Professional Documents

Culture Documents

WGDP Webinar 6 - The CIC Credit Report (ABautista) - Mar 12 2021

Uploaded by

Majoy Asilo Maraat0 ratings0% found this document useful (0 votes)

9 views12 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views12 pagesWGDP Webinar 6 - The CIC Credit Report (ABautista) - Mar 12 2021

Uploaded by

Majoy Asilo MaraatCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

The CIC Credit Report

and women entrepreneurs

Ease of Doing Business: Helping Women Entrepreneurs

Start and Sustain Their Business

12 March 2021, Friday | 02:00 PM

What is the

Credit Information Corporation?

• Created by Republic Act

No. 9510 or the Credit

Information System Act.

02 | The CIC Credit Report and women entrepreneurs

What is the

Credit Information Corporation?

• Submission of borrowers’

credit data is mandatory.

02 | The CIC Credit Report and women entrepreneurs

What is the

Credit Information Corporation?

• All lenders are required to

submit the credit data of

their clients.

02 | The CIC Credit Report and women entrepreneurs

What is the

Credit Information Corporation?

• As of today, the CIC

database has 24 million

borrowers.

02 | The CIC Credit Report and women entrepreneurs

03 | The CIC Credit Report and women entrepreneurs

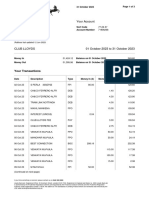

The CIC Credit Report

02 | The CIC Credit Report and women entrepreneurs

PID Number Tagging

• To become more inclusive to borrowers of microfinance institutions (MFIs),

cooperatives, and rural banks—whose borrowers may not have IDs of TIN, SSS, or

GSIS—the CIC deployed the Primary ID (PID) number tagging system.

• The Credit Information System (CIS) now accepts UMID and driver’s license, further

expanding the coverage of the CIC database.

• The average Filipino—not just those who are banked but also the unbanked and

underbanked, including women who are mostly borrowers from microfinance

institutions—are now covered by the CIS.

05 | The CIC Credit Report and women entrepreneurs

CIC EODB Milestones

CIC milestones contributing to the improvement of the

country’s competitiveness ranking, especially in the depth of

credit information index:

• 24 million borrowers and 80 million contract data in the

CIC database

• 576 financial institutions submitting credit data

• 102 accessing entities

• CIC Credit Report is now available online through a

credit bureau app which also provides credit scores.

• Online Dispute Resolution Process

06 | The CIC Credit Report and women entrepreneurs

Women entrepreneurs

and the CIC Credit Report

Toyota Financial Services, an accessing entity of the CIC,

was able to grant revolving credit facility without requiring

collateral.

Key factors: Good credit history with no negative findings as

assessed by TFS.

07 | The CIC Credit Report and women entrepreneurs

Women entrepreneurs

and the CIC Credit Report

UnionBank is also an accessing entity of the

CIC and was able to extend loans to woman

entrepreneurs because of good credit

standing.

09 | The CIC Credit Report and women entrepreneurs

The CIC Credit Report

and women entrepreneurs

Ease of Doing Business: Helping Women Entrepreneurs

Start and Sustain Their Business

12 March 2021, Friday | 02:00 PM

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1 Republic v. Security Credit and Acceptance Corp.Document2 pages1 Republic v. Security Credit and Acceptance Corp.Word MavenNo ratings yet

- DeclarationsPage PDFDocument2 pagesDeclarationsPage PDFGuy GuyersonNo ratings yet

- Accounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreDocument6 pagesAccounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreCyrine Miwa Rodriguez100% (2)

- Handbook On Barangay LegislationDocument79 pagesHandbook On Barangay LegislationMajoy Asilo MaraatNo ratings yet

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDocument2 pagesStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- Statement 10 2023Document3 pagesStatement 10 2023nvmanohar97No ratings yet

- UPI Procedural Guidelines - PDF 26112019 OnwebsiteLIVE 0Document141 pagesUPI Procedural Guidelines - PDF 26112019 OnwebsiteLIVE 0Andy_suman100% (1)

- Human Design Type ReportDocument14 pagesHuman Design Type ReportMajoy Asilo MaraatNo ratings yet

- BADAC Organizing SeminarDocument12 pagesBADAC Organizing SeminarMajoy Asilo MaraatNo ratings yet

- Survey Questionnaire (With CBA Comments) DocxDocument6 pagesSurvey Questionnaire (With CBA Comments) DocxMajoy Asilo MaraatNo ratings yet

- Social Housing Finance CorporationDocument3 pagesSocial Housing Finance CorporationMajoy Asilo MaraatNo ratings yet

- Show Primer and Sponsorship Packages BusinessesDocument1 pageShow Primer and Sponsorship Packages BusinessesMajoy Asilo MaraatNo ratings yet

- SCC 52Document13 pagesSCC 52Majoy Asilo MaraatNo ratings yet

- Validation Report: Reference Number: PVR - 197 Project Number: 32499 Loan Number: 2063 November 2012Document12 pagesValidation Report: Reference Number: PVR - 197 Project Number: 32499 Loan Number: 2063 November 2012Majoy Asilo MaraatNo ratings yet

- FINALGLOSSARYDocument57 pagesFINALGLOSSARYMajoy Asilo MaraatNo ratings yet

- Participatory Governance TWG Session 2 (Synthesis)Document4 pagesParticipatory Governance TWG Session 2 (Synthesis)Majoy Asilo MaraatNo ratings yet

- Administrative Order No. 2014 0029 2 - CompressedDocument34 pagesAdministrative Order No. 2014 0029 2 - CompressedMajoy Asilo MaraatNo ratings yet

- Training-Workshop On Documenting Good Practices For Effective Local GovernanceDocument68 pagesTraining-Workshop On Documenting Good Practices For Effective Local GovernanceMajoy Asilo MaraatNo ratings yet

- © James Muir - Best Practice International - The Perfect CloseDocument1 page© James Muir - Best Practice International - The Perfect CloseMajoy Asilo MaraatNo ratings yet

- How To Address The Biggest Challenge For Both Inbound AND Outbound SalesDocument32 pagesHow To Address The Biggest Challenge For Both Inbound AND Outbound SalesMajoy Asilo MaraatNo ratings yet

- Value Investing: Guide ToDocument19 pagesValue Investing: Guide ToDomo TagubaNo ratings yet

- ICICI Mutual Fund: Belgaum Institute of Management Studies MBADocument68 pagesICICI Mutual Fund: Belgaum Institute of Management Studies MBAPrasad KumbharNo ratings yet

- Acctg 115 - CH 10 SolutionsDocument22 pagesAcctg 115 - CH 10 SolutionschinmusicianNo ratings yet

- Horngren Fin13 F01Document52 pagesHorngren Fin13 F01Andres Deza NadalNo ratings yet

- 3MonthWaiver Poster 01Document1 page3MonthWaiver Poster 01Thanaraj SanmughamNo ratings yet

- Eaquitas SFB Initial (Monarch)Document22 pagesEaquitas SFB Initial (Monarch)beza manojNo ratings yet

- Fin242 - Chapter 3 - Cash BudgetDocument9 pagesFin242 - Chapter 3 - Cash BudgetMuhammad Amirul HasifNo ratings yet

- CAPITAL GAINS REVISION (Part 2)Document31 pagesCAPITAL GAINS REVISION (Part 2)Mana SharmaNo ratings yet

- PNB IPO FORMMicrosoft EdgeDocument1 pagePNB IPO FORMMicrosoft EdgeAshok JajalNo ratings yet

- 67178bos54090 Cp7u1Document59 pages67178bos54090 Cp7u1ashifNo ratings yet

- Tutorial 5 - Ratio Analysis - AnswerDocument6 pagesTutorial 5 - Ratio Analysis - AnswerSaravanan KandasamyNo ratings yet

- Pup Auditofreceivable1 Bsa4 2Document6 pagesPup Auditofreceivable1 Bsa4 2Makoy BixenmanNo ratings yet

- For Local Sales Only In-House and Bank Price List Meridian Place General Trias, CaviteDocument1 pageFor Local Sales Only In-House and Bank Price List Meridian Place General Trias, CaviteMary FranceNo ratings yet

- Banking: Banks Are Financial Institutions That Provide Customers With A Variety of ValuableDocument2 pagesBanking: Banks Are Financial Institutions That Provide Customers With A Variety of Valuablejuih100% (1)

- Chapter 8 Identyfing and Assessing RiskDocument18 pagesChapter 8 Identyfing and Assessing RiskDimpal RabadiaNo ratings yet

- Finance Current Affairs January Week IiDocument24 pagesFinance Current Affairs January Week IiBhav MathurNo ratings yet

- Mas (Topic1 10)Document9 pagesMas (Topic1 10)ROMAR A. PIGANo ratings yet

- Staff OD Application Format-Process-DocumentsDocument9 pagesStaff OD Application Format-Process-DocumentsSonu YadavNo ratings yet

- CHAPTER 14 - Consolidated Statement - Date of AcquisitionDocument63 pagesCHAPTER 14 - Consolidated Statement - Date of AcquisitionErina KimNo ratings yet

- Documents - Pub - Internship Report MTB Foreign Exchange OperationsDocument65 pagesDocuments - Pub - Internship Report MTB Foreign Exchange OperationsShuvoNo ratings yet

- TEGI0600Document54 pagesTEGI0600Ely TharNo ratings yet

- The Islamic Inter Bank Money MarketDocument32 pagesThe Islamic Inter Bank Money MarketSvitlana OsypovaNo ratings yet

- Quizbee Practice IntaccDocument21 pagesQuizbee Practice IntaccCharles Kevin MinaNo ratings yet

- AccountingDocument118 pagesAccountingReshmi R Nair100% (1)