Professional Documents

Culture Documents

Asset End of Year Amount Appropriate Required Return: V CF CF CF

Asset End of Year Amount Appropriate Required Return: V CF CF CF

Uploaded by

JPOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asset End of Year Amount Appropriate Required Return: V CF CF CF

Asset End of Year Amount Appropriate Required Return: V CF CF CF

Uploaded by

JPCopyright:

Available Formats

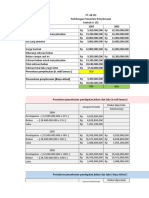

Appropriate CF 1 CF 2 CF n

Asset End of Year Amount V 0= 1

+ 2

+… n

required return (1+ r) (1+r ) (1+r )

5,000 5,000

A 1 $ 5,000 V 0= 1 V 0= $ 4,237

(1+ 0.18) 1.18

5,000 5,000

2 5,000 18% V 0= 2 V 0= 3,590

(1+ 0.18) 1.3924

5,000 5,000

3 5,000 V 0= V 0= 3,043

(1+ 0.18)

3

1.643032

1 through 1 1

B $ 300 15% V 0=CF x V 0=300 x

∞ r 0.15

C 1 0

2 0

3 0

16%

4 0

35,000 35,000

V 0= V 0=

5 $ 35,000 (1+ 0.16)5 2.10034

V 0=CF x PVIFA V 0=1,500 x 3.605

D 1 through 5 $ 1,500 $ 5,407

12%

8,500 8,500

6 8,500 V 0= 6 V 0= 4,306

(1+ 0.12) 1.973823

2,000 2,000

E 1 $ 2,000 V 0= V 0= $ 1,754

(1+ 0.14)1 1.14

3,000 3,000

2 3,000 V 0= 2 V 0= 2,308

(1+ 0.14) 1.2996

5,000 5,000

3 5,000 V 0= 3 V 0= 3,374

(1+ 0.14) 1.481544

14%

7,000 7,000

4 7,000 V 0= 4 V 0= 4,144

(1+ 0.14) 1.68896

4,000 4,000

5 4,000 V 0= V 0= 2,077

(1+ 0.14)5 1.925415

1,000 1,000

6 1,000 V 0= 6 V 0= 455

(1+ 0.14) 2.194973

You might also like

- Data Impor FenolDocument4 pagesData Impor Fenolsiti rondiyahNo ratings yet

- Calculos Circuito 2Document2 pagesCalculos Circuito 2Martín M. TorresNo ratings yet

- EBP1Document1 pageEBP1Reza MurdaniNo ratings yet

- Bunga PinjamanDocument3 pagesBunga PinjamanAmel AvantiNo ratings yet

- Forum12 - Erfan Satria Perdana - 55121110133Document4 pagesForum12 - Erfan Satria Perdana - 55121110133Erfan SatriaNo ratings yet

- Perhitungan Alat BeratDocument7 pagesPerhitungan Alat Beratnabila airenthNo ratings yet

- Borang Penilaian Pajsk Guru Penasihat KokoDocument5 pagesBorang Penilaian Pajsk Guru Penasihat KokoumiNo ratings yet

- 13 Enkel Regression Di StansDocument17 pages13 Enkel Regression Di Stansmina hannaNo ratings yet

- Ikhtisar Transaksi Bengkel SigitDocument2 pagesIkhtisar Transaksi Bengkel SigitSya Pu TraNo ratings yet

- Bab Iv - Hasil PengamatanDocument3 pagesBab Iv - Hasil PengamatanReski YuliaNo ratings yet

- Akuntansi Biaya - Asning AsdiyantiDocument1 pageAkuntansi Biaya - Asning AsdiyantiAsning YantiNo ratings yet

- Jawaban SoalDocument3 pagesJawaban SoalDina RahayuNo ratings yet

- Régua IsotanqueDocument1 pageRégua IsotanqueGUSTAVONo ratings yet

- Tugas 1 Mektan ExcelDocument4 pagesTugas 1 Mektan ExcelRezhaNo ratings yet

- Tugas Tutorial 3 Akuntansi ManajemenDocument2 pagesTugas Tutorial 3 Akuntansi ManajemenDwaayu CahyadewiNo ratings yet

- Putri Sitohang 2011031016 TAHUNANDocument7 pagesPutri Sitohang 2011031016 TAHUNANPutri SitohangNo ratings yet

- Ekonomi Och Verksamhetsstyrning LÖSNING - 20071217-LsningDocument3 pagesEkonomi Och Verksamhetsstyrning LÖSNING - 20071217-LsningJockeNo ratings yet

- Tenta 4 FacitDocument6 pagesTenta 4 FacitErikaNo ratings yet

- Sukma Widyastuti - 14030118120014 - Tugas2Document4 pagesSukma Widyastuti - 14030118120014 - Tugas2Baharudin RamadhanNo ratings yet

- A1 RDPDocument1 pageA1 RDPRinz GwennNo ratings yet

- Pyara Tri Amanda - 2111031060 - Kuis 1 - Lab Kom Pajak BDocument1 pagePyara Tri Amanda - 2111031060 - Kuis 1 - Lab Kom Pajak BPyara Tri AmandaNo ratings yet

- LK Anggaran Variabel 17 Mei 2022Document12 pagesLK Anggaran Variabel 17 Mei 2022Chelsea ApriliaNo ratings yet

- Biaya Persiapan Pembangunan Hotel D'Big SaMe Cilacap Jawa Tengah As Per 10 Oktober 2023Document1 pageBiaya Persiapan Pembangunan Hotel D'Big SaMe Cilacap Jawa Tengah As Per 10 Oktober 2023Chris HadjonNo ratings yet

- AmortizacionDocument10 pagesAmortizacionPaola CastilloNo ratings yet

- 25 - Atmiraldo Agung Nugroho - (Soal 2 Ju) - DikonversiDocument4 pages25 - Atmiraldo Agung Nugroho - (Soal 2 Ju) - DikonversiEva ChasandraNo ratings yet

- PPH 21 MarisaDocument1 pagePPH 21 MarisaPeppi ProidNo ratings yet

- Soal Latihan Evaluasi Proyek (2021) - Kelas DDocument2 pagesSoal Latihan Evaluasi Proyek (2021) - Kelas DSiti Nuria Wahyu NingsihNo ratings yet

- UAS Genap - Rek. HidrologiDocument2 pagesUAS Genap - Rek. HidrologiGahriNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingAnita Nur FadilaNo ratings yet

- Sindi F Tugas SKPDocument6 pagesSindi F Tugas SKPSindi FitrianiNo ratings yet

- 17-Ekonomi Excel-Muhammad Achtar Riandra-Xii IpsDocument13 pages17-Ekonomi Excel-Muhammad Achtar Riandra-Xii IpsAtar Riandra100% (1)

- Belinda Dwi Aprilia-2b Akm-07-Konsep LeverageDocument18 pagesBelinda Dwi Aprilia-2b Akm-07-Konsep LeverageBelinda ApriliaNo ratings yet

- Mayva Najwa Sabila S - 225020307111027 - LTH Soal 2Document7 pagesMayva Najwa Sabila S - 225020307111027 - LTH Soal 2mt4ftkdyphNo ratings yet

- Norma Hayatun NafisahDocument5 pagesNorma Hayatun NafisahDfstoreeNo ratings yet

- Tabel CremonaDocument1 pageTabel CremonaMuhamad FadhlanNo ratings yet

- HJHJKHJKHJKHJKHJKDocument4 pagesHJHJKHJKHJKHJKHJKHs WnNo ratings yet

- SPT IndukDocument1 pageSPT IndukRosmawatiNo ratings yet

- Facit Ergo Fysik 2Document34 pagesFacit Ergo Fysik 2ROro SyNo ratings yet

- Tugas 1 AKL2 Tuton 2023Document2 pagesTugas 1 AKL2 Tuton 2023ariefhid89No ratings yet

- Analisis Datos CromoDocument5 pagesAnalisis Datos CromoPaula Andrea Escorcia AhumadaNo ratings yet

- Jawaban PdaDocument18 pagesJawaban PdaNovi JuliantiNo ratings yet

- P21020020 SRIYUSNITA Financial Levereage MMA2-21 PPS STIE Amkop MakassarDocument3 pagesP21020020 SRIYUSNITA Financial Levereage MMA2-21 PPS STIE Amkop Makassarsriyusnita17No ratings yet

- Siap Print Daftar Hadir PesertaDocument13 pagesSiap Print Daftar Hadir PesertaJean KoelakNo ratings yet

- DevoirDocument2 pagesDevoirIbrahima SowNo ratings yet

- Pradinis ModelDocument1 pagePradinis ModelTomas AbraitisNo ratings yet

- L2-5 L2-7Document1 pageL2-5 L2-7heviketapangNo ratings yet

- Ekonomi Och Verksamhetsstyrning - LÖSNING 20071105 - LsningDocument2 pagesEkonomi Och Verksamhetsstyrning - LÖSNING 20071105 - LsningJockeNo ratings yet

- Mutia Syaefani - Bukti Potong A1 RinaDocument1 pageMutia Syaefani - Bukti Potong A1 RinaMutia SyaefaniNo ratings yet

- Ejercicio 3Document4 pagesEjercicio 3Carlos Monasí G.No ratings yet

- Giovani Putri R b.231.20.0285 SLPKDocument6 pagesGiovani Putri R b.231.20.0285 SLPKGiovaniputriNo ratings yet

- Kunci Jawaban Kasus PT - Ab SriDocument22 pagesKunci Jawaban Kasus PT - Ab SriAyu Ismayanti0% (2)

- Jakarta - Mitsubishi New Addb - Maret 2023 (Ii)Document1 pageJakarta - Mitsubishi New Addb - Maret 2023 (Ii)Zacky 27No ratings yet

- POTONGANDocument1 pagePOTONGANOFASETIYASARINo ratings yet

- TUGAS PERPAJAKAN FiskalDocument1 pageTUGAS PERPAJAKAN FiskalMega Dwi LestariNo ratings yet

- 10,000,000 11,000,000 20,000,000 6,000,000 6,500,000 600,000 300,000 2,500,000 TotalDocument1 page10,000,000 11,000,000 20,000,000 6,000,000 6,500,000 600,000 300,000 2,500,000 Totalhenrydunand.simatupang23No ratings yet

- Salinan KUNCI BAGIAN 4 - PROSES ANALISIS DAN INPUT TRANSAKSI PADA TABELARISDocument4 pagesSalinan KUNCI BAGIAN 4 - PROSES ANALISIS DAN INPUT TRANSAKSI PADA TABELARISDewi A LuturmasNo ratings yet

- Jawaban Uas Lab Ak BiayaDocument2 pagesJawaban Uas Lab Ak BiayaaglamNo ratings yet

- JAKARTA - MITSUBISHI NEW ADDB - JULI 2023 (Program 2)Document1 pageJAKARTA - MITSUBISHI NEW ADDB - JULI 2023 (Program 2)Sultan CikupaNo ratings yet