Professional Documents

Culture Documents

Thursday

Uploaded by

LALALA LULULUCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thursday

Uploaded by

LALALA LULULUCopyright:

Available Formats

PFRS 13 – FAIR VALUE MEASUREMENT

1. Which of the following does not pertains to Fair Value?

a. It is an Exit Price

b. Fair Value is a price from an orderly transaction.

c. Fair Value is an entity-specific measurement.

d. It is a set price of an asset or liability that was based on current condition of the market.

Answer: C, Fair-Value is a market-based measurement, not an entity-specific measurement. Because fair

value doesn’t depend on facts, and to circumstances that surrounds in a specific entity.

2. Which of the following statement is incorrect?

a. Transaction cost is the costs to sell the asset or transfer a liability that are directly attributable

to disposal of the asset or the transfer of the liability.

b. Transport cost is the costs that would be incurred to transport an asset from its current

location to its exit market

c. Fair Value in transaction cost is not adjusted and is not included because they are a

characteristic of transaction, not of the asset or liability.

d. Fair Value in transport cost is adjusted and is included because it does not change the

characteristics of an asset.

Answer: D, Transportation changes the characteristics of an asset, specifically the location.

3. Which of the following is true about the Market Price that is used in getting the fair value?

a. Market price can be the principal market and when there is no principal market the

most advantageous market is used.

b. Market Price should always be determined by a market with the greatest volume.

c. Market Price should always be determined by a market that maximizes the amount to sell an

asset and minimizes the amount to transfer a liability.

d. When using the most advantageous market, we will use the Market Price of the market that

has the lower sales proceeds.

Answer: A Is correct, it is advised to use the principal market that has a greatest volume or activity level

but when there is no principal market, we will use the most advantageous market that maximizes the

amount to sell an asset and minimizes the amount to transfer a liability. Connected to this, B and C is

incorrect because determining the Market Price depends on the situation. D is also incorrect because as

what I’ve said, in using most advantageous market we should use the Market Price that maximizes the

amount to sell an asset and minimizes the amount to transfer a liability. So, the market that has highest

sales proceeds should be used.

4. Which of the following is incorrect about the “highest and best use” in measuring non-financial

assets?

a. It is an additional consideration to the requirements of PFRS 13, specifically the valuation

techniques and fair value hierarchy

b. It is the use of a non-financial asset by market participants that would maximize the value of

the asset and liabilities

c. It takes into account the Physical Characteristics of the non-financial asset such as the location

of an asset

d. It takes into account the Financial Flexibility of an asset.

Answer: D, it should be Financial Feasibility, whether using the asset does generate an adequate income

or cash flows.

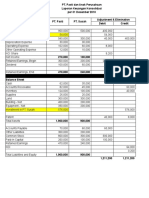

5. Given the following data compute for the fair value if neither of the Active Market #1 nor Active

Market #2 is a principal market:

Active Market #1 Active Market#2

Market Price 140,000 145,000

Agent’s Commission 20,000 22,000

Transport Cost 6,000 7,000

Cost of Rent 1,000 1,200

Solution:

1.Find the most advantageous market

Market Price 140,000 145,000

Agent’s Commission (20,000) (22,000)

Transport Cost (6,000) (7,000)

Cost of Rent (1,000) (1,200)

SALES PROCEEDS 113,000 114,800

Formula:

Market Price (Active Market #2) 145,000

Less: Transport Cost (7,000)

Fair Value 138,000

*Excluded (Transaction Cost)

Agent’s Commission

Cost of Rent

PFRS 14

1. PFRS 14 applies

a. only to government-regulated activities

b. only to entities that choose to apply it

c. to all entities that use PFRS

d. only to first -time adopters that choose to apply it

2. Regulatory deferral account balances arise from

a. US GAAP

b. SEC accounting

c. Government accounting

d. Rate-Regulated activities

3. According to PFRS 14, regulatory deferral accounts are classified in the statement of financial

position as

a. Current items

b. Noncurrent items

c. a or b

d. Neither a nor b

4. It is a principle of PFRS 14 that a first-time adopter must not continue to apply its previous GAAP

to the recognition, measurement, impairment and derecognition of regulatory deferral account

balances.

FALSE. According to its principle of ‘Continuation of existing accounting policy’, a first-time

adopter continues to apply its previous GAAP to the recognition, measurement, impairment and

derecognition of regulatory deferral account balances.

5. What are the exceptions to the ‘Continuation of existing accounting policy’ of PFRS 14?

a. Changes in accounting policies

b. Presentation of Regulatory Deferral Accounts

6. How does PFRS 14 interact with PAS 21?

PAS 21 The Effects of Changes in Foreign Exchange Rates is applied when translating regulatory

deferral account balances that are denominated in a foreign currency.

PFRS 15

1. Define PFRS 15.

Answer: PFRS 15 provides the principles in reporting the nature, amount, timing and

uncertainty of revenue and cash flows arising from an entity's contracts with customers.

2. Give atleast 3 objectives under PFRS 15.

Answer:

- State the five steps in the recognition of revenue.

- Describe how performance obligations are identified in a contract.

- Describe how the transaction price is allocated to the performance obligations.

- State the timing of revenue recognition and its measurement.

- State the presentation of contracts with customers in the statement of financial

position.

3. Describe the Core Principle of PFRS 15

Answer: An entity recognizes revenue to depict the transfer of promised goods or services to

customers in an amount that reflects the consideration to which the entity expects to be

entitled in exchange for those goods or services.

5. What are the 5 steps in revenue recognition?

Answer:

Step 1: Identify the contract with the customer

Step 2: Identify the performance obligations in the contract

Step 3: Determine the transaction price

Step 4: Allocate the transaction price to the performance obligations in the contract

Step 5: Recognize revenue when or as the entity satisfies a performance obligation

6. It is the price at which a promised good or service can be sold separately to a customer

Answer: Stand-alone Selling Price

7. State atleast 4 Examples of Promised goods or services

Answer:

a. Sales of goods produced by a manufacturing entity;

b. Resale of goods purchased by a trading entity;

c. Resale of rights to goods or services purchased by an entity;

d. Performing a contractual agreed-upon tasks by a service- oriented entity;

e. Constructing, manufacturing or developing an asset on behalf of a customer;

f. Providing a service of standing ready to provide goods or services or of making goods or

services available for a customer to use as and when the customer decides;

g. Providing a service of arranging for another party to transfer goods or services to a

customer;

h. Granting rights to goods or services to be provided in the future that a customer can resell

or provide to its customer

i. Granting licenses; and

j. Granting options to purchase additional goods or services

8. What is the difference between the input and output method?

Answer:

Input Method - measured based on efforts or inputs expended

Output Method - measured based on direct measurement of the value of the goods or

services

PFRS 16 LEASES

1. What is the difference between lessee and lessor?

- Lessee is an entity that obtains the right to use an underlying asset for a period

of time in exchange for consideration. On the other hand, lessor is an entity that

provides the right to use an underlying asset for a period of time in exchange for

consideration.

2. What is a lease?

- A contract, or part of a contract, that conveys the right to use an asset for a

period of time in exchange for consideration.

3. Give at least 3 examples of Non-lease elements.

- Maintenance

- Security services

- Supply of utilities

- Supply of goods

- Supply of operational services

4. TRUE OR FALSE. Finance lease is a lease that does not transfer substantially

all the risks and rewards incidental to ownership of an underlying asset.

- FALSE, kasi ang finance lease ay pwedeng i-transfer all the risks and rewards

incidental to ownership of an underlying asset.

5. Give at least 2 indicators of finance lease

- Transfer of ownership

- Bargain purchase option (BPO)

- Lease term is at least 75% of the useful life of the leased asset

- Present value of lease payments is at least 90% of the fair value of the leased

asset at the inception date

- Leased asset is of specialized nature

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Managing ExpectationsDocument400 pagesManaging Expectationsswaroopr8100% (8)

- Full Download Corporate Finance 4th Edition Berk Solutions ManualDocument13 pagesFull Download Corporate Finance 4th Edition Berk Solutions Manualetalibelmi2100% (41)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 1 PowerPoint Slides To Entrepreneurship Successfully Launching New VenturesDocument38 pagesChapter 1 PowerPoint Slides To Entrepreneurship Successfully Launching New VenturesCiara Caldwell100% (1)

- Pfrs 14: Regulatory Deferral AccountsDocument5 pagesPfrs 14: Regulatory Deferral AccountsLALALA LULULUNo ratings yet

- Pas 37 38 40 41 PFRS 1Document5 pagesPas 37 38 40 41 PFRS 1LALALA LULULUNo ratings yet

- 8thbatch ReciteDocument6 pages8thbatch ReciteLALALA LULULUNo ratings yet

- WEDNESDAYDocument7 pagesWEDNESDAYLALALA LULULUNo ratings yet

- ? Management Approach. Chief Operating Decision Maker: Pfrs 8 Q&ADocument8 pages? Management Approach. Chief Operating Decision Maker: Pfrs 8 Q&ALALALA LULULUNo ratings yet

- A) Share-Based Payment Transactions B) LeasesDocument1 pageA) Share-Based Payment Transactions B) LeasesLALALA LULULUNo ratings yet

- Final Accounts QuestionDocument12 pagesFinal Accounts Questionadityatiwari122006No ratings yet

- Midterms I Answer KeyDocument5 pagesMidterms I Answer Keyaldric taclanNo ratings yet

- Entrep 07 Activity 1Document2 pagesEntrep 07 Activity 1Ronald varrie BautistaNo ratings yet

- BIS Report On Derivatives - Year End 2008Document24 pagesBIS Report On Derivatives - Year End 2008Terry Tate BuffettNo ratings yet

- NPV and XIRR Calculator Excel TemplateDocument7 pagesNPV and XIRR Calculator Excel TemplateAJIT KUMAR PATRANo ratings yet

- Capital Budgeting Project Evaluation TechniquesDocument16 pagesCapital Budgeting Project Evaluation Techniquessamuel kebedeNo ratings yet

- Zerodha MarginDocument2 pagesZerodha MarginAkhilesh KumarNo ratings yet

- IBank Coaching - Investment Banking Valuation Methodology (2020) (1) - CompressedDocument23 pagesIBank Coaching - Investment Banking Valuation Methodology (2020) (1) - CompressedcherryNo ratings yet

- Answer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)Document15 pagesAnswer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)shashank saxenaNo ratings yet

- 2020 BValuation ReportDocument440 pages2020 BValuation Reportraj28_999No ratings yet

- Solusi Inventory Downstream-UpstreamDocument19 pagesSolusi Inventory Downstream-UpstreamKurrniadi AndiNo ratings yet

- Order in The Matter of Sarang Viniyog Ltd. (Formerly Known As Pincon Spirit LTD.)Document10 pagesOrder in The Matter of Sarang Viniyog Ltd. (Formerly Known As Pincon Spirit LTD.)Shyam SunderNo ratings yet

- Intermediate Accounting Ii McqsDocument7 pagesIntermediate Accounting Ii Mcqsraymart copiarNo ratings yet

- FE-Seminar 10 15 2012Document38 pagesFE-Seminar 10 15 2012yerytNo ratings yet

- SolutionDocument5 pagesSolutionClariz Angelika EscocioNo ratings yet

- Subsequent Measurement Accounting Property Plant and EquipmentDocument60 pagesSubsequent Measurement Accounting Property Plant and EquipmentNatalie SerranoNo ratings yet

- Delta Corp 2011Document144 pagesDelta Corp 2011RahulSatijaNo ratings yet

- From The Following Balance Sheet of Mayur Ltd. AnDocument1 pageFrom The Following Balance Sheet of Mayur Ltd. AnJaymala ShahiNo ratings yet

- Ch.8 Creating Successful Fin. PlanDocument16 pagesCh.8 Creating Successful Fin. PlanRose Anne RecañaNo ratings yet

- Icfai Foundation For Higher Education University: A Project Report ONDocument12 pagesIcfai Foundation For Higher Education University: A Project Report ONkishore kittuNo ratings yet

- Chapter Two Investment Alternatives Multiple Choice QuestionsDocument13 pagesChapter Two Investment Alternatives Multiple Choice QuestionsHashmi SutariyaNo ratings yet

- Net Operating Income ApproachDocument14 pagesNet Operating Income ApproachRoopesh Kannur100% (1)

- Private Equity and Venture Capital: by Professor Stefano CaselliDocument69 pagesPrivate Equity and Venture Capital: by Professor Stefano CaselliYash ModiNo ratings yet

- Financialmanagementworkbook 121105064928 Phpapp01Document881 pagesFinancialmanagementworkbook 121105064928 Phpapp01sunnysainani1No ratings yet

- Reading 35 Exchange-Traded Funds - Mechanics and ApplicationsDocument7 pagesReading 35 Exchange-Traded Funds - Mechanics and Applicationstristan.riolsNo ratings yet

- 16Ub1624-Financial Markets and Institutions K1 - Level Multiple Choice Questions Unit IDocument29 pages16Ub1624-Financial Markets and Institutions K1 - Level Multiple Choice Questions Unit Ilaale dijaanNo ratings yet

- Economic Value Added: Presented byDocument25 pagesEconomic Value Added: Presented bySachin NagargojeNo ratings yet