Professional Documents

Culture Documents

RSPL Limited: Payslip For The Month of JUNE 2021

Uploaded by

Manju ManjappaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RSPL Limited: Payslip For The Month of JUNE 2021

Uploaded by

Manju ManjappaCopyright:

Available Formats

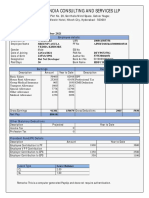

RSPL LIMITED

119-121 (Part), Block P & T, Fazal Ganj, G. T. Road,

Kanpur – 208012

Payslip for the month of JUNE 2021

Employee ID : RS15749 Employee Name : MANJAPPA A K

Dat of Birth : 19-JUL-1977 Title : Mr.

Gender : M Designation : TERRITORY SALES INCHARGE

Department : SALES HO Location : RSPL HO

Joining Date : 02-DEC-2019 PF Number : UPKNP00193410000018948

ESI Number : 2112213392 PAN : AMYPM1625K

Aadhar : 890095739542 UAN : 101447282113

GROUP DOJ : 02-DEC-2019 Pay Grade : EMPLOYEE

Regime Type : Old Regime

EARNINGS MASTER RATE PAID DEDUCTIONS Amount (Rs.) YTD Amount STANDARD DAYS : 30

BASIC 10200.00 9860.00 Provident Fund 1183.00 3429.00 DAYS WORKED : 29

House Rent Allowance 5100.00 4930.00 ESI 127.00 444.00 LOSS OF PAY DAYS : 1

Special Allowance 600.00 580.00 LOSS OF PAY REV DAYS : 0

TA 1600.00 1547.00

BANK : -

A/C No. : 35090986937

Total Earnings Rs. 16917.00 Total Deductions Rs. 1310.00 Net Salary Rs. 15607.00

Income Tax Calculation Investment Details

Particulars Cumulative Total Add: Projected Less: Exempted Annual

Provident Fund 14445.00

Basic 28571.00 91800.00 0.00 120371.00

House Rent Allowance 14285.00 45900.00 0.00 60185.00

Other Declarations

Special Allowance 1681.00 5400.00 0.00 7081.00

Declarations From Date To Date Rent/Month Metro

Ta 4482.00 14400.00 0.00 18882.00 Type

S&D Sales Incentive 8000.00 0.00 0.00 8000.00

Gdp Sales Incentive 2032.00 0.00 0.00 2032.00 Leave

Total 59051.00 157500.00 0.00 216551.00 Leave Type Entitlement Opening Availed Closing

Balance this month Balance

Add: Income received from Previous Employer 0.00

EL 0 17.04 0 18.25

Net Taxable Income 216551.00

CL 0 10 0 10

Less: Standard Deduction 50000.00

Less: Prof. Tax recovered by Previous Employer 0.00

Less: Prof. Tax recovered by Current Employer 0.00

Add: Other Taxable Income reported by the employee 0.00

Gross Taxable Income 166551.00

Less : SEC80C - Deduction U/s 80C (Limit Rs.150000/-) 14445

Income Chargeable to Tax (Rounded Off) 152110.00

Income Tax Deduction

Income Tax Payable 0.00

Less : Relief under Section 87 0.00

Net Income Tax Payable 0.00

Add : Surcharge on Income Tax 0.00

Add : Cess 0.00

Total Income Tax & S/C & Cess Payable 0.00

Less : I. Tax & S/C paid by Prev. Employer 0.00

I.Tax & S/C & Cess to be recovered 0.00

I.Tax & S/C & Cess recovered till JUNE 2021 0.00

Balance I. Tax & S/C & Cess to be recovered 0.00

Avg. Monthly I. Tax & S/C & Cess to be recovered 0.00

Note:

Thu Jul 29 15:56:15 IST 2021 Please Send Your Queries to info@excelityglobal.com

This document contains confidential information. If you are not the intended recipient you are not authorized to use or disclose it in any form.

If you received this in error please destroy it along with any copies and notify the sender immediately.

29/07/2021

You might also like

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- India Local Monthly130122210312905Document1 pageIndia Local Monthly130122210312905NAGARJUNANo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- May Payslip UdaanDocument1 pageMay Payslip UdaanVishnu Pinninty0% (1)

- Allcloud Enterprise Solutions Private Limited: Payslip For The Month of June 2019Document1 pageAllcloud Enterprise Solutions Private Limited: Payslip For The Month of June 2019Shaik IrfanNo ratings yet

- RanebennurDocument3 pagesRanebennurvirupakshrnrNo ratings yet

- Fe96beed 7a5b 4d7b A5cc C38eecd2b38dDocument1 pageFe96beed 7a5b 4d7b A5cc C38eecd2b38dChandan ShahNo ratings yet

- Arul Payslip NewDocument1 pageArul Payslip Newrajeshkapoo0% (1)

- Swati Web Technologies Private Limited: Salary Slip For July - 2023Document1 pageSwati Web Technologies Private Limited: Salary Slip For July - 2023r76768477No ratings yet

- PaySlip-210 (ASHISH SHARMA) - APR - 2018 PDFDocument1 pagePaySlip-210 (ASHISH SHARMA) - APR - 2018 PDFAnonymous OXzOm4oNo ratings yet

- #408, Ashirwad Enclave,, 104 I.P. Extention,, Delhi-110092Document1 page#408, Ashirwad Enclave,, 104 I.P. Extention,, Delhi-110092Ashutosh SharmaNo ratings yet

- PayslipDocument1 pagePayslipBalu PedapudiNo ratings yet

- Payslip Prakhar PRA745634 1635359400000Document1 pagePayslip Prakhar PRA745634 163535940000024hours service centerNo ratings yet

- N2K Info Systems Private Limited: Payslip For The Month of April - 2019Document1 pageN2K Info Systems Private Limited: Payslip For The Month of April - 2019Munna ShaikNo ratings yet

- A S Soft Technologies Private Limited: Pay Slip For The Month of July 2018Document1 pageA S Soft Technologies Private Limited: Pay Slip For The Month of July 2018srini reddyNo ratings yet

- Physic Pharmaceuticals: Pay Slip For The Month of April 2016Document3 pagesPhysic Pharmaceuticals: Pay Slip For The Month of April 2016raisNo ratings yet

- Mar 2014 PDFDocument1 pageMar 2014 PDFchinnabobNo ratings yet

- DecemberDocument1 pageDecemberPavan KumarNo ratings yet

- Ixfaekuh1tnhpn552c1oyh454637235978572027924091013 PDFDocument1 pageIxfaekuh1tnhpn552c1oyh454637235978572027924091013 PDFAnonymous zmxmihtJNo ratings yet

- Manthan Aug NewDocument1 pageManthan Aug NewManthan ShahNo ratings yet

- Adecco India Pvt. LTD.: Payslip For The Month of Sept 2016Document1 pageAdecco India Pvt. LTD.: Payslip For The Month of Sept 2016Prem KumarNo ratings yet

- Awais Ahmed (UTL0477)Document1 pageAwais Ahmed (UTL0477)Awais AhmedNo ratings yet

- A029550 - Suman MehtaDocument1 pageA029550 - Suman MehtaHitendravashisthNo ratings yet

- PaySlip1 DecDocument1 pagePaySlip1 Decjesten jadeNo ratings yet

- New SlipDocument1 pageNew Slip476No ratings yet

- Servlet ControllerDocument1 pageServlet ControllerYashasvi GuptaNo ratings yet

- Square Yards Consulting Private Limited: Payslip For The Month of April 2023Document1 pageSquare Yards Consulting Private Limited: Payslip For The Month of April 2023Neelesh PandeyNo ratings yet

- Shrine Lifesciences Private Limited: Earnings Deductions Amount AmountDocument1 pageShrine Lifesciences Private Limited: Earnings Deductions Amount Amountralesh694No ratings yet

- EMP1314Document1 pageEMP1314Laxmi JaiswalNo ratings yet

- Payslip Aug 2023Document1 pagePayslip Aug 2023paras rawatNo ratings yet

- Arunachala Logistics PVT - Ltd. Pay Slip For The Month of APR - 2019Document1 pageArunachala Logistics PVT - Ltd. Pay Slip For The Month of APR - 2019Ganesh KumarNo ratings yet

- Pay Slip-June-21Document1 pagePay Slip-June-21tejpratap pandeyNo ratings yet

- India Payslip January 2022Document1 pageIndia Payslip January 2022Mir KazimNo ratings yet

- TarunDocument1 pageTarunUbed QureshiNo ratings yet

- Payslip For The Month of JUN-2011Document1 pagePayslip For The Month of JUN-2011Binay K SrivastawaNo ratings yet

- Employee Payslip NewDocument1 pageEmployee Payslip NewRitika SharmaNo ratings yet

- Payslip For The Month of March 2015 Earnings DeductionsDocument1 pagePayslip For The Month of March 2015 Earnings Deductionsmadhusudhan N RNo ratings yet

- Purview India Consulting and Services LLPDocument1 pagePurview India Consulting and Services LLPmamatha vemulaNo ratings yet

- Manchala Sirisha PDFDocument1 pageManchala Sirisha PDFSirisha SiyatonNo ratings yet

- Payslip Jul 2023Document1 pagePayslip Jul 2023Kartika RaguvanshiNo ratings yet

- THVSH01176780000411504 PDFDocument1 pageTHVSH01176780000411504 PDFKamini Sumit ChouhanNo ratings yet

- JDFJUSBFUISDFDocument1 pageJDFJUSBFUISDFDillibabu RanganathanNo ratings yet

- Payslip 5 2021Document1 pagePayslip 5 2021Mehraj PashaNo ratings yet

- This Is A Computer Generated Statement NOT Requiring Any SignatureDocument1 pageThis Is A Computer Generated Statement NOT Requiring Any Signatureraj dNo ratings yet

- Recoveries Earnings: Amount AmountDocument3 pagesRecoveries Earnings: Amount AmountVadamalai AdhimoolamNo ratings yet

- Payslip Jun PDFDocument1 pagePayslip Jun PDFtrack ViewNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Tata Projects Limited: Salary Slip For The Month of June - 2021Document1 pageTata Projects Limited: Salary Slip For The Month of June - 2021prishaprajapati01No ratings yet

- SR No. 13/ 4 A, Plot No. 14, Khandge Hospital Road, Shitole Nagar, Sangavi, Pune - 411027 Payslip For Jan-2020Document1 pageSR No. 13/ 4 A, Plot No. 14, Khandge Hospital Road, Shitole Nagar, Sangavi, Pune - 411027 Payslip For Jan-2020Rajesh NayakNo ratings yet

- Payslip Jan 2023Document1 pagePayslip Jan 2023Ankit SinghNo ratings yet

- Payslip 221234 CIN Sep 2017Document1 pagePayslip 221234 CIN Sep 2017sharmila boseNo ratings yet

- Nikita Pay SlipsDocument10 pagesNikita Pay SlipsdesignNo ratings yet

- Bertelsmann Marketing Services India PVT LTD 15Th Floor, Tower C, BLDG No 8, DLF Cyber City GURGAON - 122002Document1 pageBertelsmann Marketing Services India PVT LTD 15Th Floor, Tower C, BLDG No 8, DLF Cyber City GURGAON - 122002mohit1990dodwalNo ratings yet

- SRS Business Solutions (India) PVT - LTD: Attendance Details ValueDocument1 pageSRS Business Solutions (India) PVT - LTD: Attendance Details ValueraghavaNo ratings yet

- PaySlip636893786027292759 PDFDocument1 pagePaySlip636893786027292759 PDFIyyan DuraiNo ratings yet

- Manish Dwivedi Nov-18Document1 pageManish Dwivedi Nov-18Anonymous 3P7aeUIW2No ratings yet

- Kanchan Pharma Private Limited: Salary Slip For July - 2023Document1 pageKanchan Pharma Private Limited: Salary Slip For July - 2023r76768477No ratings yet

- Grofers India PVT LTD: Payslip For The Month of APRIL 2021Document1 pageGrofers India PVT LTD: Payslip For The Month of APRIL 2021Anirban GhoshNo ratings yet

- Amara Raja Batteries LimitedDocument1 pageAmara Raja Batteries LimitedNani AnugaNo ratings yet

- Payroll Insights - Farsight IT SolutionsDocument1 pagePayroll Insights - Farsight IT SolutionsyogeshNo ratings yet

- FS Jecintha-Paulin - VincentDocument2 pagesFS Jecintha-Paulin - VincentkumarNo ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- Estates and Trust PDFDocument4 pagesEstates and Trust PDFJustin Robert Roque100% (1)

- ChromeDocument6 pagesChromeHarman SinghNo ratings yet

- Ey Global Payroll Operate 2021 UpdatedDocument498 pagesEy Global Payroll Operate 2021 UpdatedBelén De BlasisNo ratings yet

- Application Form: General Information: Selection Criteria For AccommodationDocument5 pagesApplication Form: General Information: Selection Criteria For AccommodationSIDDIG HASSAN SALAMAMNo ratings yet

- Chapter 9 Ohio UniversityDocument36 pagesChapter 9 Ohio UniversityMona A HassanNo ratings yet

- TAXATION 1 Transcripts - Atty. KMA - A.Y. 2020 - 2021Document52 pagesTAXATION 1 Transcripts - Atty. KMA - A.Y. 2020 - 2021Vincent John NacuaNo ratings yet

- of Wages and Salaries AdmDocument12 pagesof Wages and Salaries Admshiiba2294% (17)

- DA4139 Level III CFA Mock Exam 1 AnswersDocument79 pagesDA4139 Level III CFA Mock Exam 1 AnswersHelloWorldNow0% (1)

- Epf Joint Declaration - RajeshDocument3 pagesEpf Joint Declaration - Rajeshravikoriveda123No ratings yet

- Payslip 102703 202303 PDFDocument1 pagePayslip 102703 202303 PDFAnagha AnuNo ratings yet

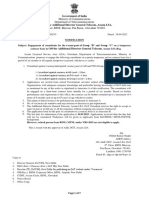

- Notification For Engagement of Consultants With Last Date of Submission of Application Till 24-05-2023 Along With Annexures - Case of AS LSADocument7 pagesNotification For Engagement of Consultants With Last Date of Submission of Application Till 24-05-2023 Along With Annexures - Case of AS LSAAbhishek SambangiNo ratings yet

- Cm1a 121 ExamDocument7 pagesCm1a 121 ExamShuvrajyoti BhattacharjeeNo ratings yet

- Actng For Taxes Employees BenefitsDocument3 pagesActng For Taxes Employees BenefitsBridget Zoe Lopez BatoonNo ratings yet

- 02 Eastern v. POEADocument3 pages02 Eastern v. POEAPatty Salas - PaduaNo ratings yet

- Fed in A Hole Winning Women Dinner Debate: China Ditches Mass Share Buys After $200bn Two-Month SpreeDocument24 pagesFed in A Hole Winning Women Dinner Debate: China Ditches Mass Share Buys After $200bn Two-Month SpreestefanoNo ratings yet

- FIS and Audit Statement TemplateDocument4 pagesFIS and Audit Statement Templateissam jendoubiNo ratings yet

- Individual Assignment Three - Employment Law - Algonquin CollegeDocument22 pagesIndividual Assignment Three - Employment Law - Algonquin CollegeOut KeepNo ratings yet

- Form e 2022 Bi 16012023Document8 pagesForm e 2022 Bi 16012023HR Dept Urban Seafood SBNo ratings yet

- Activity 2 1. List The Right and The Corresponding Duties and Obligations of A Teacher. (At Least 5 Rights and 5 Obligations)Document4 pagesActivity 2 1. List The Right and The Corresponding Duties and Obligations of A Teacher. (At Least 5 Rights and 5 Obligations)Judy DiotayNo ratings yet

- Financial Accounting and Reporting: Multiple ChoiceDocument54 pagesFinancial Accounting and Reporting: Multiple ChoiceLouiseNo ratings yet

- Uoi V Amrita Sinha 406131Document7 pagesUoi V Amrita Sinha 406131Manager PersonnelkptclNo ratings yet

- External Financing Needed QuestionDocument1 pageExternal Financing Needed QuestionShaolin105No ratings yet

- Income Tax Actual Proof Submission Form Fy 2021 - 2022Document3 pagesIncome Tax Actual Proof Submission Form Fy 2021 - 2022muralianand92No ratings yet

- Part 1 - Income TaxesDocument31 pagesPart 1 - Income TaxesCharles MateoNo ratings yet

- Income Taxation Midterm ExamDocument8 pagesIncome Taxation Midterm ExamJean Diane JoveloNo ratings yet

- Summary TAX CASESDocument20 pagesSummary TAX CASESMc DalayapNo ratings yet

- Pay Slip - 604316 - Mar-23Document1 pagePay Slip - 604316 - Mar-23ArchanaNo ratings yet

- Roster Jaipur 20112017Document2 pagesRoster Jaipur 20112017Ishwar MeenaNo ratings yet