Professional Documents

Culture Documents

Labonevane Case Study

Uploaded by

Hạt TiêuOriginal Description:

Original Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Labonevane Case Study

Uploaded by

Hạt TiêuCopyright:

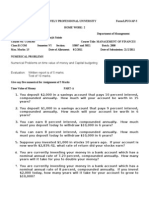

LABONEVANE CASE STUDY

Labonevane inc. plans to launch a new product. This project requires an initial investment

(year 0) of $700,000 in the construction and in the equipment of a new plant. This investment

would be linearly depreciated over 7 years. However, the firm has planned to end the project

at the end of the fourth year and thinks it will sell its plant and its equipment for $450,000.

This project would also require an initial investment in working capital requirements of

$150,000 which would be totally recovered in four years. To simplify, we neglect the annual

fluctuations of working capital requirements.

The expected sales for the first year would be $3,000,000 and would then increase in 6% a

year.

The variable costs of manufacturing would amount to 77% of the annual sales. The operating

fixed costs before depreciation would be $500,000 the first year and then would increase in

5% a year.

The tax rate is 30%.

What is the NPV of this project given that the discount rate is 12%?

You might also like

- Ps 6Document19 pagesPs 6Da Harlequin GalNo ratings yet

- ch12 2Document3 pagesch12 2ghsoub777100% (1)

- How To Start A Patio Installation Business: A Complete Patio & Concrete Installation Business PlanFrom EverandHow To Start A Patio Installation Business: A Complete Patio & Concrete Installation Business PlanRating: 3 out of 5 stars3/5 (1)

- NPV & Capital Budgeting QuestionsDocument8 pagesNPV & Capital Budgeting QuestionsAnastasiaNo ratings yet

- Practice Exercises 2Document3 pagesPractice Exercises 2Richard RobinsonNo ratings yet

- Christine Dung Nguyen Marketing Manager 1600414732Document2 pagesChristine Dung Nguyen Marketing Manager 1600414732Hạt TiêuNo ratings yet

- Chapter 2 Problems On Capital InvestmentDocument2 pagesChapter 2 Problems On Capital InvestmentamananandxNo ratings yet

- F402 In-Class Exercise - Capital Budgeting September 8, 2020Document3 pagesF402 In-Class Exercise - Capital Budgeting September 8, 2020Harrison Galavan0% (1)

- Exercise 2 - Group 5Document1 pageExercise 2 - Group 5Nhi Le Ngoc UyenNo ratings yet

- Exercises (Capital Budgeting)Document2 pagesExercises (Capital Budgeting)bdiitNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- Question One Acca 2014 June QN 1Document4 pagesQuestion One Acca 2014 June QN 1Joseph Timasi ChachaNo ratings yet

- Bài Tập Buổi 4 (Updated)Document4 pagesBài Tập Buổi 4 (Updated)Minh NguyenNo ratings yet

- SolutionDocument6 pagesSolutionaskdgasNo ratings yet

- Capital Budgeting: From The Desk of Baber SaleemDocument41 pagesCapital Budgeting: From The Desk of Baber SaleemFarhan QureshiNo ratings yet

- Project Financial Appraisal - NumericalsDocument5 pagesProject Financial Appraisal - NumericalsAbhishek KarekarNo ratings yet

- Chapter-14: Multinational Capital BudgetingDocument41 pagesChapter-14: Multinational Capital BudgetingShakib Ahammed ChowdhuryNo ratings yet

- Fin370 Myfinancelab Week 3 New 2015Document4 pagesFin370 Myfinancelab Week 3 New 2015G JhaNo ratings yet

- Mis 3300 Feasibility AnalysisDocument28 pagesMis 3300 Feasibility Analysisapi-281205316No ratings yet

- Chap 11-EXDocument1 pageChap 11-EXvytltqs170172No ratings yet

- Capital Budgeting ProblemsDocument4 pagesCapital Budgeting ProblemsLiana Monica Lopez0% (1)

- Capital Budgeting Exercise 1Document2 pagesCapital Budgeting Exercise 1Mohamed ZaitoonNo ratings yet

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pages3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- Non-Discounted Capital Budgeting Techniques: ExampleDocument2 pagesNon-Discounted Capital Budgeting Techniques: ExampleKristineTwo CorporalNo ratings yet

- Case Study 2Document8 pagesCase Study 2Tatev SaakianNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- Chapter-14: Multinational Capital BudgetingDocument14 pagesChapter-14: Multinational Capital BudgetingAminul Islam AmuNo ratings yet

- Acc208 Tutorial 5Document2 pagesAcc208 Tutorial 5lawerence0% (1)

- Bf208 Assignment 1Document3 pagesBf208 Assignment 1Emmanuel NeshiriNo ratings yet

- A - BasicDocument12 pagesA - BasicDiana Rose Apple RONCESVALLESNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingSteven MalimbwiNo ratings yet

- CFDocument1 pageCFhi babyNo ratings yet

- Problems 7.1Document1 pageProblems 7.1Tuan Anh LeeNo ratings yet

- Measuring Investment Returns: Questions and ExercisesDocument9 pagesMeasuring Investment Returns: Questions and ExercisesKinNo ratings yet

- Strategic Business AnalysisDocument8 pagesStrategic Business AnalysisAdora Chielka SalesNo ratings yet

- Hoachdinh3 PDFDocument1 pageHoachdinh3 PDFQuỳnh KhaNo ratings yet

- Non-Discounted Capital Budgeting TechniquesDocument4 pagesNon-Discounted Capital Budgeting TechniquesLloyd ReglosNo ratings yet

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- 09 Cash FlowDocument1 page09 Cash FlowShekhar SinghNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingavtaarNo ratings yet

- Lecture7 PDFDocument7 pagesLecture7 PDFJeannette VillenaNo ratings yet

- Problem Set 04 - Introduction To Excel Financial FunctionsDocument3 pagesProblem Set 04 - Introduction To Excel Financial Functionsasdf0% (1)

- HW Week 5 Fin/571Document5 pagesHW Week 5 Fin/571trelvisd0% (1)

- Tutorial 4 Capital Investment Decisions 1Document4 pagesTutorial 4 Capital Investment Decisions 1phillip HaulNo ratings yet

- Tutorial 4 - Capital Investment DecisionsDocument4 pagesTutorial 4 - Capital Investment DecisionsIbrahim HussainNo ratings yet

- HW 2Document3 pagesHW 2Love MittalNo ratings yet

- Chapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlDocument42 pagesChapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlAbel100% (1)

- FM Lect 4Document6 pagesFM Lect 4Abdul Moiz AhmedNo ratings yet

- Time Value and Capital BudgetingDocument9 pagesTime Value and Capital BudgetingaskdgasNo ratings yet

- Capital Budgeting TechniquesDocument3 pagesCapital Budgeting TechniquesbalachmalikNo ratings yet

- Year 1 2 3 4 Sales Volume (Units/year) 350,000 380,000 400,000 400,000Document13 pagesYear 1 2 3 4 Sales Volume (Units/year) 350,000 380,000 400,000 400,000সৈকত হাবীবNo ratings yet

- AE23 Capital BudgetingDocument4 pagesAE23 Capital BudgetingCheska AgrabioNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- Fin3n Cap Budgeting Quiz 1Document1 pageFin3n Cap Budgeting Quiz 1Kirsten Marie EximNo ratings yet

- HandoutDocument14 pagesHandoutJuzer ShabbirNo ratings yet

- Project Evaluation QuestionsDocument5 pagesProject Evaluation Questionsanon_615698823No ratings yet

- Problem Set 04 - More Problems Using Financial FunctionsDocument2 pagesProblem Set 04 - More Problems Using Financial FunctionsShashwatNo ratings yet

- 2015-Spring-F18-CIA Revision Practice QuestionsDocument2 pages2015-Spring-F18-CIA Revision Practice QuestionsMayal AhmedNo ratings yet

- Corporate Finance Assignment 1Document1 pageCorporate Finance Assignment 1babylovelylovelyNo ratings yet

- Tute5 Capital BudgetingDocument1 pageTute5 Capital Budgetingvivek patelNo ratings yet

- Business Game - Team 6 - Brazil - 14jul2020Document19 pagesBusiness Game - Team 6 - Brazil - 14jul2020Hạt TiêuNo ratings yet

- Stand Out During Festive Season: With Creative & Innovative SolutionsDocument29 pagesStand Out During Festive Season: With Creative & Innovative SolutionsHạt TiêuNo ratings yet

- 3fafe1f8 KantarcrosschannelanalysisDocument13 pages3fafe1f8 KantarcrosschannelanalysisHạt TiêuNo ratings yet

- Final Exam Corporate Finance CFVG 2016-2017Document8 pagesFinal Exam Corporate Finance CFVG 2016-2017Hạt TiêuNo ratings yet

- 2016 Mev Light KatherineDocument65 pages2016 Mev Light KatherineHạt TiêuNo ratings yet

- PositionPaper Guide9 PDFDocument1 pagePositionPaper Guide9 PDFHạt TiêuNo ratings yet

- IMUN Online Conference 20.0: Study GuideDocument11 pagesIMUN Online Conference 20.0: Study GuideHạt TiêuNo ratings yet

- Online Instructions - 03 PDFDocument2 pagesOnline Instructions - 03 PDFHạt TiêuNo ratings yet