Professional Documents

Culture Documents

Budgetary Control

Budgetary Control

Uploaded by

Akshay Patil0 ratings0% found this document useful (0 votes)

61 views16 pagesbudgetary control notes

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbudgetary control notes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

61 views16 pagesBudgetary Control

Budgetary Control

Uploaded by

Akshay Patilbudgetary control notes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 16

No.1 for CAICWA & MECICEC MASTER DS

18. BUDGETARY CONTROL

MODEL WISE ANALYSIS OF PAST EXAM PAPERS OF IPCC

me

Plalalal2 alelelsls

We Woe. NAME glalm/ s/s] elmols/ef2] 2] 2/3

2/2) yee) /t| sys lz|s]2

1 [cowmaevensve uocer | 18 : : “Eph

PRODUCTION — BUDGET, RAW

2 |iarenmrurcuese auoser] 2 f-|s|-|-]-|-fs}-]-]-]-

fv omecr WAGES BUOGET

2 [sags avocer TEE EE EEE SEEE

4 [FLeNBLe Buncer ee

5 | BUDGETS AND STANOAROS : Tee ee

The main characteristics of budget are as follows:

i. A budget is concemed for a definite future period,

ii, A budget is a written document.

ili. A budget is a detailed plan of all the economic activities of a business.

iv. All the departments of a business unit co-operate (the preparation of a business budget

SV

v. Budget is a mean to achieve business and it ig@SNAN end in itself.

x. Budget is usually prepared inthe light of Past Experience.

xi, Budget is a constant endeavour of the Management.

Formulas:

Production (units)= No. of units to be Sold + Closing stock- Opening stock

Consumption of Raw materials (Qty)= production x consumption of raw material per unit (OR)

= Opening stock +purchase of RM - Closing stock

Purchase of raw material (Qty) = Consumption + Closing stock — Opening stock

Purchase of raw material (Rs) = Purchase of raw material (Qty) x purchase cost per kg

Labour hours required roduction (units) x Labour hours required per unit

Machine hours required roduction (units) x Machine hours required per unit

PROBLEMS FOR CLASSROOM DISCUSSION

PROBLEM 1: A company is engaged in the manufacture of specialised sub-assemblies

required for certain electronic equipments. The company envisages that in the forthcoming

month, December, 2012, the sales will take a pattern in the ratio of 3: 4 : 2 respectively of

subassemblies, ACB, MCB and DP.

The following is the schedule of components required for manufacture’

13.1

IPCC _38e_Costing (Problems)_Budgetary Contr

8851 25025/26

‘Component requirements

‘Sub-assembly Selling price | Base board | _1C08 1ci2 1C26

‘ACB 520 1 8 4 2

MCB. 500) 4 2 10 6

DP. 350 1 2 4 8

Purchase price (Rs.) 60 20 12 8

The direct labour time and variable overheads required for each of the sub-assemblies are:

Labour hours per sub-assembly

Grade A] Grade] Variable overheads per

sub - assembly (Rs.)

ACB. 8 16 36

MCB 6 12 24

DP 4 8 24

Direct wage rate per hour (Rs) 5 4 =

The labourers work 8 hours a day for 25 days a month.

The opening stocks of sub-assemblies and components for December, 2012 are as under:

‘Sub - assemblies Components

ACB 800 Base Board 7,600

MCB 7,200 1COB 7,200

DP 2,800 IC412 6,000

1C26 4,000

Fixed overheads amount to Rs. 7,57,200 for the month monthly profit target of Rs. 12

lacs has been set. The company is eager for a reducti fosing inventories for December,

2012 of subassemblies and components by 10% iity as compared to the opening

‘stock.

Prepare the following budgets for December 2 2

a) Sales budget in quantity and value SB

b) Production budget in quantity LY

c) Component usage budget in quantity.

d) Component purchase budget in quantity and value.

e) Manpower budget showing the number of workers and the amount of wages payable.

(SM)(Ans.: a) 6,200, 32,76,000, b) 6,220, c) 74,160, d) 18,260, 10,95,600, e) 576, 6,76,000)

(Solve problem no 1of assignment problems as rework)

Note:

MODEL 2: PRODUCTION BUDGETRAW MATERIAL PURCHASE BUDGET AND

DIRECT WAGES BUDGET

PROBLEM 2: Jigyasa Ltd. is drawing a production plan for its two products Minimax (MM) and

Heavy (HH) for the year 2013-14. The company's policy is to hold closing stock of

finished goods at25% of the anticipated volume of sales of the succeeding month. The

following are the estimated data for two products:

Minimax (MM) Heavy high (HH)

Budgeted Production units 4,80,000 4,20,000

(Rs) (Rs)

IPCC _38e_Costing (Problems)_Budgetary Control, 13.2

No.1 for CAICWA & MECICEC MASTER

Direct material cost per unit 220 280

Direct labour cost per unit, 130 120

Manufacturing overhead 4,00,000 5,00,000

The estimated units to be sold in the first four months of the year 2013-14 are as under

April May. June July

Minimax 8,000 10,000 12,000 16,000

Heavy high 6,000 8,000 9,000 14,000

Prepare production budget for the first quarter in monthwise.

(SM, RTP — N13)(Ans.: Production = 8,500,10,500,13,000)

(Solve problem no 2 of assignment problems as rework)

Note:

PROBLEM 3: AK Limited produces and sells a single product. Sales budget for calendar year

2012 by quarters is as under:

Quarters l o uM Vv

No. of units to be sold 48,000 G00 25,000 27,000

The year is expected to open with an inventory. AB

with inventory of 8,000 units. Production is cug@RBtily scheduled to provide for 70% of the

current quarter's sales demand plus 30%ve{S® following quarter demand. The budgeted

selling price per unit is Rs. 40. The stand&svost details for one unit of the product are as

follows: &S

Variable Cost Rs. 34.50 per unit, R&@KBverheads Rs.2 hours 30 minutes @Rs, 2 per hour

based on a budgeted production QNwne of 1,10,000 direct labour hours for the year. Fixed

overheads are evenly distributed thrSughout the year.

You are required to:

a) Prepare Quarterly Production Budget for the year.

b) Inwhich quarter of the year, company expected to achieve break-even point

(PM, M12 - 5M)(Ans: i 19,200 uts, 22,900 uts, 25,600 uts, 26,300 uts, i. BEP achieved in 2 quarter.)

(Solve problem no 3 of assignment problems as rework)

90 units of finished products and close

Note:

PROBLEM 4: (PRINTED SOLUTIONS AVAILABLE) A company is engaged in manufacturing

two products ‘X’ and ‘Y’. product X uses one unit component ‘P’ and two units of component

‘Q’. product ‘Y’ uses two units of component 'P’, one unit of component ‘Q’ and two units of

component 'R’. Component ‘R’ which is assembled in the factory uses one unit of component

o

Components ‘P’ and ‘Q’ are purchased from the market. The company has prepared the

following forecast of sales and inventory for the next year.

Product "x" Product ‘Y"

Sales (in units) 80,000 4,50,000

At the end of the years 10,000 20,000

At the beginning of the year 30,000 50,000

IPCC _38e_Cos'

9 (Problems)_Budgetary Control. 13.3

8851 25025/26 www.mastermindsind

com

The production of both the products and the assembling of the component ‘R’ will be spread

out uniformly throughout the year. The company at present orders its inventory of ‘P’ and ‘Qin

quantities equivalent to 3 months production. The company has compiled the following data

related to two components:

P Q

Price per unit (Rs.) 20 8

Order placing cost per order (Rs.) 1,500 1,500

Carrying cost per annum 20% 20%

Required:

a) Prepare a Budget of production and requirements of components during next year.

b) Suggest the optimal order quantity of components ‘P’ and ‘Q (M - 06)

(Ans.: (a). Total Requirement: P is 3,00,000; @ is 4,80,000; R is 2,40,000; (b)P is 18,000; @ is 30,000

‘components)

Note:

PROBLEM 5: (PRINTED SOLUTION AVAILABLE) A single product Company estimated its

sales (in units) for the next year quarter — wise as under-

Q-1 Q-2 Q-3 Q-4

30,000 units 37,500 units 44,250 units 45,000 units

The Opening Stock of Finished Goods is 10,000 units a Company expects to maintain

the Closing Stock of Finished Goods at 16,250 units ind of the year. The production

pattern in each quarter is based on 80% of the Sal ie current quarter and 20% of the

Sales of the next quarter. Qs

The Opening Stock of Raw Materials in the be{K@)WU f the year is 10,000 kg and the Closing

Stock at the end of the year is required te GE YONinizined at 6,000 kg, Each unit of finished

output requires 2 kg of Raw Materials. US

‘The Company proposes to purchase th&shtire annual requirement of Raw Materials in the

first three quarters in the proportion and at the prices given below-

Quarter Purchase of Raw Materials % to total annual Price per kg

requirement in quantity

I 30% Rs.2

Ul 50% Rs.3

u 20% Rs.4

The value of the Opening Stock of Raw Materials in the beginning of the year is Rs.20,000.

Required: Present the following for the next year, quarter — wise-

1. Production Budget in units.

2. Raw Material Consumption Budget in Quantity,

3. Raw Material Purchase Budget in Quantity and Value.

(SM)(Solve problem no 4 of assignment problems as rework)

(Ans.: (1) I~ 31500 uts, Il - 38250 uts, Ill - 42000 uts, IV - 48250 uts; (2) | - 63000 uts, 1! - 76500 uts, lll ~

84000 uts, IV — 96500 uts; (3) 315000, Rs.9,13,500)

Note:

IPCC _38e_Costing (Problems)_Budgetary Control, 13.4

No.1 for CAICWA & MECICEC MASTER

IDS

PROBLEM 6: (PRINTED SOLUTIONS AVAILABLE) Concorde Ltd, manufactures two

products using two types of materials and one grade of labour. Shown below is an extract from

the company's working papers for the next month's budget

Product-A| Product -B.

Budgeted sales (in units) 2,400 3,600

Budgeted material consumption per unit (in kg):

Material-X 5 3

Materia-Y 4 6

‘Standard labour hours allowed per unit of product 3 5

Material - X and Material - Y cost Rs. 4 and Rs. 6 per kg and labours are paid Rs. 25 per hour.

Overtime premium is 50% and is payable, if a worker works for more than 40 hours a week

There are 180 direct workers.

The target productivity ratio (or efficiency ratio) for the productive hours worked by the direct

workers in actually manufacturing the products is 80%. In addition the non-productive

downtime is budgeted at 20% of the productive hours worked.

There are four 5 - days weeks in the budgeted period and it is anticipated that sales and

production will occur evenly throughout the whole period

Itis anticipated that stock at the beginning of the period will be:

Product - A. 400 units

Product - B 200 units

Material - X 1,000 kg, S

Material - Y 500 kg. &

The anticipated closing stocks for budget re as below:

Product - A. 4 days sales

Product - B 5 days s

Material - X 10 days imption

Material - Y 6 days consumption

Require

Calculate the Material Purchase Budget and the Wages Budget for the direct workers,

‘showing the quantities and values, for the next month.

(SM, RTP - M14)(Ans: 36,950, 45,936Kgs, Rs.1,47,828, Rs. 2,75,616; 43,410 hrs, Rs.12,67,875,)

(Solve problem no § of assignment problems as rework)

Note:

PROBLEM 7: A fruit juice manufacturer is in the process of preparing budgets for the next

few months, and the following draft figures are available:

Sales Forecast

June 6,000 Litres

July 7,500 Litres

August 8,500 Litres

September 7,000 Litres

October 6,500 Litres

A litre of fruit juice has a standard cost of Rs. 75 and a standard selling price of Rs. 105. Each

litre of juice uses 3.5 kg. of fruits and it is policy to have stocks of fruits at the end of each

month to cover 50 per cent of next month's production. There are 5,800kg in stock on 1st

June.

IPCC _38e_Cos'

9 (Problems)_Budgetary Control. 13.5

dsindi

8851 25025/26 www.master com

There are 750 litres of finished fruit juice in stock on 1st June and it is policy to have stocks at

the end of each month to cover 10% of the next month's sales.

Requirements

a) Prepare a production budget (in litres) for June, July, August and September.

b) Prepare a fruits purchase budget (in kg.) for the months of June, July and August.

¢) Calculate the budgeted gross profit for the quarter June to August.

(MTP - N15)(Ans: a) 6,000, 7,600, 8,360, 6,950; b) 28,500, 27,912.5, 26,776; c) 1,80,000, 2,28,000, 2,85,000)

(Solve problem no 6 of assignment problems as rework)

Note:

PROBLEM 8: (PRINTED SOLUTION AVAILABLE) Aditya Ltd. manufactures two products

K596 and H852. The sales director has anticipated to sale 8,000 units of Product K596 and 4,200

nits of Product H852. The Standard cost data for the products for next year are as follows:

Product - K596 Product - H852

Per unit Per unit

Direct materials’

- Material X @ Rs. 15 per kg 12kg 15kg

- Material Y@ Rs. 16 per kg 15kg 6kg

- Material Z @ Rs. 5 per itr 8 tr. 14 itr.

Direct wages:

= Unskilled @ Rs. 40 perhour | 12 hour, S 10 hour

- Skilled @ Rs. 75 per hour Bhy S hour

Budgeted stocks for next year are as follows: 110%

With the help of intensive advertisement rea ure additional sales (over and above

the above mentioned estimated sales by Divisi lanagers) are possible:

Product ision West division

x Lo 70 units

w 40 units 50 units

You are required to prepare sales Budget for 2015-16 after incorporating above estimates and

also show the Budgeted sales and Actual sales of 2014-15.

(NOV-15,8M) (Ans: 5,000, 7,000, 13,000, 19,000, 3600, 5,400, 6,300, 10,500, 4,500, 6,300, 8,700, 14,700)

Note:

MODEL 4: FLEXIBLE BUDGET

PROBLEM 10:4 factory which expects to operate 7,000 hours, i.e., at 70% level of activity,

furnishes details of expenses as under:

Variable expenses Rs. 1,260

‘Semi - variable expenses Rs, 1,200

Fixed expenses Rs. 1,800

The semi-variable expenses go up by 10% between 85% and 95% activity and by 20% above

95% activity. Construct a flexible budget for 80, 90 and 100 per cent activities.

(SM) (Ans.: Rs. 4,260, Rs. 4,440, Rs. 4,740, Rs. 5,040)

(Solve problem no 7, 8 of assignment problems as rework)

Note:

IPCC _38e_Cos'

9 (Problems)_Budgetary Control. 13.7

dsindi

PI com

8851 25025/26 www.master

PROBLEM 41: ABC Ltd. is currently operating at 75% of its capacity. In the past two years, the

level of operations were 55% and 65% respectively. Presently, the production is 75,000 units. The

‘company is planning for 85% capacity level during 2013-2014. The cost details are as follows:

55% (RS.) 65%(RS.) T5%{RS.)

Direct Materials 11,00,000 13,00,000 15,00,000

Direct Labour 5,50,000 650,000 7,50,000

Factory Overheads 3,10,000 3,30,000 3,50,000

Selling Overheads 3,20,000 3,60,000 4,00,000

‘Administrative Overheads 1,60,000 1,60,000 7,60,000

Profit is estimated @ 20% on sales

The following increases in costs are expected during the year

In percentage

Direct Materials 8

Direct Labour 5

Variable Factory Overheads i 5

Variable Selling Overheads i 8

Fixed Factory Overheads 10

Fixed Selling Overheads 15.

‘Administrative Overheads 10,

Prepare flexible budget for the period 2013-2014 at 85% level of capacity. Also ascertain profit

and contribution, (SM) (Ans: Total cost at 85% capacity:37, 85,200; profit:9,46,300;contribution:14,57,300)

Note:

PROBLEM 12: (PRINTED SOLUTION avanssug ino has prepared its expense

budget for 20,000 units in its factory for the year2{ letailed below:

& (Rs. per,

unit)

Direct Materials & 50

Direct Labour 20

Variable Overhead 15

Direct Expenses 6

Selling Expenses (20% fixed) 75

Factory Expenses (100% fixed) 7

‘Administration expenses (100% fixed) 4

Distribution expenses (85% variable) 2

Total 729

Prepare an expense budget for the production of 15,000 units and 18,000 units

(PM)(MAY-13,7M) (Solve problem no 9, 10 of assignment problems as rework)

(Ans.: 25,80,000, 20,14,000, 23,83,000)(Solve problem no 9 of assignment problems as rework)

Note:

PROBLEM 13: (PRINTED SOLUTIONS AVAILABLE) A department of Company X attains

sales of Rs. 6,00,000 at 80% of its normal capacity. Its expenses are given below:

‘Administration costs: (Rs) Selling Costs :

Office salaries 90,000 | Salaries 8% of sales

General expenses 2% of sales | Travelling expenses 2% of sales

IPCC _38e_Costing (Problems)_Budgetary Control, 13.8

No.1 for CAICWA & MECICEC MASTER IDS

Depreciation 7,500 | Sales office expenses 1% of sales

Rates and Taxes 8,750 | General expenses 1% of sales

Distribution costs:

Wages (Rs.) 15,000

Rent 1% of sales

‘Other expenses ‘4% of sales

Draw up Flexible Administration, Selling and Distribution Costs Budget, operating at 90 per

cent, 100 per cent and 110 per cent of normal capacity

(SM) (Ans.: 2,35,260 2,49,500, 2,63,750, 2,78,000)

(Solve problem no 11, 12 of assignment problems as rework)

Note:

PROBLEM 14: Action Plan Manufacturers normally produce 8,000 units of their product in a

month, in their Machine Shop. For the month of January, they had planned for a production of

10,000 units. Owing to a sudden cancellation of a contract in the middle of January, they could

only produce 6,000 units in January.

Indirect manufacturing costs are carefully planned and monitored in the Machine Shop and the

Foreman of the shop is paid a 10% of the savings as bonus when in any month the indirect

manufacturing cost incurred is less than the budgeted grovision

The Foreman has put in a claim that he should b bonus of Rs. 88.50 for the month of

January, The Works Manager wonders how ai ‘an claim a bonus when the Company

has lost a sizeable contract. The relevant figur ’as under:

Indirect manufacturing nses for Planned for Actual in

& normal January | costs January

‘month (Rs.) (Rs.) (Rs.)

Salary of foreman 1,000 1,000 1,000

Indirect labour 720 900 600

Indirect material 800 1,000 700

Repairs and maintenance 600 650 600

Power 800 875 740

Tools consumed 320 400 300

Rates and taxes 150 150 150

Depreciation 800 800 800

Insurance 100 100 100

5,290 5,875 4,990

Do you agree with the Works Manager? Is the Foreman entitled to any bonus for the

performance in January? Substantiate your answer with facts and figures.

(SM) (Ans.: No, 4,705, 4,990)

Note:

PROBLEM 15: (PRINTED SOLUTION AVAILABLE) TQM Ltd. has furnished the following

information for the month ending 30th June, 2014.

Master Budget | Actual Variance

Units produced and sold 80,000 72,000

Sales (Rs.) 3,20,000 2,80,000 | “40,000 (A)

Direct material (RS) 80,000 73,600 | 6,400 (F)

IPCC _38e_Cos'

9 (Problems)_Budgetary Control. 13.9

Ph:98851 25025/26 www.mastermindsindia.com

Direct wages (Rs) 7,20,000 704,600 | 15,200 F)

Variable overheads (Rs.) 40,000 37,600 2,400 (F)

Fixed overhead (Rs.) 40,000 39,200 800 (F)

Total Cost 2,80,000 2,55,200

The Standard costs of the products are as follows:

Per unit (Rs.)

Direct materials (1 kg. at the rate of Rs.1 per kg.) 1.00)

Direct wages (1 hour at the rate of Rs.1.50) 1.50)

Variable overheads (1 hour at the rate of Rs.0.50) 0.50

Actual results for the month showed that 78,400 kg, of material were used and 70,400 labour

hours were recorded,

Required:

a) Prepare Flexible budget for the month and compare with actual results.

b) Calculate Material, Labour, Sales Price, Variable Overhead and Fixed Overhead

Expenditure variances and Sales Volume (Profit) variance.

(PM)(Ans.; a) Profit 7,200(A), b) MCV = 1,600(A), FOHEXV = 800(F)

Note:

PROBLEM 16:The M-Tech Manufacturing Company,

processes for the manufacture of a toy. The followin

sSently evaluating two possible

tion is available:

7 Process B

Particulars (Rs.)

Variable cost per unit we 12 14

Sales price per unit 20 20

Total fixed costs per year '30,00,000 21,00,000

Capacity (in units) 4,30,000 5,00,000

Anticipated sales (Next year, in units) 4,00,000 4,00,000

Suggest:

1. Which process should be chosen?

2. Would you change your answer as given above, if you were informed that the capacities of

the two processes are as follows:

A.6,00,000 units; B 5,00,000 units 7 Why? (16)

Note:

IPCC _38e_Costing (Problems)_Budgetary Control, 13.10

MASTER

No.1 for CAICWA & MECICEC

ASSIGNMENT PROBLEMS

MODEL 1: COMPREHENSIVE BUDGET

PROBLEM 1: S Ltd., manufactures and sells 2 products, St and $2. The following data is

relevant for drawing budget 1997.

a) Projected Sales:

Product Units Price (Rs.)

1 60,000 140

2 40,000 200

b) To produce one unit of S1 and S2 the following raw materials are used :

Raw Material Unit ‘Amount used per unit

St $2

A Kgs 4 5

B Kgs 2 3

c kgs 2 1

¢) Inventories in Units:

Product Expected January 1, 4897 | Target December 31, 1997

st 20,000 LY 25,000

s2 8,000 9,000

SG

Raw Material

A SS)” 32,000 Kgs 36,000 Kgs

B 29,000 Kgs 32,000 Kgs

c 6,000 Kgs 7,000 Kgs

d) The anticipated purchase price of raw material A, B and C are Rs.12, Rs. and Rs.3 per

Kg. respectively.

e) Projected direct labour requirements for 1997, and rates of pay are

Product Hours per Unit Rate per hour

st 2 2

s2 3 16

f) Overhead is applied at the rate of Rs.20 per direct labour hour.

Based on the above projections & budget requirements for 1997, prepare the following budgets:

Sales budget in Rupees;

Production budget in units;

Raw material purchase budget in quantities;

Raw material purchase budget in Rupees;

Direct labour budget in Rupees;

Budgeted finished goods at 31/12 in Rupees;

Profit and Loss Budget.

(Ans.: (1) Rs.1,64,00,000; (2) $4 - 65000 uts, S2 - 41000 uts; (3) A ~ 469000 Kgs, 8 - 256000 Kgs, C— 172000

Kgs; (4) A ~ Rs, 5628000, B - Rs. 1280000, C ~ Rs. 516000; 6) Rs. 3528000 (6) $1 ~ Rs. 3200000, S2— Rs.

1674000; (7) $1 - Rs. 720000, $2 Rs.560000)

NO@aone

IPCC _38e_Cos'

9 (Problems)_Budgetary Control. 13.41

8851 25025/26

MODEL 2: PRO!

PROBLEM 2: X Y Z Limited is drawing a production plan for its two products - Product 'xmr

and Product ‘yml' for the year 2015-16. The company's policy is to maintain closing stock of

finished goods at 25% of the anticipated volume of sales of the succeeding month.

The following are the estimated data for the two products:

xml Ymi

Budgeted Production (in units) 2,00,000 1,50,000

Direct Material (per unit) Rs.220 Rs.280

Direct Labour (per unit) Rs.130 Rs.120

Direct Manufacturing Expenses Rs.4,00,000 Rs.5,00,000

The estimated units to be sold in the first four months of the year 2015-16 are as under:

April I May June I July

Xml 8,000 | 10,000 12,000 | 16,000

Ym 6,000 8,000 9,000 44,000

Prepare:

i) Production Budget (Month wise)

ii) Production cost Budget (for first quarter of the year)

PROBLEM 3: Calculate efficiency and activity ratio fror

Capacity ratio = 75%

Budgeted output 6,000 ngs

Actual output = 5,000 yj

Standard Time per unit

en data:

(M15, 8M)(Ans.:i) 8,500, 10,500, 13,000; i) 1,12,64,000, 1,00,83,333)

(PM)(ans.: 111.19%, 83.33%)

PROBLEM 4: A Light Motor Vehicle manufacturer has prepared sales budget for the next few

months, and the following draft figures are available:

Month No. of vehicles

(October 4,000

November 3,500

December 4,500

January 6,000

February 6,500

To manufacture a vehicle a standard cost of Rs. 2,85,700 is incurred and sold through dealers

at an uniform selling price of Rs. 3,95,600 to customers. Dealers are paid 12.5% commission

on selling price on sale of a vehicle

Apart from other materials four units of Part-X are required to manufacture a vehicle. It is a

policy of the company to hold stocks of Part-X at the end of the each month to cover 40% of

next month's production. 4,800 units of Part-X are in stock as on 1st October.

There are 950 nos. of completed vehicles are in stock as on 1st October and it is policy to

have stocks at the end of each month to cover 20% of the next month's sales.

You are required to

a) Prepare Production budget (in nos.) for the month of October, November, December and

January,

IPCC _38e_Costing (Problems)_Budgetary Control, 13.12

IDS

b) Prepare a Purchase budget for Part-X (in units) for the months of October, November and

December.

) Calculate the budgeted gross profit for the quarter October to December.

(PM, RTP - N14, MTP -M15)(Ans: a) 3,750, 3,700, 4,800, 6,100; b)16,120, 16,560, 21,260; ¢) 7,254)

No.1 for CAICWA & MECICEC MASTER

PROBLEM 5: G Ltd. manufactures two products called ‘M’ and ‘N’. Both products use a

‘common raw material Z. The raw material Z is purchased @ Rs. 36 per kg from the market.

The company has decided to review inventory management policies for the forthcoming year.

The following forecast information has been extracted from departmental estimates for the

year ended 31st March 2016 (the budget period):

Product M Product N

‘Sales (units) 28,000 13,000

Finished goods stock increase by year-end 320 160

Post-production rejection rate (%) 4 6

Material Z usage (per completed unit, net of wastage) 5kg 6kg

Material Z wastage (%) 10 5

Additional information

- Usage of raw material Z is expected to be at a constant rate over the period

- Annual cost of holding one unit of raw material in stock is 11% of the material cost.

- The cost of placing an orders is Rs. 320 per order.

- The management of G Ltd. has decided that they 1uld not be more than 40 orders ina

year for the raw material Z.

Required S

a) Prepare functional budgets for ended 31st March 2016 under the

followingheadings:

i) Production budget for Produ

ee ind NN (in units).

ii) Purchases budget for Mat&RQY (in kgs and value).

b) Calculate the Economic Order Quantity for Material Z (in kgs).

c) If there is a sole supplier for the raw material Z in the market and the supplier do notsale

more than 4,000 kg. of material Z at a time. Keeping the managementpurchase policy and

production quantity mix into consideration, calculate themaximum number of units of

Product M and N that could be produced.

(RTP -N15) (Ans.: a) (i) 21,500, 14,000; (ii) 2,52,310, 90,83,160; b) 6,385.72; c) 18,707, 8,878)

PROBLEM 6: Following is the sales budget for the first six months of the year 2009 in respect

of POR Ltd

Month Jan. Feb. March | April May June

Sales (units): 10,000 [12,000 [14,000 | 15,000 | 15,000 | 16,000

Finished goods inventory at the end of each month is expected to be 20% of budgeted sales

quantity for the following month. Finished goods inventory was 2,700 units on January 1

2009. There would be no work-in-progress at the end of any month.

Each unit of finished product requires two types of materials as detailed below:

Material X: 4 kgs @ Rs.10/kg

Material Y: 6 kgs @ Rs. 15/kg

Material on hand on January 1, 2009 was 19,000 kgs of material X and 29,000 kgs of material

Y. Monthly closing stock of material is budgeted to be equal to half of the requirements of next

month's production.

IPCC _38e_Cos'

9 (Problems)_Budgetary Control. 13.13

8851 25025/26 www.mastermindsind

com

Budgeted direct labour hour per unit of finished product is % hour.

Budgeted direct labour cost forthe first quarter of the year 2009 is Rs. 10,89,000,

Actual data for the quarter one, ended on March 31, 2009 is as under:

‘Actual production quantity: 40,000 units

Direct material cost

(Purchase cost based on materials actually issued to production)

Material X: 1,65,000kgs @ Rs.10.20/kg

Material Y: 2,38,000kgs @ Rs.15.10/kg

Actual direct labour hours worked: 32,000 hours

Actual direct labour cost: Rs.13,12,000

Required:

a) Prepare the following budgets:

i. Monthly production quantity for the quarter one

ii, Monthly raw material consumption quantity budget from January, 2009 to April, 2009.

ili, Materials purchase quantity budget for the quarter one.

b) Compute the following variances

i. Material cost variance

ii, Material price variance

iii. Material usage variance

iv. Direct labour cost variance &

v. Direct labour rate variance WS

Vi. Direct labour efficiency variance

(Ph) (Ans.: Ai. 36,200 units, i. Material X ~ 2,06,200

~'2,33,800 K's; 6)1, 768008, 1:86 S08 20,0008, v1, 12,0008, v. 32,0008, v. 80,0008 )

MODEL 4: FLEXIBLE BUDGET

PROBLEM 7: M/s NNSG Ltd, specialized in manufacturing of piston rings for motor vehicle. It

has prepared budget for 8,000 units per annum at budgeted cost of Rs.21,64,400 as detailed

below:

(Rs) (Rs)

Fixed cost (Manufacturing) 2,28,000

Variable costs:

Power 78,000

Repairs, etc. 16,000

‘Other variable cost 6,400

Direct material 616,000

Direct labour. 12,80,000 | 19,36,400

21,64,400

Considering the possible impact on sales tumover by market trends, the company decides to

prepare flexible budget with a production target of 4,000 and 6,000 units. On behalf of the

company you are required to prepare a flexible budget for production levels at 50% and

75%.Assuming the selling price per unit is maintained at Rs.400 as at present, indicate the

effect on net profit. Administration, selling and distribution overheads continue at Rs.72,000.

(PM)(Ans.: 3,31,800, 6,47,700, 9,63,600)

IPCC _38e_Costing (Problems)_Budgetary Control, 13.14

IDS

PROBLEM 8: RST limited is presently operating at 50% capacity and producing30,000 units.

The entire outp ut is sold at a price of 200 per unit. The cost structure at the 50% level of

activity is as under:

No.1 for CAICWA & MECICEC MASTER

Direct material 75 per unit

Direct wages 25 per unit

Variable overheads 25 per unit

Direct expenses 15 per unit

Factory overheads (25%fixed) 20 per unit

Selling and distribution exp.(B0%variable) 10 per unit

Office and administrative exp.(100%fixed) 5 per unit

The company anticipates that the variable costs will go up by 10% and fixed costs will go up

by15%.

Your require to prepare an expense budget, on the basis of marginal cost for the company at

50% and 60%level of activity and find out the profits at respective levels.

(PM, N14 - 8M) (Ans: 2,07,000, 3,31,200)

PROBLEM 9:The budgeted cost of a factory specializing in the production of a single product

at the optimum capacity of 6,400 units per annum amounts to Rs.1,76,048 as detailedbelow:

Rs. Rs.

Fixed costs 20,688

Variable costs: Sy

Power 1,440

Repairs, etc. 1,700

Miscellaneous 540

Direct Material 49,280

Direct labour: ES 7,02,400 7,558,360

S 7,76,048

Taking note of the possible impact Sales turnover by market trends, the companydecides to

have a flexible budget with a production target of 3,200 and 4,800 units(the actual quantity

proposed to be produced being left to a later date before commencement of the budget

period). Prepare a flexible budget for production levels at 50% and 75%. Assuming the selling

price per unit is maintained at Rs. 40as at present, indicate the effect on net profit

Administration, selling and distribution expenses continue at Rs. 3,600

(MTP - N15)(Ans.: 26,032, 51,192, 76,362)

PROBLEM 10: S Ltd. has prepared budget for the coming year for its two products A and B.

Product A | Product B

(Rs.) (Rs.)

Production & Sales unit 6,000 units | 9,000 units

Raw material cost per unit 60.00 42.00

Direct labour cost per unit 30.00 18.00

Variable overhead per unit 12.00 6.00

Fixed overhead per unit 8.00 4.00

‘Selling price per unit 720.00 78.00

After some marketing efforts, the sales quantity of the Product A & B can be increased by

1,500 units and 500 units respectively but for this purpose the variable overhead and fixed

overhead will be increased by 10% and 5% respectively for the both products.

You are required to prepare flexible budget for both the products:

a) Before marketing efforts

9 efforts, (PM, RTP - M15) (Ans.: 60,000, 72,000)

9 (Problems)_Budgetary Control. 13.15

8851 25025/26

www.master

dsindi

com

PROBLEM 11: Float glass Manufacturing Company requires you to present the Master

budget for the next year from the following information:

Indirect labour —

‘Works manager

Foreman

Stores and spares

Depreciation on machinery

Light and power

Repairs and maintenance

Others sundries

Administration, selling and distribution expenses

Sales:

Toughened Glass Rs. 6,00,000

Bent Glass Rs. 2,00,000

Direct material cost 60% of sales

Direct wages 20 workers @ Rs. 150 per month

Factory overheads :

Rs, 500 per month

Rs, 400 per month

2.5% on sales

Rs. 12,600

Rs. 3,000

Rs. 8,000

10% on direct wages

Rs. 36,000 per year

details for year 2012.

PROBLEM 12:The cost accountant of manufacturing company provides you the following

(SM)(Ans.:4,0,000)

(Rs) (Rs)

Direct materials 1,75,000 | Other variable costs 80,000

Direct Wages 7,00,000 | Other fixed costs 80,000

Fixed factory overheads 7,00,000 | Profit 1,15,000

Variable factory overheads 7,00,000 | Sales WF 7,50,000

During the year, the company manufactured two pr

were: 5

"A and B and the output and costs

A B

‘Output (units) SG 2,00,000 [| 7,00,000

Selling price per unit v Rs.2.00| Rs. 3.50

Direct materials per unit Rs.0.50| Rs. 0.75

Direct wages per unit Rs.0.25| Rs. 0.50

Variable factory overhead are absorbed as a percentage of direct wages. Other

‘expected that the demand for product A will fall by 25 % and for B by 50%. It

manufacture a further product C, the cost for which are estimated as follows:

ave been computed as: Product A Rs. 0.25 per unit; and B Rs. 0.30 per unit. During 2013, itis

variable costs

is decided to

Product C

‘Output (units) 2,00,000

‘Selling price per unit Rs. 1.75

Direct materials per unit Rs. 0.40

Direct wages per unit Rs. 0.25

It is anticipated that the other variable costs per unit will be the same as for product A. Prepare

a budget to present to the management, showing the current position and the position for

2013. Comment on the comparative results. (SM)(Ans.:1,18,000, 1,26,000)

ABC ANALYSIS

A category B category C category

Classroom problems | _2,3,6,9,11,12, 4,4,5,7,8,10, 13,14,15,16

Assignment problems 23.8, 4,4,10 5,6,7,9,11,12

THE END

IPCC _38e_Costing (Problems)_Budgetary Control, 13.16

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- As 11Document17 pagesAs 11Akshay PatilNo ratings yet

- AS 10 (Revised) : Property, Plant and EquipmentDocument34 pagesAS 10 (Revised) : Property, Plant and EquipmentAkshay PatilNo ratings yet

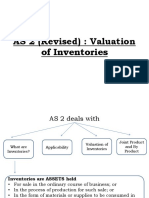

- AS 2 (Revised) : Valuation of InventoriesDocument13 pagesAS 2 (Revised) : Valuation of InventoriesAkshay PatilNo ratings yet

- Account Must Do List For May 2021Document129 pagesAccount Must Do List For May 2021Akshay PatilNo ratings yet