Professional Documents

Culture Documents

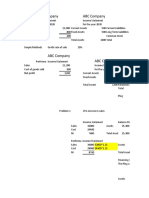

Example: Non Current Assets (NBV) Current Assets

Uploaded by

Mohammad El HajjOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example: Non Current Assets (NBV) Current Assets

Uploaded by

Mohammad El HajjCopyright:

Available Formats

Example

Calculate relevant ratios for the year ended 31 st December 2016 and interpret the

results.

EDWARDS LTD : SUMMARISED BALANCE SHEET AT 31 DECEMBER 2016

€000 €000

Non Current Assets (NBV) 2,600

Current assets

Stocks 600

Debtors ( Receivables ) 900

Balance at bank 100

1,600

Current Liabilities.

Trade creditors ( Payables ) 800

Net Current Assets (Working Capital) 800

Total assets less current liabilities 3,400

Long term Liabilities

Long Term Bank Loans 1,600

NET ASSETS 1,800

Capital and reserves

Ordinary share capital (£1 shares) 1,000

Profit and loss account (Reserves) 800

1,800

EDWARDS LTD : SUMMARISED PROFIT AND LOSS ACCOUNT FOR THE YEAR

ENDED 31 DECEMBER 2016

€000

Sales or Turnover 6,000

Cost of sales (materials) 4,500

Gross profit 1,500

Administrative and distribution costs 1,160

Operating Profit (Profit before interest and tax) 340

Bank Loan interest 74

Profit before tax after interest 266

Taxation 106

Profit after tax ( Profit available for ordinary shareholders) 160

Ordinary dividend 20

Retained profit 140

Using the ratio formula sheets provided, calculate the following ratio’s.

1. Return on capital employed. (Capital Employed =Equity + Long Term Liabilities)

2. Net Profit Margin. (Operating Profit or Profit before interest and tax).

Sales

2. Asset Turnover (i.e. Non Current Assets + Current Assets – Current Liabilities)

4. Gross Profit Margin.

5. Return on owners equity = Profit after interest and tax.

Ordinary shares + Reserves

6. Current Ratio.

7. Acid Test.

8. Debtors (Receivables) ratio

9. Creditors (Payables) ratio

10. Stock Turnover

11. Earnings per Share.

12. Dividend Cover

13. Gearing

14. Interest Cover

You might also like

- Statement of Cash Flow: A Teaching NoteDocument6 pagesStatement of Cash Flow: A Teaching NoteMichealNo ratings yet

- Student Name: Student ID: Class: DateDocument4 pagesStudent Name: Student ID: Class: DateKinNo ratings yet

- Chapter 4 Problems Evaluating A Firm'S Financial PerformanceDocument22 pagesChapter 4 Problems Evaluating A Firm'S Financial Performancerony_naiduNo ratings yet

- Learning Activity 1 - Analysis of Financial StatementsDocument3 pagesLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- Corporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Document9 pagesCorporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Eunice NanaNo ratings yet

- Fin CH 2 ProblemsDocument9 pagesFin CH 2 Problemsshah118850% (4)

- Learning Activity 3 - Analysis of Financial StatementsDocument3 pagesLearning Activity 3 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- Chapter 3 Financial Statements, Free Cash FlowDocument2 pagesChapter 3 Financial Statements, Free Cash FlowPik Amornrat SNo ratings yet

- IAS 7 Full Conso Statement of Cash Flows-Akorfa GroupDocument2 pagesIAS 7 Full Conso Statement of Cash Flows-Akorfa GroupeoafriyieNo ratings yet

- Chapter 6 Set 2 Residual Income ModelDocument20 pagesChapter 6 Set 2 Residual Income ModelNick HaldenNo ratings yet

- SBA03 FSAnalysisPart32of3Document5 pagesSBA03 FSAnalysisPart32of3Jr PedidaNo ratings yet

- 2021 Tutorial 9 Nov26 Problem SheetDocument7 pages2021 Tutorial 9 Nov26 Problem SheetdsfghNo ratings yet

- Appendix D - Answers To Self-Test Problems PDFDocument32 pagesAppendix D - Answers To Self-Test Problems PDFgmcrinaNo ratings yet

- Financial Management - MGT201 Spring 2008 Assignment 01 SolutionDocument2 pagesFinancial Management - MGT201 Spring 2008 Assignment 01 SolutionNoemi Santoyo CondeNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Recycle PLC - QuestionDocument3 pagesRecycle PLC - Questiontom willetsNo ratings yet

- Accounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusDocument18 pagesAccounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusAung Zaw HtweNo ratings yet

- Assignment 1 MENG 6502Document6 pagesAssignment 1 MENG 6502russ jhingoorieNo ratings yet

- Financial Management ExercisesDocument6 pagesFinancial Management ExercisesLeanne Quinto100% (1)

- CSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Document8 pagesCSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Melokuhle MhlongoNo ratings yet

- Chapter 4Document9 pagesChapter 4Ali ANo ratings yet

- TPBALANCESHEET DeloyDocument1 pageTPBALANCESHEET DeloyJen DeloyNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Pt. Coba Coba Neraca Per 31 Desember 2017 Dan 2018 Aktiva 2017 2018Document17 pagesPt. Coba Coba Neraca Per 31 Desember 2017 Dan 2018 Aktiva 2017 2018AD'N VAPEHOUSE Tasikmalaya100% (1)

- Ratio Analysis - Advanced QuestionsDocument5 pagesRatio Analysis - Advanced Questionsrobinkapoor100% (2)

- C5B Profitability AnalysisDocument6 pagesC5B Profitability AnalysisSteeeeeeeephNo ratings yet

- FIN 440 Financial Forecasting, Planning, and Budgeting Chapter Reference - CHP 4Document4 pagesFIN 440 Financial Forecasting, Planning, and Budgeting Chapter Reference - CHP 4the learners club5100% (1)

- FORUM FINANCE - Daniel Korompis (2540117893)Document5 pagesFORUM FINANCE - Daniel Korompis (2540117893)Daniel KorompisNo ratings yet

- Chapter 7Document4 pagesChapter 7Aisha AlarimiNo ratings yet

- Birla Institute of Technology and Science, PilaniDocument3 pagesBirla Institute of Technology and Science, PilaniArjun Jaideep BhatnagarNo ratings yet

- Assets Current AssetsDocument3 pagesAssets Current AssetsJere Mae MarananNo ratings yet

- Assignment Chapter 3Document3 pagesAssignment Chapter 3Beatrice BallabioNo ratings yet

- Tutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityDocument5 pagesTutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Problem 3 Page 41Document8 pagesProblem 3 Page 41MAG MAGNo ratings yet

- Student Name: Student ID: Class: DateDocument4 pagesStudent Name: Student ID: Class: DateKinNo ratings yet

- Summative Quiz 2Document3 pagesSummative Quiz 2Sheena Gallentes LeysonNo ratings yet

- Heriot-Watt University Accounting - June 2016 Section II Case Studies Case Study 1Document5 pagesHeriot-Watt University Accounting - June 2016 Section II Case Studies Case Study 1sanosyNo ratings yet

- Practice-Assignment - Afs - 31-Augsut-2019Document10 pagesPractice-Assignment - Afs - 31-Augsut-2019Waqar AhmadNo ratings yet

- Student Name: Student ID: Class: DateDocument4 pagesStudent Name: Student ID: Class: DateKinNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (28)

- 03 - Excelfiles - Student Text - Assignments - 2010Document12 pages03 - Excelfiles - Student Text - Assignments - 2010leuleuNo ratings yet

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- Ifrs Nov 2010Document3 pagesIfrs Nov 2010Maddy RulesNo ratings yet

- Lecture 3 - Elements of Financial Statements - JJDocument27 pagesLecture 3 - Elements of Financial Statements - JJTariq KhanNo ratings yet

- The Financial Statements Chapter 2Document37 pagesThe Financial Statements Chapter 2Rupesh PolNo ratings yet

- Active Runner StoreDocument4 pagesActive Runner StoreAarshi AroraNo ratings yet

- Translation QuestionsDocument6 pagesTranslation QuestionsVeenal BansalNo ratings yet

- FM1 ActivityDocument4 pagesFM1 ActivityChieMae Benson Quinto100% (1)

- 4 1 Question - 1Document7 pages4 1 Question - 1McAndah JoeNo ratings yet

- Cash Flow Statement StudentDocument60 pagesCash Flow Statement StudentJanine MosatallaNo ratings yet

- Percentage of Sales MethodDocument6 pagesPercentage of Sales MethodFrancois Duvenage100% (1)

- Notes For Ratios: Accounting Principles AssetsDocument14 pagesNotes For Ratios: Accounting Principles AssetsSudhanshu MathurNo ratings yet

- Case 8 2 Palmerstown Company - CompressDocument4 pagesCase 8 2 Palmerstown Company - CompressPhương Nguyễn HàNo ratings yet

- OLC Chap 6Document11 pagesOLC Chap 6Isha SinghNo ratings yet

- Illustration Ratio AnalysisDocument6 pagesIllustration Ratio AnalysisMUINDI MUASYA KENNEDY D190/18836/2020No ratings yet

- New Microsoft Office Word DocumentDocument3 pagesNew Microsoft Office Word DocumentrupokNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Convenience Store Revenues World Summary: Market Values & Financials by CountryFrom EverandConvenience Store Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- ABC and XYZ - QuestionDocument2 pagesABC and XYZ - QuestionMohammad El HajjNo ratings yet

- ABC and XYZ - AnswerDocument6 pagesABC and XYZ - AnswerMohammad El HajjNo ratings yet

- The Effects of Leadership Styles and The Communication Competency The Case of Turkish BanksDocument9 pagesThe Effects of Leadership Styles and The Communication Competency The Case of Turkish BanksMohammad El HajjNo ratings yet

- Ian Gillespie-Principles of Financial Accounting (Third Edition) - Financal Times Management (2004) PDFDocument513 pagesIan Gillespie-Principles of Financial Accounting (Third Edition) - Financal Times Management (2004) PDFMohammad El Hajj100% (2)

- Options - SIPP - Fee ScheduleDocument5 pagesOptions - SIPP - Fee Schedulelopaz777No ratings yet

- Bottle Manufacturing UnitsDocument17 pagesBottle Manufacturing UnitsVIJAY PAREEKNo ratings yet

- Manipal Academy CaseDocument6 pagesManipal Academy CaseDhananjay DubeyNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- Market Conduct GuidelinesDocument32 pagesMarket Conduct GuidelinesRon CatalanNo ratings yet

- 19M S4hana1909 BPD en UsDocument31 pages19M S4hana1909 BPD en UsBiji RoyNo ratings yet

- ADB - Organizational ChartDocument1 pageADB - Organizational Chartsern soon0% (1)

- Chapter 5 CGTMSEDocument17 pagesChapter 5 CGTMSEMikeNo ratings yet

- Strunal CZ, A.s.: Strunal Schönbach S.R.O. Is A String Instrument Manufacturer BasedDocument4 pagesStrunal CZ, A.s.: Strunal Schönbach S.R.O. Is A String Instrument Manufacturer BasedXAREG VARNo ratings yet

- 2023 Budget Ordinance First ReadingDocument3 pages2023 Budget Ordinance First ReadinginforumdocsNo ratings yet

- Stress ManagementDocument109 pagesStress ManagementVinayaka McNo ratings yet

- An Empirical Analysis of Growth of Msme in India and Role of SidbiDocument14 pagesAn Empirical Analysis of Growth of Msme in India and Role of SidbiShubhi SinghNo ratings yet

- GSK E 3 2020 Case StudyDocument3 pagesGSK E 3 2020 Case StudynikhilNo ratings yet

- New Jeevan Dhara 1 - Pension Plan - My LIC IndiaDocument10 pagesNew Jeevan Dhara 1 - Pension Plan - My LIC IndiaAntony ChackoNo ratings yet

- ETH-1217 2021 ESL ShipmentDocument7 pagesETH-1217 2021 ESL ShipmentAnteneh ShumeteNo ratings yet

- Bharti Airtel LTD.: Your Account Summary This Month'S ChargesDocument5 pagesBharti Airtel LTD.: Your Account Summary This Month'S ChargesMadhukar Reddy KukunoorNo ratings yet

- CFA一级百题预测 财务Document90 pagesCFA一级百题预测 财务Evelyn YangNo ratings yet

- SJB ProfileDocument4 pagesSJB ProfileSourajit PattanaikNo ratings yet

- 21 00202 Proposed Construction of Basketball Court Roofing at Bugallon PlazaDocument84 pages21 00202 Proposed Construction of Basketball Court Roofing at Bugallon PlazaJN CNo ratings yet

- Monitoring Mhs Magang - Angkatan 2016Document28 pagesMonitoring Mhs Magang - Angkatan 2016Ihda WahyuNo ratings yet

- Human Resource Accounting: BY: Ompriya Acharya Pradyusha Patro Uma Rani TantyDocument11 pagesHuman Resource Accounting: BY: Ompriya Acharya Pradyusha Patro Uma Rani TantyOmpriya AcharyaNo ratings yet

- Background of The Company (Khaadi)Document7 pagesBackground of The Company (Khaadi)Haider AliNo ratings yet

- SAP S 4HANA Cloud Business Scope 1663004094Document181 pagesSAP S 4HANA Cloud Business Scope 1663004094Alok ManikNo ratings yet

- Advanced Manufacturing Tutorial AnswersDocument12 pagesAdvanced Manufacturing Tutorial Answerswilfred chipanguraNo ratings yet

- Bond Valuation A Mini Case and Solution OutlineDocument7 pagesBond Valuation A Mini Case and Solution OutlinegeorgeNo ratings yet

- Content Overview and OnboardingDocument29 pagesContent Overview and OnboardingMaria AngelNo ratings yet

- UntitledDocument132 pagesUntitledDigital ServiceNo ratings yet

- Iron CastingsDocument49 pagesIron Castingsmathias alfred jeschke lopezNo ratings yet

- Integrated Accounting 8th Edition Klooster Allen and Owen Solution ManualDocument22 pagesIntegrated Accounting 8th Edition Klooster Allen and Owen Solution Manualjanice100% (28)

- Define PERT and CPM in Project Management and Its Importance and PROS and Cons of Pert and CPM in Project ManagementDocument4 pagesDefine PERT and CPM in Project Management and Its Importance and PROS and Cons of Pert and CPM in Project Managementbaskar rajuNo ratings yet