Professional Documents

Culture Documents

8 Digit BIN Expansion Mandate and PCI DSS Impact

Uploaded by

गीतिका गंगवारCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8 Digit BIN Expansion Mandate and PCI DSS Impact

Uploaded by

गीतिका गंगवारCopyright:

Available Formats

MASTERCARD SITE DATA PROTECTION (SDP) PROGRAM

8-Digit BIN Expansion Mandate

and PCI DSS Impact

DECEMBER 2018

www.mastercard/8-digit BINs

Background

In the Global Security Bulletin No. 5, 15 May 2017, it was announced that Mastercard will

adopt the International Organization for Standardization (ISO) 8-digit BIN standard and 8-DIGIT BIN STANDARD

will begin assigning 8-digit BINs to issuers by request, effective April 2022. Increasing BIN IMPACTS PCI DSS

demand across the entirety of the electronic payments ecosystem has brought about the

need for the extension of BINs from the first six digits of a primary account number (PAN) REQ. 3.3 AND 3.4

to the first eight digits of a PAN, with no change to PAN length.

To help ensure ecosystem readiness, Mastercard has mandated that all acquirers and their

third party processors be able to support 11-digit account ranges and the 8-digit BIN MASKING

standard by April 2022. Req. 3.3—A method of

concealing a segment of

data when displayed or

printed. Masking is used

when there is no business

requirement to view the

entire PAN. Masking relates

to protection of the PAN

when displayed or printed.

TRUNCATION

Example: card 5412 7512 3412 3456 has account range 5412 7512 341. Req. 3.4—A method of

Today, the BIN can be identified by the first 6 digits: 5412 75. After April 2022, rendering the full PAN

the BIN will be identified by the first 8 digits. unreadable by permanently

removing a segment of PAN

data. Truncation relates to

protection of the PAN when

stored in files, databases,

etc.

Mastercard Update

Site Data Protection (SDP) Program Standards require that all Level 1-3 merchants and www.mastercard/rules

Level 1-2 service providers comply with the Payment Card Industry (PCI) Data Security

Standard (DSS) and must validate compliance by completing annual PCI compliance

requirements as defined in the in section 10.3.4, “Implementation Schedule,” of the Security MASTERCARD

Rules and Procedures manual. SDP STANDARDS

With the recent BIN expansion mandate, Mastercard’s acceptable formats for meeting PCI

DSS Requirements 3.3 (mask PAN when displayed) and 3.4 (render PAN unreadable Security Rules and Procedures note

that all merchants and service

anywhere it is stored) have been updated which could impact an entity’s PCI compliance providers that store, process, or

validation. transmit cardholder data must

validate PCI DSS compliance

PCI DSS Impact annually.

The expansion of BINs from 6-digit BINs to 8-digit BINs primarily affects two requirements

of the PCI DSS:

Requirement 3.3

Mask PAN when displayed (the first six and last four digits are the maximum number

of digits to be displayed), such that only personnel with a legitimate business need

can see more than the first six/last four digits of the PAN; and

Requirement 3.4

Render PAN unreadable anywhere it is stored (including on portable digital media,

backup media, and in logs) by using any of the following approaches:

– One-way hashes based on strong cryptography, (hash must be of the entire PAN)

– Truncation (hashing cannot be used to replace the truncated segment of PAN)

– Index tokens and pads (pads must be securely stored)

– Strong cryptography with associated key-management processes and procedures.

©2018 MASTERCARD. PROPRIETARY. ALL RIGHTS RESERVED. PAGE 1

For Requirement 3.3, the masking approach should always

ensure that only the minimum number of digits is displayed as

necessary to perform a specific business function. For example,

if only the last four digits are needed to perform a business

function, mask the PAN so that individuals performing that

function can view only the last four digits. While the intent of

While the intent of Requirement 3.3 is to display no more than the “first six and last If an entity needs to

Requirement 3.3 is to four digits” of a PAN, an entity will be permitted to display more store more than “first

display no more than digits if needed but only with a documented business six and any other

the “first six and last justification. four,” then truncation

four digits” of a PAN, cannot be used to

an entity will be For Requirements 3.4, the maximum digits of a PAN that can be meet Requirement

permitted to display stored using truncation are “first six and any other four.” 3.4 and one of the

more digits if needed Mastercard’s acceptable truncation format has not changed as other three

but only with a a result of the 8-digit BIN expansion mandate. If an entity needs approaches would

documented business to store more than “first six and any other four,” then truncation need to be applied to

justification. cannot be used to meet Requirement 3.4 and one of the other render the PAN

three approaches would need to be applied to render the PAN unreadable anywhere

unreadable anywhere it is stored. it is stored.

Note—PCI DSS Requirement 3.3 relates to protection of the PAN

displayed on screens, paper receipts, printouts, etc., and is not to

be confused with PCI DSS Requirement 3.4 for protection of PAN

when stored in files, databases, etc.

Frequently Asked Questions

The following list of PCI Council questions on acceptable formats for masking and truncation of PANs can be found on the

PCI Council’s website:

What is the difference between masking and truncation?

What are acceptable formats for truncation of primary account numbers?

Are truncated Primary Account Numbers (PAN) required to be protected in accordance with PCI DSS?

Can the full credit card number be displayed within a browser window?

For More Information www.mastercard.com/pci360

For more information on Mastercard’s adoption of the ISO 8-digit BIN standard and impacts

on an entity’s PCI DSS compliance validation, please send an email to: sdp@mastercard.com

or BIN_Inquiries@mastercard.com. In addition, the following resources are available to you:

Mastercard

The Mastercard PCI 360 website contains information including white papers and webinars

on cardholder data security. This site offers beginner to expert level training curricula suitable

for merchants of all sizes and complexity.

Mastercard PCI 360 Education Portal: www.mastercard.com/pci360 For frequently asked questions about

Mastercard Site Data Protection Program Site: www.mastercard.com/sdp the Mastercard SDP Program, such

as compliance validation

The Payment Card Industry Security Standards Council requirements for Level 1-Level 4

The PCI SSC’s Document Library includes a framework of specifications, tools, measurements merchants and appropriate

validation tools merchants can use

and support resources to help organizations ensure the safe handling of cardholder

including SAQs, ASV Scans, and On-

information at every step. site Assessments, download the SDP

Program- FAQs document on the

PCI SSC Document Library: www.pcisecuritystandards.org/document_library PCI 360 website.

PCI SSC Site: www.pcisecuritystandards.org

©2018 MASTERCARD. PROPRIETARY. ALL RIGHTS RESERVED. PAGE 2

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- India Salary Guide - Pay Scaler 2021Document56 pagesIndia Salary Guide - Pay Scaler 2021srk12No ratings yet

- Invoice Flomih & Vio Bussines SRL: CX Ref: 18911926 Invoice No.: 151140-838 Invoice Date: 29 Nov 2019Document1 pageInvoice Flomih & Vio Bussines SRL: CX Ref: 18911926 Invoice No.: 151140-838 Invoice Date: 29 Nov 2019calinmusceleanuNo ratings yet

- Century National Bank AnalysisDocument6 pagesCentury National Bank AnalysisVeri KurniawanNo ratings yet

- PDF - ChallanList - 10 - 7 - 2021 12 - 00 - 00 AMDocument1 pagePDF - ChallanList - 10 - 7 - 2021 12 - 00 - 00 AM11 R N Roshikha 9 CNo ratings yet

- Challenges and Prospects of Eletronic Banking SystemDocument47 pagesChallenges and Prospects of Eletronic Banking Systemyohannes johnNo ratings yet

- Mit Cisr Digital Transformation DbsDocument21 pagesMit Cisr Digital Transformation DbsAmbuj Joshi100% (1)

- Brac Bank StatementDocument1 pageBrac Bank Statementshahid2opu100% (2)

- Sabra Hemram BankDocument8 pagesSabra Hemram BankAnkit KoriNo ratings yet

- Ay VPJ SWKW AM33 X RDocument7 pagesAy VPJ SWKW AM33 X RRahul DwivediNo ratings yet

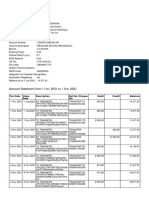

- Account Statement From 1 Apr 2018 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2018 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceJabbar ShaikhNo ratings yet

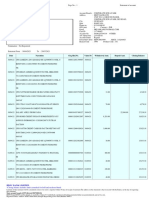

- E StatementDocument2 pagesE StatementhalimNo ratings yet

- Transaction Report: Zahid AbuDocument4 pagesTransaction Report: Zahid AbuSãbbìŕ RàhmâñNo ratings yet

- mt101 ManualDocument53 pagesmt101 ManualNestor Julio Arias MonáNo ratings yet

- Account Relationship Summary: CS - A83 - M - 20211206 - 00.DAT/C-00891/A-01154/P-03796Document16 pagesAccount Relationship Summary: CS - A83 - M - 20211206 - 00.DAT/C-00891/A-01154/P-03796Rifal Rafiudin RestuNo ratings yet

- Pakistan Data Sheet - Ecomm 2020Document5 pagesPakistan Data Sheet - Ecomm 2020Meekal ANo ratings yet

- ORDRE DE CONFIRMATION DE COMMANDE ERBA Distritech OC - 650-170097Document5 pagesORDRE DE CONFIRMATION DE COMMANDE ERBA Distritech OC - 650-170097Luc YaoNo ratings yet

- List of Doc Types and Posting Keys CombinationDocument10 pagesList of Doc Types and Posting Keys CombinationPavan UlkNo ratings yet

- StatementDocument5 pagesStatementjenay obiNo ratings yet

- Prom Photo Package OptionsDocument1 pageProm Photo Package Optionsapi-475716528No ratings yet

- Account Statement - : Balance SummaryDocument1 pageAccount Statement - : Balance SummaryNestor DelgadoNo ratings yet

- Mexico Payments SystemsDocument35 pagesMexico Payments SystemsVelocity_PDNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument25 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVicky GunaNo ratings yet

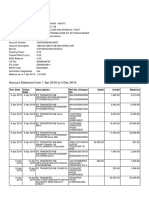

- Gunasekhar SBI Bank Statement 01.03.2019 To 04.12.2019Document7 pagesGunasekhar SBI Bank Statement 01.03.2019 To 04.12.2019Venu MadhavNo ratings yet

- Onlinestmt 3746996567Document17 pagesOnlinestmt 3746996567Lande AshutoshNo ratings yet

- Transaction Details: Date Description Amount TypeDocument20 pagesTransaction Details: Date Description Amount Typeavisinghoo7No ratings yet

- Credit Card CloningDocument2 pagesCredit Card CloningRicardo Antonio Guerrero OrtizNo ratings yet

- Canara Bank Debit CardDocument8 pagesCanara Bank Debit Cardmir musaweer aliNo ratings yet

- GO2Bank Template 2021Document5 pagesGO2Bank Template 2021Marilyn CastilloNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument26 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceBEPF 32 Sharma RohitNo ratings yet

- CBE BASE24-Eps ISO 8583 1993 Host External Message SpecificationDocument500 pagesCBE BASE24-Eps ISO 8583 1993 Host External Message SpecificationBruck FikreNo ratings yet