Professional Documents

Culture Documents

Receivables

Uploaded by

Light MaidenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Receivables

Uploaded by

Light MaidenCopyright:

Available Formats

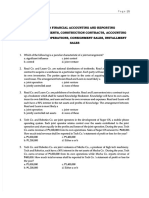

1. Hayden Co.

provided some information on their financial records on December 31, 2021:

Accounts Receivable, January 1 P 1,920,000

Collections of account receivable 6,240,000

Bad Debts 200,000

Inventory, January 1 2,880,000

Inventory, December 31 2,640,000

Accounts payable, January 1 1,000,000

Accounts payable, December 31 1,500,000

Cash sales 1,200,000

Purchases 4,800,000

Gross profit on Sales 2,160,000

What is the ending balance of accounts receivable on December 31, 2021?

a. 1,680,000 b. 2,880,000 c. 3,120,000 d. 4,080,000

2. Yellow Company has an 8% note receivable dated June 30, 2020, in the original amount of

P600,000. Payments of P200,000 in principal plus accrued interest are due annually on July 1,

2021, 2022, and 2023.

In its June 30, 2022 statement of financial position, what amount should Yellow Company report

as a current asset for interest on the note receivable?

a. None b. 16,000 c. 32,000 d. 48,000

3. On December 31, 2021, the “Receivables” account of Mon Company shows an amortized cost of

P1,950,000. Subsidiary details show the following:

Trade accounts receivable, P775,000; Trade notes receivable, P100,000; installment receivable,

normally due one 9year) to two (2) years, P300,000; Customers’ accounts reporting credit

balances arising from sales returns, P30,000; Advance payments for purchase of merchandise,

P150,000; Customers’ accounts reporting credit balances arising from advance payments,

P20,000; Cash advances to subsidiary, P400,000; Claims from insurance company, P15,000;

Subscription receivable due in 60 days, P300,000; Accrued interest receivable, P10,000.

How much should be presented as “trade and other receivables” under current assets?

a. 725,000 b. 1,125,000 c. 1,290,000 d. 1,650,00

You might also like

- CCE ReceivablesDocument5 pagesCCE ReceivablesJane TuazonNo ratings yet

- Quiz Recl FinancingDocument1 pageQuiz Recl FinancingLou Brad IgnacioNo ratings yet

- Practice Set - Cost BehaviorDocument2 pagesPractice Set - Cost BehaviorPotie RhymeszNo ratings yet

- Cost 2 - Quiz5 PDFDocument7 pagesCost 2 - Quiz5 PDFshengNo ratings yet

- PFRS-15-LTCC Franchise ConsignmentDocument2 pagesPFRS-15-LTCC Franchise ConsignmentArlyn A. Zuniega0% (1)

- FAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFDocument4 pagesFAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFvhhhNo ratings yet

- Module 5 - Assessment ActivitiesDocument4 pagesModule 5 - Assessment Activitiesaj dumpNo ratings yet

- Public Accountancy PracticeDocument69 pagesPublic Accountancy Practicelov3m3100% (2)

- Quiz-3 Cost2 BSA4Document6 pagesQuiz-3 Cost2 BSA4Kathlyn Postre0% (1)

- Intacc2 - Assignment 4Document3 pagesIntacc2 - Assignment 4Gray JavierNo ratings yet

- HB Quiz 2020Document4 pagesHB Quiz 2020Allyssa Kassandra LucesNo ratings yet

- Seatwork-Hedging of A Net Investment in Foreign OperationDocument1 pageSeatwork-Hedging of A Net Investment in Foreign OperationAnthony Tunying MantuhacNo ratings yet

- Cost Quiz 3Document5 pagesCost Quiz 3Jerric CristobalNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- MA REV 1 Finals Dec 2017Document33 pagesMA REV 1 Finals Dec 2017Dale PonceNo ratings yet

- Defined Benefit Plan-Midnight CompanyDocument2 pagesDefined Benefit Plan-Midnight CompanyDyenNo ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument3 pagesCpa Review School of The Philippines Mani LaKristelleNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingNiña FajardoNo ratings yet

- Cost Concepts, Classification and Segregation: M.S.M.CDocument7 pagesCost Concepts, Classification and Segregation: M.S.M.CAllen CarlNo ratings yet

- Quiz 5 Problems Second Semester AY2223 With AnswersDocument4 pagesQuiz 5 Problems Second Semester AY2223 With AnswersManzano, Carl Clinton Neil D.No ratings yet

- Far JpiaDocument14 pagesFar JpiaJNo ratings yet

- Managerial Economics QuestionnairesDocument26 pagesManagerial Economics QuestionnairesClyde SaladagaNo ratings yet

- Exam in Taxation Exam in Taxation: Business Tax (Naga College Foundation) Business Tax (Naga College Foundation)Document29 pagesExam in Taxation Exam in Taxation: Business Tax (Naga College Foundation) Business Tax (Naga College Foundation)jhean dabatosNo ratings yet

- AFAR Assessment 2Document5 pagesAFAR Assessment 2JoshelBuenaventuraNo ratings yet

- Job Order Assignment PDFDocument3 pagesJob Order Assignment PDFAnne Marie100% (1)

- Batch 18 1st Preboard (P1)Document14 pagesBatch 18 1st Preboard (P1)Jericho PedragosaNo ratings yet

- Divide by Average Number of Shares OutstandingDocument11 pagesDivide by Average Number of Shares OutstandingJo FenNo ratings yet

- Assignment 01 Cash and Accrual Basis Answer KeyDocument6 pagesAssignment 01 Cash and Accrual Basis Answer KeyDan Andrei BongoNo ratings yet

- Home Office Questions With AnswersDocument10 pagesHome Office Questions With AnswersDaniel Nichole MerindoNo ratings yet

- AP Equity 1Document3 pagesAP Equity 1Mark Michael Legaspi100% (1)

- Answer The Following With Speed and Accuracy. Solutions Must Be DisclosedDocument4 pagesAnswer The Following With Speed and Accuracy. Solutions Must Be DisclosedUNKNOWNNNo ratings yet

- MODULE 2 CVP AnalysisDocument8 pagesMODULE 2 CVP Analysissharielles /No ratings yet

- Afar 5Document4 pagesAfar 5Tk KimNo ratings yet

- AainvtyDocument4 pagesAainvtyRodolfo SayangNo ratings yet

- Auditing ProblemsDocument26 pagesAuditing ProblemsKingChryshAnneNo ratings yet

- Module #6Document20 pagesModule #6Joy RadaNo ratings yet

- Master in Managerial Advisory Services: Easy QuestionsDocument13 pagesMaster in Managerial Advisory Services: Easy QuestionsKervin Rey JacksonNo ratings yet

- Consolidating Balance SheetsDocument4 pagesConsolidating Balance Sheetsangel2199No ratings yet

- Chapter 2 Partnership OperationsDocument24 pagesChapter 2 Partnership OperationsChelsy SantosNo ratings yet

- Closing Entries - Branchbooks: (Branch Books) Home OfficeDocument2 pagesClosing Entries - Branchbooks: (Branch Books) Home OfficeUnknown 01No ratings yet

- Abm QuizDocument5 pagesAbm QuizCastleclash CastleclashNo ratings yet

- MAS 7 Exercises For UploadDocument9 pagesMAS 7 Exercises For UploadChristine Joy Duterte RemorozaNo ratings yet

- HW On Operating Segments BDocument3 pagesHW On Operating Segments BJazehl Joy ValdezNo ratings yet

- Assignment 3.2 Inventory CutoffDocument3 pagesAssignment 3.2 Inventory CutoffHannah NolongNo ratings yet

- CH 15Document20 pagesCH 15grace guiuanNo ratings yet

- True/False: Variable Costing: A Tool For ManagementDocument174 pagesTrue/False: Variable Costing: A Tool For ManagementKianneNo ratings yet

- HW On INVESTMENT PROPERTY - 1Document2 pagesHW On INVESTMENT PROPERTY - 1Charles TuazonNo ratings yet

- MAS Final Preboard Solutions B93Document5 pagesMAS Final Preboard Solutions B93813 cafeNo ratings yet

- PINTO - Razmen R. (MASECO MT EXAM)Document4 pagesPINTO - Razmen R. (MASECO MT EXAM)Razmen Ramirez PintoNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's CheckDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's CheckJunzen Ralph Yap100% (1)

- Job Order CostingDocument51 pagesJob Order CostingKenneth TallmanNo ratings yet

- PRACTICAL ACCOUNTING 1 Part 2Document9 pagesPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagNo ratings yet

- Chapter 12-14Document18 pagesChapter 12-14Serena Van Der WoodsenNo ratings yet

- Accp303 Prefinals Nov 15 2021 KeyDocument9 pagesAccp303 Prefinals Nov 15 2021 KeyAngelica RubiosNo ratings yet

- AFAR Question PDFDocument16 pagesAFAR Question PDFNhel AlvaroNo ratings yet

- Assignment On Forecasting 2020Document2 pagesAssignment On Forecasting 2020Kim JennieNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- ARDocument2 pagesARTk KimNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet