Professional Documents

Culture Documents

Bac 309 Financial Derivatives ASSIGNMENT DUE20/07/2021

Bac 309 Financial Derivatives ASSIGNMENT DUE20/07/2021

Uploaded by

WINFRED KYALOOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bac 309 Financial Derivatives ASSIGNMENT DUE20/07/2021

Bac 309 Financial Derivatives ASSIGNMENT DUE20/07/2021

Uploaded by

WINFRED KYALOCopyright:

Available Formats

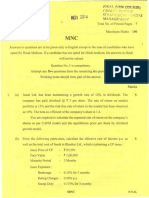

BAC 309 FINANCIAL DERIVATIVES

ASSIGNMENT DUE20/07/2021

Q 1 i)Distinquish between commodity and financial markets

ii) ) Suppose the sport price for a barrel of oil is ksh 500 per barrel in January 2020.The one

year futures price was ksh 550 per barrel while the interest rate is 7%. What is the net

convenience yield?

iii) Briefly outline the main differences between a future and a forward contract(15mks)

Q2 i)Susan owns dividend paying stock that is currently worthy ksh 500 .He plans to sell the

stock in 90 days and in order to hedge against a possible price fluctuation he takes a short

position in a forward contract that expires in 90 days. The risk free rate is 9% while over the

next 90 days the stock is expected to pay dividens as follows;

Days to next dividend Dividend per share

30 Sh 2.50

60 Sh 2.50

90 Sh 2.50

Required

i)Calculate the forward price of a contract established today and the expiring in 90 days

ii)After 60 days of entering the forward contract the stock price has hiked to ksh 145, calculate

the value of the forward contract at this poin

iii)At expiration point after 90 days the stock price is ksh 160, calculate the value of the forward

contract at expiration(15mks)

Q3 i) Difference between option and future markets structure

ii)Discuss the importance of Derivative Market development in emerging markets(10mks)

You might also like

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- August 2016Document3 pagesAugust 2016nwanguiNo ratings yet

- End Term Question Paper - FDM - Term V Batch 2020-22Document2 pagesEnd Term Question Paper - FDM - Term V Batch 2020-22sumit rajNo ratings yet

- Derivatives (Q) .Document3 pagesDerivatives (Q) .chandrakantchainani606No ratings yet

- Corporate Finance and Capital BudgetingDocument3 pagesCorporate Finance and Capital BudgetingRAHUL kumarNo ratings yet

- Dba 302 Financial Management Supplementary TestDocument3 pagesDba 302 Financial Management Supplementary Testmulenga lubembaNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument25 pagesPaper - 2: Strategic Financial Management Questions Security ValuationPalisthaNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerKuperajahNo ratings yet

- SFM N RTP, MTP, EXAMDocument204 pagesSFM N RTP, MTP, EXAMKuperajahNo ratings yet

- Memory Tech SDN BHD - PTC PDFDocument16 pagesMemory Tech SDN BHD - PTC PDFBadrul HakimiNo ratings yet

- BCF 3202 - Financial Institutions and Markets - April 2021Document4 pagesBCF 3202 - Financial Institutions and Markets - April 2021dev hayaNo ratings yet

- Ca Final May 2012 Exam Paper 2Document7 pagesCa Final May 2012 Exam Paper 2Asim DasNo ratings yet

- Ilovepdf MergedDocument23 pagesIlovepdf MergedSubhahan BashaNo ratings yet

- Roll No. ..................................... : Part-ADocument7 pagesRoll No. ..................................... : Part-Akevin12345555No ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- CA Final FR Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Final FR Q MTP 2 May 2024 Castudynotes ComAudit UserNo ratings yet

- Crescent All CAF Mocks With Solutions Compiled by Saboor Ahmad-1Document124 pagesCrescent All CAF Mocks With Solutions Compiled by Saboor Ahmad-1Omair HasanNo ratings yet

- 2840202Document4 pages2840202lathigara jayNo ratings yet

- MTP 1 May 18 QDocument4 pagesMTP 1 May 18 QSampath KumarNo ratings yet

- Business Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesBusiness Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationSyed Muhammad JawwadNo ratings yet

- AccountingDocument4 pagesAccountingnwanguiNo ratings yet

- Quarter Test 2 QPDocument7 pagesQuarter Test 2 QPOmair HasanNo ratings yet

- 05 - Derivatives Queue Cma FinalDocument40 pages05 - Derivatives Queue Cma Finalrehaliya15No ratings yet

- Tutorial Topic2 Questions-1Document4 pagesTutorial Topic2 Questions-1Aliyana SmolderhalderNo ratings yet

- PAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadDocument132 pagesPAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadHadeed HafeezNo ratings yet

- SFM Mixed Compilation QTSDocument25 pagesSFM Mixed Compilation QTSBijay AgrawalNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerAyushi GuptaNo ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- Of Questions-6: LimitedprovidesDocument16 pagesOf Questions-6: Limitedprovidesanila rathodaNo ratings yet

- Practice Set (Questions) - IFRS 5 PDFDocument2 pagesPractice Set (Questions) - IFRS 5 PDFAli Haider100% (1)

- Mock Exam 2Document7 pagesMock Exam 2ZahidNo ratings yet

- Model Test Paper For CAIIB BFMDocument13 pagesModel Test Paper For CAIIB BFMAnkit Sahu100% (1)

- SFM Q 2Document5 pagesSFM Q 2riyaNo ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- SFM QDocument4 pagesSFM QriyaNo ratings yet

- 2023 JA - FM - QuestionDocument4 pages2023 JA - FM - Questionmiradvance studyNo ratings yet

- 2023 MA-. FM QuestionDocument3 pages2023 MA-. FM Questionmiradvance studyNo ratings yet

- BCM 4206 Corporate Finance PDFDocument4 pagesBCM 4206 Corporate Finance PDFSimon silaNo ratings yet

- FIN3020 Exam 2020 May PDFDocument8 pagesFIN3020 Exam 2020 May PDFSteven LiNo ratings yet

- PAC All CAF Mocks With Solutions Compiled by Saboor AhmadDocument128 pagesPAC All CAF Mocks With Solutions Compiled by Saboor AhmadOmair HasanNo ratings yet

- FAR MA-2023 Suggested AnswersDocument10 pagesFAR MA-2023 Suggested AnswersMd HasanNo ratings yet

- Nov 10Document7 pagesNov 10chandreshNo ratings yet

- Inter - Nov 2023 Exam - Acc Test 1 - QueDocument3 pagesInter - Nov 2023 Exam - Acc Test 1 - QueSrushti AgarwalNo ratings yet

- FAR MA-2023 QuestionDocument4 pagesFAR MA-2023 QuestionMd HasanNo ratings yet

- Past Paper - BFDDocument73 pagesPast Paper - BFDarifgillcaNo ratings yet

- P14 S16Document16 pagesP14 S1674ef8465d65d1bNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityCA Kiran KhatriNo ratings yet

- Assignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Document2 pagesAssignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Ramesh Chand GuptaNo ratings yet

- AL Financial Management Nov Dec 2016Document4 pagesAL Financial Management Nov Dec 2016hyp siinNo ratings yet

- NCFM Test: (B) T+3 To T+2Document18 pagesNCFM Test: (B) T+3 To T+2Upasana KollanaNo ratings yet

- Adobe Scan 20-Mar-2024Document3 pagesAdobe Scan 20-Mar-2024BhagyaNo ratings yet

- Term Test 2 (QP)Document4 pagesTerm Test 2 (QP)Ali OptimisticNo ratings yet

- FAR JA-2023 QuestionDocument4 pagesFAR JA-2023 QuestionMd HasanNo ratings yet

- DER1 1516 Assignment 01 PDFDocument1 pageDER1 1516 Assignment 01 PDFvalleNo ratings yet

- Financial Markets and Institutions248 ut9g7tDEPEDocument2 pagesFinancial Markets and Institutions248 ut9g7tDEPEKhushi SangoiNo ratings yet

- Day 4Document7 pagesDay 4sabrina006No ratings yet

- 4A. Derivatives QuestionsDocument32 pages4A. Derivatives QuestionsMukunda HandeNo ratings yet

- CAF 1 FAR1 Autumn 2023Document6 pagesCAF 1 FAR1 Autumn 2023z8qcsqfj8dNo ratings yet

- FIMDDA Debt Module1Document7 pagesFIMDDA Debt Module1Kirti SahniNo ratings yet

- 06 - Test 6 Mission 80+Document4 pages06 - Test 6 Mission 80+Safal BhandariNo ratings yet