Professional Documents

Culture Documents

Demon Et Ization

Demon Et Ization

Uploaded by

Syed fayas thanveer SCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Demon Et Ization

Demon Et Ization

Uploaded by

Syed fayas thanveer SCopyright:

Available Formats

86 Business Studies

Demonetisation: The Government unaccounted wealth and pay

of India, made an announcement taxes at a penalty rate.

on November 8, 2016 with profound 2. Demonetisation is also

implications for the Indian economy. interpreted as a shift on the part

The two largest denomination notes, of the government indicating

`500 `1,000, were ‘demonetised’ that tax evasion will no longer be

with immediate effect, ceasing to be tolerated or accepted.

legal tender except for a few specified 3. Demonetisation also led to tax

purposes such as paying utility bills. administration channelizing

This led to eighty six per cent of the savings into the formal financial

money in circulation invalid. The system. Though, much of the

people of India had to deposit the cash that has been deposited in

invalid currency in the banks which the banking system is bound to

came along with the restrictions be withdrawn but some of the new

placed on cash withdrawals. In other deposits schemes offered by the

words, restrictions were placed on banks will continue to provide a

the convertibility of domestic money base loans, at lower interest rates.

and bank deposits. 4. Another feature of demonetisation

The aim of demonetisation was is to create a less-cash or

to curb corruption, counterfeiting cash-lite economy, i.e., channeling

the use of high denomination notes more savings through the formal

for illegal activities; and especially financial system and improving

the accumulation of ‘black money’ tax compliance. Though there

generated by income that has not are arguments against this as

been declared to the tax authorities. digital transactions require use

Features of cell phones for customers and

1. Demonetisation is viewed as a tax Point-of-Sale (PoS) machines for

administration measure. Cash merchants, which will only work if

holdings arising from declared there is internet connectivity. On

income was readily deposited the contrary, these disadvantages

in banks and exchanged for are counterbalanced by an

new notes. But those with black understanding that it helps

money had to declare their people into the formal economy,

Digitalisation has broadly impact three sections of society: the

poor, who are largely outside the digital economy; the less largely

outside the digital economy; the less affluent, who are becoming

part of the digital economy who have been covered under Jan Dhan

Accounts and Rupay cards; and the affluent, who are fully conversant

with digital transactions.

2019-2020

Ch_03.indd 86 26-Feb-19 4:24:58 PM

Business Environment 87

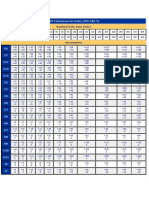

Impact of Demonetisation

1. Money/Interest i. Decline in cash transactions

rates ii. Bank deposits increased

iii. Increase in financial savings

2. Private wealth Declined since some high demonetised notes were not returned

and real estate prices fell

3. Public sector No effect

wealth

4. Digitisation Digital transactions amongst new users (RuPay/AEPS) increased

5. Real estate Prices declined

6. Tax collection Rise in income tax collection because of increased disclosure

Adapted from Economic Survey, 2016–17

thereby increasing financial (ii) More demanding customers:

saving and reducing tax evasion. Customers today have become

more demanding because they

are well-informed. Increased

Impact of Government competition in the market gives

Policy Changes on the customers wider choice in

purchasing better quality of

Business and Industry goods and services.

The policy of liberalisation, privati (iii) Rapidly changing technological

sation and globalisation of the environment: Increased com

Government has made a significant petition forces the firms to develop

impact on the working of enterprises new ways to survive and grow in the

in business and industry. The Indian market. New technologies make

corporate sector has come face-to- it possible to improve machines,

face with several challenges due to process, products and services.

government policy changes. These The rapidly changing technological

challenges can be explained as environment creates tough challe

follows: nges before smaller firms.

(i) Increasing competition: As a (iv) Necessity for change: In a

result of changes in the rules of regulated environment of pre-

industrial licensing and entry 1991 era, the firms could have

of foreign firms, competition relatively stable policies and

for Indian firms has increased practices. After 1991, the market

especially in service industries forces have become turbulent as

like telecommunications, airlines, a result of which the enterprises

banking, insurance, etc. which have to continuously modify

were earlier in the public sector. their operations.

2019-2020

Ch_03.indd 87 26-Feb-19 4:24:58 PM

You might also like

- Galen Woods All ChartsDocument172 pagesGalen Woods All Chartsvisakh s80% (15)

- Fintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay ChoubeyDocument27 pagesFintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay ChoubeyGaurav Ahirkar100% (1)

- MANAGERIAL ECONOMICS & BUSINESS STRATEGY Chap014 SolutionsDocument3 pagesMANAGERIAL ECONOMICS & BUSINESS STRATEGY Chap014 SolutionsAbhi100% (2)

- Differentiation 2nd WeekDocument12 pagesDifferentiation 2nd WeekÐhammaþriyaKamßleNo ratings yet

- Group1 ECommerceDocument14 pagesGroup1 ECommerceYASH CHAUDHARYNo ratings yet

- Liberalisation Impacts On Indian EconomyDocument1 pageLiberalisation Impacts On Indian Economyharshini archaeoNo ratings yet

- Ponmathi Mangai B. Ibm Activity 3Document6 pagesPonmathi Mangai B. Ibm Activity 3Crazy MechonsNo ratings yet

- M&a PDFDocument6 pagesM&a PDFHarshita SethiyaNo ratings yet

- Xii-Bst-3. Business Environment NotesDocument3 pagesXii-Bst-3. Business Environment NotesNaman GuptaNo ratings yet

- Blume-Fintech RPRT - Aug 2020Document27 pagesBlume-Fintech RPRT - Aug 2020Rajesh DuttaNo ratings yet

- Redefining The Fintech Experience: Impact of Covid-19: June 2020Document44 pagesRedefining The Fintech Experience: Impact of Covid-19: June 2020rajasekar venkatesan100% (1)

- COVID-19 Impact Towards Different IndustriesDocument48 pagesCOVID-19 Impact Towards Different IndustriesAnuruddha Rajasuriya100% (1)

- Artificial Intelligence IN Financial Sector: Shantanu KrishnaDocument25 pagesArtificial Intelligence IN Financial Sector: Shantanu Krishnakuppani abhiNo ratings yet

- WEF Accelerating Digital Payments in Latin America and The Caribbean 2022Document28 pagesWEF Accelerating Digital Payments in Latin America and The Caribbean 2022Fernando HernandezNo ratings yet

- India Union Budget 2019 20Document42 pagesIndia Union Budget 2019 20majhiajitNo ratings yet

- Technology, Media and Telecom (TMT) : Online Businesses and Disruptive Technologies - Key India Tax and Regulatory AspectsDocument33 pagesTechnology, Media and Telecom (TMT) : Online Businesses and Disruptive Technologies - Key India Tax and Regulatory AspectsSunny KhavleNo ratings yet

- Artificial Intelligen Ce in Financial Secto R: Shantanu KrishnaDocument25 pagesArtificial Intelligen Ce in Financial Secto R: Shantanu KrishnasalekingNo ratings yet

- RBI Circulars March 2023Document8 pagesRBI Circulars March 2023Udya singhNo ratings yet

- GD of MBFSDocument2 pagesGD of MBFSHimanshu KumarNo ratings yet

- Fintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay ChoubeyDocument27 pagesFintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay Choubeydevang bohraNo ratings yet

- Seminar 11 Introduction and Demonstration of Finance and Taxation System& Discussion 5 The Best Practice Case of Tax DigitizationDocument51 pagesSeminar 11 Introduction and Demonstration of Finance and Taxation System& Discussion 5 The Best Practice Case of Tax DigitizationPoun GerrNo ratings yet

- FinTech Making Services Available, Accessible, and AffordableDocument3 pagesFinTech Making Services Available, Accessible, and AffordableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Shapeshifting: A Look at The Evolving Landscape of Cross-Border PaymentsDocument11 pagesShapeshifting: A Look at The Evolving Landscape of Cross-Border PaymentsPritish KohliNo ratings yet

- Emerging Technologies Disrupting The Financial Sector PDFDocument56 pagesEmerging Technologies Disrupting The Financial Sector PDFvaragg24No ratings yet

- An 9Io44nC3jHkRuXH95S-FseYZwOd5ggw6QCPhE9uUBusCEEzFlmvvwzD-GpUd-sbEUHJ7uko3TGd40pBWFugAcGD8Ft kQuUjoWnQvqTuNrVYvI4dLskg 2v8FqADocument14 pagesAn 9Io44nC3jHkRuXH95S-FseYZwOd5ggw6QCPhE9uUBusCEEzFlmvvwzD-GpUd-sbEUHJ7uko3TGd40pBWFugAcGD8Ft kQuUjoWnQvqTuNrVYvI4dLskg 2v8FqALIGHTFOOT rubalcavaNo ratings yet

- Global Trends in The Cards and Payments Industry 2020Document40 pagesGlobal Trends in The Cards and Payments Industry 2020Naman JainNo ratings yet

- Latest Trends in Finance 1. Acceleration Focus On Digital TransformationDocument2 pagesLatest Trends in Finance 1. Acceleration Focus On Digital TransformationLarra KraftNo ratings yet

- Business and Environment - noPWDocument5 pagesBusiness and Environment - noPWcitizendenepal_77No ratings yet

- Regulatory Compliance Is A Data Management Game 0Document12 pagesRegulatory Compliance Is A Data Management Game 0P MandalNo ratings yet

- In Tax Budget Expectations NoexpDocument32 pagesIn Tax Budget Expectations NoexpMayurNo ratings yet

- 2021 Prime Time ReportDocument69 pages2021 Prime Time ReportkNo ratings yet

- Visa PresentationDocument9 pagesVisa PresentationAbhilash SrichandanNo ratings yet

- Financial WorldDocument17 pagesFinancial WorldKirtiPrakash MishraNo ratings yet

- Challenges Remain On Profi Return On Investment: Consumer-Facing BusinessDocument1 pageChallenges Remain On Profi Return On Investment: Consumer-Facing BusinessNi007ckNo ratings yet

- Ey The Winds of Change India Fintech Report 2021Document76 pagesEy The Winds of Change India Fintech Report 2021ShwetaNo ratings yet

- Digital Banking Playbook PDFDocument21 pagesDigital Banking Playbook PDFnikNo ratings yet

- Problems of Private Sector in IndiaDocument15 pagesProblems of Private Sector in IndiaMayank Digari50% (4)

- The Fintech 2 0 Paper PDFDocument20 pagesThe Fintech 2 0 Paper PDFAnnivasNo ratings yet

- PecftvledDocument16 pagesPecftvledGopal DubeyNo ratings yet

- Case AnalysisDocument6 pagesCase AnalysisTHERESA SUBRADONo ratings yet

- Financial Technology (Fintech) : Fintech in The UkDocument5 pagesFinancial Technology (Fintech) : Fintech in The UkChimwemwe TambwaliNo ratings yet

- India's Financial Services Sector: Group 14 B Atheeth Ayushman Swetha P Tanisha Rohit Roy SwayamDocument8 pagesIndia's Financial Services Sector: Group 14 B Atheeth Ayushman Swetha P Tanisha Rohit Roy SwayamSwetha Parameswaran 21-23No ratings yet

- EfHWHqoQX-CSW - Finance - White Paper - The New Financial WorldDocument9 pagesEfHWHqoQX-CSW - Finance - White Paper - The New Financial WorldaNo ratings yet

- AGI Technology-Impact On Asian Finance 2013Document34 pagesAGI Technology-Impact On Asian Finance 2013sdenkaspNo ratings yet

- OP-ED Consolidated Vol 9Document10 pagesOP-ED Consolidated Vol 9Mana PlanetNo ratings yet

- Instant Is The New Norm: Treasury and Trade SolutionsDocument4 pagesInstant Is The New Norm: Treasury and Trade SolutionsAviral AgarwalNo ratings yet

- Deloitte NL Fsi Fintech Report 1Document30 pagesDeloitte NL Fsi Fintech Report 1ANIRBAN BISWASNo ratings yet

- Detection of Tax Avoidance Due To The COVID-19 Pandemic With The Tax Aggressiveness ModelDocument5 pagesDetection of Tax Avoidance Due To The COVID-19 Pandemic With The Tax Aggressiveness ModelHiền MỹNo ratings yet

- Brief Digital Financial Inclusion Feb 2015Document4 pagesBrief Digital Financial Inclusion Feb 2015Mubashar BashirNo ratings yet

- ACT1202.Case Study No. 2 - SEC 6Document4 pagesACT1202.Case Study No. 2 - SEC 6Futuramarama100% (1)

- Group 4 BVCR ReportDocument36 pagesGroup 4 BVCR ReportUtkarsh BansalNo ratings yet

- The Future of BankingDocument12 pagesThe Future of BankingSabrina-MariaCatrinaNo ratings yet

- Chapter 1Document2 pagesChapter 1Shafaq Hamid RazaNo ratings yet

- Telecom Woes in India: What Does It Tell Us About Regulation?Document6 pagesTelecom Woes in India: What Does It Tell Us About Regulation?Koshy MATHEWNo ratings yet

- Assignment 1 CB Vishal Vangwad FinalDocument4 pagesAssignment 1 CB Vishal Vangwad FinalVishal VangwadNo ratings yet

- Start Path and CB Insights 2019 TrendsDocument5 pagesStart Path and CB Insights 2019 TrendsSiddhant AggarwalNo ratings yet

- TAXATIONDocument4 pagesTAXATIONYuvraj SinghNo ratings yet

- Transactions 2025 An Economic Times Report On The Future of Payments in IndiaDocument16 pagesTransactions 2025 An Economic Times Report On The Future of Payments in IndiaSaurabh JainNo ratings yet

- Challenges Faced by Fintechs in IndiaDocument2 pagesChallenges Faced by Fintechs in IndiaSRISHTI NARANGNo ratings yet

- Analytical Views: FactoringDocument6 pagesAnalytical Views: FactoringingaleharshalNo ratings yet

- (9781800375949 - FinTech) Chapter 1 - INTRODUCTION - WHAT IS FINTECHDocument21 pages(9781800375949 - FinTech) Chapter 1 - INTRODUCTION - WHAT IS FINTECHMonica VeressNo ratings yet

- Digital Senegal for Inclusive Growth: Technological Transformation for Better and More JobsFrom EverandDigital Senegal for Inclusive Growth: Technological Transformation for Better and More JobsNo ratings yet

- IntroductionToMacroeconomics L1&L2Document12 pagesIntroductionToMacroeconomics L1&L2Jai KishoreNo ratings yet

- Fiscal Policy in India - 05112019Document28 pagesFiscal Policy in India - 05112019Jai KishoreNo ratings yet

- Inference About 2 Population MeansDocument49 pagesInference About 2 Population MeansJai KishoreNo ratings yet

- Application of Bayes TheoremDocument30 pagesApplication of Bayes TheoremJai KishoreNo ratings yet

- Income Tax Payment Challan: PSID #: 162486635Document1 pageIncome Tax Payment Challan: PSID #: 162486635samNo ratings yet

- Nominal Hole Sizes (MM) : ISO Tolerances For Holes (ISO 286-2)Document4 pagesNominal Hole Sizes (MM) : ISO Tolerances For Holes (ISO 286-2)Ina IoanaNo ratings yet

- DBDocument133 pagesDBфывйцйцNo ratings yet

- Neha Project 2Document31 pagesNeha Project 2Er Purushottam PalNo ratings yet

- Lista LagardDocument19 pagesLista Lagardκονξ ομ παξ100% (1)

- Synopsis: Project Title-Hospitality Industry in Gujarat - Going VibrantDocument3 pagesSynopsis: Project Title-Hospitality Industry in Gujarat - Going Vibrantsid02101988No ratings yet

- Final Project On DisinvestmentDocument55 pagesFinal Project On DisinvestmentUrmi Maru88% (8)

- Research Report On WAPDA Energy CrisesDocument29 pagesResearch Report On WAPDA Energy CrisesAbdullah Izam75% (4)

- Rosa J CCJ-DXBDocument2 pagesRosa J CCJ-DXBnoelrNo ratings yet

- A Gad Story: The Toclong 1 Multi-Purpose CooperativeDocument4 pagesA Gad Story: The Toclong 1 Multi-Purpose CooperativeMary Monique Llacuna LaganNo ratings yet

- Ang Yu Asuncion, Et Al. vs. Court of Appeals, Et Al. - Supra Source PDFDocument14 pagesAng Yu Asuncion, Et Al. vs. Court of Appeals, Et Al. - Supra Source PDFmimiyuki_No ratings yet

- Choose The Best Title For Each Paragraph From A-F Below and Write The Letter (A-F) On The Lines Below. There Is One Title You Don't NeedDocument2 pagesChoose The Best Title For Each Paragraph From A-F Below and Write The Letter (A-F) On The Lines Below. There Is One Title You Don't NeedLaura Bernabé100% (1)

- 201011PSI Report QuitDocument12 pages201011PSI Report QuitDramatic dudeNo ratings yet

- INR One Thousand Eight Hundred and Thirty Four Rupees and Zero Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EDocument1 pageINR One Thousand Eight Hundred and Thirty Four Rupees and Zero Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EAshish MishraNo ratings yet

- BMSR 2016 PDFDocument205 pagesBMSR 2016 PDFFitria Rizal Eka PutriNo ratings yet

- Phoenix Lamps 231007Document18 pagesPhoenix Lamps 231007rahul.pms100% (1)

- Money Market InstrumentsDocument6 pagesMoney Market InstrumentsPooja ChavanNo ratings yet

- List of Nodal Officers at Regional Offices Under Banking Ombudsman SchemeDocument2 pagesList of Nodal Officers at Regional Offices Under Banking Ombudsman Schemepra CNo ratings yet

- Camso Agco Sales BrochureDocument9 pagesCamso Agco Sales BrochureOCTOPARTS GOIÂNIANo ratings yet

- 5-Test FPL For RPLL - RJAA - 20220427 - P4JAGDocument8 pages5-Test FPL For RPLL - RJAA - 20220427 - P4JAGLavern SipinNo ratings yet

- Location Theory Planning 3Document29 pagesLocation Theory Planning 3Karlo MagbutayNo ratings yet

- Henry John HeinzDocument11 pagesHenry John HeinzTodd StufflebeamNo ratings yet

- Meaning of PricingDocument5 pagesMeaning of PricingPushkar PandeyNo ratings yet

- Bir Form 2305Document1 pageBir Form 2305rbolandoNo ratings yet

- PAMI Asia Balanced Fund Product Primer v3 Intro TextDocument1 pagePAMI Asia Balanced Fund Product Primer v3 Intro Textgenie1970No ratings yet

- Donor's Tax A) Basic Principles, Concept and DefinitionDocument4 pagesDonor's Tax A) Basic Principles, Concept and DefinitionAnonymous YNTVcDNo ratings yet

- New and Renewal (March 2015)Document38 pagesNew and Renewal (March 2015)Bplo CaloocanNo ratings yet