Professional Documents

Culture Documents

Cash Flow Class Question Solved

Uploaded by

Kabeer Qureshi0 ratings0% found this document useful (0 votes)

7 views2 pagesOriginal Title

Cash Flow Class Question solved

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesCash Flow Class Question Solved

Uploaded by

Kabeer QureshiCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

Operating Activities Cash Flow

Profit before taxation

Financial Charges Paid

Long-term loans and advances - net increase in assets

Long-term deposits – net decrease in assets

Depreciation charged to Profit and Loss account during the year

Impairment loss recorded in Profit and Loss account

Amortization of intangible assets during the year

Profit on sale of fixed assets

Fixed assets retired (net book value)

Provision for gratuity recorded in Profit and Loss account

Provision for slow moving / obsolete stores and spares

Increase in current assets

Profit on short term investment and bank deposit accounts recoded in P&L

Financial charges recorded in Profit and Loss account

Increase in current liabilities

Gratuity

Taxes Paid

Net cash used in operating activities

Investing Activities Cash Flow

Capital expenditure during the year

Profit received on investment and bank deposit accounts during the year

Proceeds from sale of operating fixed assets

Net cash used in investing activities

Financing Activities Cash Flow

Proceeds from long-term financing from banking companies

Repayment of long-term financing from banking companies

Proceeds from long-term sponsor's loan

Proceeds from long-term sponsor's subordinated loan

Repayment of Director loan

Net cash used in financing activities

Net decrease in cash and cash equivalent

Opening cash and cash equivalent

Ending cash and cash equivalent

37,442

(81,610)

(5,100)

149

277,827

873

39

(508)

29

9,232

3,500

(1,479,376)

(27)

99,693

304,450

(4,383)

(26,879)

(864,649)

(2,592,761)

72

1,433

(2,591,256)

5,500,000

(3,559,524)

450,000

75,000

(150,000)

2,315,476

(1,140,429)

(277,118)

(1,417,547)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- PTA License ListDocument46 pagesPTA License ListKabeer QureshiNo ratings yet

- MS & PHD Economics Fall 2022Document1 pageMS & PHD Economics Fall 2022Kabeer QureshiNo ratings yet

- MS Development Studies Fall 2022Document1 pageMS Development Studies Fall 2022Kabeer QureshiNo ratings yet

- MBA Evening Fall 2022 City CampusDocument8 pagesMBA Evening Fall 2022 City CampusKabeer QureshiNo ratings yet

- MBA Evening Main Campus Spring 2023Document1 pageMBA Evening Main Campus Spring 2023Kabeer QureshiNo ratings yet

- Assignment 6Document1 pageAssignment 6Kabeer QureshiNo ratings yet

- MS Marketing Fall 2022Document1 pageMS Marketing Fall 2022Kabeer QureshiNo ratings yet

- MS Finance Fall 2022Document1 pageMS Finance Fall 2022Kabeer QureshiNo ratings yet

- Resource Leveling & Resource SmoothingDocument6 pagesResource Leveling & Resource SmoothingKabeer QureshiNo ratings yet

- MSCS & DS Fall 2022Document1 pageMSCS & DS Fall 2022Kabeer QureshiNo ratings yet

- Problem Set 1 PMDocument3 pagesProblem Set 1 PMKabeer QureshiNo ratings yet

- Prabhar Oil CompanyDocument15 pagesPrabhar Oil CompanyKabeer QureshiNo ratings yet

- j.PinsonandBrosdahl 2013JMMRDocument16 pagesj.PinsonandBrosdahl 2013JMMRKabeer QureshiNo ratings yet

- MBA Morning Spring 2023Document1 pageMBA Morning Spring 2023Kabeer QureshiNo ratings yet

- MBA Executive Spring 2023Document1 pageMBA Executive Spring 2023Kabeer QureshiNo ratings yet

- NIB 2016 NIB BankDocument133 pagesNIB 2016 NIB BankKabeer QureshiNo ratings yet

- AMC - Assignment 2 - 3Document3 pagesAMC - Assignment 2 - 3Kabeer QureshiNo ratings yet

- Case Study - Lucky Cement and OthersDocument16 pagesCase Study - Lucky Cement and OthersKabeer QureshiNo ratings yet

- Plant Assets, Natural Resources, and Intangible AssetsDocument92 pagesPlant Assets, Natural Resources, and Intangible AssetsKabeer QureshiNo ratings yet

- Financial Performance Report General Tyres and Rubber Company-FinalDocument29 pagesFinancial Performance Report General Tyres and Rubber Company-FinalKabeer QureshiNo ratings yet

- Course Outline - FAIS Online Summer 2020Document6 pagesCourse Outline - FAIS Online Summer 2020Kabeer QureshiNo ratings yet

- Summary of Corporate Fraud ArticleDocument3 pagesSummary of Corporate Fraud ArticleKabeer QureshiNo ratings yet

- Vehicle Telematics Catalog February 2020Document29 pagesVehicle Telematics Catalog February 2020Kabeer QureshiNo ratings yet

- ME Viva-Instructions and Guiding QuestionsDocument2 pagesME Viva-Instructions and Guiding QuestionsKabeer QureshiNo ratings yet

- Satayam CaseDocument4 pagesSatayam CaseKabeer QureshiNo ratings yet

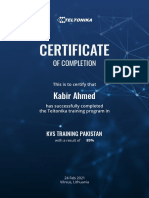

- KVS Training CertificateDocument1 pageKVS Training CertificateKabeer QureshiNo ratings yet

- Annual Report 2020Document149 pagesAnnual Report 2020Kabeer QureshiNo ratings yet

- Genset Fuel MonitoringDocument10 pagesGenset Fuel MonitoringKabeer QureshiNo ratings yet

- Financial Accounting Basics Part 1Document40 pagesFinancial Accounting Basics Part 1Kabeer QureshiNo ratings yet