesMCQs - TAX - General PrinciplesElaineJrV-Igot100% (1)

- MCQs - TAX - General PrinciplesDocument24 pagesMCQs - TAX - General PrinciplesElaineJrV-Igot100% (1)

- Notes FAR Investment in Associates Equity MethodDocument4 pagesNotes FAR Investment in Associates Equity MethodKerwin Lester MandacNo ratings yet

- Notes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)Document10 pagesNotes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)ElaineJrV-IgotNo ratings yet

- Chapter 6 - ProblemsDocument6 pagesChapter 6 - ProblemsDeanna GicaleNo ratings yet

- Week 1 .05 Government Accounting Manual and International Public Sector Accounting StandardsDocument21 pagesWeek 1 .05 Government Accounting Manual and International Public Sector Accounting StandardsElaineJrV-IgotNo ratings yet

- PPEDocument1 pagePPEExcelsia Grace A. Parreño0% (1)

- JJJDocument12 pagesJJJCamille ManalastasNo ratings yet

- Alvarez Hazel C.audit of Notes Payable SolutionDocument4 pagesAlvarez Hazel C.audit of Notes Payable Solutionhazel alvarezNo ratings yet

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatriceNo ratings yet

- Teamprtc Mock Board Oct 2020 Afar PDFDocument16 pagesTeamprtc Mock Board Oct 2020 Afar PDFBryle EscosaNo ratings yet

- ZMSQ 08 Capital BudgetingDocument10 pagesZMSQ 08 Capital BudgetingMary Grace Narag100% (1)

- Local Media7735387659572366861Document3 pagesLocal Media7735387659572366861heynuhh gNo ratings yet

- This Study Resource Was: Operating Lease and LeasebackDocument7 pagesThis Study Resource Was: Operating Lease and LeasebackMarcus MonocayNo ratings yet

- Diagnostic Exam 1 23 AKDocument11 pagesDiagnostic Exam 1 23 AKAbegail Kaye BiadoNo ratings yet

- 1.Gdpr - Preparation Planning GanttDocument6 pages1.Gdpr - Preparation Planning GanttbeskiNo ratings yet

- Christiane Nord - Text Analysis in Translation (1991) PDFDocument280 pagesChristiane Nord - Text Analysis in Translation (1991) PDFDiana Polgar100% (2)

- BASICS of Process ControlDocument31 pagesBASICS of Process ControlMallikarjun ManjunathNo ratings yet

- Prelim Task De-Vera Angela-KyleDocument6 pagesPrelim Task De-Vera Angela-KyleJohn Francis RosasNo ratings yet

- San Beda College Alabang Homework Exercise-Act851RDocument4 pagesSan Beda College Alabang Homework Exercise-Act851RJomel BaptistaNo ratings yet

- Assets MCDocument19 pagesAssets MCpahuyobea cutiepatootieNo ratings yet

- Examination About Investment 7Document3 pagesExamination About Investment 7BLACKPINKLisaRoseJisooJennieNo ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- DocxDocument10 pagesDocxAiziel OrenseNo ratings yet

- Pre Week MaterialsDocument44 pagesPre Week MaterialsMarjorie PalmaNo ratings yet

- LiabilitiesDocument8 pagesLiabilitiesGerald F. SalasNo ratings yet

- Bvps and EpsDocument30 pagesBvps and EpsRenzo Melliza100% (1)

- Audit ProbDocument36 pagesAudit ProbSheena BaylosisNo ratings yet

- This Study Resource Was: F-ACADL-01Document8 pagesThis Study Resource Was: F-ACADL-01Marjorie PalmaNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- P 1Document3 pagesP 1Thea Kimberly Oamil0% (1)

- Investment in Bonds / Financial Assets at Amortized CostDocument1 pageInvestment in Bonds / Financial Assets at Amortized CostSteffanie Olivar0% (1)

- Global CompanyDocument1 pageGlobal Companydagohoy kennethNo ratings yet

- This Study Resource Was Shared Via: Solution 23-2 Answer DDocument5 pagesThis Study Resource Was Shared Via: Solution 23-2 Answer DDummy GoogleNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- ExamDocument7 pagesExamKristen WalshNo ratings yet

- Current LiabilitiesDocument9 pagesCurrent LiabilitiesErine ContranoNo ratings yet

- Compound Financial Instruments and Note PayableDocument4 pagesCompound Financial Instruments and Note PayablePaula Rodalyn MateoNo ratings yet

- AP Review LiabDocument10 pagesAP Review LiabTuya DayomNo ratings yet

- Cash and Cash Equivalents: Answer: CDocument142 pagesCash and Cash Equivalents: Answer: CGarp BarrocaNo ratings yet

- AssignmentDocument2 pagesAssignmentLois JoseNo ratings yet

- Answers Chapter 13 Quiz.f13Document2 pagesAnswers Chapter 13 Quiz.f13Razel TercinoNo ratings yet

- A6 Share 221 eDocument2 pagesA6 Share 221 eNika Ella SabinoNo ratings yet

- Audit-Of Inventory ACHA - KJDocument47 pagesAudit-Of Inventory ACHA - KJKhrisna Joy AchaNo ratings yet

- Renton Effective Am21Document5 pagesRenton Effective Am21Kris Hazel RentonNo ratings yet

- Examination About Investment 2Document2 pagesExamination About Investment 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- Ae16 Interm AccDocument15 pagesAe16 Interm Accana rosemarie enaoNo ratings yet

- Chapter 2 Problems - IADocument8 pagesChapter 2 Problems - IAKimochi SenpaiiNo ratings yet

- Audit of Inventory 2021 - ExamDocument9 pagesAudit of Inventory 2021 - ExammoreNo ratings yet

- C3 - Warranty LiabilityDocument12 pagesC3 - Warranty LiabilityRiza Kristine DaytoNo ratings yet

- Ia Shareholder's Equity Practice ProblemsDocument5 pagesIa Shareholder's Equity Practice ProblemsMary Jescho Vidal AmpilNo ratings yet

- ACC 226 Final Exam SOLUTIONDocument14 pagesACC 226 Final Exam SOLUTIONEllen MNo ratings yet

- Examination About Investment 13Document2 pagesExamination About Investment 13BLACKPINKLisaRoseJisooJennieNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur Salameda100% (1)

- Module 13 Present ValueDocument10 pagesModule 13 Present ValueChristine Elaine LamanNo ratings yet

- RevalDocument2 pagesRevalRusselle Therese DaitolNo ratings yet

- Receivable Practice Problem 1Document2 pagesReceivable Practice Problem 1ayeeeNo ratings yet

- 5.1 Seatwork Quiz Receivable FinancingDocument2 pages5.1 Seatwork Quiz Receivable FinancingSean Aaron Segucio0% (1)

- Answer Value 800000Document1 pageAnswer Value 800000Kath LeynesNo ratings yet

- ReviewerDocument5 pagesReviewermaricielaNo ratings yet

- Qualifying Examination: Financial Accounting 2Document11 pagesQualifying Examination: Financial Accounting 2Patricia ByunNo ratings yet

- Pract 1Document24 pagesPract 1Andrea TugotNo ratings yet

- BS & Is (Questions)Document7 pagesBS & Is (Questions)Dale JimenoNo ratings yet

- Date Entry Per Client Correct Entry A. 2020 No Entry (Failed To Record)Document22 pagesDate Entry Per Client Correct Entry A. 2020 No Entry (Failed To Record)Scarlet DragonNo ratings yet

- Week 1 .03 Definition, Scope and Objectives of Government AccountingDocument13 pagesWeek 1 .03 Definition, Scope and Objectives of Government AccountingElaineJrV-IgotNo ratings yet

- Week 1 .06 - Revised Chart of AccountsDocument19 pagesWeek 1 .06 - Revised Chart of AccountsElaineJrV-IgotNo ratings yet

- Ch2 Cases NotesDocument14 pagesCh2 Cases NotesElaineJrV-IgotNo ratings yet

- Notes - FAR - InvestmentDocument7 pagesNotes - FAR - InvestmentElaineJrV-IgotNo ratings yet

- STATEMENT OF ETHICAL PROFESSIONAL PRACTICE - ACC6001 Spring 2018 PDFDocument4 pagesSTATEMENT OF ETHICAL PROFESSIONAL PRACTICE - ACC6001 Spring 2018 PDFRATIKA ARORANo ratings yet

- Chapter 13 14 Afar PDF FreeDocument13 pagesChapter 13 14 Afar PDF FreeNiki HanNo ratings yet

- 21Document2 pages21ElaineJrV-IgotNo ratings yet

- 17Document2 pages17ElaineJrV-IgotNo ratings yet

- Bee Seance Ait) Rete Ce Nature of Audit Evidence Available L Rieu ToDocument2 pagesBee Seance Ait) Rete Ce Nature of Audit Evidence Available L Rieu ToElaineJrV-IgotNo ratings yet

- Sample Quiz KEY1Document6 pagesSample Quiz KEY1ElaineJrV-IgotNo ratings yet

- 18Document2 pages18ElaineJrV-IgotNo ratings yet

- This Study Resource Was: Answer Key Chapter 1 and Chapter 2 QuizDocument7 pagesThis Study Resource Was: Answer Key Chapter 1 and Chapter 2 QuizLaiza Joyce SalesNo ratings yet

- 20Document2 pages20ElaineJrV-IgotNo ratings yet

- Sample Quiz KEY1Document6 pagesSample Quiz KEY1ElaineJrV-IgotNo ratings yet

- Notes - FAR - Cash and Cash EquivalentsDocument9 pagesNotes - FAR - Cash and Cash EquivalentsElaineJrV-IgotNo ratings yet

- Notes - MAS - ManAcc (Budgeting)Document2 pagesNotes - MAS - ManAcc (Budgeting)ElaineJrV-IgotNo ratings yet

- 5.ast - Installment & FranchisingDocument12 pages5.ast - Installment & FranchisingElaineJrV-IgotNo ratings yet

- Notes - FAR - InvestmentDocument7 pagesNotes - FAR - InvestmentElaineJrV-IgotNo ratings yet

- 4.ast - Consignment & InstallmentDocument17 pages4.ast - Consignment & InstallmentElaineJrV-IgotNo ratings yet

- The 5 Basic Sentence PatternsDocument6 pagesThe 5 Basic Sentence PatternsShuoNo ratings yet

- 07.03.09 Chest PhysiotherapyDocument10 pages07.03.09 Chest PhysiotherapyMuhammad Fuad MahfudNo ratings yet

- Mag Issue137 PDFDocument141 pagesMag Issue137 PDFShafiq Nezat100% (1)

- G.R. No. 205307 PEOPLE Vs EDUARDO GOLIDAN y COTO-ONGDocument24 pagesG.R. No. 205307 PEOPLE Vs EDUARDO GOLIDAN y COTO-ONGRuel FernandezNo ratings yet

- 21st Century NotesDocument3 pages21st Century NotesCarmen De HittaNo ratings yet

- Literacy Block Lesson PlanDocument5 pagesLiteracy Block Lesson Planapi-286592038No ratings yet

- Gender Religion and CasteDocument41 pagesGender Religion and CasteSamir MukherjeeNo ratings yet

- List of Naruto Char.Document40 pagesList of Naruto Char.Keziah MecarteNo ratings yet

- 280-Article Text-1201-1-10-20220426Document8 pages280-Article Text-1201-1-10-20220426Ayu Ratri PNo ratings yet

- The First Quality Books To ReadDocument2 pagesThe First Quality Books To ReadMarvin I. NoronaNo ratings yet

- Anais Nin - Under A Glass Bell-Pages-29-32 WordDocument6 pagesAnais Nin - Under A Glass Bell-Pages-29-32 WordArmina MNo ratings yet

- Men Orr HagiaDocument8 pagesMen Orr HagiaAtika Bashirati IlmanNo ratings yet

- Upload Emp Photo ConfigDocument14 pagesUpload Emp Photo Configpaulantony143No ratings yet

- Seerat Mujaddid Alf-e-Sani (Urdu)Document518 pagesSeerat Mujaddid Alf-e-Sani (Urdu)Talib Ghaffari100% (12)

- Accounting Volume 1 Canadian 8th Edition Horngren Solutions ManualDocument25 pagesAccounting Volume 1 Canadian 8th Edition Horngren Solutions ManualElizabethBautistadazi100% (43)

- Beginner Levels of EnglishDocument4 pagesBeginner Levels of EnglishEduardoDiazNo ratings yet

- Ra 9048 Implementing RulesDocument9 pagesRa 9048 Implementing RulesToffeeNo ratings yet

- Nursing Documentation Course 2020Document36 pagesNursing Documentation Course 2020Marianne Laylo100% (1)

- What If The Class Is Very BigDocument2 pagesWhat If The Class Is Very BigCamilo CarantónNo ratings yet

- Grátis ExamDocument26 pagesGrátis ExamMaurilioNo ratings yet

- Mein Leben Und Streben by May, Karl Friedrich, 1842-1912Document129 pagesMein Leben Und Streben by May, Karl Friedrich, 1842-1912Gutenberg.orgNo ratings yet

- Summary of All Sequences For 4MS 2021Document8 pagesSummary of All Sequences For 4MS 2021rohanZorba100% (3)

- Soal Respi 2010Document41 pagesSoal Respi 2010Joseph ThanaNo ratings yet

- Mindfulness: Presented by Joshua Green, M.S. Doctoral Intern at Umaine Counseling CenterDocument12 pagesMindfulness: Presented by Joshua Green, M.S. Doctoral Intern at Umaine Counseling CenterLawrence MbahNo ratings yet

- Hapter 2: Theoretical FrameworkDocument18 pagesHapter 2: Theoretical FrameworkMohamed HamzaNo ratings yet

- Remarkings AirportsDocument1 pageRemarkings AirportsJuan Jose CaleroNo ratings yet