Professional Documents

Culture Documents

Payback Period Sample

Payback Period Sample

Uploaded by

MARIA THERESA ABRIOOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payback Period Sample

Payback Period Sample

Uploaded by

MARIA THERESA ABRIOCopyright:

Available Formats

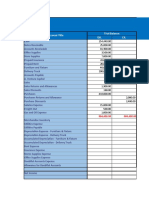

Due to increased demand, the management of Rani Beverage Company is

considering to purchase a new equipment to increase the production and revenues.

The useful life of the equipment is 10 years and the company’s maximum desired

payback period is 4 years. The inflow and outflow of cash associated with the new

equipment is given below:

Initial cost of equipment: $37,500

Annual cash inflows:

Sales $75,000

Annual cash outflows:

Cost of ingredients: $45,000

Salaries expenses: $13,500

Maintenance expenses: $1,500

Non-cash expenses:

Depreciation expenses $5,000

Required: Should Rani Beverage Company purchase the new equipment? Use

payback method for your answer.

Solution:

Step 1: In order to compute the payback period of the equipment, we need to workout the

net annual cash inflow by deducting the total of cash outflow from the total of cash inflow

associated with the equipment.

Computation of net annual cash inflow:

$75,000 – ($45,000 + $13,500 + $1,500)

= $15,000

Step 2: Now, the amount of investment required to purchase the equipment would be

divided by the amount of net annual cash inflow (computed in step 1) to find the payback

period of the equipment.

= $37,500/$15,000

=2.5 years

Depreciation is a non-cash expense and has therefore been ignored while calculating

the payback period of the project.

According to payback method, the equipment should be purchased because the payback

period of the equipment is 2.5 years which is shorter than the maximum desired payback

period of 4 years.

You might also like

- South Asialink Finance Corporation (Credit Union)Document1 pageSouth Asialink Finance Corporation (Credit Union)Charish Kaye Radana100% (1)

- Accounting ProjectDocument135 pagesAccounting ProjectMylene SalvadorNo ratings yet

- (#2) Supply-Demand and Philippine Economic ProblemsDocument16 pages(#2) Supply-Demand and Philippine Economic ProblemsBianca Jane GaayonNo ratings yet

- Opertions Auditing - SyllabusDocument4 pagesOpertions Auditing - SyllabusMARIA THERESA ABRIONo ratings yet

- Business FinanceDocument18 pagesBusiness FinanceFriedrich Mariveles100% (1)

- Fabm2 Learning-Activity-1Document7 pagesFabm2 Learning-Activity-1Cha Eun WooNo ratings yet

- Bubbles DishwashingDocument17 pagesBubbles DishwashingPee JayNo ratings yet

- W07 - Conversion Table: Names: JAMSDocument6 pagesW07 - Conversion Table: Names: JAMSJovelle Sydell EbonaNo ratings yet

- Chapter 2 - Review of LiteratureDocument10 pagesChapter 2 - Review of LiteratureLaniNo ratings yet

- Parts of A Business PlanDocument4 pagesParts of A Business PlanGrace BartolomeNo ratings yet

- Term Paper TQMDocument10 pagesTerm Paper TQMKathy SarmientoNo ratings yet

- Om TQM PrelimDocument19 pagesOm TQM PrelimAnthony John BrionesNo ratings yet

- Research Final 1Document63 pagesResearch Final 1Renzie Mae JaoNo ratings yet

- The PESTLE AnalysisDocument6 pagesThe PESTLE AnalysisAgumas KinduNo ratings yet

- PESTEL Analysis For Small BusinessesDocument3 pagesPESTEL Analysis For Small BusinessesJohurul HoqueNo ratings yet

- No.4 Factor Affecting Marketing StrategiesDocument11 pagesNo.4 Factor Affecting Marketing StrategiesMarkNo ratings yet

- ABM PM 2nd QTR SLM Week12Document9 pagesABM PM 2nd QTR SLM Week12ganda dyosaNo ratings yet

- Seemo Eyewear Lagro, Quezon City 09954625142Document17 pagesSeemo Eyewear Lagro, Quezon City 09954625142ChristineLimosneroJulapongNo ratings yet

- HR Restructuring - Coke and DaburDocument9 pagesHR Restructuring - Coke and DaburVijeta SinghNo ratings yet

- Accounting Ratio For CHP 4Document5 pagesAccounting Ratio For CHP 4HtetThinzarNo ratings yet

- Business Environment ScanningDocument5 pagesBusiness Environment ScanningIshan GoyalNo ratings yet

- Cash FlowDocument23 pagesCash FlowSundara BalamuruganNo ratings yet

- Clarisonic Business ReportDocument13 pagesClarisonic Business Reportapi-484594814No ratings yet

- Service Quality and Customer Satisfaction of Beauty SalonDocument2 pagesService Quality and Customer Satisfaction of Beauty SalonleizelNo ratings yet

- Paburrito Business PlanDocument64 pagesPaburrito Business PlanCzarlyna CelestialNo ratings yet

- Name: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingDocument2 pagesName: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingIrish C. BamuyaNo ratings yet

- 1.4 Classification of ProductDocument11 pages1.4 Classification of Productbabunaidu2006No ratings yet

- Chapter I Final 3Document13 pagesChapter I Final 3Catherine Avila IINo ratings yet

- Name of The BusinessDocument6 pagesName of The BusinessVincent L. SantiagoNo ratings yet

- CCASBBAR34Document49 pagesCCASBBAR34Sahadev KarkiNo ratings yet

- Undifferentiated Marketing Differentiated Marketing Concentrated Targeting Customized MarketingDocument5 pagesUndifferentiated Marketing Differentiated Marketing Concentrated Targeting Customized MarketingTekletsadik TeketelNo ratings yet

- Business Research ProposalDocument37 pagesBusiness Research ProposalMOHAMED rabei ahmedNo ratings yet

- Risk and Rewards of EntrepreneurshipDocument12 pagesRisk and Rewards of EntrepreneurshipAnanya50% (2)

- Group10 - Chapter 12 - Social Issues and Problem of Urbanization in A Global WorldDocument24 pagesGroup10 - Chapter 12 - Social Issues and Problem of Urbanization in A Global WorldCyrss BaldemosNo ratings yet

- Section IiDocument7 pagesSection IiAica Aleria AycoNo ratings yet

- Session 8. CECILIA DEL CASTILLO - Innovations and InitiativesDocument38 pagesSession 8. CECILIA DEL CASTILLO - Innovations and InitiativesADBGADNo ratings yet

- The Business Plan: Creating and Starting The Venture: Click To Add TextDocument22 pagesThe Business Plan: Creating and Starting The Venture: Click To Add TextCristine Joy PublicoNo ratings yet

- Preferred Types of Marketing Strategies and Types of Senior High School Consumers in Central Colleges of The PhilippinesDocument76 pagesPreferred Types of Marketing Strategies and Types of Senior High School Consumers in Central Colleges of The PhilippinesSEBASTIAN MIRABALLES MADRIDEONo ratings yet

- 9 - Special JournalDocument30 pages9 - Special JournalYallyNo ratings yet

- Perpetual Help: Calculate Future Value and Present Value of Money andDocument8 pagesPerpetual Help: Calculate Future Value and Present Value of Money andDennis AlbisoNo ratings yet

- Week 4-6 Lessons: Collection of DataDocument8 pagesWeek 4-6 Lessons: Collection of Databernadeth salmoroNo ratings yet

- Pest Analysis of Toiletries Industry:: Political FactorsDocument2 pagesPest Analysis of Toiletries Industry:: Political FactorsrupokNo ratings yet

- Entrep 12Document72 pagesEntrep 12Angelie JalandoniNo ratings yet

- Product, Pricing and Promotional Strategies of Restaurants in Nueva Ecija: An AssessmentDocument4 pagesProduct, Pricing and Promotional Strategies of Restaurants in Nueva Ecija: An AssessmentIjaems JournalNo ratings yet

- Accounting Cycle of A Merchandising Business: Prepared By: Prof. Jonah C. PardilloDocument41 pagesAccounting Cycle of A Merchandising Business: Prepared By: Prof. Jonah C. PardilloRoxe XNo ratings yet

- Reaction Paper OligopolyDocument3 pagesReaction Paper OligopolyDafnie TobeoNo ratings yet

- Price Hike of Rice and Its Effects To The Consumer in Public Market of Iriga CityDocument59 pagesPrice Hike of Rice and Its Effects To The Consumer in Public Market of Iriga CityJommel Arce EstanielNo ratings yet

- Philippine National BankDocument23 pagesPhilippine National BankRegine CostaNo ratings yet

- Group 10 ENTREPRENEURAL FORMATION AND EVALUATIONDocument17 pagesGroup 10 ENTREPRENEURAL FORMATION AND EVALUATIONMenard MarananNo ratings yet

- Philippine Musical Instruments LuzonDocument30 pagesPhilippine Musical Instruments LuzonChristma MarianoNo ratings yet

- UntitledDocument9 pagesUntitledTaneo, Anesa P.No ratings yet

- BUSINESS PLAN For Insurance UnitDocument3 pagesBUSINESS PLAN For Insurance UnitArpit JohnNo ratings yet

- BUSINESS-Plan2.docx FINALDocument48 pagesBUSINESS-Plan2.docx FINALAilyn VillaruelNo ratings yet

- Chapter 3CDocument16 pagesChapter 3CFerdinand GeliNo ratings yet

- Vision & Mission of Footwear Industry (Sports)Document6 pagesVision & Mission of Footwear Industry (Sports)saurav mansingkaNo ratings yet

- Chapter 3Document5 pagesChapter 3Faith LacreteNo ratings yet

- Edtle2-Business PlanDocument11 pagesEdtle2-Business Planjoshua zabalaNo ratings yet

- Marketing PlanDocument25 pagesMarketing PlanGmae FampulmeNo ratings yet

- Online Shopping: Perspective of 11-ABM Blance Students of San Rafael National High SchoolDocument6 pagesOnline Shopping: Perspective of 11-ABM Blance Students of San Rafael National High SchoolArriane HeiraNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- OutlineDocument9 pagesOutlineMARIA THERESA ABRIONo ratings yet

- Accounting For Business Combinations - SyllabusDocument3 pagesAccounting For Business Combinations - SyllabusMARIA THERESA ABRIONo ratings yet

- Auditing & Assurance Principles - RecapDocument2 pagesAuditing & Assurance Principles - RecapMARIA THERESA ABRIONo ratings yet

- Auditing and Assurance Concept and Applicatiosn 1 - SyllabusDocument2 pagesAuditing and Assurance Concept and Applicatiosn 1 - SyllabusMARIA THERESA ABRIONo ratings yet

- Accounting For Special Transactions - SyllabusDocument3 pagesAccounting For Special Transactions - SyllabusMARIA THERESA ABRIONo ratings yet

- Output - CSRDocument1 pageOutput - CSRMARIA THERESA ABRIONo ratings yet