Professional Documents

Culture Documents

Assignment WACC

Uploaded by

Nicolas ErnestoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment WACC

Uploaded by

Nicolas ErnestoCopyright:

Available Formats

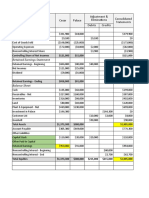

Exercise: WACC Due date: April 20, 2021

1. As of the end of Waltermart’s most recent quarter (Oct. 31, 2020), its book value of debt was $100

billion. As of April 6, 2021, its market cap (or equity value) is $300 billion. Waltermart’s stock has a beta

compared to the market of 0.37, assume that the risk-free rate is 2.7% and expected market return is

generally estimated to be 7%. Waltermart’s recent fiscal year interest expense is $4.7 billion. Thus, its

cost of debt is 4.7%, or $4.7 billion / $100 billion. The company’s tax rate in the annual report, said to be

30% for the last fiscal year. What is Walmart’s weighted average cost of capital (WACC)? Please show

your calculation.

2. Moto’s recent market value of equity is $134.5 billion. Its book value of debt is -$34.5 billion

(negative). Its stock has a beta of 0.82. The risk-free rate is 2.5% and market risk premium is 8%. Moto’s

cost of debt is 2% and the recent tax rate is 26%. (1) What is Walmart’s weighted average cost of capital

(WACC)? Please show your calculation. (2) Suppose that Moto’s yields returns after the investment is

20%. If compare with the WACC, what does it mean?

You might also like

- Assignment 1: InstructionsDocument2 pagesAssignment 1: InstructionsRuhul Amin RaadNo ratings yet

- Part I: Multiple Choice Questions: $ TomorrowDocument13 pagesPart I: Multiple Choice Questions: $ TomorrowKhánh EclipseNo ratings yet

- IntCorpFin Exercises CoC InvDecisionsDocument5 pagesIntCorpFin Exercises CoC InvDecisionscolorfulsalemNo ratings yet

- Compre BAV QP 2019-20 1Document3 pagesCompre BAV QP 2019-20 1f20211062No ratings yet

- Year CF To Equity Int (1-t) CF To Firm: Variant 1 A-MDocument5 pagesYear CF To Equity Int (1-t) CF To Firm: Variant 1 A-MNastya MedlyarskayaNo ratings yet

- QUIZDocument5 pagesQUIZNastya MedlyarskayaNo ratings yet

- Cost of Capital Question SetDocument8 pagesCost of Capital Question SethbyhNo ratings yet

- FIN924 Workshop Topic 2 QuestionsDocument4 pagesFIN924 Workshop Topic 2 QuestionsYugiii YugeshNo ratings yet

- Final Revision-2Document5 pagesFinal Revision-2barakat.yara2002No ratings yet

- Assignment2 Side1Document4 pagesAssignment2 Side1HrishikeshNo ratings yet

- Financial Management AssignmentDocument3 pagesFinancial Management AssignmentHamza FayyazNo ratings yet

- Compre BAV Sol 2019-20 1Document9 pagesCompre BAV Sol 2019-20 1f20211062No ratings yet

- Corporate FinanceDocument15 pagesCorporate Financecaglar ozyesilNo ratings yet

- Finance Pq1Document33 pagesFinance Pq1pakhok3No ratings yet

- Data Appendix: Taxes, Regulations, and The Value of U.S. and U.K. CorporationsDocument35 pagesData Appendix: Taxes, Regulations, and The Value of U.S. and U.K. CorporationspostscriptNo ratings yet

- HW2 CF1 Spring 2013Document3 pagesHW2 CF1 Spring 2013impurewolfNo ratings yet

- Introduction To Finance: Course Code: FIN201 Lecturer: Tahmina Ahmed Section: 7 Email: Tahmina98ahmedsbe@iub - Edu.bdDocument17 pagesIntroduction To Finance: Course Code: FIN201 Lecturer: Tahmina Ahmed Section: 7 Email: Tahmina98ahmedsbe@iub - Edu.bdTarif IslamNo ratings yet

- Stanphyl Capital Letter - October 2020Document15 pagesStanphyl Capital Letter - October 2020Facebook supportNo ratings yet

- At A Glance: Repurchase AgreementsDocument2 pagesAt A Glance: Repurchase AgreementsKyle AkinNo ratings yet

- WACC Formula Excel TemplateDocument3 pagesWACC Formula Excel TemplateNikita KumariNo ratings yet

- Q1 2011 ResultsDocument7 pagesQ1 2011 ResultsPatricia bNo ratings yet

- BUS 497a - Homework 1 - Solution GuideDocument5 pagesBUS 497a - Homework 1 - Solution GuidesaltyaxelNo ratings yet

- Financial CasesDocument64 pagesFinancial CasesMarwan MikdadyNo ratings yet

- Cffinals PDFDocument82 pagesCffinals PDFsultaniiuNo ratings yet

- UntitledDocument13 pagesUntitledJocelyn GiselleNo ratings yet

- Corporate Finance: Final Exam - Spring 2003Document38 pagesCorporate Finance: Final Exam - Spring 2003Omnia HassanNo ratings yet

- Equity Valuation-WACC-Cash FlowDocument12 pagesEquity Valuation-WACC-Cash FlowJackNo ratings yet

- Solutions To Chapters 7 and 8 Problem SetsDocument21 pagesSolutions To Chapters 7 and 8 Problem SetsAn Ngoc CồNo ratings yet

- Exercises + Answers - The Cost of CapitalDocument6 pagesExercises + Answers - The Cost of CapitalWong Yong Sheng Wong100% (1)

- Quiz1 PDFDocument45 pagesQuiz1 PDFShami Khan Shami KhanNo ratings yet

- Chapter 9 - SolutionsDocument53 pagesChapter 9 - SolutionsLILYANo ratings yet

- Bond or Note Valuation QuestionDocument4 pagesBond or Note Valuation QuestionRaheel Ahmed0% (1)

- WalMart Business ValuationDocument27 pagesWalMart Business ValuationFikremarkos Abebe100% (2)

- Comprehensive ExampleDocument3 pagesComprehensive ExampleCarolina LopezNo ratings yet

- Problems For CBDocument28 pagesProblems For CBĐức HàNo ratings yet

- Individual AssignmentDocument2 pagesIndividual AssignmentJoann PierreNo ratings yet

- End Term ExamDocument4 pagesEnd Term ExamKeshav Sehgal0% (2)

- WACC Formula Excel Template: Visit: EmailDocument3 pagesWACC Formula Excel Template: Visit: Emailw_fib100% (1)

- Alternative InvestmentsDocument29 pagesAlternative InvestmentsIMOTEP100% (1)

- Corporate Finance - Unit IV - Nguyen Duy SonDocument8 pagesCorporate Finance - Unit IV - Nguyen Duy SonsonndNo ratings yet

- Chap 2Document10 pagesChap 2Houn Pisey100% (1)

- Quiz 1Document46 pagesQuiz 1linerz0% (1)

- Finance 2midterm 2010 - SolutionsDocument5 pagesFinance 2midterm 2010 - SolutionsKelvin FuNo ratings yet

- Only Problems BetaDocument4 pagesOnly Problems BetaSupriya Rane0% (1)

- Risk MGMT Solutions Manual PDFDocument58 pagesRisk MGMT Solutions Manual PDFSofia MouraNo ratings yet

- Answers Risk Management and Financial Institutions 4th EditionDocument58 pagesAnswers Risk Management and Financial Institutions 4th EditionMincong ZhouNo ratings yet

- FNBK 3650 Final PaperDocument9 pagesFNBK 3650 Final PaperqttpieNo ratings yet

- Old Exam 2Document5 pagesOld Exam 2clementNo ratings yet

- Corporate+Finance Tutorial 04 ExercisesDocument2 pagesCorporate+Finance Tutorial 04 Exercisesstrategy.informNo ratings yet

- Soal Latihan UASDocument2 pagesSoal Latihan UASGistima Putra JavandaNo ratings yet

- Problem Set 2 - Equity ValuationDocument2 pagesProblem Set 2 - Equity Valuationmattgodftey1No ratings yet

- Wal-Mart Business Valuation: September 2011Document27 pagesWal-Mart Business Valuation: September 2011Vaishali SharmaNo ratings yet

- CH 14Document7 pagesCH 14AnsleyNo ratings yet

- CB Chapter 16Document4 pagesCB Chapter 16Sim Pei YingNo ratings yet

- Walmart CaseDocument5 pagesWalmart CaseJudWintonNo ratings yet

- FR sd21 Examiner ReportDocument28 pagesFR sd21 Examiner Reportlananhgau1603No ratings yet

- Financial Reporting (FR) Sept/Dec 2021 Examiner's ReportDocument28 pagesFinancial Reporting (FR) Sept/Dec 2021 Examiner's ReportOmid BasirNo ratings yet

- PL S18 FM WebDocument7 pagesPL S18 FM WebIQBAL MAHMUDNo ratings yet

- Cost of Capital HandoutDocument5 pagesCost of Capital HandoutAli SajidNo ratings yet

- Latihan Soal With DiscussionDocument6 pagesLatihan Soal With DiscussionNicolas ErnestoNo ratings yet

- Latihan Soal Consolidation Worksheet With DiscussionDocument5 pagesLatihan Soal Consolidation Worksheet With DiscussionNicolas ErnestoNo ratings yet

- Transaction AnalysisDocument16 pagesTransaction AnalysisNicolas ErnestoNo ratings yet

- Asia-Pacific International University Faculty of Business Administration Mid-Term Examination (Online)Document3 pagesAsia-Pacific International University Faculty of Business Administration Mid-Term Examination (Online)Nicolas ErnestoNo ratings yet

- Assignment Chapter 14Document8 pagesAssignment Chapter 14Nicolas ErnestoNo ratings yet

- Test Soal AdjustingDocument2 pagesTest Soal AdjustingNicolas ErnestoNo ratings yet

- Worksheet Advertising AgencyDocument1 pageWorksheet Advertising AgencyNicolas ErnestoNo ratings yet

- Final Test Acc 11Document1 pageFinal Test Acc 11Nicolas ErnestoNo ratings yet

- Final Test Acc 1 SolutionDocument4 pagesFinal Test Acc 1 SolutionNicolas ErnestoNo ratings yet

- Problem: Accounting Club Test SEPTEMBER 07, 2021Document3 pagesProblem: Accounting Club Test SEPTEMBER 07, 2021Nicolas ErnestoNo ratings yet

- Unit Test 1 2021Document2 pagesUnit Test 1 2021Nicolas ErnestoNo ratings yet

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- The Value of a Whale: On the Illusions of Green CapitalismFrom EverandThe Value of a Whale: On the Illusions of Green CapitalismRating: 5 out of 5 stars5/5 (2)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursFrom EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursRating: 5 out of 5 stars5/5 (13)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyFrom EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyRating: 3 out of 5 stars3/5 (1)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (19)

- Summary of Scott Kupor's Secrets of Sand Hill RoadFrom EverandSummary of Scott Kupor's Secrets of Sand Hill RoadRating: 5 out of 5 stars5/5 (1)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)