Professional Documents

Culture Documents

RR No. 4 2021.ra 11534 Create - Vat and Opt Irr

RR No. 4 2021.ra 11534 Create - Vat and Opt Irr

Uploaded by

Charisse Abordo0 ratings0% found this document useful (0 votes)

7 views7 pagesOriginal Title

Rr No. 4 2021.Ra 11534 Create.vat and Opt Irr

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views7 pagesRR No. 4 2021.ra 11534 Create - Vat and Opt Irr

RR No. 4 2021.ra 11534 Create - Vat and Opt Irr

Uploaded by

Charisse AbordoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

Date:_0.8 APR 2021

REVENUE REGULATIONS No. 4-202)

SUBJECT : Implementing the Provisions on Value-Added Tax (VAT) and Percentage

Tax Under Republic Act (RA) No. 11534, Otherwise Known as the

“Corporate Recovery and Tax Incentives for Enterprises Act” (CREATE)

Which Further Amended the National Internal Revenue Code of 1997, as

Amended, as Implemented by Revenue Regulations (RR) No. 16-2005

(Consolidated Value-Added Tax Regulations of 2005), as Amended.

TO All Internal Revenue Officials,

jployees and Others Concerned.

SECTION 1. SCOPE. ~ Pursuant to the provisions of Sections 244 and 245 of the

National Intemal Revenue Code of 1997 (Tax Code), as amended, in relation to Secs. 12 and

13 of RA. No. 11534 or CREATE Act, and in compliance with Section 21 thereof, these

Regulations are issued to implement the amendments introduced to the VAT and percentage

tax provisions of the Tax Code, as amended.

SECTION 2. AMENDMENTS. ~ Pursuant to the provisions of CREATE amending

Sections 109 and 116 of the Tax Code, as amended, Sections 4.109-1, and 4.116-1 of RR No.

16-2005, as amended, shall now be read as follows:

“SEC. 4.109-1, VAT-Exempt Transactions, —

xxx 2x xxx

(B) Exempt transactions. —

xxx Xxx xxx

(p) The following sales of real properties are exempt from VAT, namely

Xxx XXX, Xxx,

(4) Sale of residential lot valued at One Million Five Hundred Thousand Pesos

(P1,500,000.00) and below, or house & lot and other residential dwellings valued at Two

Million Five Hundred Thousand Pesos (P2,500,000,00) and below, as adjusted in 2011 using

the 2010 Consumer Price Index values.

xXx XXX XAX

Provided, That beginning January 1, 2021, the VAT exemption shall only apply to sale

of real properties not primatily held for sale to customers or held for lease in the ordinary

course of trade or business; sale of real property utilized for socialized housing as defined by

Republic Act (RA) No. 7279, as amended; and, sale of house and lot, and other residential

aU REVENUE

INTER:

EAU OF INTERN

dwellings with selling price of not more than Two Million Pesos (P2,000,000.00), as adjusted

in 2011 using the 2010 Consumer Price Index values: Provided, further, That every three (3)

years thereafter, the amounts stated herein shall be adjusted to its present value using the

‘Consumer Price Index as published by the Philippine Statistics Authority (PSA).

XXX, XXX XXX

(1) Sale, importation, printing or publication of books, and any newspaper, magazine,

journal, review bulletin, or any such educational reading material covered by the United

Nations Educational, Scientific and Cultural Organization (UNESCO) Agreement on the

importation of educational, scientific and cultural materials, including the digital or electronic

format thereof. Provided, That the materials enumerated herein are not devoted principally to

the publication of paid advertisements. Provided further, That the materials enumerated herein

are compliant with the requirements set forth by the National Book Development Board

pursuant to R.A. No. 8047.

xxx. XXX, XXX

(aa) Sale or importation of prescription drugs and medicines for:

(i) Diabetes, high cholesterol, and hypertension beginning January 1, 2020; and

(ii) Cancer, mental illness, tuberculosis, and kidney diseases beginning January 1,

2021

‘The exemption from VAT under this subsection shall only apply to the sale or

importation by the manufacturers, distributors, wholesalers and retailer of drugs and

medicines included in the “list of approved drugs and medicines” issued by the Department of

Health (DOH) for this purpose.

(bb) Sale or importation of the following beginning January 1, 2021 to December 31,

2023:

(i Capital equipment, its spare parts and raw materials, necessary for the

production of personal protective equipment (PPE) components such as

coveralls, gown, surgical cap, surgical mask, n-95 mask, scrub suits, goggles

and face shield, double or surgical gloves, dedicated shoes, and shoe covers,

for COVID-19 preventior

(ii) All drugs, vaccines and medical devices specifically prescribed and directly

used for the treatment of COVID-19; and

(iii) Drugs for the treatment of COVID-19 approved by the Food and Drug

Administration (FDA) for use in clinical trials, including raw materials

directly necessary for the production of such drugs.

Provided, That the Department of Trade and Industry (DTI) shall certify that such

equipment, spare parts or raw materials for importation are not locally available or

insufficient in quantity, or not in accordance with the quality or specification required.

‘BUREAU

OF INTERNAL REVENUE

ATW IN

MN

Provided further, That for item (ii), within sixty (60) days from the effectivity of the

CREATE, and every three (3) months thereafter, the Department of Health (DOH) shalll issue

a list of prescription drugs and medical devices covered by this provision.

Provided finally, That for items (i) and (ii) hereof, on the sale or importation of

equipment, spare parts and raw materials for the production of PPE components as well as the

sale or importation of raw materials directly necessary for the production of drugs for the

treatment of COVID-19, the supplier/s or importer shall submit, for the purpose of availing

the exemption, the following

(1) Certified true copy of “License to Operate”, issued to the manufacturer-buyer

by the DOH-FDA authorizing the manufacture of medical grade PPE

components and drugs for the treatment of COVID-19; and

(2) “Sworn Declaration” from the manufacturer-buyer that the items shall be used

for the manufacture of the PPE components and drugs for the treatment of

COVID-19.

The exemption claimed under this subsection shall be subject to post audit by the

Bureau of Internal Revenue (BIR) or the Bureau of Customs (BOC), as may be applicable.

ILLUSTI

ATION

JRAC Corp. is a VAT-registered entity and a holder of License to Operate issued by FDA.

to manufacture medical-grade PPE components such as coveralls, gown, surgical cap, surgical

mask, n-95 mask, scrub suits, goggles and face shield, double or surgical gloves, dedicated

shoes, and shoe covers, for COVID-19 prevention.

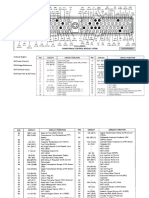

During the period of April to June 2021, the company had the following transactions:

Tmmportaiion of raw materials (not locally available) [PF 2,000,000.00

Importation of capital equipment ~ -25,000,000.00

Importation of raw materials (locally available) P_1,000,000.00 |

Sale or transfer of raw materials to an affiliated company which P 500,000.00

is also a holder of License to Operate issued by the FDA

he above transactions shall be treated for VAT purposes as follows:

vaT

‘Treatment

Importation of raw materials (not Tocally | Exempt | Imported item isnot

available or insufficient in quantity) | locally available

Importation of capital equipment Exempt | Importation of capital

| equipment for use in

| production of PPES is

Transaction Explanation

| VAT-exempt

Importation of raw materials (locally available) | Subject to | Subject since the imported

VAT _| items locally available

BONSASY Tenes31NI JO NYSENE

Sale or transfer of raw materials toan affiliated | Exempt _| Sale of PPE raw materials

& =

BUREAU OF INTERNAL REVENUE

Tt Yin)

wy

A808 me

RECO ant

‘company which is also a holder of License to is exempt from VAT

Operate issued by the FDA

(ce) Sale or lease of goods or properties or the performance of services other than the

transactions mentioned in the preceding paragraphs, the gross annual sales and/or receipts do

not exceed the amount of Three Million Pesos (B3,000,000.00).

For purposes of these Regulations, the B3,000,000.00 gross annual sales shall comprise

of the business’ total revenues from sales of its products, which are either goods or services,

including non-refundable advance deposits/payments for services, net of discounts, sales

returns and allowances, covering the calendar or fiscal year. Sales incidental to the registered

operations of the business shall also be included pursuant to Section 105 of the Tax Code, as

amended,

Xxx XxX Xxx’

SEC.4-116. Tax on Persons Exempt from VAT. —

Any person whose sales or receipts are exempt under Section 109(1)(CC) of the Tax

Code from the payment of VAT and who is not a VAT-registered petson shall pay a tax

equivalent to three percent (3%) of his gross quarterly sales or receipts: Provided, however,

that the following shall be exempt from the payment of three percent (39%) percentage tax:

1. Cooperatives: and

2, Self-employed individuals and professionals availing of the 8% tax on gross sales

and/or receipts and other non-operating income, under Sections 24(A)(2)(b) and

24(A)(2)(¢)(2)(a) of the Tax Code.

Provided, further, that effective July 1, 2020 until June 30, 2023, the rate shall be one

percent (1%).

XXX XXX XXX’

SECTION 3. TRAN!

‘ORY PROVISION:

1. A VAT-registered taxpayer who opted to register as non-VAT as a result of the

additional VAT-exempt provisions under Sections 109(1)(R), 109(1)(AA), and 109(1)(BB) of

the Tax Code, as amended by CREATE Act and provided that it did not meet the threshold set

under Section 109(1)(CC) thereof, shall:

a. Submit an inventory list of unused invoices and/or receipts as of the date of filing

of application for update of registration from VAT to Non-VAT, indicating the

number of booklets and its corresponding serial numbers; and

b. Surrender the said invoices and/or receipts for cancellation.

A number of unused invoices/receipts, as determined by the taxpayer with the

approval of the appropriate BIR Office, may be allowed for use, provided the phrase “Non-

g \

VAT registered as of (date of filing an application for update of registration) Not valid for

claim of input tax.” shall be stamped on the face of every copy thereof, until new registered

non-VAT invoices or receipts have been received by the taxpayer or until August 31, 2021.

Upon receipt of newly-printed registered non-VAT invoices or receipts, the taxpayer shall

submit immediately a new inventory list of, and surrender for cancellation, all unused

previously-stamped invoices/receipts."

2. The taxpayer shall treat the resulting excess taxes paid due to the inelusion in the

items exempt from VAT or adjustment in percentage tax rates, as the case may be, in the

following manner:

a. Unutilized VAT paid on local purchases and importation under subsections 4.109-

1(B)(aa)(ii) and 4.109-1(B)(bb) hereof from their specified effectivity under R.A.

No. 11534 on January 1, 2021 until the effectivity of these Regulations may be

cattied-over to the succeeding taxable quarter/s or be charged as part of cost,

pursuant to Section 110 of the Tax Code.

Input VAT which are directly attributable to goods now classified as VAT-exempt

may be allowed as part of cost. For input VAT that cannot be attributed to goods

now classified as VAT-exempt, only a ratable portion thereof shall be charged to

cost.

ILLUSTRATIONS:

Assumption 1. No additional Purchases for the period

MMC Pharmaceutical Corp. is an exclusive distributor of a certain brand of prescription drugs

for cancer and several other drugs in the Philippines. For the period January to March 2021,

the said company had the following:

Inventory of cancer drugs as of December 31, 2020 +2200,000,000.00

Sale for cancer medicines (goods from previous inventory) __-®200,000,000.00

Total sales for the period 2500,000,000.00

Percentage of sale of cancer medicines to total sales for the period 40%

All input taxes from the existing inventory of cancer drugs have been utilized as of December

31, 2020.

Assuming that MMC Pharmaceutical Corp. incurred 220,000,000.00 of input tax for the

period from purchases of medicines other than those prescribed for cancer and no additional

purchases of prescription drugs for cancer was purchased during the period. The VAT payable

shall be computed as follows:

Sales subject to VAT B 300,000,000.00

Multiply by: VAT Rate 12%

Output tax for the period BP 36,000,000.00

Deduct: Input tax for the period

VAT Payable

Assumption 2. Option to charge to cost the input VAT directly identifiable to now VAT-

exempt goods

VTG Pharmaceutical Corp. incurred #20,000,000.00 of input tax for the period from

purchases of medicines other than those prescribed for cancer and no additional purchases of

prescription drugs for cancer was purchased during the period. There was an unutilized input

tax of 210,000,000.00 coming from the inventory of cancer drugs from previous period that

was carried-over to the succeeding quarter and 50% of the inventory of cancer drugs was

sold during the period. The VAT payable shall be computed as follows:

Sales subject to VAT B300,000,000.00

Multiply by: VAT Rate 12%

Output tax for the period RB 36,000,000.00

Deduct: Input tax for the period

Input tax carried over from

previous period (cancer drug) —P10,000,000.00

Input tax from current purchases — 20,000,000.00

(non-cancer drug)

Total input taxes P30,000,000.00

Deduct: Input tax identifiable 10 5 999.999,09 —25,000,000.00

exempt sales (50% of inventory)

VAT Payable ~ B_11,000,000.00

Note: the P5,000,000.00 directly identifiable to exempt sales shall be charged tows!

Assumption 3. Option to charge as part of cost a ratable portion of the input VAT not

directly identifiable to goods now classified as VAT-exempt

JBA Pharmaceutical Corp. sold drugs for cancer which were part of the Corp's previous and

current purchases, Total sales for the period is B500,000,000.00, fifty percent (50%) of which

is VAT-exempt. The Corp. also incurred 820,000,000.00 of input tax for the period from

purchases of medicines including those prescribed for cancer. ‘There was an unutilized input

tax of B10,000,000,00 coming from the previous period but cannot be attributed to the

inventory of drugs for cancer. The VAT payable shall be computed as follows:

7 Sales subject to VAT B 250,000,000.00

Ss Multiply by: VAT Rate 12%

ol Output tax for the period B 30,000,000.00

‘S| Deduet: Input tax for the period

z Input tax carried over from ® 10,000,000.00

| previous period

g Input tax from current purchases 000,000.00

z Total available input taxes # 30,000,000.00

z Deduct: Input tax ratable to

exempt sales (50% of total sales) __19:000,000.00 __15,000,000.00

VAT Payable P_15,000,000.00

Note: the P15,000,000,00 allocated to exempt sales shall be charged to cost.

ee

b. Excess percentage tax payments as a result of the decrease of tax rate from 3% to

1% starting July 1, 2020 until the effectivity of these Regulations may be carried

forward to the succeeding taxable quarter/s by reflecting the excess percentage tax

payment under Line 17 of the Quarterly Percentage Tax Return (BIR Form No.

2551Q), “Other Tax Credit/Payment”, specifying therein as “Carry-Over Excess

Percentage Taxes Paid from Previous Quarter/s”.

3. Excess/Unutilized input taxes as a result of the change of status from VAT to

Non-VAT registration, under Sec. 112(B) of the Tax Code of 1997, as amended, may be

subject to refund or the issuance of Tax Credit Certificate (TCC), at the option of the

taxpayer.

SECTION 4. REPEALING CLAUSE. ~ Any rules and regulations, issuances or parts

thereof inconsistent with the provisions of these Regulations are hereby repealed, amended or

modified accordingly.

ECTION 5. SEPARABILITY CLAUSE. ~ If any of the provisions of these

Regulations is subsequently declared unconstitutional, the validity of the remaining

provisions hereof shall remain in full force and effect.

SECTION 6. EFFECTIVITY. ~ These Regulations shall take effect fifteen (15) days

following publication in the Official Gazette or in a leading newspaper of general circulation,

whichever comes first. Provided, however, that the new exemptions introduced herein by

CREATE shall commence upon the effectivity of the said law, unless otherwise stated,

CARLOS G. DOMINGY

Secretary of Finance BS

Recommending Approval: APR OT 2A

pte

CAESAR R. DULAY

‘Commissioner of Intemal Revenue

042290

BUREAU OF INTERNAL REVENUE

TS IAYIN

DM

i |} APR 8 2zn

Wire

eGunus v9, DIVISION

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Samsung SSD Pricelist JulyDocument1 pageSamsung SSD Pricelist JulyNico Rivera CallangNo ratings yet

- Kioxia and Trek Pricelist August 2020Document6 pagesKioxia and Trek Pricelist August 2020Nico Rivera CallangNo ratings yet

- Hikvision SSD Pricelist August 2020Document4 pagesHikvision SSD Pricelist August 2020Nico Rivera CallangNo ratings yet

- Hikvision Flash Pricelist August 2020Document6 pagesHikvision Flash Pricelist August 2020Nico Rivera CallangNo ratings yet

- CP Plus Red Series - 2020 - 1596589468Document9 pagesCP Plus Red Series - 2020 - 1596589468Nico Rivera CallangNo ratings yet

- Payatas 2.O LogsDocument598 pagesPayatas 2.O LogsNico Rivera CallangNo ratings yet

- Ford Exped Gen 1 ECU Pin OutDocument3 pagesFord Exped Gen 1 ECU Pin OutNico Rivera CallangNo ratings yet

- HIKVISION Fever Screening Thermal Solution Pricelist Update 2020Document29 pagesHIKVISION Fever Screening Thermal Solution Pricelist Update 2020Nico Rivera CallangNo ratings yet

- AmendedAOI 03062020 DITO CME Holdings CorpDocument14 pagesAmendedAOI 03062020 DITO CME Holdings CorpNico Rivera CallangNo ratings yet

- 2020.11.11 Indicative Corporate Structure Post SwapDocument1 page2020.11.11 Indicative Corporate Structure Post SwapNico Rivera CallangNo ratings yet

- Inteluck Trucker Rates - RustansDocument5 pagesInteluck Trucker Rates - RustansNico Rivera CallangNo ratings yet

- Naic PH NortheastDocument1 pageNaic PH NortheastNico Rivera CallangNo ratings yet

- HIKVISION IP Camera Pricelist 2020Q1 IntegratorDocument114 pagesHIKVISION IP Camera Pricelist 2020Q1 IntegratorNico Rivera CallangNo ratings yet

- ZK TECO Body Temperature Product Line: Category Picture Model Name SpecificationsDocument7 pagesZK TECO Body Temperature Product Line: Category Picture Model Name SpecificationsNico Rivera CallangNo ratings yet

- Warehouse 1 of 6: List of Pre-Owned Vehicles For SaleDocument9 pagesWarehouse 1 of 6: List of Pre-Owned Vehicles For SaleNico Rivera CallangNo ratings yet

- 2004 Buick Regal OwnersDocument354 pages2004 Buick Regal OwnersNico Rivera CallangNo ratings yet

- Province of Nueva Vizcaya: SUBASTA 2019Document18 pagesProvince of Nueva Vizcaya: SUBASTA 2019Nico Rivera CallangNo ratings yet

- HIKVISION Access Control Intercom Pricelist 2020Document121 pagesHIKVISION Access Control Intercom Pricelist 2020Nico Rivera CallangNo ratings yet

- Hikvision DVR NVR Storage 2020 MSRPDocument57 pagesHikvision DVR NVR Storage 2020 MSRPNico Rivera CallangNo ratings yet

- TP Link Eap225Document104 pagesTP Link Eap225Nico Rivera CallangNo ratings yet