Professional Documents

Culture Documents

The Economic Recession of Nigeria and TH

Uploaded by

garba shuaibuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Economic Recession of Nigeria and TH

Uploaded by

garba shuaibuCopyright:

Available Formats

International Journal of Social Science and Economic Research

ISSN: 2455-8834

Volume:04, Issue:01 "January 2019"

THE ECONOMIC RECESSION IN NIGERIA: ELUCIDATING THE

INTERVENTIONIST ROLE OF GOVERNMENT.

1

Ishaka Dele, 2Zainab Lawal Kankara, 3Humphrey Ukeaja

1,3

Department of Political Science, University of Abuja, Abuja.

2

Department of Sociology, University of Abuja, Abuja.

ABSTRACT

The Nigerian economy slid into recession path in the first quarter of 2016. The negative

consequence of the recession has led to the reduction of standard of living and the quality of life

of the people and increase in poverty rate. This paper seeks to examine and analyzed the main

reasons for the emergence of the current economic recession in Nigeria. The paper gives a

theoretical exposition of how government policies can potentially curb the recession and enhance

better economic well-being of the Nigerian populace. The finding of the study indicates that the

main causes for the emergence of the economic recession in Nigeria can be group under three

main factors: legacy factors, policy factors and political/security factors. The paper recommends

among other, effective government intervention through an effective synchronization between

measures of fiscal and monetary policy in the direction of increasing liquidity in the economy,

decreasing interest rates, increasing investment and employment, increasing the income of

economic entities and finally, in the direction of increasing aggregate demand as an exit from the

phase of recession.

Keywords: Economic recession, Nigeria economy, government Intervention, investment.

Unemployment, economic growth.

INTRODUCTION

Economic or business cycle is one of the major topic of interest in modern macroeconomics

theory. Every economy (country) is affected by business cycle (or economic cycle). Business

cycle refers to economy-wide (nationwide) fluctuations in production, trade and general

economic activities over medium-to-long-term in a free market system. Free market economy is

one where there is no government intervention in economic activities; rather demand and supply

interact to correct disequilibrium (anomalies) in the market. The business cycle is the upward

and downward movements of levels of gross domestic product (GDP), and refers to the period of

www.ijsser.org Copyright © IJSSER 2019, All rights reserved Page 184

International Journal of Social Science and Economic Research

ISSN: 2455-8834

Volume:04, Issue:01 "January 2019"

expansions and contractions in the level of economic activities (business fluctuations) around its

long-term growth trend. These fluctuations involve shifts over time between periods of relatively

rapid economic growth (boom), and periods of relative stagnation or decline (a contraction or

recession (CBN, 2012). Recessionas a phase of economic cycle occurs after two consecutive

quarters of negative growth featuring low output and investment, abnormal increases in

unemployment due to massive retrenchment, falls in the availability of credit facilities,

fluctuation in forex market, illiquidity, downsizing and layoff as well as reduce amount of trade

and commerce. According the National Bureau of Statistics (NBS) the Nigerian economy slid

into recession path in first quarter (Q1) of 2016 (since 2004) with real GDP of-0.36 percent, the

contraction of economic activities resulted from an evaporation of confidence and no new

investments, inordinate delay in government speeding during the period, acrimonious legislative

squabbles in approving budget, erosion in the value of Naira in the forex market, pipelines

vandalism, misaligned currency and forex shortages, high interest rate environment as well as

trade and import restrictions. The current recession seems to affect socio political structures,

Nigeria’s credit condition general living standards, imports, production and employment as well

as consumption demand in Nigeria (Agri, Maliafia and Umejiaku, 2017). The economy lost over

500,000 jobs, power supply down from the grid, down to 2,2023.3MW from 3593MW,

unemployment and under-employment now up 31.2 percent, labour productivity growthdown to

(-0.4 percent) , stagnant wages and decline in retail sales. Macroeconomic indicators get worsen

by the day, showing that, if there is no appropriate intervention by the government, the economy

may slip further into depression. Governments in market economies perform several tasks. These

include: promoting production and trade by defining property rights, enforcing contract and

settling disputes; enforcing laws design to maintain competition; redistribution of income via

taxes and transfer; reallocating resources by providing public goods and intervening to correct

negative and positive externalities and promotion of economic growth and full employment.

(Mankiw& Taylor, 2011)

It is against this background that this paper seeks to examine the causes of the current economic

recession in Nigeria and how government policies can potentially curb the recession and enhance

better economic well-being of the Nigerian populace.

CONCEPTUAL ELUCIDATION

a. Economic recession:

The National Bureau of Economic Research (NBER), defines recession as “a significant decline

in economic activity spread across the macro-economy, lasting more than a few months,

normally visible in real gross domestic product (RGDP), real income, employment, industrial

production and wholesale-retail sales”. When a country is in the phase of recession, the economy

www.ijsser.org Copyright © IJSSER 2019, All rights reserved Page 185

International Journal of Social Science and Economic Research

ISSN: 2455-8834

Volume:04, Issue:01 "January 2019"

is far from the point of effective use of resources, i.e. Far from the optimal production and the

natural rate of unemployment (Nikoloski and Lazarov, 2000). Usually, recession may be

triggered by financial crisis and or credit crunch, as well as demand and supply side shocks.

Globally, there is geopolitical tension around the world, causing global crisis and commodity

prices dropping, the drop in crude oil prices, Brexit, crucial American election in 2016, South

China Sea issues, Russia-Syria crisis, ISIS, illegal migration and refugee crisis which are remote

but important causes of economic recession around the world. The global financial crisis of 2007

and the ongoing recession was triggered by the United States housing bubble; excessive lending

of banks into high-risk subprime and adjustable rate mortgages resulted in high default rates as

well as downfall of banking sector. Defaults and losses on other categories of loans also rose

considerably as the crisis expanded from the housing market to other sectors of the economy.

Bankruptcy of several high rated investment banks started to panic on the inter-bank loan and

stock markets and eventually, the bubble busted. This resulted in the fall of global GDP, rising

unemployment and economic difficulties in emerging markets and frontier where Nigeria

unfortunately stands today.(Adelmann, 2011, Kamar, 2012).

Causes of the Current Economic Recession in Nigeria

Economic recession can be caused by two broad factors: internal (endogenous) and external

(exogenous) factors. The former is usually as a result of conflict of ideas, misapplication of

economic theory and regulatory negligence or policy inconsistency. The external causes of

recession have to do with factors that are exogenous to the economy over which policy makers

have little or no control. Factors like natural disaster, climate change, revolution and wars (CBN,

2012).The reasons for the emergence of the current economic recession in Nigeria, can be linked

to the above aforementioned factors to include; legacy factors, policy factors and

political/security factors.

The legacy factors involves; over dependence on oil production for government revenue, low

sovereign savings, political risk and fiscal leakages and official corruption. The negative

demand-side shocks that affect the aggregate demand in Nigeria work through a global economic

slowdown that impacts major trading partners of a country. When there is economic slowdown

in the U.S., China, India and EU, it could have negative impact on the demand of Nigerian crude

oil from these countries (CBN, 2012). As a result, the price of crude oil which was sold for over

$100 per barrel went as low as below $50 per barrel. Government’s revenue and spending would

drop, taxes will rise, disposable income will fall and aggregate demand will fall, adversely

impacting the production of goods and services in the economy. These developments

consequently result into economic recession. From the foregoing, it is clear that Nigeria’s GDP is

quite diversified, so the problem is not the structure of domestic production. The issue is

www.ijsser.org Copyright © IJSSER 2019, All rights reserved Page 186

International Journal of Social Science and Economic Research

ISSN: 2455-8834

Volume:04, Issue:01 "January 2019"

undiversified structure of government revenue and export revenue. Nigeria’s foreign reserves

down to $30billion at 2015 from over $65billion in 2007. This fund is intended to safeguard the

economy against budgetary deficits. It would be a last resort from which government may

withdraw annually to meet shortfalls in the budget brought about by falls in oil prices or other

budgetary constraints. The policy factors involves the lack of clarity over economic policy;

wrong policy choices and no strategy for private capital. A major contributor to the current

economic recession in Nigeria was the denial and policy incoherence over Foreign Exchange

(FOREX) policy. The ban on 41 items in a market-base FOREX market perpetuates multiple

exchange rates. Manufacturers who rely on some of these imports will have to buy from the

parallel market at a very high rates, leading to high cost of production and a rise in the general

price level (inflation).

Also the inconsistences between monetary policy which pursued monetary tightening through

treasury single account (TSA), raising cash reserve requirement (CRR) and monetary policy rate

(MPR) further worsen the economic sanity. Furthermore, the budget relies exclusively on

borrowing for fiscal stimulus in the absence of private capital strategy. And the big gap in policy

is the lack of a strategy to leverage and optimise private capital. From the preceding, the

consequence of policy factors has resulted in low investment and market confidence from both

domestic and foreign investors and has impacted forex flows, foreign direct investment (FDI),

new domestic investment, capital markets, employment and economic growth negatively.

The political/security factors involves the impact of Niger-Delta militancy on oil production,

impact of herdsmen/farmers conflicts on agricultural production across the country, but

particularly in the North-Central and the continuing (though reduced) impact of Boko Haram

activity on agricultural output and trade in North-East and impact of grave internally displaced

persons (IDPs) situation in the regionhas contributed to the current economic recession in

Nigeria.

UNDERSTANDING THE GOVERNMENT INTERVENTIST ROLE.

The current economic crisis Nigerians are going through is taking its toll on almost every sector

of the economy. Both the rich and the poor are adversely affected by the economic recession.

Findings across the nation indicate that the economic situation is getting worsen by the day, as

the prices of foodstuff and other basic need has sky-rocketed to an alarming rates; the price of a

bag of rice which was sold for N9,000, now sold for N22,000 which is above the minimum wage

of an average civil servant, garri that is commonly tagged as poor man food is out of reach of the

poor masses now, as a rubber cost N1,400, price of vegetable oil have increase by 100 percent,

cement that was sold for N1500 is now N2600 only but to mentioned just few amongst many

commodity whose price has doubled with reduce quantity and quality. The current economic

www.ijsser.org Copyright © IJSSER 2019, All rights reserved Page 187

International Journal of Social Science and Economic Research

ISSN: 2455-8834

Volume:04, Issue:01 "January 2019"

recession has caused extreme poverty and suffering of the masses; children right to quality

education, affordable inclusive healthcare are deprived, cost of living has gone extremely high

for the core poor and the middle income class. There is also increase in crime rates as life gets

harder for a greater number of the people (the poor), living conditions are getting worse, crime

rates have escalated: increase in kidnapping, petty stealing, child trafficking, robberies and other

financial crimes and fraudulent Ponzi schemes: the like of MMM, givers forum, ultimate cycler,

twinkers etc. which has further worsen the welfare of some Nigerians seeking ways to leverage

themselves from the economic hardship posed by the recession. The basic needs of life have

eluded almost 85% of Nigerians. There is high cost of transportation, lack of portable water,

epileptic power supply and poor aggregate infrastructure. Social indices are fast declining as oil

revenue continue to fall. The economy is deteriorating in human development indices, the quality

of education and healthcare has collapsed, with extreme poverty, acute hunger and starvation

prevailing amongst the poorest poor (Agri, Maliafia and Umejiaku, 2017).

Government whose main objective is ensuring a maximized social and economic welfare of the

citizenry should intervene using various tools at its disposal in order to alleviate the negative

effects of the recession and create enabling conditions for the achievement of positive economic

growth rate.

KEYNESIAN APPROACH TO ECONOMIC RECESSION

Keynesians believed that the major cause of economic recession are ineffective demand and bad

economic planning. Keynesian economists posit that, because wages and prices adjust slowly

during recession, distortions in production or consumption may move the economy away from its

desired level of production and employment for a longer period of time. According to the view

of Keynesian, the stateshould intervene through measures of economic policy,in particular,

monetary policy actions by the central bank and fiscal policy actions by the government, can

help stabilize output over the business cycle. Keynesian economists often advocate an active role

for government intervention during recessionsto alleviate the consequences of the recession and

the reduction of overall economic activity in the economy. The focal points of the Keynesian

approach to economic recession is to increase aggregate demand through the manipulation of

government spending, taxation, money supply, interest rates regulation and devaluation to

stimulate production, employment and creation of new investment.

POLICY RECOMMENDATIONS TO END THE ECONOMIC RECESSION

Nigeria is a mono-product economy, which solemnly dependence on oil exportation for its

survival. Therefore, the fall of oil price in the international market and the activities of the Niger-

Delta avengers’ calls for and inward looking into the Nigerian economy and the need to shore up

www.ijsser.org Copyright © IJSSER 2019, All rights reserved Page 188

International Journal of Social Science and Economic Research

ISSN: 2455-8834

Volume:04, Issue:01 "January 2019"

the non-oil sector of the economy to diversify the structure of government revenue and export

revenue. Mere increase in government spending will not solve the problems posed by the

recession, but rather planned and strategic spending in area with high multiplier effect such as

the agricultural, manufacturing, and construction sectors that has the ability to stimulate

aggregate demand. The government needs to expand her export earnings and production base

away from the oil sector through wise investment on non-oil sector with high multiplier effect,

because such sectors will produce alternative goods and goods that can be exported to make up

for the earning or deficit for imported goods.

The raising of the cash reserve requirement (CRR) and monetary policy rate (MPR) which

pursue monetary tightening is not an accommodative monetary policy for an economy in

recession. Therefore, the CBN should increase access to credit facilities by reducing the real

interest rate to encourage new investment by both foreign and domestic investors. With the

increase of money supply and reducing interest rates in the short run, central bank can improve

the deteriorated economic performance. The government should ensure continued efforts to

restore normalcy in the North-East and also resolve the IDPs situation in the region. There

should be political engagement and security measures to end the sabotage of oil infrastructure in

Niger-Delta as well as zero tolerance for herdsmen/farmers clashes in the North-Central and

across the country. There should be an improvement of the business environment through

government conscious effort by way of providing economic and social infrastructure, particularly

electricity, in order to lower the cost of doing business and encourage or attract foreign direct

investment into Nigeria. There should also be improvement in institutions to make them more

functional to reduce the level of official corruption, fiscal leakages as well as, political, social

and religions crises(the likes of Boko Haram, Fulani herdsmen, Niger-delta avengers etc.) to

ensure stable government and guarantee the sustainability of democratic rule free from

unwarranted changes, or intervention by the military. In order to reduce unemployment, the

government should invest in the informal sector of the economy since it can no longer absorb the

increasing number of job seekers in the country by providing the necessary infrastructures and

enforcing laws to protect and support the sector. Government should also invest in skill

acquisition such as; soap making, beads making, cake baking, event planning, event decoration,

photography, IT, telecommunication, agro-allied, sports among others. Government should

empower the youth to go into agriculture by providing a platform for free training on various

aspect of agriculture.

CONCLUSION AND RECOMMENDATIONS

Recession as a phase of economic cycle in one point or the other has affected every economy

(country) around the globe. Economic recession is a very serious symptom that indicate that the

www.ijsser.org Copyright © IJSSER 2019, All rights reserved Page 189

International Journal of Social Science and Economic Research

ISSN: 2455-8834

Volume:04, Issue:01 "January 2019"

economy is diseased and requires vigorous economic measures to be taken for its faster recovery.

The Nigerian economy slid into recession path in Q1 of 2016. The negative consequences of the

recession has led to the reduction of standard of living and the quality of life of the people and

increase in poverty rate. In the phase of recession most macroeconomic fundamentals (variables)

such unemployment, inflation, exchange rate and economic growth gets worsen an life become

unbearable for the majority of the population (the poor) indicating that if there is no appropriate

policy responds from the government, the economy may slip further into depression. According

to the view of Keynesian, the government should intervene through measures of economic policy

to alleviate consequences of the occurrence of recession and the reduction of overall economic

activity. This paper suggest an effective synchronization between measures of fiscal and

monetary policy in the direction of increasing liquidity in the economy, decreasing interest rates,

increasing investment and employment, increasing the income of economic entities and finally,

in the direction of increasing aggregate demand as an exit from the phase of recession.

REFERENCES

[1] Agri, E. M., Mailafia, D. & Umejiaku, R., I. (2017). Impact of Economic Recessionon

Macroeconomic Stability and Sustainable Development in Nigeria. Science Journal of

Economics. ISSN: 2276-6286.

[2] Adelmann. B. (2011). “The Panic of 1893: Boosting Banker’s Money and Power”. New

American (08856540) 27.8:pp35-39.

[3] CBN, (2012). Understanding Monetary Policy Series. NO 14. Economic Recession.

ISBN: 13:978-52861-3-7

[4] Famakinwa, M. (2016). Effects of Economic Hardship on Nigerians

[5] Fapohunda, T. (2012). The Global Economic Recession: Impact and Strategies for

Human Resources Management in Nigeria. International Journal of Economics and

Management Sciences.

[6] Kamar, B. (2012), Financial Crises‟ International Monetary Fund Institute for Capacity

Development

[7] Mankiw, N, G. & Taylor P.M. (2011). Economics: Principles, Problems and Policies.

2nd edition, United Kingdom, Cengagelearing EMEA.

[8] Nikoloski, K., & Lazarov, D. (2000). Impact of Recession on the Macroeconomic

Variables In Republic of Macedonia. Krste Misirkovb. bp.o. 201, 2000.

www.ijsser.org Copyright © IJSSER 2019, All rights reserved Page 190

International Journal of Social Science and Economic Research

ISSN: 2455-8834

Volume:04, Issue:01 "January 2019"

[9] Noko, E, J. (2016). Economic Recession in Nigeria: Causes and Solution

[10] Oladapo, F, A. (2016). Perspective on the Nigerian Economic Recession.

[11] https://en.m.wikipedia.org/wiki/keynesian_economics

[12] https://www.proshareng.com/.../...

[13] Trumpetmediagroup.com/…/…

www.ijsser.org Copyright © IJSSER 2019, All rights reserved Page 191

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- GST 111 Skills in EenglishDocument55 pagesGST 111 Skills in Eenglishgarba shuaibuNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tutorial 4 ELASTICITYDocument2 pagesTutorial 4 ELASTICITYCHZE CHZI CHUAHNo ratings yet

- Charles Munger - Psychology Human MisjudgmentDocument21 pagesCharles Munger - Psychology Human MisjudgmentEmily HunterNo ratings yet

- Module 1 The Foundations of Business With Activity and Case StudyDocument8 pagesModule 1 The Foundations of Business With Activity and Case StudyThe PsychoNo ratings yet

- 2 Guna Fibres Ltd.Document20 pages2 Guna Fibres Ltd.Lance EstopenNo ratings yet

- My Project 2 (BSC)Document52 pagesMy Project 2 (BSC)garba shuaibuNo ratings yet

- Chapter One 1.1 Background of The StudyDocument84 pagesChapter One 1.1 Background of The Studygarba shuaibuNo ratings yet

- STATEMENT OF PU-WPS OfficeDocument1 pageSTATEMENT OF PU-WPS Officegarba shuaibuNo ratings yet

- The Impact of Ethical Tax Behaviour On TDocument10 pagesThe Impact of Ethical Tax Behaviour On Tgarba shuaibuNo ratings yet

- 46th Inaugural Baba OwojoriDocument72 pages46th Inaugural Baba Owojorigarba shuaibuNo ratings yet

- ECO 108 Economic History of West AfricaDocument40 pagesECO 108 Economic History of West Africagarba shuaibu100% (2)

- Acc 101 Basic Accounting IDocument70 pagesAcc 101 Basic Accounting Igarba shuaibuNo ratings yet

- Atswa Cost AccountingDocument504 pagesAtswa Cost Accountinggarba shuaibuNo ratings yet

- GST 122 PapaersDocument82 pagesGST 122 Papaersgarba shuaibuNo ratings yet

- Acc 207Document71 pagesAcc 207garba shuaibuNo ratings yet

- Acc 205 Data Processing and ProgrammingDocument20 pagesAcc 205 Data Processing and Programminggarba shuaibuNo ratings yet

- Acc 201 Introduction To Financial Accounting IDocument73 pagesAcc 201 Introduction To Financial Accounting Igarba shuaibuNo ratings yet

- Forensic Auditing and Productivity of NiDocument78 pagesForensic Auditing and Productivity of Nigarba shuaibuNo ratings yet

- Impact of Information and CommunicationDocument80 pagesImpact of Information and Communicationgarba shuaibuNo ratings yet

- Effect of Internal Control On Fraud PrevDocument38 pagesEffect of Internal Control On Fraud Prevgarba shuaibuNo ratings yet

- 12 Malum Islamic BankingDocument14 pages12 Malum Islamic Bankinggarba shuaibuNo ratings yet

- Role of Corporation PDFDocument5 pagesRole of Corporation PDFMariaNo ratings yet

- Test Statistics 2022 Accounting CFABDocument21 pagesTest Statistics 2022 Accounting CFABShirah ShahrilNo ratings yet

- Sri Ganganagar Inv. 226Document1 pageSri Ganganagar Inv. 226Harshita LalwaniNo ratings yet

- Semi-Periphery Countries: Sociological TheoryDocument11 pagesSemi-Periphery Countries: Sociological TheoryLebogangNo ratings yet

- TSK Showrya - Project Report - Overseas Direct InvestmentDocument26 pagesTSK Showrya - Project Report - Overseas Direct InvestmentShowrya TirnatiNo ratings yet

- Covid-19 Implications On Financial Reporting: Marija Mitevska, Olivera Gjorgieva-Trajkovska, Vesna Georgieva SvrtinovDocument8 pagesCovid-19 Implications On Financial Reporting: Marija Mitevska, Olivera Gjorgieva-Trajkovska, Vesna Georgieva SvrtinovSang PhamNo ratings yet

- Campus PlacementDocument20 pagesCampus PlacementPrasant SharamaNo ratings yet

- Ingles Cuestionario Quimestre 2-1Document3 pagesIngles Cuestionario Quimestre 2-1Ana AlvaradoNo ratings yet

- Imec G 20Document11 pagesImec G 20sinhamonika22No ratings yet

- Section 1 - Principle of Economics 220220Document25 pagesSection 1 - Principle of Economics 220220Ngân KimNo ratings yet

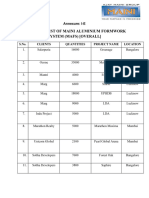

- Customer List of Maini Aluminium Formwork System - MafsDocument6 pagesCustomer List of Maini Aluminium Formwork System - MafsgurushankarNo ratings yet

- Ascon NodeDocument2 pagesAscon NodeMuhammad WaseemNo ratings yet

- Chương 4 EngDocument61 pagesChương 4 EngVĩnh Tân TrầnNo ratings yet

- Latihan Soal Leasing - Nov2019 - SolusiDocument3 pagesLatihan Soal Leasing - Nov2019 - SolusiABDUL KHALIQ BRUTUNo ratings yet

- Analisis Laporan Keuangan SyariahDocument18 pagesAnalisis Laporan Keuangan SyariahVia ManiezNo ratings yet

- Problems and Prospects of Readymade Garments Export in BangladeshDocument25 pagesProblems and Prospects of Readymade Garments Export in BangladeshBoni AminNo ratings yet

- Annex-V Commodity CodeDocument399 pagesAnnex-V Commodity CodemirzanadeembaigNo ratings yet

- The Elliot-Wave-Principle: Master and Ride The WavesDocument48 pagesThe Elliot-Wave-Principle: Master and Ride The WavesOburoh Bemigho Peter100% (1)

- Corporate Governance - Christine Mallin - Role of Institutional Investors in Corporate GovernanceDocument3 pagesCorporate Governance - Christine Mallin - Role of Institutional Investors in Corporate GovernanceUzzal Sarker - উজ্জ্বল সরকারNo ratings yet

- Diffusion Aceleration and Business Cycle Hickman 1959Document32 pagesDiffusion Aceleration and Business Cycle Hickman 1959Eugenio MartinezNo ratings yet

- Holly Fashions Ratio Analysis: 1. Calculate The Firm's Ratios Listed in Exhibit 3Document7 pagesHolly Fashions Ratio Analysis: 1. Calculate The Firm's Ratios Listed in Exhibit 3saraNo ratings yet

- Global EconomyDocument1 pageGlobal EconomyDiana CamachoNo ratings yet

- Megatrends Digital LivingThe Next Billion Internet UsersDocument40 pagesMegatrends Digital LivingThe Next Billion Internet Userssonstar1991No ratings yet

- PhilEquity Fund ProspectusDocument42 pagesPhilEquity Fund ProspectuskimencinaNo ratings yet

- Nuts and Dried Fruits - Statistical - Yearbook - 2019-2020Document80 pagesNuts and Dried Fruits - Statistical - Yearbook - 2019-2020Tânia Sofia OliveiraNo ratings yet

- Under Separate Cover Attachments: Community and Resources Committee 26 April 2022Document118 pagesUnder Separate Cover Attachments: Community and Resources Committee 26 April 2022maverick_1901No ratings yet