Professional Documents

Culture Documents

May 2014 - Full Answer - V10 (Post Exam)

Uploaded by

magnetbox8Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

May 2014 - Full Answer - V10 (Post Exam)

Uploaded by

magnetbox8Copyright:

Available Formats

Note:

This report is far more comprehensive than would be expected from a candidate in

exam conditions. It is more detailed for teaching purposes.

T4 - Part B - Case Study

YJ - Oil and gas industry case - May 2014

REPORT

To: Orit Mynde, Chief Financial Officer

From: Management Accountant

Date: 22 May 2014

Review of issues facing YJ

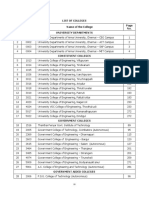

Contents

1.0 Introduction

2.0 Terms of reference

3.0 Prioritisation of the issues facing YJ

4.0 Discussion of the issues facing YJ

5.0 Ethical issues and recommendations on ethical issues

6.0 Recommendations

7.0 Conclusions

Appendices:

Appendix 1 SWOT analysis

Appendix 2 PEST analysis

Appendix 3 Evaluation of rights issue and new debt finance

Appendix 4 Cash flow forecast with new equity and debt finance (and no farm-out

arrangements)

Appendix 5 Cash flow forecast with alternative farm-out proposals

Appendix 6 Comparison of the NPV generated by the N and P farm-out proposals

Appendix 7 Evaluation of Country Z potential oil and gas field KKK

Appendix 8 Part (b) – Email on the merits of a farm-out agreement and which of the farm-

out proposals from N or P is better suited to YJ‟s cash requirements.

1.0 Introduction

YJ is a small E & P oil and gas company which was listed on the AIM in 2007. YJ has been

reasonably successful to date and already has three oil and gas fields in production (AAA, BBB

and CCC).YJ‟s share price has grown from US$ 6.00 per share when it was initially listed on the

UK AIM in 2007, to its current share price of US$ 32.50, following the announcement that it has

been awarded the licences for three further oil and gas fields (FFF, GGG and HHH). This

represents a huge growth in the market capitalisation of this small company and reflects

investors‟ confidence in YJ‟s ability to deliver long-term profits. Additionally, YJ is awaiting the

outcome of one further licence application from an African government.

© The Chartered Institute of Management Accountants 2014

As a small company, YJ has limited access to the vast amount of cash required for drilling costs

in order to bring oil and gas fields into production and YJ has been approached by two different

multi-national oil and gas companies with farm-out proposals.

Tullow Oil plc is an independent oil and gas exploration company based in the Republic of

Ireland. It has grown from a small company which won its first licence in Senegal, Africa in 1986,

to become one of the largest independent oil and gas companies in Europe with production

assets and interests in over 90 licences spread across 23 countries.

2.0 Terms of reference

I am the Management Accountant appointed to write a report to Orit Mynde, Chief Financial

Officer, which prioritises, analyses and evaluates the issues facing YJ and makes appropriate

recommendations.

I have also been asked to draft an email to the Board to help persuade the CEO and the rest of

YJ‟s Board on the merits of a farm-out arrangement and to advise on which of the farm-out

proposals from N or P is better suited to YJ‟s cash requirements. This draft email also

comments on the financial analysis of the farm-out proposals and contains my recommendation.

This is included in Appendix 8 to this report.

3.0 Prioritisation of the issues facing YJ

3.1 Top priority – Three licences awarded and forecast cash flows

The top priority is the forecast cash flows in respect of the huge cash requirements needed for

the forecast drilling costs for the three licences recently awarded to YJ.

YJ has to undertake test and production drilling at all three locations and has to bring these oil

and gas fields into production within two and a half years. It is unlikely that YJ will have

adequate cash to do this. A rights issue and raising more debt finance are both possible but

even these may not provide enough cash for the forecast drilling costs.

3.2 Second priority – Farm-out proposals

This is considered to be the second priority as YJ has two different multi-national oil and gas

companies which both want a share of one or two or all three of the newly licensed oil fields.

These multi-national companies probably know that YJ cannot raise enough finance for the very

large forecast drilling costs on its own. They also want a share of the oil and gas from these

fields in exchange for payment of farm-out agreement fees. The two multi-national companies

have offered different farm-out fee proposals, one with a one-off up-front fee and a share of

drilling costs and the other offering an annual farm-out fee as well as a share of drilling costs.

3.3 Third priority – Potential oil and gas field KKK (in Country Z)

This issue is considered to be the third priority as this is a future opportunity for growth and the

possibility for YJ to win a licence for another oil and gas field. However, the government of Z has

insisted that YJ pay 80% of the profits generated from production as a licence fee. This is a very

high percentage for the government of Z to demand and it will reduce the profit for YJ from this

potential new oil and gas field.

May 2014 Page No: 2 T4 Part B Case - Answer

3.4 Fourth priority – Managers‟ reward structure

The fourth priority is considered to be the proposed change to the managers‟ reward structure

that is being considered for introduction in January 2015. There is a shortage of skilled

manpower in the oil and gas industry and as YJ grows, this is an issue which needs to be

addressed now in order to put plans in place for the proposed start date of January 2015.

It should be noted that the payments made to an African company, X, could be ranked in the top

four issues. However, this issue is considered only as an ethical issue in this suggested answer.

A SWOT analysis summarising the strengths, weaknesses, opportunities and threats facing YJ

is shown in Appendix 1.

A PEST analysis is shown in Appendix 2.

4.0 Discussion of the issues facing YJ

4.1 Three licences awarded and forecast cash flows

Currently YJ has just three oil and gas fields operational (AAA, BBB and CCC) and so the news

that YJ has been granted the licences for all three oil and gas fields in this Asian country is

excellent news. However, for a small AIM listed company such as YJ, this poses the problem of

how to finance the drilling costs for these three new oil and gas fields.

YJ‟s existing three oil and gas fields that are in production are generating larges sources of

cash. They could be categorised as „Cash Cows‟ using the BCG matrix, as they are cash

generators and profitable and that these profits can be used to support other aspects of the

company that are in their development stage.

Drilling costs

The oil and gas industry is very capital intensive with the need to undertake test drilling for

information gathering purposes to establish whether the survey information has accurately

identified the size of the oil and gas reserves and to establish the best way to extract the oil and

gas and bring them to the surface. Only after test drilling has confirmed the size of the reserves

within each of the licensed areas can production drilling commence. The forecast cash flows

show that test drilling will cost US$ 36.0 million for each of the three newly licensed oil and gas

fields. It is likely that this cost will include test drilling at more than one location within each

licensed field. Therefore, total test drilling is forecast to cost a total of US$ 108.0 million before

production drilling can commence. This is a huge capital investment. It is forecast that oil and

gas from FFF will start generating positive cash flows during the financial year 2015/16.

Production drilling is a further huge capital investment with forecast production drilling costs at

US$ 100.0 million for each of the three licensed oil and gas fields. Therefore this will require a

total of US$ 300.0 million. Total drilling costs, including test drilling, are therefore US$ 408.0

million. This is a huge investment for any company and appears to be beyond the cash

capabilities of YJ, which has a cash balance at 1 May 2014 of only US$ 45.6 million, although its

three oil and gas fields currently in production are generating substantial cash from operations.

In summary, the three licences recently awarded to YJ have resulted in the company facing the

challenge of having sufficient cash to bring all three newly licensed oil and gas fields into

production by the deadline date of 30 September 2016. This is only a little over two years and

cash generated from operations will not cover the huge cash requirements for drilling costs.

May 2014 Page No: 3 T4 Part B Case - Answer

Rights issue and new loan finance

A rights issue would raise US$ 50.0 million (after issue costs) as shown in Appendix 3.

The case material states that YJ‟s investors are only willing to buy one new share for each five

existing shares held, which will increase the number of shares from the current 10 million shares

to 12 million shares. This rights issue will generate an additional US$ 52.0 million, based on the

current share price of $32.50 at a 20% discount. After issue costs of US$ 2.0 million, the net

cash generated from the rights issue would be only US$ 50.0 million. Whilst this is a substantial

cash injection from YJ‟s existing investors, it does not generate sufficient cash in order to

finance the drilling at all three newly licensed fields.

New loan finance of US$ 40.0 million will help. However, this still results in a forecast deficit of

US$ (150.0) million by 30 September 2016, as shown in Appendix 4.

Appendix 4 shows the cash flow forecast for the rest of the current financial year as well as for

the next two financial years, up to 30 September 2016, and shows that YJ has a forecast very

large cash deficit of US$ (150.0) million, even after a rights issue and new loan finance.

In order to have generated adequate cash from the rights issue to cover the US$ (150.0) million

forecast cash deficit, the rights issue would have had to be around 4 new shares for every 5

shares held. This is four times the volumes of new shares that the existing investors have stated

that they are prepared to invest. Therefore YJ will need to seek finance from other sources.

Long-term

However, there is a long-term consideration that YJ should seek a listing on the full stock

exchange in order to have access to a wider pool of investors in order to raise money for

financing drilling costs at future newly licensed oil and gas fields. However, undertaking a full

stock exchange listing will take around 18 months and utilise a large amount of management

time. This would be a huge distraction for YJ‟s management team to undertake a full listing with

all the work associated with the three newly licensed fields. Furthermore, the cash generated

from a full listing could not be generated in sufficient time to finance drilling costs for these three

oil and gas fields. However, it is something that YJ should plan to undertake in the future.

Summary of cash deficit

Therefore, even with a rights issue and new loan finance, YJ does not have adequate cash in

order to bring all three newly licensed oil and gas fields into production on its own.

It is necessary to put the financing in place before test and production drilling commences, so

that YJ does not face liquidity problems.

The production date of September 2016 cannot be moved as this is one of the terms of the

licence, and therefore alternative finance would be required. This could be in the form of one or

more farm-out arrangements from either of the two multi-national companies interested in a

share of these newly licensed oil and gas fields.

YJ is a young company which is short of the cash required to fund all of the required E & P work

on the potential oil and gas fields identified by its survey team. In contrast, some of its

competitors, such as Afren plc hold licences in many African oil and gas fields, and Afren plc

has become a full listed company and is able to issue bonds to raise hundreds of millions of

dollars in order to fund its E & P costs.

May 2014 Page No: 4 T4 Part B Case - Answer

4.2 Farm-out proposals

Forecast cash deficit

As can be seen from the section above on cash flow forecasts and Appendix 4 to this report, YJ

has a forecast cash deficit of US$ (150.0) million by 30 September 2016, if it is to try to bring all

three of the newly licensed oil and gas fields into production.

This forecast deficit is after new equity and debt finance has been raised. Therefore it is

essential that another way to raise sufficient cash to fund the drilling costs at these three oil and

gas fields is found.

Farm-out and farm-in arrangements are commonly used in the oil and gas industry with many

large multi-national companies taking a stake in oil and gas fields identified and licensed to

small E & P companies. For example, BP plc is involved in a number of farm-in arrangements. A

farm-in is defined as acquiring an interest in a licence from another E & P company. In Brazil,

BP has acquired a 30% interest in five deep-water exploration fields held by an international oil

company.

The fees payable for farm-out arrangements vary greatly, with some multi-national companies

paying large annual fees in order to obtain a share of the licensed oil and gas fields identified

and managed by other smaller E & P companies.

YJ has two different multi-national oil and gas companies which both want a share of one or two

or all three of the newly licensed oil fields in the form of farm-out agreements. This is a good

situation for YJ to be in as these multi-national companies can help fill the financing gap

identified above.

These multi-national oil and gas companies probably know that YJ cannot finance the very large

costs of drilling on its own and they want a share of the oil and gas from these fields in

exchange for paying of farm-in agreement fees.

YJ has been successful in locating through its survey work these potential oil and gas fields and

also in securing a licence for each of the three oil and gas fields. The farm-out fees receivable

from the multi-national oil and gas companies compensates YJ for the work that it has already

undertaken in identifying and getting licences for these fields.

The proposed farm-out fees vary between the two multi-national companies N and P, but both N

and P will pay a 40% share of the test drilling and production drilling costs at each of the oil and

gas fields in which they agree to a farm-out arrangement.

Therefore, YJ has a choice to farm-out one, two or all three licensed fields to either N or P or

any combination, such as one farm-out with N and two farm-outs with P.

The case material states that Ullan Shah, Chief Executive Officer (CEO), does not really want to

share any of the oil and gas fields although he recognises that farm-out agreements may be

necessary, but that the minimum number of farm-out arrangements should be made. Ullan Shah

is a key stakeholder with high power and high interest as categorised in Mendelow‟s stakeholder

analysis.

Therefore the dilemma is what combination of farm-out arrangements, and with N or with P, will

be required in order to generate sufficient cash to overcome the US$ (150.0) million forecast

deficit and will meet the CEO‟s desire to minimise the number of farm-out agreements.

Choice of farm-out proposals - N proposal:

The farm-out proposal from N is a fixed one-off fee of US$ 100.0 million for each farm-out

agreement, payable when the chosen oil and gas field (either FFF or GGG or HHH) has been

test drilled to confirm that it is economic to go into production.

May 2014 Page No: 5 T4 Part B Case - Answer

N will also pay 40% of the test drilling and 40% of the production drilling costs. N‟s 40% share of

total drilling costs is US$ 54.4 million (based on 40% x US$ 36.0 million test drilling plus US$

100.0 million production drilling costs).

If more than one oil and gas field is to be farmed-out, then N will pay two or even three fees of

US$ 100.0 million as well as a 40% share of the total drilling costs. However, it is in YJ‟s

interests not to share the oil and gas from these wells with any company at all and Ullan Shah

has stated that he wishes to minimise the number of farm-out arrangements.

For each oil and gas field farmed-out to N, the fees payable would be US$ 154.4 million, based

on the upfront fee of US$ 100.0 million plus N‟s 40% share of total drilling costs of US$ 54.4

million.

As YJ has a forecast deficit of US$ (150.0) million, just one farm-out agreement with N would be

sufficient to generate enough cash to cover this deficit, and leave a small surplus of US$ 4.4

million. This is shown in Appendix 5.

Choice of farm-out proposals - P proposal:

The farm-out fee proposal from P differs from that being offered by N, as it is a farm-out fee of

US$ 22.0 million that is payable annually for the forecast 10 year life of the oil and gas field.

P would also pay 40% of the test drilling and 40% of the production drilling costs. P‟s 40% share

of total drilling costs is US$ 54.4 million (based on 40% x US$ 36.0 million test drilling plus US$

100.0 million production drilling costs).

Therefore, the total cash that would be paid by P over the two year period to 30 September

2016 for just one farm-out agreement would be US$ 98.4 million. This is based on US$ 22.0

million x 2 years plus 40% of total drilling costs (as shown above) of US$ 54.4 million. However,

this would not be sufficient to cover the forecast cash deficit of US$ (150.0) million, and would

still leave a cash deficit of US$ 51.6 million. This is shown in Appendix 5.

Therefore, the proposal from P would not generate sufficient cash for YJ with just one farm-out

arrangement, as the annual fee from P would necessitate more than one farm-out agreement

with P. With two farm-out agreements with P, YJ would have a cash balance at 30 September

2016 of US$ 46.8 million.

Summary and comparison of N and P proposals

The farm-out fee proposal from P would generate less cash early on compared to the fee

proposal from N. However, on overall cash flows for the life of the oil and gas field, the fee

proposal from P generates a higher NPV for YJ.

Appendix 6 shows the NPV of the proposed farm-out fees payable by N and P. Over the 10 year

life, the US$ 100.0 million fee from N is worth US$ 90.1 million, discounted at YJ‟s cost of

capital. This compares to the US$ 22.0 million each year from P which is worth more at US$

129.6 million. This is almost 44% higher than N. Therefore, in long-term cash flows, the better

proposal is from P.

However, in short-term cash flow terms, YJ could decide to undertake just one farm-out with N

compared to having two farm-out arrangements with P. This is shown in Appendix 5.

It should be noted that the NPV comparison between N and P is based on the same cost of

capital of 11% and that it could be argued that the proposal with P, which results in cash flows

over a longer period of time, exposes YJ to greater risks and should perhaps have a higher risk-

adjusted cost of capital. This would therefore reduce the difference in the NPV‟s from both

proposals.

May 2014 Page No: 6 T4 Part B Case - Answer

With both of the different farm-out proposals from N or P it would not be necessary to undertake

farm-out arrangements for all three newly licensed fields.

In summary, the choice is either one farm-out with N or two farm-out agreements with P.

It should be remembered that Ullan Shah has stated that the preferred method of financing the

forecast deficit is with the minimum number of farm-out arrangements. Therefore, this would

indicate that N is the preferred multi-national company for YJ to enter into just one farm-out

agreement with.

As YJ needs cash urgently it is suggested that the farm-out agreement is made in respect of the

oil and gas field that would be developed the earliest, which would be field FFF.

These proposed farm-out agreements are based only on the cost of bringing the newly licensed

FFF, GGG and HHH oil and gas fields into production. If YJ were to win any further licences for

any additional oil and gas fields, it may need to raise further finance which could be in the form

of further farm-out arrangements.

Longer-term, instead of sharing the gas and oil from its licensed oil and gas fields through farm-

out agreements, YJ should seek a full stock exchange listing to provide it with access to

additional new equity and debt finance, as stated above.

Other E & P companies, such as Tullow Oil plc have farmed-out a range of different levels of

interests in the fields it has identified, in order to manage its exposure to the total capital

expenditure required. Tullow Oil plc has interests in a range of fields ranging from 15% to 90%.

4.3 Potential oil and gas field KKK (in Country Z)

One of YJ‟s survey teams has been working on an exploration project for a potential new oil and

gas field. This potential oil and gas field, KKK, in Country Z provides YJ with a further

opportunity for growth.

However, the government of Z has insisted that YJ pays it 80% of the profits generated from

production. This is a high percentage for the government to demand and it will reduce the share

of the profit from this potential oil and gas field to 20% for YJ.

The forecast size of KKK is very large with 4,250 bopd for oil and 3,275 boepd for gas, but 80%

of the profits generated from the production and sale of the oil and gas would go to Z‟s

government. This is probably why no other oil and gas companies have taken this oil and gas

field into production before.

As can be seen from the analysis earlier in this report concerning the three newly licensed oil

and gas fields in Asia, YJ is short of cash for the required test and production drilling costs. If YJ

were to proceed to try to win a licence for KKK, then it would have to raise additional finance for

the forecast drilling costs of US$ 130.0 million. This would be difficult for YJ to raise.

Investment criterion

YJ has set its investment criterion to require a minimum pre-tax return on capital employed

(ROCE) of 20%. The capital employed is defined as total capital employed before the

amortisation provision.

The total capital employed for KKK is US$130.0 million. Therefore the required ROCE at 20%

would be US$ 26.0 million.

The proposal meets this ROCE criterion as YJ‟s share of the operating profit is US$ 26.6 million,

which is 20.5%. However, it meets this criterion very marginally. This is shown in Appendix 7.

May 2014 Page No: 7 T4 Part B Case - Answer

However, ROCE is not a suitable measure for this scale of investment. ROCE can be a

misleading measure as it appears to improve over time, due to the amortised value of the asset

compared to the same level of annual profits, although the criterion in this case was based on

the original value. ROCE also takes no account of the cost of finance. This method also ignores

the availability of the finance required. Furthermore, ROCE takes no account of future cash

flows, as it is based on profits.

The best measure for assessing the financial viability of large investments is whether the

investment would generate a positive NPV. The NPV can be compared against other

investments using a profitability index (PI), as YJ has a shortage of cash available to it for

investment in drilling costs. The PI method compares the investment which generates the

highest NPV (based on a risk adjusted discount rate on forecast cash flows over the life of the

oil and gas field) as a proportion of the level of the investment required. Furthermore, using the

NPV method, cash flows can be discounted at a suitable risk-adjusted discount rate to take

account of the risks faced in the E & P industry.

The case material does not ask for the NPV to be calculated and it does not give a suitable risk-

adjusted cost of capital. However, the NPV for this proposal would be a small positive NPV. In

theory a company should pursue all positive NPV projects. However, YJ would need to have the

available resources to enable it to undertake KKK. It does not have either of the scarce

resources which are cash for the required capital investment or available manpower.

Scarce resources

YJ has a scarcity of two key resources which are:

Cash

Manpower

This investment would require US$ 130.0 million of investment for drilling costs. If YJ is only

able to retain 20% of the profits, then the proposal does not appear attractive and would require

a large amount of cash which YJ does not have.

With YJ recently being awarded the three licensed oil and gas fields in Asia, its manpower will

be required to bring these into production, and therefore it would not have sufficient managers

available to undertake drilling work at the potential oil and gas field, KKK, for a very marginal

return on investment.

KKK perhaps could be accepted only if a farm-out agreement with a multi-national company

could be agreed, but it is unlikely that the relatively small returns, after the high 80% licence fee

payment, would appeal to any of the multi-national companies which generally invest in farm-out

arrangements.

YJ would be using all of its skilled managers in bringing the three newly licensed fields in Asia

(FFF, GGG and HHH) into production and therefore would not have adequate skilled manpower

to undertake drilling at KKK.

May 2014 Page No: 8 T4 Part B Case - Answer

Summary

In summary this proposal could be assessed using the Johnson, Scholes and Whittington model

as follows:

Suitability – The proposal to apply for a licence for KKK is suitable for YJ as this potential oil and

gas field is ready for E & P and this is what YJ specialises in. YJ has the expertise to bring KKK

into production.

Acceptability – the proposal appears to be acceptable to YJ based on its investment criterion of

a 20% ROCE, as it generates a ROCE of 20.5% which is marginally above the hurdle rate.

However the measure of ROCE is not considered to be a suitable criterion for an investment of

this type which requires heavy capital investment years before there are any positive cash

inflows. Furthermore, YJ has a shortage of skilled managers and therefore it may not be

acceptable whilst it is still working on the three newly licensed fields in Asia.

Feasibility – This proposal is not feasible due to the lack of finance that YJ has to bring this oil

and gas field into production. YJ is having to undertake a farm-out for one of the three newly

licensed Asian fields as well as gaining new equity and debt finance. Perhaps in a few years‟

time YJ will have adequate cash generated from operations to fund the drilling costs for KKK,

but at present it does not have the required cash resources to make this proposal feasible to

undertake.

4.4 Managers‟ reward structure

At present YJ pays all of its managers a fixed annual salary which reflects each manager‟s

experience and responsibilities. However, there is a concern that as YJ grows, its future could

be adversely affected by the lack of suitably experienced managers that YJ could recruit and

retain.

As YJ‟s Management Accountant, I have been asked to work with YJ‟s HR manager to

investigate and assess whether a change in the way YJ‟s managers are paid is required. There

is a proposal to introduce performance related pay (PRP) by either:

paying a bonus to managers for meeting or exceeding agreed performance targets

or

rewarding its managers with free shares in YJ.

With the shortage of skilled manpower in the oil and gas industry, as YJ grows, this is an issue

which needs to be addressed in order to ensure that YJ‟s future growth is not hindered.

Additionally, a plan needs to be put in place for the proposed start date for the new reward

structure of January 2015.

It should be noted that this proposal affects only YJ‟s managers and not all of its employees,

such as secretarial and administration employees.

Additionally, it should be noted that myself, as Management Accountant, has a vested interest in

YJ introducing PRP for its managers, but approval of any proposed change to employees pay

and contracts of employment would need to be approved by YJ‟s Board.

YJ is a young company, as it was only listed in 2007, and already has three oil and gas fields

operational and another three newly licensed oil and gas fields which are due to commence

drilling. Huge amounts of cash investments are needed to get each oil and gas field into

production before any revenues start being generated. Therefore, if employees are motivated to

meet agreed dates for drilling and subsequently daily bopd production targets, the company can

achieve its full potential. PRP is a good motivator and will help the company retain its managers.

The opportunities for managers to gain good experience and to take on additional

responsibilities within YJ in the future are very good, as the company is growing fast.

May 2014 Page No: 9 T4 Part B Case - Answer

YJ‟s competitors usually pay performance related bonuses. In the long term YJ will not be able

to attract and retain the skilled workforce it needs in this highly specialised industry unless it also

offers some type of performance related pay (PRP). PRP is common at senior levels in many

industries to motivate employees and to try to achieve goal congruence and to achieve the

company‟s plans.

The choice of PRP for meeting or exceeding agreed performance targets is either bonuses or

shares in YJ. A cash bonus has the advantage of being an instant reward to managers at the

end of the year, if they meet agreed performance targets, but this bonus would be taxable and

therefore the value to the individual may be reduced. This will depend on the tax status of each

employee, as many oil and gas industry workers spend a large amount of time outside their

home country and the level of their personal tax payable is reduced.

PRP in the form of shares in YJ is a good long-term way to incentivise managers. If the manager

wants to realise the value of the free shares given to him / her for meeting performance targets,

then these shares could be sold on the AIM market. Otherwise, the manager could retain the

free shares and see the value of them grow as YJ‟s share price increases due to the growth in

the business and the increased revenues and profits generated. Since YJ was listed in 2007 at

a price of US$ 6.00 per share, the price has risen to US$ 32.50 per share, which is a growth rate

of 442% in just 7 years.

Free shares in YJ will also help managers to “take ownership” of the company‟s growth targets

and its planned and annual budgets. Managers are more likely to be interested and motivated to

achieving financial and performance targets, such as daily bopd or completion dates for drilling,

if they are to be rewarded for meeting this range of performance targets.

Many companies both within the oil and gas industry and in other industries have adopted PRP

through the use of issuing shares to employees including companies such as BT plc, Tesco and

Asda-Walmart.

The effectiveness of PRP as a motivator will also depend on the way performance is measured

and what range of targets are set. It is suggested that YJ also introduce the Balanced Scorecard

which uses four categories of performance measures and not just financial measures.

The Balanced Scorecard is widely used in industry, notably by Tesco plc, and assesses

performance in four categories which are:

Customer perspective.

Internal business process – to measure the efficiency of YJ‟s business processes

including YJ‟s management of outsourced suppliers.

Learning and growth – to measure how innovative YJ is and its investment in new

technology.

Financial perspective.

The use of the Balanced Scorecard would be very suitable for YJ as most of the managers are

working towards achieving non-financial targets such as deadline dates for drilling, production

measured in barrels of oil per day and therefore the performance measures that they are trying

to achieve would be the same as the performance measures that they would be rewarded for

meeting or exceeding.

May 2014 Page No: 10 T4 Part B Case - Answer

5.0 Ethical issues and recommendations on ethical issues

5.1 Range of ethical issues facing YJ

There are two ethical issues that will be discussed and recommendations made, which are:

1. Payments made

2. Working away from home country

5.2 – Payments made

5.2.1 Why this is an ethical issue

When I, as Management Accountant spoke to Ullan Shah, I was instructed to arrange payment

without delay and to not discuss this payment with anyone. I feel that the CEO is pressurising

me to pay this invoice and I am not happy to do this. It goes against the CIMA Code of Ethics

concerning the need to act with integrity.

This is also an ethical issue as Ullan Shah, CEO, has not acted with transparency and honesty

in connection with the authorisation of these five invoices received from the consultancy

company in an African country, X, of which four invoices have already been paid. The invoices

appear suspicious. The invoice describes the services as “geological consultancy services” but

the payments have been made to a Swiss bank account.

The implications of YJ being involved with the possible bribery of a government official in the

African country X, in order to obtain a licence would have huge adverse implications for the

company and YJ‟s reputation.

5.2.2 Recommendations for this ethical issue

It is recommended that the Management Accountant (myself) speaks directly with Orit Mynde,

Chief Financial Officer, and to tell him what Ullan Shah has instructed me to do and that I am

concerned that he is putting pressure on me.

It is further recommended that this invoice should NOT be paid and any further invoices from

this company should be blocked and not paid, until a satisfactory explanation of what services

have been provided to YJ is received.

Furthermore, there should be an investigation to check whether these invoices were really for

“geological consultancy services” or not. It is recommended that Orit Mynde speaks directly to

Milo Purdeen, Director of Exploration, to ask whether he knows anything about these invoices or

not. As Director of Exploration, he should be familiar with all of the companies his team are

using and whether these invoices are genuinely for “geological consultancy services” or not.

It is also recommended that Orit Mynde and Milo Purdeen arrange to discuss the matter with the

Non-executive Chairman, Jeremy Lion.

If the investigation shows that these payments were bribes, then it would be suitable to ask

Ullan Shah to resign from YJ, as these disreputable payments could seriously damage YJ‟s

good reputation.

May 2014 Page No: 11 T4 Part B Case - Answer

5.3 – Working away from home country

5.3.1 Why this is an ethical issue

This is an ethical issue as employees are not being treated in accordance with their contract of

employment terms. Furthermore, the geologist that asked to take leave, to which he is entitled,

should not be refused. The offer of a bonus is a different matter. When he appealed to Ullan

Shah, CEO, he was told that he must remain on site. This is an unethical way to treat a loyal

employee.

YJ‟s employees are loyal and hardworking and are based on oil and gas drilling sites in many

overseas countries, far from their home base. Therefore, their need for regular leave is

essential. Work-related stress could lead to accidents. This is not a good way to treat

employees. Employers owe a duty of care to its employees and should be fair to them and to

respect the terms of their contracts of employment.

The morale of the survey team is essential to the long-term success of a small E & P company

like YJ and these employees need to be treated in a fair way. In order to maintain the motivation

of the survey team, YJ‟s management should consider both Maslow‟s hierarchy of needs,

especially in respect of safety, as well as Hertzberg‟s hygiene factors in respect of the treatment

of employees.

5.3.2 Recommendations for this ethical issue

It is recommended that all employees‟ terms of employment should be met and that all

employees should be allowed adequate leave to return home in accordance with each

employee‟s contract.

Leave should be authorised immediately for those employees who are overdue to return home

or if some employees do not wish to return home then they should be offered payment in lieu of

home leave.

This incident should be reported to the HR manager. It is recommended that the Chairman

should discuss this matter with Ullan Shah, after seeking advice from the HR Manager. Ullan

Shah should not have insisted that any employee of YJ remains on duty overseas when the

employee wishes to return home, when home leave is overdue. It is further recommended that

Ullan Shah should apologise to the geologist who asked for leave to return home.

It is recommended that Milo Purdeen, Director of Exploration and also Adebe Ayrinde, Director

of Drilling Operations, arrange a better rotation of their employees to allow them to return home

on a regular basis. The short-term view of making employees work too hard, should be avoided

as these employees will start to feel resentful and could choose to leave the company.

With the massive skill shortage in this industry and YJ‟s current success in finding and obtaining

licences for viable oil and gas fields, these employees should be valued and respected and the

terms of their employment contracts should be met in full.

May 2014 Page No: 12 T4 Part B Case - Answer

6.0 Recommendations

6.1 – Three licences awarded and forecast cash flows

6.1.1 Recommendation

It is recommended that YJ should proceed with the rights issue and new loan finance for US$

40.0 million.

Even after a rights issue and new loan finance, YJ would have a cash shortfall of US$ (150.0)

million by end 2015/16 taking into account drilling costs at all three newly licensed oil and gas

fields as shown in Appendix 4.

Due to the need to bring all of these three fields into production within two years, it is

recommended that YJ will need to gain finance from other sources. Therefore, it is

recommended that YJ will have to undertake a farm-out arrangement for one or more oil and

gas fields.

It is recommended that YJ consider seeking a full stock exchange listing in the next few years in

order to finance its future growth.

6.1.2 Justification

The 1 for 5 shares rights issue would raise US$ 50.0 million net of issue costs and new loan

finance of US$ 40.0 million will help towards financing drilling costs but will still result in a deficit

of US$ (150.0) million, which will need to be financed by YJ undertaking a farm-out agreement

with one or both of the multi-national companies for at least one newly licensed oil and gas field.

Long-term financing needs to be put in place as clearly the existing investors are not willing to

invest the capital required to fund the forecast drilling costs for these newly licensed oil and gas

fields. A full stock exchange listing will give YJ access to a larger pool of new finance.

6.1.3 Actions to be taken

1. YJ needs to notify its shareholders about the rights issue as soon as possible in order to

raise this additional equity investment.

2. YJ needs to negotiate and raise the US$ 40.0 million additional debt finance.

3. YJ needs to discuss farm-out arrangements with one or both of the multi-national

companies which are interested in a share of one or more of the newly licensed fields.

See recommendation in paragraph 6.2 below.

4. The Board needs to discuss YJ becoming listed on the main stock exchange and when

would be the right time to undertake this. This would enable YJ to access new sources

of finance, both equity and debt finance.

5. Revised cash flow forecast to be prepared when farm-out agreements have been

signed.

6. Drilling costs should be closely monitored and reported against forecast costs to ensure

financing can be put in place if there should be any cost over-runs.

May 2014 Page No: 13 T4 Part B Case - Answer

6.2 – Farm-out proposals

6.2.1 Recommendation

As YJ has a forecast cash shortfall of US$ (150.0) million even after a rights issue and new loan

finance, it is recommended that one farm-out arrangement with N is undertaken.

It is further recommended that the farm-out arrangement with N should be for the first oil and

gas field, FFF, to be developed.

This would allow YJ to retain 100% of production and 100% of all future cash flows at the

remaining two (GGG and HHH) of the three newly licensed oil and gas fields, which would

maximise YJ‟s shareholders‟ long-term profits.

6.2.2 Justification

Without a farm-out agreement, YJ could not raise sufficient finance in order to drill at all three

licensed oil and gas fields and to bring all three into production to meet the deadline in the

licence of 30 September 2016.

The justification for recommending that one farm-out agreement with N is accepted is that this

would provide adequate finance to YJ to undertake drilling at all three of the newly licensed oil

and gas fields. This would overcome YJ‟s forecast cash deficit of US$ (150.0) million. N would

provide an up-front one-off payment to YJ of US$ 100.0 million as well as a 40% share of drilling

costs which would total US$ 54.4 million. This would allow YJ to retain 100% of the other two

licensed fields without having to share the long-term production and profits from these fields at

all. This is in line with Ullan Shah‟s wish to minimise the number of farm-out arrangements.

Whilst the offer from P generates the highest NPV at US$ 129.6 million (which is US$ 39.5

million (43.8%) higher than N), the cash flows to YJ will occur every year over the 10 year life of

each oil and gas field. If P were to have been selected for a farm-out arrangement, then more

than one farm-out agreement would be required. This is because one farm-out agreement would

only generate a total of US$ 98.4 million by the end of financial year 2015/16. This would leave

YJ with a cash shortage of US$ (51.6) million. This is shown in Appendix 5.

Therefore, if P had been recommended, then YJ would need to agree to two farm-out

agreements in order to generate sufficient finance to overcome YJ‟s cash shortage. Two farm-

out agreements with P would leave YJ with a cash surplus at end 2015/16 of US$ 46.8 million.

Note:

There are ONLY two alternative acceptable recommendations for the farm-out proposal which

are:

1. Agree to ONE farm-out with N which provides a total of US$ 154.4 million (including

N‟s share of drilling costs). This overcomes the US$ (150.0) million cash shortage.

or

2. Agree to TWO farm-outs with P which over the period to 30 September 2016 will

generate US$ 196.8 million (including P‟s share of drilling costs). This overcomes the

US$ (150.0) million cash shortage.

The best recommendation to maximise YJ’s long-term interests and profitability is

ONLY to undertake ONE farm-out with N.

Note: What is NOT an acceptable recommendation is to only accept a farm-out with P for one

oil and gas field or to not take ANY farm-outs as YJ does NOT have enough cash to bring all

three fields into production on its own.

May 2014 Page No: 14 T4 Part B Case - Answer

6.2.3 Actions to be taken

1. To contact multi-national N and prepare legal documents to undertake a farm-out

agreement to allow N a 40% share of just one licensed oil and gas field, which should

be field FFF.

2. To contact P and to decline its farm-out agreement for these three licensed oil and gas

fields but to state that YJ may be interested in working with it in the future.

3. Cash flow forecasts to be updated to reflect the 40% share of drilling costs and the up-

front one-off fee payable by N of US$ 100.0 million.

6.3 – Potential oil and gas field KKK (in Country Z)

6.3.1 Recommendation

It is recommended that this potential oil and gas field KKK is not pursued and that YJ does not

apply for a licence from the government of Z.

It is also recommended that YJ changes the method for assessing future investments from

ROCE and that it instead uses the net present value (NPV) technique to assess all future oil and

gas fields.

Furthermore, where there are competing alternative investment opportunities, it is

recommended that YJ should use the profitability index (PI) to measure the investment which

generates the highest NPV (based on a risk adjusted discount rate on forecast cash flows over

the life of the oil and gas field) as a proportion of the level of the investment required.

6.3.2 Justification

YJ has a shortage of finance and the proposal to apply for a licence to drill in KKK would tie up a

large amount of capital expenditure in drilling costs. Furthermore, under the PSA licence

agreement that the government is insisting on, YJ would only retain 20% of the operating profit,

as it would have to pay Z‟s government 80% of the operating profit.

Whilst the proposal generates a ROCE of 20.5% and meets the 20% ROCE hurdle rate, this

method of assessing an investment is considered flawed. ROCE is not a useful criterion to

assess an investment as capital employed reduces over time as the drilling costs are amortised,

and therefore the ROCE will appear to increase. This is not a suitable criterion for such a large

investment.

A further justification for rejecting the proposal to invest in KKK is that the Z government is

insisting on such a high PSA licence cost of 80% of all operating profit. With such a large share

of the profits going to the government of Z and with YJ‟s shortage of cash to bring KKK into

production, it is recommended that YJ does not apply for a licence at this time.

6.3.3 Actions to be taken

1. Contact the government of Z and reject the proposal to apply for a licence for KKK due

the very high PSA licence fee of 80% of operating profits required by the government of

Z.

2. Cease any other survey work in off-shore areas owned by the government of Z.

3. Establish a new rule within YJ that exploration and survey work should not be

undertaken in a new country without first establishing what level of PSA licence will be

May 2014 Page No: 15 T4 Part B Case - Answer

required by the government of the country which owns the potential oil and gas field.

This will reduce the cost of wasted efforts to locate and survey potential oil and gas

fields with other governments that insist on exceptionally high PSA licence fees.

4. Orit Mynde, CFO, to establish a new criterion for assessing future investment proposals

using the NPV and PI methods.

6.4 Managers‟ reward structure

6.4.1 Recommendation

It is recommended that YJ should change its reward structure to an employee share scheme for

all of YJ‟s managers. This change would need to be approved by YJ‟s Board including the

NED‟s.

It is also recommended that the employee share scheme is awarded based on managers

meeting a range of performance measures using the Balanced Scorecard, which uses four

categories of measures and not just financial measures.

6.4.2 Justification

In order for YJ to be able to recruit more managers to meet the growth in its business activities,

and to retain existing managers, it is considered essential that managers should be rewarded

with shares. This is what other oil and gas companies do to reward their managers. YJ needs to

be an attractive company for skilled oil and gas industry managers to work for and this includes

an employee share scheme.

The justification for the recommendation to award free shares in YJ based on managers meeting

or exceeding their agreed performance measure is that this would help achieve goal

congruence and encourage managers to achieve the company‟s long-term objectives. Free

shares will also help managers identify more with the company‟s planned growth targets, its 5-

year plan and annual budgets.

The justification for awarding shares based on the Balanced Scorecard is that a range of

financial as well as non-financial measures is needed in this industry as most of YJ‟s managers

are not directly controlling sales revenue or cost of sales in the usual way, as applied in other

industries. Managers are more likely to be interested and motivated to achieving a range of

other performance targets, such as daily bopd or completion dates for drilling, if they are to be

rewarded for meeting this range of performance targets. Most of the managers‟ targets are likely

to be non-financial, such as drilling deadlines, safety issues and production volumes in barrels

per day.

6.4.3 Actions to be taken

In terms of the actions required in order to introduce an employee share scheme by January

2015, it is recommended that the following process should occur:

1. Introduction of the Balanced Scorecard for YJ from the start of the new financial year on

1 October 2014.

2. The principle of an employee share scheme for all managers to be agreed by the YJ

Board in June 2014.

3. Then a 2 month period of consultation with all of YJ existing managers. HR should

discuss with managers the use of the Balanced Scorecard as a method for setting and

measuring performance targets.

May 2014 Page No: 16 T4 Part B Case - Answer

4. Feedback of managers comments to HR and then to the YJ Board in September 2014

5. Board decision in October 2014 on the reward structure for shares to be introduced.

6. Setting of performance related objectives based on the four categories of measures in

the Balanced Scorecard for the 12 months period January to December 2015 for the

company and for each manager.

7. Clear understanding and sign off on performance related objectives and ways for

measuring performance to be put in place. These should be visible and transparent for

all managers, so as to motivate them to achieve their business objectives.

7.0 Conclusions

YJ faces a challenging but exciting future. With the three newly licensed oil and gas fields in

Asia, the company could be doubling its production output and sales revenue in just over two

years‟ time. However, in order to bring the three newly licensed oil and gas fields into

production, the company faces a major cash deficit, even after the injection of new equity and

new debt finance. Therefore, for the first time in YJ‟s history it will have to undertake a farm-out

agreement for one of the newly licensed oil and gas fields in order to generate enough cash to

finance the drilling costs for all three fields.

Longer term, as the company grows, it will face further cash demands as the huge costs of

drilling new oil and gas fields precede any flows of oil and gas and the revenues from them.

Therefore it would be sensible for YJ to seek a full stock exchange listing to enable it to raise

more equity finance for future new E & P work.

YJ also needs to change the reward structure in order to be able to retain and recruit managers

in the industry which is facing a skill shortage.

May 2014 Page No: 17 T4 Part B Case - Answer

Appendix 1

SWOT analysis

Strengths Weaknesses

Experienced Board members Lack of financing for expansion of the

New CEO with a reputation for company

bringing new oil and gas fields into Investors are only willing to invest in a

production swiftly rights issue on a 1 for 5 share offer

Good track record of bringing three of Only able to raise US$ 40.0 million in

the four oil and gas fields into new debt due to market lending

production, with only one unsuccessful restrictions

field Employees not being given adequate

Strong revenues and profits after early breaks to return home

years of losses Retaining and recruiting experienced

Successful in winning new licences managers

Just been awarded three licences for High PSA licensing agreement fee for

FFF, GGG and HHH potential oil and gas field KKK that will

severely impact YJ‟s profitability

Opportunities Threats

To bring FFF, GGG and HHH oil and Shortage of cash for investment in test

gas fields into production and production drilling at the three

YJ could secure funding from N or P newly licensed oil and gas fields in

for one, or more, in a farm-out Asia

arrangement for FFF or GGG or HHH Future risk of a shortage of skilled oil

YJ is waiting to hear whether it will be and gas managers, which is an

granted a further licence in Africa industry wide problem

To bid for a licence for KKK in Asia Threat of the discovery of payments

To identify more potential new oil and made, which possibly may be bribes in

gas fields in the future connection with the African country, X,

Future full stock market listing that YJ has applied for a licence from

Launch a new managers‟ reward Employees suffering from work-related

structure stress

Note:

The above SWOT analysis is detailed for teaching purposes. However, in exam conditions a

SWOT containing fewer bullet points, which cover the main issues from the case and the

unseen material, is expected.

May 2014 Page No: 18 T4 Part B Case - Answer

Appendix 2

PEST analysis

Political

Ability of YJ to win licences from different governments

Risks of civil unrest in some countries close to the countries that YJ operates in

Risk of terrorist incidents

New laws on safety aspects for the oil and gas industry

Economic

Improving profitability and lowering operating costs through the use of new technology

Increasing demand for oil and gas putting pressure on prices

The knowledge that the world is facing a shortage of oil and gas which will affect prices

in future

Impact of exchange rates on YJ‟s costs which are incurred in a range of currencies

Impact of interest rates on YJ‟s debt financing

Social

Cost of oil and gas affects demand

Sustainability and environmental concerns by lobbyists

Risks of accidents and damage to the ecology

Current increasing consumer and business demand for oil and gas

Possible future reduced demand for oil when alternative fuels for domestic cars (electric

cars or bio-fuels) are developed and accepted on a wider basis than currently used

Technological

Improving operational performance through the use of new technology

Improved technology to help improve the quality of geological surveys to reduce the risk

of subsequently finding the field not economic to go into production after expensive test

drilling

Improvements in transportation of oil and gas to improve efficiency and safety, such as

LNG technology.

May 2014 Page No: 19 T4 Part B Case - Answer

Appendix 3

Evaluation of rights issue and new debt finance

Number Net

of new Share Rights Funds Issue funds

shares price Discount price raised costs raised

US$ US$

per per US$ US$ US$

Million share share million million million

1 for 5 shares 2.0 32.50 20% 26.00 52.0 2.0 50.0

Additional loan

finance 40.0

Total net funds that can be raised

externally 90.0

May 2014 Page No: 20 T4 Part B Case - Answer

Appendix 4

Cash flow forecast with new equity and debt finance

(and no farm-out arrangements)

Rest of

2013/14 2014/15 2015/16

US$ US$ US$

million million million

Opening cash balance: surplus / (deficit) 45.6 48.2 (68.9)

Cash generated from existing operations 27.0 64.0 64.0

Cash generated from new oil and gas fields 0.0 0.0 36.0

Rights issue 50.0

New loan finance 40.0

Total cash available 72.6 202.2 31.1

Finance costs (including new loan) (6.4) (20.9) (20.9)

Tax payable 0.0 (10.2) (10.2)

Test drilling:

FFF (18.0) (18.0)

GGG (36.0)

HHH (36.0)

Production drilling

FFF (100.0)

GGG (50.0) (50.0)

HHH (100.0)

Total cash outflows (24.4) (271.1) (181.1)

Cash balance at end of each financial year:

surplus / (deficit) 48.2 (68.9) (150.0)

Total forecast cash deficit at 30 September 2016 is US$ (150.0) million.

Alternatively, if YJ‟s overdraft limit of US$ 5.0 million is used, then the cash deficit is

US$ (145.0) million.

May 2014 Page No: 21 T4 Part B Case - Answer

Appendix 5

Cash flow forecast with alternative farm-out proposals

N proposal - share of drilling costs and farm-out for ONE licence ONLY

Alternative

answer

Rest of incl. $5 m

2013/14 2014/15 2015/16 overdraft

US$ US$ US$ US$

million million million million

Closing cash balance if YJ on own

(per Appendix 4) 48.2 (68.9) (150.0)

Previous year(s) cash inflows from farm-out 7.2 154.4

N‟s share of drilling - test drilling 7.2 7.2

N‟s share of drilling - production drilling 40.0

Up-front farm-out fee of US$ 100.0 million from N 100.0

Cash balance with farm-out with N for ONE field only 55.4 85.5 4.4 9.4

OR

P proposal - farm-out fee at US$ 22.0 million per year for ONE licence only

Closing cash balance if YJ on own (per Appendix 4) 48.2 (68.9) (150.0)

Previous year(s) cash inflows from farm-out 7.2 76.4

P‟s share of drilling - test drilling 7.2 7.2

P‟s share of drilling - production drilling 40.0

Farm-out fee at US$ 22.0 million per year from P 22.0 22.0

Cash balance with farm-out with N for ONE field only 55.4 7.5 (51.6) (46.6)

OR

P proposal - farm-out fee at US$ 22.0 million per year for 2

licences

Closing cash balance if YJ on own (per Appendix 4) 48.2 (68.9) (150.0)

Previous year(s) cash inflows from farm-outs 7.2 132.8

P‟s share of drilling - test drilling FFF 7.2 7.2

P‟s share of drilling - test drilling GGG 14.4

P‟s share of drilling - production drilling - FFF 40.0

P‟s share of drilling - production drilling - GGG 20.0 20.0

With 2 farm-out fees at US$ 22 million per year from P 44.0 44.0

Cash balance with farm-out with N for TWO fields 55.4 63.9 46.8 51.8

May 2014 Page No: 22 T4 Part B Case - Answer

Appendix 6

Comparison of the NPV generated by the N and P farm-out proposals

Farm-out proposals (based on

timings for a farm-out for FFF):

Pre-tax Year 1

cost of discount

capital rate Pre-tax NPV

US$ million

N One-off payment of US$ 100.0 million

at end of Year 1 11% 0.901 90.1

Pre-tax Pre-tax 10 year

cash flow cost of cumulative

capital discount

US$ million rate Pre-tax NPV

US$ million

P 10 years at US$ 22.0 million

per year 22.0 11% 5.889 129.6

Difference between N and P

in NPV terms + 39.5 million

+ 43.8%

Notes:

1. The comparison shown above assumes the one-off payment from N would be paid at

the end of Year 1 and the annual payments from P would be paid in Years 1 to 10. This

would applicable to a farm-out arrangement for oil and gas field FFF which would go

into production drilling during Year 1 (YJ‟s financial year 2014/15).

2. It should be noted that the comparison of the NPV‟s for the other two potential farm-out

proposals for fields GGG and HHH, which would not go into production drilling until Year

2 (YJ‟s financial year 2015/16), would affect the discount rates used for comparison

purposes, and would result in slightly different NPV values for N and for P.

3. This assumes that YJ‟s pre-tax cost of capital of 11% is suitable for both N and P.

May 2014 Page No: 23 T4 Part B Case - Answer

Appendix 7

Evaluation of Country Z potential oil and gas field KKK

Oil Gas Total

Daily production (bopd / boepd) 4,250 3,275

Revenue per barrel / equivalent barrel 110 20

US$ million US$ million US$ million

Revenue 170.6 23.9 194.5

Production costs before licence fee

(based on 25% of revenue) 48.6

US $ million

Total drilling costs 130.0

Amortisation over 10 years 13.0 13.0

Total operating profit for KKK 132.9

Z government‟s PSA licence fee at

80% of total operating profit 106.3

YJ‟s share of operating profit 26.6

Capital employed at start of Year 1 130.0

ROCE 20.5%

May 2014 Page No: 24 T4 Part B Case - Answer

Appendix 8

Part (b) – Email to the Board on the merits of a farm-out agreement and which of

the farm-out proposals from N or P is best suited to YJ’s cash requirements.

To: YJ Board members

From: Management Accountant

Date: 22 May 2014

Merits of a farm-out arrangement

1. Shares the cost of test and production drilling, as instead of YJ having to finance total

drilling costs of US$ 136.0 million for each of the three newly licensed oil and gas fields,

YJ would receive 40% of the drilling costs at each of the fields farmed-out (US$ 54.4

million).

2. The farm-out proposal will give N or P 40% of all future oil and gas production but it will

allow YJ to go into production sooner and not risk the possibility of not going into

production before the licence expires at 30 September 2016.

3. Without one or more farm-out agreements YJ would not be able to finance the drilling at

all three newly licensed oil and gas fields as this requires a total of US$ 408.0 million,

which YJ does not have, even with a rights issue and some new loan finance, as these

would only generate US$ 90.0 million.

4. Without a farm-out proposal for at least one of the new oil and gas fields, YJ would have

a cash shortfall of US$ (68.9) million at end 2014/15 which is forecast to grow to a cash

shortfall of US$ (150.0) million by the end of 2015/16.

5. Farm-out agreements share the cost of test drilling, which reduces YJ‟s risk should the

oil and gas field prove not to be economic to take into production.

Whether the proposal from N or P is better suited to YJ‟s cash requirements:

6. YJ need to finance the forecast total cash shortfall of US$ (150.0) million and can only

raise this finance through one or more farm out proposals.

7. Ullan Shah wants to minimise the number of farm-out arrangements and this can only

be done by having a farm-out arrangement with N, as this generates a large up front

one-off fixed fee and is best suited to YJ‟s cash requirements.

8. YJ could accept the proposal to farm-out just one licensed oil and gas field with N as

this will generate a one-off fee of US$ 100.0 million plus the 40% share of drilling costs

which equals US$ 54.4 million.

9. If YJ were to accept the farm-out proposal from P, which generates the highest NPV,

then it would need to farm-out two of the three newly licensed oil and gas fields as this

proposal would not raise enough finance if just one oil and gas field were to be farmed-

out.

Recommendation:

10. It is recommended that YJ farm-out just one oil and gas field and accept the proposal

from N, which includes the one-off fee of $100.0 million plus a 40% share of drilling

costs, totalling US$ 154.4 million, as this generates the much needed cash for YJ to

bring all three oil and gas fields into production.

End of answer

May 2014 Page No: 25 T4 Part B Case - Answer

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Examiner's Answers For Financial Strategy: Section ADocument18 pagesThe Examiner's Answers For Financial Strategy: Section Amagnetbox8No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Partnerships: Liquidation: Mcgraw-Hill/IrwinDocument25 pagesPartnerships: Liquidation: Mcgraw-Hill/Irwinmagnetbox8No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Consolidation Ownership Issues: Mcgraw-Hill/IrwinDocument41 pagesConsolidation Ownership Issues: Mcgraw-Hill/Irwinmagnetbox8No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Financial Reporting Class NoteDocument9 pagesFinancial Reporting Class Notemagnetbox8No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- May 2006 Examinations: Strategy LevelDocument32 pagesMay 2006 Examinations: Strategy Levelmagnetbox8No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- 8143 Companies Income Tax (Amendment) Act, 2007Document10 pages8143 Companies Income Tax (Amendment) Act, 2007magnetbox8No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- LixingcunDocument11 pagesLixingcunmagnetbox8No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Corporate Reporting (International) : Tuesday 14 June 2011Document8 pagesCorporate Reporting (International) : Tuesday 14 June 2011magnetbox8No ratings yet

- Corporate Reporting (International) : Tuesday 15 June 2010Document7 pagesCorporate Reporting (International) : Tuesday 15 June 2010magnetbox8No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 15 Af 503 sfm61Document4 pages15 Af 503 sfm61magnetbox8No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- T4 - Part B Case Study Examination: Wednesday 28 August 2013Document32 pagesT4 - Part B Case Study Examination: Wednesday 28 August 2013magnetbox8No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Case Study July 2015 Examiners Report and MP Combined FINALDocument27 pagesCase Study July 2015 Examiners Report and MP Combined FINALmagnetbox8No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- T4 - Part B Case Study Examination: Tuesday 25 February 2014Document28 pagesT4 - Part B Case Study Examination: Tuesday 25 February 2014magnetbox8No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- T4 May 2014 - For PublicationDocument28 pagesT4 May 2014 - For Publicationmagnetbox8No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- T4 March 2013 AnswersDocument25 pagesT4 March 2013 Answersmagnetbox8No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Pakistan: Monday, The 17th February 2014Document4 pagesPakistan: Monday, The 17th February 2014magnetbox8No ratings yet

- March 2014 AnswersDocument23 pagesMarch 2014 Answersmagnetbox8No ratings yet

- Case Study November 2015 Illustrative Script 1Document16 pagesCase Study November 2015 Illustrative Script 1magnetbox8No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- July 2015 Case Study EPDocument19 pagesJuly 2015 Case Study EPmagnetbox8No ratings yet

- Case Study November 2015 Illustrative Script 2Document15 pagesCase Study November 2015 Illustrative Script 2magnetbox8No ratings yet

- CALIDocument58 pagesCALIleticia figueroaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Kampfgruppe KerscherDocument6 pagesKampfgruppe KerscherarkhoshNo ratings yet

- Information: Republic of The Philippines Regional Trial Court 8 Judicial Region Branch VIDocument2 pagesInformation: Republic of The Philippines Regional Trial Court 8 Judicial Region Branch VIlossesaboundNo ratings yet

- Company Profile ESB Update May 2021 Ver 1Document9 pagesCompany Profile ESB Update May 2021 Ver 1Nakaturi CoffeeNo ratings yet

- A - Persuasive TextDocument15 pagesA - Persuasive TextMA. MERCELITA LABUYONo ratings yet

- Activity-Based Management (ABM) Is A Systemwide, Integrated Approach That FocusesDocument4 pagesActivity-Based Management (ABM) Is A Systemwide, Integrated Approach That FocusestogarikalNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Introduction To Emerging TechnologiesDocument145 pagesIntroduction To Emerging TechnologiesKirubel KefyalewNo ratings yet

- A Practical Guide To Transfer Pricing Policy Design and ImplementationDocument11 pagesA Practical Guide To Transfer Pricing Policy Design and ImplementationQiujun LiNo ratings yet

- Aqualab ClinicDocument12 pagesAqualab ClinichonyarnamiqNo ratings yet

- Science Technology and SocietyDocument46 pagesScience Technology and SocietyCharles Elquime GalaponNo ratings yet

- Micro TeachingDocument3 pagesMicro Teachingapi-273530753No ratings yet

- Diva Arbitrage Fund PresentationDocument65 pagesDiva Arbitrage Fund Presentationchuff6675No ratings yet

- The Nature of Mathematics: "Nature's Great Books Is Written in Mathematics" Galileo GalileiDocument9 pagesThe Nature of Mathematics: "Nature's Great Books Is Written in Mathematics" Galileo GalileiLei-Angelika TungpalanNo ratings yet

- Sabbir 47MDocument25 pagesSabbir 47MMd.sabbir Hossen875No ratings yet

- Eradication, Control and Monitoring Programmes To Contain Animal DiseasesDocument52 pagesEradication, Control and Monitoring Programmes To Contain Animal DiseasesMegersaNo ratings yet

- Concordia: The Lutheran Confessions - ExcerptsDocument39 pagesConcordia: The Lutheran Confessions - ExcerptsConcordia Publishing House28% (25)

- Novedades Jaltest CV en 887Document14 pagesNovedades Jaltest CV en 887Bruce LyndeNo ratings yet

- Research PaperDocument9 pagesResearch PaperMegha BoranaNo ratings yet

- Green Campus Concept - A Broader View of A Sustainable CampusDocument14 pagesGreen Campus Concept - A Broader View of A Sustainable CampusHari HaranNo ratings yet

- ANI Network - Quick Bill Pay PDFDocument2 pagesANI Network - Quick Bill Pay PDFSandeep DwivediNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ANSI-ISA-S5.4-1991 - Instrument Loop DiagramsDocument22 pagesANSI-ISA-S5.4-1991 - Instrument Loop DiagramsCarlos Poveda100% (2)

- Approach To A Case of ScoliosisDocument54 pagesApproach To A Case of ScoliosisJocuri KosoNo ratings yet

- TNEA Participating College - Cut Out 2017Document18 pagesTNEA Participating College - Cut Out 2017Ajith KumarNo ratings yet

- User Manual For Inquisit's Attentional Network TaskDocument5 pagesUser Manual For Inquisit's Attentional Network TaskPiyush ParimooNo ratings yet

- Barangay AppointmentDocument2 pagesBarangay AppointmentArlyn Gumahad CahanapNo ratings yet

- Lower Gastrointestinal BleedingDocument1 pageLower Gastrointestinal Bleedingmango91286No ratings yet

- Is Electronic Writing or Document and Data Messages Legally Recognized? Discuss The Parameters/framework of The LawDocument6 pagesIs Electronic Writing or Document and Data Messages Legally Recognized? Discuss The Parameters/framework of The LawChess NutsNo ratings yet

- BSBHRM405 Support Recruitment, Selection and Induction of Staff KM2Document17 pagesBSBHRM405 Support Recruitment, Selection and Induction of Staff KM2cplerkNo ratings yet

- 1INDEA2022001Document90 pages1INDEA2022001Renata SilvaNo ratings yet

- Designing HPE Server Solutions: Supporting ResourcesDocument3 pagesDesigning HPE Server Solutions: Supporting ResourcesKARTHIK KARTHIKNo ratings yet