Professional Documents

Culture Documents

Leases PS Goods

Uploaded by

DissentOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leases PS Goods

Uploaded by

DissentCopyright:

Available Formats

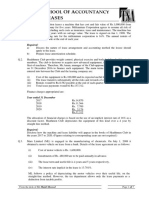

Practice Set: PFRS 16 – Leases

Instructions: Answer to learn

1. Dahyun contracted a 4-year lease of a machinery with Jackson Weng on

January 1, 20x1. Rent in 20x1 is ₱10,000 and as stipulated in the

contract, shall increase by 10% annually starting on January 1, 20x2.

Rentals are payable at every year end. Dahyun pays Jackson a lease

bonus of ₱5,000 on January 1, 20x1. Dahyun opts to use the practical

expedient allowed under PFRS 16 for leases of low value assets. How

much is the lease expense in 20x1?

2. Wiwil Co. from Malaybalay City leased an equipment of January 3,

2017 from the lessor Gui-yang Corp. The lease contract provides the

following:

Annual fixed payments in advanced at

January 3 of each lease year Php 2,000,000

Initial direct cost paid on January 3, 2017 500,000

Lease incentive received 300,000

Residual value guaranteed 600,000

Executory cost 50,000

Contractual lease term 5 years

Useful life of equipment 6 years

The implicit rate of the lease was at 8%

a. Compute for the cost of the right of use asset recognized by

Wiwil at the start of the lease.

b. What is the interest expense for 2017?

c. What is the depreciation expense for 2017?

3. Jan K Jang. Inc entered into a lease contract on January 1, 2017

with Jude Jar Co. for a 6 year lease of a cold spring with a useful

life of 8 years.

It was agreed that annual rental payable at the end of each

year was Php 1,200,000

Because of the attractiveness of the cold spring, a payment

was made by Jan K Jang Inc. to Jude Jar Co. to obtain the

long-term lease: Php 200,000

Insurance, maintenance and taxes per year to be paid by Jan K

Jang. Php 100,000

Initial direct cost incurred by JK Jang Inc. was Php 248,000

Unguaranteed residual value of the cold spring was Php 400,000

Cost of restoring the cold spring as required in the contract

Php 800,000

The lease neither provides a transfer of title to the lessee

nor a purchase option.

The implicit rate of the lease cannot be determined, but as

inquired from Banko de Oro, the same financing can be obtained

at the rate of 10%

a. What is the current portion to be presented in the statement of

financial position for the lease liability as of December 31,

2017?

b. What is the noncurrent portion to be presented in the statement

of financial position for the lease liability as of December 31,

2017?

c. What is the carrying amount of the lease liability as of December

31, 2017?

d. What is the accumulated depreciation on the right of use asset

for 2018?

4. Maaa Mits Co. is a company based in Iligan City. It has been the

policy of Maaa Mits Co. to acquire equipment by leasing. On January

2, 2017, Maaa Mits Co. signed a leased contract with Shapi Company

for a new delivery truck that had a selling price of Php 1,060,000.

The lease contract provides that annual payments of Php 210,000 will

be made for 6 years. Maaa Mits Co. made the first lease payment on

January 2, 2017, and subsequent payments are made on December 31 of

each year. Maaa Mits Co. guarantees a residual value of Php 183,560

at the end of the lease term. After considering the guaranteed

residual value, the implicit rate in the lease is determined to be

12%. Maaa Mits Co. has an incremental borrowing rate of 15% as

determined from a local bank. A security of Php 150,000 was made by

Maaa Mits Co. to Shapi to cover for any damages occurring during the

lease term. The economic life of the truck is 9 years. Maaa Mits

depreciates its other equipment using the straight-line method and

uses the calendar year for financial reporting purposes.

a. What is the cost of the leased delivery truck at the commencement

of the lease?

b. What is the balance of the lease liability after the first

payment at the commencement of the lease?

c. What is the depreciation expense to be recognized by Maaa Mits

Co for the year ended December 31, 2017?

d. What is the balance of the lease liability as of December 31,

2020?

5. In the long-term liabilities section of its balance sheet at December

31, 2019, Gwapo Kaayo Co. reported a lease liability of ₱75,000, net

of current portion of ₱1,364. Payments of ₱9,000 were made on both

January 2, 2020, and January 2, 2021. Gwapo Kaayo’s incremental

borrowing rate on the date of the lease was 11% and the lessor's

implicit rate, which was known to Gwapo Kaayo, was 10%. In its December

31, 2x20, balance sheet, what amount should Gwapo Kaayo report as

lease liability, net of current portion?

LESSOR Problems

1. On January 1, 20x1, Chantaly Bars Co. leased equipment to NJA Inc.

Information on the lease is shown below:

Cost of equipment ₱ 2,400,000

Useful life of equipment 5 years

Lease term 4 years

Annual rent payable at the start of each year 800,000

Interest rate implicit in the lease 10%

Initial direct costs amounted to Php 160,000. The lease qualifies for

sales type lease accounting.

a. How much is the gross investment in the lease on January 1, 20x1?

b. How much is the net investment in the lease on January 1, 20x1?

c. How much is the total interest income (finance income) to be

recognized by Chantaly Bars over the lease term?

d. How much is the gross profit from the sale?

e. How much is the net profit from the sale?

2. On January 1, 20x1, Kating J Corp. leased equipment to Adonis Inc.

The cost of equipment leased was Php 1,322,588

Useful life of equipment is 5 years with the agreed lease term of

4 years

Annual rent payable at the end of each year 400,000

The incremental borrowing rate is 8% while the interest rate

implicit in the lease is 10%.

Residual value 80,000

The equipment will revert back to Kating J Corp. at the end of the

lease term. The lease is classified as direct financing lease.

a. Assuming the residual value is guaranteed, how much is the

gross investment in the lease on January 1, 20x1?

b. Assuming the residual value is unguaranteed, how much is the

net investment in the lease?

c. How much is the total interest income to be recognized by

Kating J Corp. over the lease term if the residual value is

unguaranteed and guaranteed, respectively?

3. As an inducement to enter a lease, Hashirama Inc., a lessor, grants

Madara Corp., a lessee, nine months of free rent under a five-year

operating lease. The lease is effective on July 1, 20x5, and provides

for monthly rental of Php 1,000 to begin April 1, 20x6. In Art's

income statement for the year ended June 30, 20x6, rent income should

be reported as?

4. On January 1, 2017, Carlo Senpai Inc. leased machinery to Molly Co.

with a lease term and useful life of 5 years. The lease provides for

a transfer of title to the Molly Co. at the end of the lease term.

The implicit rate is 8%. The PV of ordinary annuity at 8% for 5

periods is 3.993, PV of 1 at 8% for 5 periods is 0.6805, while PV of

annuity due at 8% for 5 periods is 4.312. The cost of the machinery

is Php 10,348,800 with a residual value of Php 1,500,000. The annual

rental is payable in advance on January 1 of each year starting

January 1, 2017.

a. How much is the annual rental?

b. How much is the unearned interest income of Carlo Senpai Inc.

as of January 1, 2017?

c. How much is the interest income on the lease for 2017?

d. How much is the unearned interest income of Carlo Senpai Inc.

as of December 31, 2017?

e. What is the finance lease receivable as of December 31, 2017?

You might also like

- Mary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Document5 pagesMary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Angela TuazonNo ratings yet

- Guided Exercise1Document2 pagesGuided Exercise1Kim Nicole ReyesNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- Accounting 8 - ReviewerDocument4 pagesAccounting 8 - ReviewerAshley David AligonsaNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- Assignment Ppfrs 16Document3 pagesAssignment Ppfrs 16Joseph DoctoNo ratings yet

- On January 1, 2-WPS OfficeDocument4 pagesOn January 1, 2-WPS OfficeSanta-ana Jerald JuanoNo ratings yet

- Calculate lease accounting under IFRS 16Document4 pagesCalculate lease accounting under IFRS 16Ellah Sharielle SantosNo ratings yet

- Lease Problem With SolutionDocument19 pagesLease Problem With SolutionJeane Mae Boo100% (1)

- Far Project PrefiDocument16 pagesFar Project PrefiMarjorie PagsinuhinNo ratings yet

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- Chapter 15,16, & 17 IA Valix Sales Type LeaseDocument15 pagesChapter 15,16, & 17 IA Valix Sales Type LeaseMiko ArniñoNo ratings yet

- Chapter 15 and 16 IA Valix Sales Type LeaseDocument13 pagesChapter 15 and 16 IA Valix Sales Type LeaseMiko ArniñoNo ratings yet

- Accounting for Employee Benefits, Leases and Other LiabilitiesDocument3 pagesAccounting for Employee Benefits, Leases and Other LiabilitiesmarygraceomacNo ratings yet

- 6988 Finance Lease LesseeDocument2 pages6988 Finance Lease LesseeFREE MOVIESNo ratings yet

- Soal Kuis Minggu 11Document7 pagesSoal Kuis Minggu 11Natasya ZahraNo ratings yet

- Lease Accounting Multiple Choice QuestionsDocument5 pagesLease Accounting Multiple Choice QuestionsDarrelNo ratings yet

- Solve lease accounting problemsDocument2 pagesSolve lease accounting problemsJobelle Marie MahNo ratings yet

- SEATWORK 04 - Leases: Multiple ChoiceDocument9 pagesSEATWORK 04 - Leases: Multiple ChoiceLilii DsNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- ALL Quiz Ia 3Document29 pagesALL Quiz Ia 3julia4razoNo ratings yet

- Problem Set 8. Finance LeaseDocument7 pagesProblem Set 8. Finance LeaseitsBlessedNo ratings yet

- Lessee Lecture Notes Lessee Lecture NotesDocument8 pagesLessee Lecture Notes Lessee Lecture NotesDahyun KimNo ratings yet

- Chapter 8 - Leases Part 2Document5 pagesChapter 8 - Leases Part 2JEFFERSON CUTE100% (1)

- Discussion Problems - Lessor AccountingDocument4 pagesDiscussion Problems - Lessor AccountingangelapearlrNo ratings yet

- Leases Set CDocument12 pagesLeases Set CbessmasanqueNo ratings yet

- Lease AnalysisDocument5 pagesLease AnalysisJust JhexNo ratings yet

- Ap 301Document4 pagesAp 301Christine Jane AbangNo ratings yet

- Leases: Lease Part 1Document10 pagesLeases: Lease Part 1ZyxNo ratings yet

- INTAC3 McsDocument10 pagesINTAC3 Mcsrachel banana hammockNo ratings yet

- Financial Accounting II RequirementDocument27 pagesFinancial Accounting II RequirementAnonymousNo ratings yet

- SEO-Optimized Title for Lease Accounting Questions Under 40 CharactersDocument4 pagesSEO-Optimized Title for Lease Accounting Questions Under 40 CharactersAEHYUN YENVYNo ratings yet

- 65Document25 pages65Mark RevarezNo ratings yet

- Problem Solving-LeaseDocument2 pagesProblem Solving-LeasegadingancielomarieNo ratings yet

- Use The Following Information To Answer Items 1 To 4Document4 pagesUse The Following Information To Answer Items 1 To 4Chris Jay LatibanNo ratings yet

- Operating Lease Vs Finance LeaseDocument5 pagesOperating Lease Vs Finance LeasexjammerNo ratings yet

- Lease Practical Accounting ProblemsDocument2 pagesLease Practical Accounting ProblemsCamille BonaguaNo ratings yet

- Modaud2 Unit 6 Audit of Leases t31516 FinalDocument3 pagesModaud2 Unit 6 Audit of Leases t31516 Finalmimi96No ratings yet

- Lessor Sample ProbDocument24 pagesLessor Sample ProbCzarina Jean ConopioNo ratings yet

- AP Quiz Liab2Document4 pagesAP Quiz Liab2maurNo ratings yet

- Tutorial 11 (Exercise)Document2 pagesTutorial 11 (Exercise)Vidya IntaniNo ratings yet

- Tutorial 11Document2 pagesTutorial 11Vidya IntaniNo ratings yet

- 07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. BaulDocument5 pages07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. Baulkrisha millo50% (2)

- Quizzes Midterm To Finals OnlyDocument40 pagesQuizzes Midterm To Finals OnlyMikasa MikasaNo ratings yet

- 6833 Finance Lease LesseeDocument2 pages6833 Finance Lease LesseeJeslyn Kris Alobba SaguiboNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument11 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionGabrielleNo ratings yet

- Practical Accounting 1 - Review Leases 2019Document15 pagesPractical Accounting 1 - Review Leases 2019Gabrielle100% (1)

- Marine Engineering Problems Chapter 11 & 12Document24 pagesMarine Engineering Problems Chapter 11 & 12Sean AustinNo ratings yet

- Lease and Accounting For Income Tax DrillsDocument3 pagesLease and Accounting For Income Tax DrillsmarygraceomacNo ratings yet

- Assignment 02 Leases - Solution - OportoDocument4 pagesAssignment 02 Leases - Solution - OportoDevina OportoNo ratings yet

- (Pfrs/Ifrs 16) LeasesDocument11 pages(Pfrs/Ifrs 16) LeasesBromanineNo ratings yet

- Leases - Brief ExercisesDocument5 pagesLeases - Brief ExercisesPeachyNo ratings yet

- Rayos, Lyka Mae A - Ia3 CompilationsDocument7 pagesRayos, Lyka Mae A - Ia3 CompilationsKayeNo ratings yet

- IFRS-16 LeasesDocument7 pagesIFRS-16 LeasesHuzaifa WaseemNo ratings yet

- Orca Share Media1577676537770-1Document3 pagesOrca Share Media1577676537770-1Jayr BV100% (1)

- Seatwork On LeasesDocument1 pageSeatwork On Leasesmitakumo uwuNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Rental Property Investing: A Handbook and Guide for Becoming a Landlord!From EverandRental Property Investing: A Handbook and Guide for Becoming a Landlord!No ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Fasb 109Document116 pagesFasb 109Gopal Krishna OzaNo ratings yet

- Baglamukhi Masala Fs 2076-77Document44 pagesBaglamukhi Masala Fs 2076-77sudhakar ShakyaNo ratings yet

- Asistensi 1 Kunci JawabanDocument7 pagesAsistensi 1 Kunci JawabanNur Fitriah Ayuning BudiNo ratings yet

- Business Judgement Rule Dikaitkan Dengan Tindak Pidana Korupsi Yang Dilakukan Oleh Direksi Badan Usaha Milik Negara Terhadap Keputusan Bisnis Yang DiambilDocument12 pagesBusiness Judgement Rule Dikaitkan Dengan Tindak Pidana Korupsi Yang Dilakukan Oleh Direksi Badan Usaha Milik Negara Terhadap Keputusan Bisnis Yang DiambilWied WidayatNo ratings yet

- 23 CH 23 Textbook Quizzes (Student)Document7 pages23 CH 23 Textbook Quizzes (Student)Naveen Rênârd100% (1)

- Capital BudgetingDocument87 pagesCapital BudgetingCBSE UGC NET EXAMNo ratings yet

- Calculate NPV and IRR of M&A dealsDocument3 pagesCalculate NPV and IRR of M&A dealsJared TanNo ratings yet

- Solved - Refer To The Financial Statements of Campbell Soup Comp...Document2 pagesSolved - Refer To The Financial Statements of Campbell Soup Comp...Iman naufalNo ratings yet

- Corporation Bylaws S CorpDocument11 pagesCorporation Bylaws S Corppniko1100% (2)

- Project Stepup - Prospectus (v.2) (ICA Circle-Ups)Document76 pagesProject Stepup - Prospectus (v.2) (ICA Circle-Ups)devesh moreNo ratings yet

- M&M Company Overview and Financial AnalysisDocument69 pagesM&M Company Overview and Financial AnalysisAnjaliNo ratings yet

- History 1Document14 pagesHistory 1Yonatan AimerNo ratings yet

- AB1201 Exam - Sem1 AY 2020-21 - QDocument10 pagesAB1201 Exam - Sem1 AY 2020-21 - QEn Yu HoNo ratings yet

- (FM02) - Chapter 1 The Role and Environment of Financial ManagementDocument12 pages(FM02) - Chapter 1 The Role and Environment of Financial ManagementKenneth John TomasNo ratings yet

- Finacial Management Full NotesDocument114 pagesFinacial Management Full NotesBhaskaran BalamuraliNo ratings yet

- SBR Study Notes - 2018 - FinalDocument293 pagesSBR Study Notes - 2018 - Finalprerana pawar100% (2)

- Shop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountDocument7 pagesShop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountvikramtonseNo ratings yet

- Shareholders VsDocument2 pagesShareholders VsNidheesh TpNo ratings yet

- 16 April 16 Internal Financial Control Reporting - Practical Approach CA Murtuza KanchwalaDocument100 pages16 April 16 Internal Financial Control Reporting - Practical Approach CA Murtuza Kanchwalapreeti singhNo ratings yet

- Isbm University Semester Examination, April-20Document2 pagesIsbm University Semester Examination, April-20Sidharth MIshraNo ratings yet

- CPA Review School Philippines Final Exam GuideDocument14 pagesCPA Review School Philippines Final Exam GuideAzureBlazeNo ratings yet

- Accounting Ratios of HUL LTDDocument11 pagesAccounting Ratios of HUL LTDSaloni LohiaNo ratings yet

- Supply Chain ManagementDocument15 pagesSupply Chain Managementgabriel jimenezNo ratings yet

- Fund Fact Sheets - Prosperity Index FundDocument1 pageFund Fact Sheets - Prosperity Index FundJohh-RevNo ratings yet

- Adjusting ProbsDocument6 pagesAdjusting ProbsJheriko MallariNo ratings yet

- Maxwell Communications Corporation and Mirror Group NewspaperDocument2 pagesMaxwell Communications Corporation and Mirror Group NewspaperLamis ShalabiNo ratings yet

- Management Advisory Services Cpa ReviewDocument30 pagesManagement Advisory Services Cpa ReviewRyan PedroNo ratings yet

- Analyze key financial ratios for solvency, profitability, activity and market valueDocument1 pageAnalyze key financial ratios for solvency, profitability, activity and market valuejovelyn labordoNo ratings yet

- Arti - LT 2020Document194 pagesArti - LT 2020Ayu NingsihNo ratings yet

- Cash BudgetDocument2 pagesCash BudgetAbdulkarim Hamisi KufakunogaNo ratings yet