Professional Documents

Culture Documents

Exercise Problems Relevant Costing

Uploaded by

Jolly CastroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise Problems Relevant Costing

Uploaded by

Jolly CastroCopyright:

Available Formats

talieylagan@gmail.com talileylagan@gmail.

com

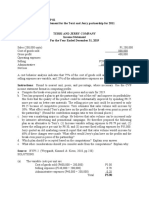

Problem 1

Covid Company is considering replacing its old equipment. Relevant data are given below:

Old Equipment New Equipment

Purchase cost P120,000 P150,000

Accumulated depreciation 70,000 ----

Current salvage value 10,000 ----

Salvage value for 5 years ---- ----

Estimated annual operating costs 90,000 60,000

Remaining useful life 6 years 6 years

REQUIRED:

1. How much is the sunk cost in this decision-making? _______________

2. Should Covid Company retain or replace its old equipment? __________

3. What is the opportunity cost of the better alternative? ______________

Problem 2

The manufacturing capacity of Vaccine Company’s facilities is 50,000 units of product per year. A summary

of operating results for the year ended December 31, 2019 is as follows:

Total Per Unit

Sales (38,000 units) P3,800,000 P100.00

Less: Variable costs and expenses 2,090,000 55.00

Contribution margin 1,710,000 45.00

Less: Fixed costs and expenses 900,000

Operating income P 810,000

Sinovac, a distributor company has offered to buy 12,000 units of P90.00 per unit during 2020. Assume that

all the corporation’s costs would be at the same levels and rates in 2020 as to 2019.

REQUIRED:

1. Assuming the corporation has no alternative use of the idle capacity, should Vaccine accept

or reject the special sales order from Sinovac? _________ Why? (Show supporting amounts)

talieylagan@gmail.com talieylagan@gmail.com talieylagan@gmail.com

talieylagan@gmail.com talileylagan@gmail.com

2. If the special order is accepted, 2,000 units of regular sales is expected to be lost, should

Vaccine accept or reject the special sales order? _______ Why? (Show supporting amounts)

3. Assuming that a distributor has ordered, 16,000 units and the corporation has to sacrifice

some of its regular customers to accommodate the special order, should Vaccine Company

accept or reject the special sales order? ________ Why? (Show supporting amounts)

Problem 3

Farmer Corporation produces three products at segregation point, Kah, Mooh, Tey. These products could

be processed further then later sold at a higher sales value. The total joint costs in manufacturing these

three products were P3,000,000. The data below were made available by the accounting and production

personnel:

Kah Mooh Tey

Production and sales 10,000 units 40,000 units 50,000 units

Unit sales price at split-off point P80 P100 P200

Unit sales price after further processing 90 120 230

Unit variable costs of subsequent processing 8 18 27

If product Kah is process further, an equipment should be rented at cost of P12,000. To process further

product Mooh, an outside contractor will be engaged for an amount of P90,000 because the company has

no available space and manpower for its subsequent processing. Product Tey could be subsequently

processed by using idle machine and manpower time within the company. The total setup cost of

subsequent processing product Tey is P120,000.

REQUIRED:

1. Which product should be processed further to maximize profit? ________ (Show amounts)

2. To maximize profit, what is the minimum sales price for product Kah that should be set after

it is processed further?___________

talieylagan@gmail.com talieylagan@gmail.com talieylagan@gmail.com

You might also like

- Discover the training secrets of legendary bodybuildersDocument129 pagesDiscover the training secrets of legendary bodybuildersfatmir100% (7)

- Method of Statement For Pipeline WorkDocument15 pagesMethod of Statement For Pipeline WorkHalil Güney100% (3)

- TB Incremental AnalysisDocument41 pagesTB Incremental AnalysisBusiness MatterNo ratings yet

- English: Quarter 4 - Module 1: Using Appropriate Grammatical Signals or Expressions To Each Pattern of Idea DevelopmentDocument32 pagesEnglish: Quarter 4 - Module 1: Using Appropriate Grammatical Signals or Expressions To Each Pattern of Idea DevelopmentSherivieMendonza71% (7)

- ACCT 311 - Chapter 5 Notes - Part 1Document4 pagesACCT 311 - Chapter 5 Notes - Part 1SummerNo ratings yet

- Decision Making Class Practice 1 SOLUTIONSDocument3 pagesDecision Making Class Practice 1 SOLUTIONSAhmer ChaudhryNo ratings yet

- THE LIVING MATRIX: A MODEL FOR THE PRIMARTY RESPIRATORY MECHANISMDocument69 pagesTHE LIVING MATRIX: A MODEL FOR THE PRIMARTY RESPIRATORY MECHANISMRukaphuongNo ratings yet

- Standard Costing and Variance AnalysisDocument10 pagesStandard Costing and Variance AnalysisAnne Danica TanNo ratings yet

- Relevant Costing or Incremental AnalysisDocument48 pagesRelevant Costing or Incremental Analysis06162kNo ratings yet

- 14Document76 pages14Minh Nguyễn50% (2)

- Overview of absorption and variable costing methodsDocument3 pagesOverview of absorption and variable costing methodsAreeb Baqai100% (1)

- 13 Consolidated Financial StatementDocument5 pages13 Consolidated Financial StatementabcdefgNo ratings yet

- Module 2 ACCOUNTING FOR MATERIALSDocument9 pagesModule 2 ACCOUNTING FOR MATERIALSJhoanne Marie TederaNo ratings yet

- Cost - Volume - ProfitDocument52 pagesCost - Volume - ProfitsueernNo ratings yet

- Acct 203 - CH 6 DqsDocument2 pagesAcct 203 - CH 6 Dqsapi-340301334100% (1)

- IAS 16 Property, Plant and EquipmentDocument4 pagesIAS 16 Property, Plant and Equipmentisaac2008100% (5)

- Assignment 1Document2 pagesAssignment 1Betheemae R. MatarloNo ratings yet

- Case 1. Landers CompanyDocument3 pagesCase 1. Landers CompanyMavel DesamparadoNo ratings yet

- Location StrategyDocument15 pagesLocation Strategyhesham hassanNo ratings yet

- Relevant Costing by A BobadillaDocument99 pagesRelevant Costing by A BobadillaShailene DavidNo ratings yet

- BOI Application FormDocument11 pagesBOI Application Formien_dsNo ratings yet

- Fundamentals of Accounting 3- Segment Reporting and Responsibility AccountingDocument25 pagesFundamentals of Accounting 3- Segment Reporting and Responsibility AccountingAndrew MirandaNo ratings yet

- Managerial Accounting Review Variable Costing Absorption CostingDocument4 pagesManagerial Accounting Review Variable Costing Absorption CostingdamdamNo ratings yet

- CHAPTER FOUR Process CostingDocument10 pagesCHAPTER FOUR Process Costingzewdie100% (1)

- Managerial Accounting Mid-term Exam Break-even Analysis & Costing MethodsDocument3 pagesManagerial Accounting Mid-term Exam Break-even Analysis & Costing MethodsjaeNo ratings yet

- Subject: ED 801 Statistics II: Ratio Level of MeasurementDocument4 pagesSubject: ED 801 Statistics II: Ratio Level of Measurementgmarico5176No ratings yet

- Module 2 - Relevant CostingDocument7 pagesModule 2 - Relevant CostingJuliana ChengNo ratings yet

- Impact of ASEAN Integration on Philippine Accountancy ProfessionDocument8 pagesImpact of ASEAN Integration on Philippine Accountancy ProfessionMark Stanley PangoniloNo ratings yet

- Test Bank TOCDocument1 pageTest Bank TOCAkai Senshi No TenshiNo ratings yet

- Job Order, Operation and Life Cycle Costing Job Order CostingDocument19 pagesJob Order, Operation and Life Cycle Costing Job Order Costingjessa mae zerdaNo ratings yet

- Man Econ Ass. Module 6Document2 pagesMan Econ Ass. Module 6Trisha Mae AbocNo ratings yet

- Value Engineering Case Study Medical KnobDocument14 pagesValue Engineering Case Study Medical KnobVinitmhatre143100% (1)

- CH 6Document3 pagesCH 6jhonqwerty111No ratings yet

- 2010-03-22 081114 PribumDocument10 pages2010-03-22 081114 PribumAndrea RobinsonNo ratings yet

- Soal 2 Akl 1Document5 pagesSoal 2 Akl 1Hamzah Shalahuddin0% (1)

- Cost Profit Analysis: Romnick E. Bontigao, Cpa, CTT, Mritax, Mba (O.G.)Document46 pagesCost Profit Analysis: Romnick E. Bontigao, Cpa, CTT, Mritax, Mba (O.G.)KemerutNo ratings yet

- Performance Measurement SolmanDocument55 pagesPerformance Measurement SolmanJoseph Deo CañeteNo ratings yet

- Responsibility Accounting and Transfer PricingDocument4 pagesResponsibility Accounting and Transfer PricingMerlita TuralbaNo ratings yet

- Chapter Review Guide QuestionsDocument1 pageChapter Review Guide QuestionsRick RanteNo ratings yet

- ABC and Standard CostingDocument16 pagesABC and Standard CostingCarlo QuinlogNo ratings yet

- Strategic Cost Management: Absorption vs Variable CostingDocument3 pagesStrategic Cost Management: Absorption vs Variable CostingMarites AmorsoloNo ratings yet

- Flexible Budgets and Overhead Analysis: True/FalseDocument69 pagesFlexible Budgets and Overhead Analysis: True/FalseRv CabarleNo ratings yet

- Auditing Theory - Solution ManualDocument21 pagesAuditing Theory - Solution ManualAj de CastroNo ratings yet

- Practice Problems For The Final - 2 - UpdatedDocument8 pagesPractice Problems For The Final - 2 - Updatedmaroo566100% (1)

- Hilton 2222Document70 pagesHilton 2222Dianne Garcia RicamaraNo ratings yet

- MA-16-How Well Am I Doing - Financial Statement AnalysisDocument72 pagesMA-16-How Well Am I Doing - Financial Statement AnalysisAna Patricia Basa MacapagalNo ratings yet

- GP Variance SmartsDocument6 pagesGP Variance SmartsKarlo D. ReclaNo ratings yet

- 21decentralized Operations and Segment ReportingDocument142 pages21decentralized Operations and Segment ReportingyejiNo ratings yet

- 5 6255862442081910859Document29 pages5 6255862442081910859Christine PedronanNo ratings yet

- Variable Costing - Lecture NotesDocument22 pagesVariable Costing - Lecture NotesRaghavNo ratings yet

- LabVIEW (Unit01) PDFDocument47 pagesLabVIEW (Unit01) PDFMike QuinteroNo ratings yet

- Cost Volume Profit Analysis Review NotesDocument17 pagesCost Volume Profit Analysis Review NotesAlexis Kaye DayagNo ratings yet

- Managerial Analysis: CVP 01 Break-EvenDocument4 pagesManagerial Analysis: CVP 01 Break-EvenGrace SimonNo ratings yet

- PartnershipDocument43 pagesPartnershipIvhy Cruz EstrellaNo ratings yet

- Financial ManagementDocument13 pagesFinancial ManagementEliNo ratings yet

- City College of Tagaytay: Republic of The PhilippinesDocument9 pagesCity College of Tagaytay: Republic of The PhilippinesJeff Jeremiah PereaNo ratings yet

- Chapter 1 StudentsDocument7 pagesChapter 1 StudentsArah Opalec0% (1)

- Budgeting Basics for Operating and Financial PlansDocument4 pagesBudgeting Basics for Operating and Financial PlansCarl Angelo LopezNo ratings yet

- ch11 Doc PDF - 2 PDFDocument39 pagesch11 Doc PDF - 2 PDFRenzo RamosNo ratings yet

- CH 09Document78 pagesCH 09Jeep RajNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Thirty Percent of Overhead Is Fixed at Any Production Level From 80,000 Units To 90,000 Units The Remaining 70% of Annual Overhead Cost Are Variable With Respect To VolumeDocument14 pagesThirty Percent of Overhead Is Fixed at Any Production Level From 80,000 Units To 90,000 Units The Remaining 70% of Annual Overhead Cost Are Variable With Respect To Volume?????50% (2)

- Practice Drills - Relevant CostingDocument3 pagesPractice Drills - Relevant CostingRameir Angelo CatamoraNo ratings yet

- 673 Quirino Highway, San Bartolome, Novaliches, Quezon CityDocument4 pages673 Quirino Highway, San Bartolome, Novaliches, Quezon CityRodolfo ManalacNo ratings yet

- Work Immersion PortfolioDocument15 pagesWork Immersion PortfolioKaye Irish RosauroNo ratings yet

- Caffeine Natural Coffee BeanDocument1 pageCaffeine Natural Coffee BeanMayang TariNo ratings yet

- Reactor & Impeller Design in Hydrogenation: GBHE Technical Bulletin CTB #79Document13 pagesReactor & Impeller Design in Hydrogenation: GBHE Technical Bulletin CTB #79manuNo ratings yet

- Mutual Funds: Rajinder S Aurora PHD Professor in FinanceDocument33 pagesMutual Funds: Rajinder S Aurora PHD Professor in FinanceRahulJainNo ratings yet

- Benign EntitiesDocument37 pagesBenign EntitiesleartaNo ratings yet

- Non-Digestible Oligosaccharides: A Review: Solange I. Mussatto, Ismael M. MancilhaDocument11 pagesNon-Digestible Oligosaccharides: A Review: Solange I. Mussatto, Ismael M. MancilhaPatrícia Felix ÁvilaNo ratings yet

- Report On PantaloonsDocument63 pagesReport On PantaloonsKashish AroraNo ratings yet

- Fertilization to Implantation StagesDocument18 pagesFertilization to Implantation StagesNurulAqilahZulkifliNo ratings yet

- Jear C PB 2018 PDFDocument174 pagesJear C PB 2018 PDFArasu RajendranNo ratings yet

- Income Tax BasicsDocument48 pagesIncome Tax BasicsAzad Singh BajariaNo ratings yet

- Help to Buy ISA GuideDocument4 pagesHelp to Buy ISA GuidefsdesdsNo ratings yet

- 4 ReactorsDocument58 pages4 ReactorsKiran ShresthaNo ratings yet

- 08 Ch-8 PDFDocument6 pages08 Ch-8 PDFMANJEET SINGHNo ratings yet

- Sedimentation Tank Design NptelDocument7 pagesSedimentation Tank Design NptelNayan HalderNo ratings yet

- Payroll Accounting 2015 1st Edition Landin Test Bank 1Document106 pagesPayroll Accounting 2015 1st Edition Landin Test Bank 1dorothy100% (47)

- 2requirements Permit PDFDocument1 page2requirements Permit PDFHazel CorralNo ratings yet

- What Is A PronounDocument9 pagesWhat Is A PronounFanera JefferyNo ratings yet

- Concrete Pump Hose TDSDocument2 pagesConcrete Pump Hose TDSAlaa Abu KhurjNo ratings yet

- Sorogon Medical Mission Group Hospital Operation RecordDocument3 pagesSorogon Medical Mission Group Hospital Operation RecordRoden BerdinNo ratings yet

- Riel Comun Fstguide2Document2 pagesRiel Comun Fstguide2Rosita TejedaNo ratings yet

- ICICI Pru IProtect Smart Illustrated BrochureDocument56 pagesICICI Pru IProtect Smart Illustrated Brochuresoubhadra nagNo ratings yet

- 1619928348861forensic Science UNIT - VII 1 PDFDocument159 pages1619928348861forensic Science UNIT - VII 1 PDFVyshnav RNo ratings yet

- Specialty Vents & Valves 30 MinDocument15 pagesSpecialty Vents & Valves 30 MinAnonymous Wd2KONNo ratings yet

- NeseritideDocument28 pagesNeseritideNavojit Chowdhury100% (1)

- Analysis of Alloy Constituents (Cu and ZnDocument5 pagesAnalysis of Alloy Constituents (Cu and Znaryan kushwaha100% (2)

- M 200Document3 pagesM 200Rafael Capunpon VallejosNo ratings yet