Professional Documents

Culture Documents

HTMLReports

Uploaded by

Rashmi Awanish Pandey0 ratings0% found this document useful (0 votes)

62 views1 pageSachin Pandey's pay slip for April 2021 from STEAG Energy Services shows:

- Gross pay of 33,612 rupees for the month

- Net pay of 30,567 rupees after deductions of 3,045 rupees

- Annual earnings breakdown including basic salary, HRA, conveyance allowance, and project allowance totaling 403,344 rupees.

Original Description:

Original Title

HTMLReports (8)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSachin Pandey's pay slip for April 2021 from STEAG Energy Services shows:

- Gross pay of 33,612 rupees for the month

- Net pay of 30,567 rupees after deductions of 3,045 rupees

- Annual earnings breakdown including basic salary, HRA, conveyance allowance, and project allowance totaling 403,344 rupees.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

62 views1 pageHTMLReports

Uploaded by

Rashmi Awanish PandeySachin Pandey's pay slip for April 2021 from STEAG Energy Services shows:

- Gross pay of 33,612 rupees for the month

- Net pay of 30,567 rupees after deductions of 3,045 rupees

- Annual earnings breakdown including basic salary, HRA, conveyance allowance, and project allowance totaling 403,344 rupees.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

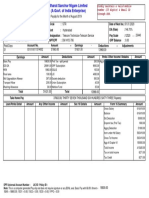

STEAG Energy Services (India) Pvt.

Ltd

903, Bhikaji Cama Bhawan, Bhikaji Cama Place, New Delhi - 110066

Pay Slip for the month of April 2021

Code : 03148 Division Name Operation & Maintenance

Location : Banawala

Name : Sachin Pandey Bank/MICR : Others

Department : Operations Bank A/c No. : 20148961547

Designation : Senior Engineer Group DOJ: Cost Centre :

Grade : Arrear Days : 0.00 PF No. : DLCPM00393710000013191

DOB 11/11/1989 DOJ : 10/12/2018 Payable Days : 30.00 PF UAN : 100827244197 PAN CQWPP0361H

:

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

BASIC 18,095 18,095 18,095 PROV. FUND 1,800

HRA 8,143 8,143 8,143 PROF TAX 200

CONVEYANCE 1,600 1,600 1,600 LWF 5

MEDALL 1,250 1,250 1,250 MESS DED 1,040

PROJ ALLOW 4,524 4,524 4,524

GROSS PAY 33,612 33,612 GROSS DEDUCTION 3,045

Net Pay : 30567.00 (Rupees Thirty Thousand Five Hundred Sixty-Seven Only)

Income Tax Worksheet for the Period April 2021 - March 2022

Description Gross Exempt Taxable Deduction Under Chapter VI-A HRA Calculation

BASIC 217,140 217,140 Investments u/s 80C Rent Paid

HRA 97,716 97,716 PROV. FUND 21,600 From

CONVEYANCE 19,200 19,200 To

MED RIM 15,000 15,000 1. Actual HRA 97,716

PROJ ALLOW 54,288 54,288 2. 40% or 50% of Basic

3. Rent > 10% Basic

Least of above is exempt

Taxable HRA 97,716

Gross Salary 403,344 403,344 Total of Investment u/s 80C 21,600

Deduction

Standard Deduction 50,000 U/S 80C 21,600

Previous Employer Professional Tax

Professional Tax 2,400

Under Chapter VI-A 21,600

Any Other Income

Taxable Income 329,344

Total Tax 3,967

Tax Rebate 3,967

Surcharge

Tax Due

Educational Cess 0

Net Tax 0

Tax Deducted (Previous Employer) Leave Balances

Tax Deducted Till Date Type Opening Availed Closing

Tax to be Deducted

Tax / Month Total of Ded Under Chapter VI-A 21,600

Tax on Non-Recurring Earnings

Tax Deduction for this month Interest on Housing Loan

Personal Note :

Employee ID:03148EMail ID:sachin.pandey@steag.inPWD:

You might also like

- Best EIN Verification Letter 05 - BackupDocument2 pagesBest EIN Verification Letter 05 - BackupYooo100% (1)

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Apoorv - Oct 2022 PayslipDocument1 pageApoorv - Oct 2022 Payslipguda sureshNo ratings yet

- Civil Core Projects India PVT LTD: Salary Slip For The Month of Jan 2021Document6 pagesCivil Core Projects India PVT LTD: Salary Slip For The Month of Jan 2021Dhanush DMNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

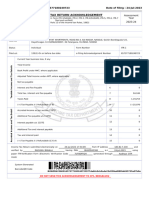

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAmit DuttaNo ratings yet

- Corporate Recovery and Tax Incentives For EnterprisesDocument5 pagesCorporate Recovery and Tax Incentives For EnterprisesIvy BoseNo ratings yet

- Bharat Sanchar Nigam Limited: Salary SlipDocument1 pageBharat Sanchar Nigam Limited: Salary SlipRohit raagNo ratings yet

- Payslip October 2022Document1 pagePayslip October 2022Raja guptaNo ratings yet

- Payslip For The Month of February - 2022: Spanidea Systems Private LimitedDocument1 pagePayslip For The Month of February - 2022: Spanidea Systems Private LimitedChinmaya SahooNo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument1 pageEPF Universal Account Number: LIC ID / Policy IDRapole DathatriNo ratings yet

- Pay Slip 10949 February, 2021Document1 pagePay Slip 10949 February, 2021Abebe SharewNo ratings yet

- Salary AugDocument1 pageSalary AugdivanshuNo ratings yet

- Itr 22-23Document1 pageItr 22-23MoghAKaranNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- S T S World School: Vill. Rajgomal, Po. Rurka Kalan, Teh: PhillaurDocument3 pagesS T S World School: Vill. Rajgomal, Po. Rurka Kalan, Teh: Phillaursunny singhNo ratings yet

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- PDF 472850270150723Document1 pagePDF 472850270150723Pijush SinhaNo ratings yet

- April 21 PayslipDocument1 pageApril 21 PayslipStephen SNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNANDAN SALESNo ratings yet

- Salary Slip A12Document1 pageSalary Slip A12Pritam GoswamiNo ratings yet

- Pay Slip - 604316 - May-22Document1 pagePay Slip - 604316 - May-22ArchanaNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Payslip 4 2021Document1 pagePayslip 4 2021Mehraj PashaNo ratings yet

- Slip PDFDocument1 pageSlip PDFPratikDutta0% (1)

- Ack 657377180240723Document1 pageAck 657377180240723SRIYA GADAGOJUNo ratings yet

- Pushparaj R PayslipDocument3 pagesPushparaj R PayslipHenry suryaNo ratings yet

- Form PDFDocument2 pagesForm PDFSuresh DoosaNo ratings yet

- PDF 192659360280722Document1 pagePDF 192659360280722MILTON MOHANTYNo ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 392007Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 392007vipin agarwal0% (1)

- India Payslip January 2023 PDFDocument1 pageIndia Payslip January 2023 PDFN RamPrasadNo ratings yet

- PaySlip 221253181486P PDFDocument1 pagePaySlip 221253181486P PDFpraveenNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearSagar GargNo ratings yet

- Bhanu Pay SlipDocument1 pageBhanu Pay SlipShyam ChouhanNo ratings yet

- This Is My Money. I Earned It by Doing My Best For Our CustomersDocument2 pagesThis Is My Money. I Earned It by Doing My Best For Our CustomersSomeshNo ratings yet

- MeharwanDocument1 pageMeharwanSteve BurnsNo ratings yet

- Localcube Commerce Private Limited: Payslip For The Month of July 2020Document1 pageLocalcube Commerce Private Limited: Payslip For The Month of July 2020Aswin KumarNo ratings yet

- Salry DecDocument1 pageSalry DecAnkush KumarNo ratings yet

- Aug - 23 Salary SlipDocument1 pageAug - 23 Salary SlipBack-End MarketingNo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument2 pagesEPF Universal Account Number: LIC ID / Policy IDBiswajit DasNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- IRS Letter ResponseDocument4 pagesIRS Letter ResponseCarl AKA Imhotep Heru El50% (2)

- March Salary PDFDocument1 pageMarch Salary PDFomkassNo ratings yet

- PDF 309648880270623Document1 pagePDF 309648880270623Vinay PatelNo ratings yet

- Payslip 8 2022Document1 pagePayslip 8 2022Md SharidNo ratings yet

- India JUN-2020 ...Document1 pageIndia JUN-2020 ...laxman luckyNo ratings yet

- Bijay Kumar Nayak Audit Report Ay 23-24Document19 pagesBijay Kumar Nayak Audit Report Ay 23-24tapireg689No ratings yet

- Form 16 20-21Document2 pagesForm 16 20-21Mohammad AliNo ratings yet

- Wipro FebruaryDocument1 pageWipro FebruaryDeum degOnNo ratings yet

- PayslipSalary Slips - 9-2020 PDFDocument1 pagePayslipSalary Slips - 9-2020 PDFSukant ChampatiNo ratings yet

- AugustDocument1 pageAugustNikhil DubeyNo ratings yet

- Salary SlipDocument1 pageSalary SlipSYAHRIL 25071991No ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Someshekar SB AC Dec-17 To Dec 18Document3 pagesSomeshekar SB AC Dec-17 To Dec 18mohmmedNo ratings yet

- Ack 137988180310723Document1 pageAck 137988180310723Lakesh kumar padhyNo ratings yet

- Itr 21-22Document1 pageItr 21-22MoghAKaranNo ratings yet

- Itr 2023 2024Document1 pageItr 2023 2024Deepak ThangamaniNo ratings yet

- PDF 628846520240522Document1 pagePDF 628846520240522Narayana Rao GanapathyNo ratings yet

- Salary Slip S5Document1 pageSalary Slip S5M.B TrickNo ratings yet

- Payslip PDFDocument1 pagePayslip PDFChetna PatwalNo ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalNo ratings yet

- Payslip 5 2021Document1 pagePayslip 5 2021Mehraj PashaNo ratings yet

- Payslip Prakhar PRA745634 1635359400000Document1 pagePayslip Prakhar PRA745634 163535940000024hours service centerNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- Activity Example 1040 TaxDocument2 pagesActivity Example 1040 TaxKevin ÁlvarezNo ratings yet

- Tally Erp 9 Sop 2 Part 3Document1 pageTally Erp 9 Sop 2 Part 3srehaan891No ratings yet

- Survey of Malabon RatesDocument5 pagesSurvey of Malabon RatesMarcus DoroteoNo ratings yet

- E-Way BillDocument1 pageE-Way BillPEDAPUDI SIVANo ratings yet

- Chapter 10 Student Answer Sheet 2020Document2 pagesChapter 10 Student Answer Sheet 2020api-534566718No ratings yet

- Taxation RA 10963 - TRAIN LAW: Readings in Philippine History Kurt Zeus L. DizonDocument16 pagesTaxation RA 10963 - TRAIN LAW: Readings in Philippine History Kurt Zeus L. DizonLennon Jed AndayaNo ratings yet

- Advanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsDocument15 pagesAdvanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsONASHI DEVNANI BBANo ratings yet

- A Guide To Taxation in The PhilippinesDocument3 pagesA Guide To Taxation in The PhilippinesPhia CustodioNo ratings yet

- Transfer and Business Taxation HOMEWORK 006 (HW006)Document3 pagesTransfer and Business Taxation HOMEWORK 006 (HW006)sora cabreraNo ratings yet

- SolutionsDocument16 pagesSolutionsapi-3817072100% (2)

- Ibm Kukkala Aravind KumarDocument1 pageIbm Kukkala Aravind Kumar9666993990akNo ratings yet

- Billing Address: Tax InvoiceDocument1 pageBilling Address: Tax InvoiceAayush SinghNo ratings yet

- Altair 2015 Relocation Tax Issues & AnswersDocument40 pagesAltair 2015 Relocation Tax Issues & AnswersHenry MajorosNo ratings yet

- T91310720522154 RPsDocument2 pagesT91310720522154 RPsRahul 31No ratings yet

- DTR & BillingDocument190 pagesDTR & Billingkate perezNo ratings yet

- FORM No. 16: Pune Municipal CorporationDocument2 pagesFORM No. 16: Pune Municipal CorporationAtharv MarneNo ratings yet

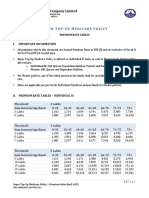

- A-Health Advance-I Premium RatesDocument2 pagesA-Health Advance-I Premium RatesExsan OthmanNo ratings yet

- Taxation of Agricultural IncomeDocument3 pagesTaxation of Agricultural IncomeSandéêp DägärNo ratings yet

- Super Top-Up Medicare Policy Premium Chart - Including GSTDocument6 pagesSuper Top-Up Medicare Policy Premium Chart - Including GSTvinay_814585077No ratings yet

- Afar AUD FAR MAS RFBT TAX TheoryDocument1 pageAfar AUD FAR MAS RFBT TAX TheoryralphalonzoNo ratings yet

- Bar Code Printer - InvoiceDocument1 pageBar Code Printer - InvoiceArindam HaldarNo ratings yet

- Tax Calculator by Tax GurujiDocument4 pagesTax Calculator by Tax GurujiSunitKumarChauhanNo ratings yet

- CGT Drill Answers and ExplanationsDocument4 pagesCGT Drill Answers and ExplanationsMarianne Portia SumabatNo ratings yet

- 4.03 Key Terms For Preparing PayrollDocument21 pages4.03 Key Terms For Preparing Payrollapi-262218593No ratings yet

- TAXA 301 SyllabusDocument12 pagesTAXA 301 SyllabusAdrian Perolino DelosoNo ratings yet

- Penalties and RemediesDocument3 pagesPenalties and RemediesAerl XuanNo ratings yet