Professional Documents

Culture Documents

Central Banking

Uploaded by

Pakeeza JavedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Central Banking

Uploaded by

Pakeeza JavedCopyright:

Available Formats

CENTRAL BANKING

1. Discount rate of State Bank of Pakistan is: More than 5% but not more than 15%

2. State Bank was established in: 1948

3. 10-rupees note is issued by: State Bank of Pakistan

4. Acting as lender of last resort, a central bank lends to: Commercial banks

5. Which statement is true of the relationship between bond prices and bond yields? They vary inversely

6. When the State Bank wants to decrease money supply in the country, it: Buys govt. securities in stock market

7. Which is the most widely used tool of monetary policy: Open-market operations

8. Monetary policy consists of: Changing total money supply

9. State Bank of Pakistan has departments: Issue, research and banking department

10. Central bank's rate of landing to commercial banks is called: Discount rate

11. When a central bank wants to increase money supply in circulation: Purchases govt. securities and Lowers

bank rate

12. State Bank of Pakistan is run by: Board of directors

13. Credit money is controlled by: Central bank

14. Every country establishes central bank to: Issue notes and Supervise commercial banks

15. It is NOT an instrument of monetary policy: Issue notes

16. Which is a monetary measure to increase employment: Reducing interest rate

17. In order to reduce consumer borrowing this is raised: Interest rate

18. Which organization controls the banking system in most countries? Central bank

19. Treasury bill is used for Getting short term loans

20. It creates credit: Commercial banks

21. Out of the following the only recognized legal tender is: Bank notes and coins

22. Open market operations is: Buying and selling govt. securities

23. Monetary policy has the objective: Decrease inflation rate

24. Every country establishes central bank to: Issue currency

25. It is a monetary employment: Reducing interest rate

26. In order to reduce consumer borrowing: Interest rate is increased

27. Which organization controls the banking system: Central bank

28. The money called legal tender includes: Currency notes and coins

29. Open market operations refer to: Buying and selling govt. securities

30. If SLR (statutory liquidity ratio) is 20% and a bank gets a new deposit of 10 million, the total increase in its

deposits can rise up to: 50 millions

31. State Bank policy of regulating interest rate is called: Monetary policy

What is National Savings?

It is a concept studied in economics. Saving means something kept from being used for instance, if a person earns

an amount of 10 rupees, he keep 2 rupees aside from being used we call it those 2 rupees saving of that person.

Whereas on aggregate level the concept of National savings describes the sum of private and public savings in an

economy as a whole.

GDP is national income. We can deduce the national savings from the formula GDP is used to calculate.

So, Y= National income, I= Investment, C= Consumption, G= Government Expenditure.

GDP or Y= C+I+G

National Savings = Y-C-G = I

The amount of money saved is equal to the amount of money invested in a closed economy. Gross domestic

savings (% of GDP) in Pakistan was last measured at 9.37 in 2011, according to the World Bank.

What are determinants of Savings?

1. Demographic Factors (dependent and aging sections of population)

2. Consumerism (spending more)

3. Income Level (as high incomes are associated with high savings)

4. Public Finance (the more the govt: expenditure the less is the saving)

5. Economic Uncertainty

6. Inflation, interest rates and other business cycle fluctuations

Concept of opportunity cost and diminishing marginal returns and many other

concepts on individual level determine the rate of savings.

You might also like

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- State Bank of PakistanDocument13 pagesState Bank of PakistanMuhammad Talha KhanNo ratings yet

- Summary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionFrom EverandSummary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionNo ratings yet

- MD Naimur Rahman 32025Document4 pagesMD Naimur Rahman 32025Naeem UR RahmanNo ratings yet

- Money Facts: 169 Questions & Answers on MoneyFrom EverandMoney Facts: 169 Questions & Answers on MoneyNo ratings yet

- AssignmentDocument8 pagesAssignmentSundas MashhoodNo ratings yet

- SMDocument9 pagesSMThảo Anh PhạmNo ratings yet

- Interview PreparationDocument12 pagesInterview PreparationRabeea AsifNo ratings yet

- Central BankDocument17 pagesCentral BankSania ZaheerNo ratings yet

- Chapter Two: Banking SystemDocument45 pagesChapter Two: Banking Systemዝምታ ተሻለNo ratings yet

- Document 2Document28 pagesDocument 2prachilakhanixoNo ratings yet

- Iem Ass4Document10 pagesIem Ass4Bhavya SinghNo ratings yet

- Answer 8: Difference Between Central Bank and Commercial Banks in IndiaDocument8 pagesAnswer 8: Difference Between Central Bank and Commercial Banks in IndiaEsha WaliaNo ratings yet

- Central Banking and Functions of Central BankDocument82 pagesCentral Banking and Functions of Central Bankjoshjeth100% (1)

- Indian Financial System CIADocument16 pagesIndian Financial System CIAabhishek anandNo ratings yet

- Central Bank: The Guardian of MoneyDocument5 pagesCentral Bank: The Guardian of MoneyBe YourselfNo ratings yet

- Chapter Seven: Central BankingDocument23 pagesChapter Seven: Central BankingManuelNo ratings yet

- Overview of Central BanksDocument6 pagesOverview of Central BanksMehwish AsimNo ratings yet

- Espana Boulevard, Sampaloc, Manila, Philippines 1015 Tel. No. 406-1611 Loc.8241 - Telefax: 731-5738 - Website: WWW - Ust.edu - PHDocument6 pagesEspana Boulevard, Sampaloc, Manila, Philippines 1015 Tel. No. 406-1611 Loc.8241 - Telefax: 731-5738 - Website: WWW - Ust.edu - PHNica SalazarNo ratings yet

- Macroeconomic Final AssessmentDocument11 pagesMacroeconomic Final AssessmentS. M. Hasibur RahmanNo ratings yet

- A Central Bank or Reserve Bank, or Monetary Authority Is An InstitutionDocument14 pagesA Central Bank or Reserve Bank, or Monetary Authority Is An InstitutionVEDANT BASNYATNo ratings yet

- Macroeconomic Indicators PDFDocument29 pagesMacroeconomic Indicators PDFsnsahuNo ratings yet

- Functions of Central Bank PDFDocument27 pagesFunctions of Central Bank PDFPuja BhardwajNo ratings yet

- Lecture 2 - Central Bank and Its FunctionsDocument20 pagesLecture 2 - Central Bank and Its FunctionsLeyli MelikovaNo ratings yet

- Manidha Naeyam Free IAS Academy: Banking TermsDocument8 pagesManidha Naeyam Free IAS Academy: Banking TermsJefastin RajaNo ratings yet

- By B.K.VashishthaDocument33 pagesBy B.K.VashishthaIshan BansalNo ratings yet

- Economics Project 1Document15 pagesEconomics Project 1gangarbhakti89% (18)

- Hid - Chapter 3 2015Document91 pagesHid - Chapter 3 2015hizkel hermNo ratings yet

- Central BankDocument9 pagesCentral BanksakibNo ratings yet

- Bank GKDocument51 pagesBank GKTarun JakharNo ratings yet

- MacroDocument21 pagesMacroShivansh JaiswalNo ratings yet

- Macro OutcomesDocument8 pagesMacro Outcomesshoaibakhtar036No ratings yet

- Bank of BangladeshDocument50 pagesBank of BangladeshNyimaSherpaNo ratings yet

- Central Banking: Functions of Central BankDocument3 pagesCentral Banking: Functions of Central BankK.m.khizir AhmedNo ratings yet

- Ashraf Sir AssignmentDocument12 pagesAshraf Sir AssignmenthimelNo ratings yet

- Bank PODocument10 pagesBank POtgvnayagamNo ratings yet

- Banking Terms: 1. What Is A Repo Rate?Document7 pagesBanking Terms: 1. What Is A Repo Rate?Chanky AgrNo ratings yet

- Welcome To Our Presentation: Topic:-Function of Bangladesh Bank and Is Conduct Monetary PolicyDocument13 pagesWelcome To Our Presentation: Topic:-Function of Bangladesh Bank and Is Conduct Monetary PolicyMahaboob HossainNo ratings yet

- Current Ac DeficitDocument7 pagesCurrent Ac DeficitMalti KothariNo ratings yet

- Contribution of Financial Market in BDDocument8 pagesContribution of Financial Market in BDAmeen IslamNo ratings yet

- What Is RBI's Monetary Policy: Objectives & Instruments: Fiscal Policy in IndiaDocument12 pagesWhat Is RBI's Monetary Policy: Objectives & Instruments: Fiscal Policy in IndiaNIKHIL KUMAR SAHANo ratings yet

- BT - Selective Bank and Its FunctionDocument5 pagesBT - Selective Bank and Its FunctionBoobalan RNo ratings yet

- MDI GWPI Prep - Monetrix ChapterDocument22 pagesMDI GWPI Prep - Monetrix ChapterAnand1832No ratings yet

- Central Bank: Sales Performance, Sales Technique and StrategiesDocument15 pagesCentral Bank: Sales Performance, Sales Technique and StrategiesNirupam AgarwalNo ratings yet

- Banking Terms: Banking Terminology 1. What Is A Repo Rate?Document9 pagesBanking Terms: Banking Terminology 1. What Is A Repo Rate?Ravi AgarwalNo ratings yet

- Reserve Bank of IndiaDocument33 pagesReserve Bank of Indiaabhishek00soodNo ratings yet

- Differences Between A Central Bank and Commercial BankDocument4 pagesDifferences Between A Central Bank and Commercial BankMuhammadZariyan AsifNo ratings yet

- All Project2Document48 pagesAll Project2swap_randiveNo ratings yet

- Monetary Policy New 1Document15 pagesMonetary Policy New 1Abdul Kader MandolNo ratings yet

- Lesson 7 - Monetary PolicyDocument8 pagesLesson 7 - Monetary PolicyJojoNo ratings yet

- Ch-3 Financial Market in BangladeshDocument8 pagesCh-3 Financial Market in Bangladeshlabonno350% (1)

- Fiscal and Monetary PolicyDocument11 pagesFiscal and Monetary PolicyNahidul IslamNo ratings yet

- Final Project of RBIDocument19 pagesFinal Project of RBISonia Singh100% (1)

- Chapter 6 BDocument25 pagesChapter 6 Bbirook27No ratings yet

- Banking TermsDocument36 pagesBanking TermslenovojiNo ratings yet

- How To Analyze The Stock MarketDocument9 pagesHow To Analyze The Stock MarketantumanipadamNo ratings yet

- Overview of Financial System of BangladeshDocument26 pagesOverview of Financial System of Bangladeshshafiqul8588% (8)

- Indian Financial System: Debjani SinghaDocument48 pagesIndian Financial System: Debjani SinghadebjanisinghaNo ratings yet

- Interview Q&ADocument23 pagesInterview Q&ACarol EvanNo ratings yet

- Monetary & Fiscal PolicyDocument29 pagesMonetary & Fiscal PolicySandeep BeheraNo ratings yet

- National SavingsDocument1 pageNational SavingsPakeeza JavedNo ratings yet

- 3RoleofGovernmentin PDFDocument11 pages3RoleofGovernmentin PDFNawabzada ALiNo ratings yet

- Annual Budget in PakDocument2 pagesAnnual Budget in PakPakeeza JavedNo ratings yet

- Past PaperDocument6 pagesPast PaperKamran KhanNo ratings yet

- Public Finance - Basic Concepts, Ties and Aspects: Aim of This ChapterDocument75 pagesPublic Finance - Basic Concepts, Ties and Aspects: Aim of This Chapterdiy with OshinixNo ratings yet

- Balance of TradeDocument5 pagesBalance of TradePakeeza JavedNo ratings yet

- DepreciationDocument6 pagesDepreciationPakeeza JavedNo ratings yet

- Assignment No01 Credit and Risk ManagementDocument2 pagesAssignment No01 Credit and Risk ManagementPakeeza JavedNo ratings yet

- Summarizing A Research ArticleDocument3 pagesSummarizing A Research ArticleRahib JaskaniNo ratings yet

- Phy 101 Assignment No 3 SolutionDocument2 pagesPhy 101 Assignment No 3 SolutionPakeeza JavedNo ratings yet

- PM GDBDocument2 pagesPM GDBPakeeza JavedNo ratings yet

- Article For Assignment FIN725Document10 pagesArticle For Assignment FIN725Pakeeza JavedNo ratings yet

- The Eleven Deadliest Sins of Knowledge ManagementDocument13 pagesThe Eleven Deadliest Sins of Knowledge ManagementPakeeza JavedNo ratings yet

- Tugas-3 (English Version) Corporate Social ResponsibilityDocument20 pagesTugas-3 (English Version) Corporate Social ResponsibilityIrzal KifliNo ratings yet

- Commonly Used Words in IELTS Listening Test11 PDFDocument4 pagesCommonly Used Words in IELTS Listening Test11 PDFreema198777% (26)

- Ijast PDFDocument13 pagesIjast PDFCh Tayyab DhilloNo ratings yet

- Improve Your Writing skill-IELTSDocument21 pagesImprove Your Writing skill-IELTSfgousiosNo ratings yet

- Challan Form-21-05-2014 PDFDocument1 pageChallan Form-21-05-2014 PDFAila DarNo ratings yet

- There Are Two Activities of This Assignment.: A 2 M A (FIN704) F 2017Document3 pagesThere Are Two Activities of This Assignment.: A 2 M A (FIN704) F 2017Pakeeza JavedNo ratings yet

- 04 Ahmad, Fida, and Zakaria - 2Document12 pages04 Ahmad, Fida, and Zakaria - 2Pakeeza JavedNo ratings yet

- Ielst Writing SamplesDocument12 pagesIelst Writing SamplesThomas StpeterNo ratings yet

- Analysis of The Effect of Corporate Social Responsibility On Financial Performance With Earnings Management As A Moderating VariableDocument13 pagesAnalysis of The Effect of Corporate Social Responsibility On Financial Performance With Earnings Management As A Moderating VariablePakeeza JavedNo ratings yet

- ArticleDocument6 pagesArticlePakeeza JavedNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Senior Auditor 2014Document4 pagesSenior Auditor 2014MuhammadHafeezNo ratings yet

- Fin 404 Mid NotesDocument10 pagesFin 404 Mid NotesPakeeza JavedNo ratings yet

- Time Value - Future ValueDocument4 pagesTime Value - Future ValueSCRBDusernmNo ratings yet

- WTC2014 NRL80%HSBCLondonDocument11 pagesWTC2014 NRL80%HSBCLondonMarcus StevensNo ratings yet

- Note 500 RsDocument2 pagesNote 500 Rsranjit_more22683No ratings yet

- How The Credit Card Processing Flow WorksDocument4 pagesHow The Credit Card Processing Flow Works777priyankaNo ratings yet

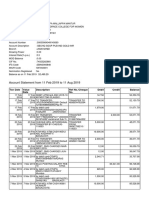

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNanu PatelNo ratings yet

- The Secret Burial: The Hidden History of Money & New World Order Usury Secrets Revealed at Last! Page 29Document1 pageThe Secret Burial: The Hidden History of Money & New World Order Usury Secrets Revealed at Last! Page 29foro35No ratings yet

- M F8 Ot Ui VIOOs GRXMDocument6 pagesM F8 Ot Ui VIOOs GRXMSupreet ManturNo ratings yet

- United Coconut Planters Bank V Sps. BelusoDocument3 pagesUnited Coconut Planters Bank V Sps. BelusoKaren Ryl Lozada BritoNo ratings yet

- BANGLADESH BANK GUIDELINES FOR FOREIGN EXCHANGE TRANSACTIONS Vol 1Document137 pagesBANGLADESH BANK GUIDELINES FOR FOREIGN EXCHANGE TRANSACTIONS Vol 1Osman Goni100% (6)

- Commercial BankDocument29 pagesCommercial BankMahesh RasalNo ratings yet

- A Study On Impact of Demonetization On Online Transactions: AbstractDocument5 pagesA Study On Impact of Demonetization On Online Transactions: AbstractJaivik PanchalNo ratings yet

- World BankDocument13 pagesWorld BankSanskar YadavNo ratings yet

- Swift copy-5B-L2L-MAB AGDocument2 pagesSwift copy-5B-L2L-MAB AGB KNo ratings yet

- Banking Project FinalDocument17 pagesBanking Project Finalnimitajinjala27No ratings yet

- Khel Maharan Teacher NameDocument6 pagesKhel Maharan Teacher NameZalorthang ZateNo ratings yet

- Account Transaction DetailsDocument1 pageAccount Transaction DetailsIrfanNo ratings yet

- Senior 12 FABM2 Q1 - M8Document22 pagesSenior 12 FABM2 Q1 - M8Sitti Halima Amilbahar AdgesNo ratings yet

- Caso ATM - IN32Document6 pagesCaso ATM - IN32jorge sotoNo ratings yet

- Progress Monitoring Report: Basic Data Available Funds (US$) Total Cost and SourceDocument6 pagesProgress Monitoring Report: Basic Data Available Funds (US$) Total Cost and SourceFREDY RODRINo ratings yet

- 04 - Bank Mandiri A Case in Strategic TransformationDocument13 pages04 - Bank Mandiri A Case in Strategic TransformationEka DarmadiNo ratings yet

- Dan Bank StatementDocument3 pagesDan Bank StatementJessica FullerNo ratings yet

- Discuss The Role of Banking System in Economic Growth and Development of IndiaDocument5 pagesDiscuss The Role of Banking System in Economic Growth and Development of IndiaNaruChoudharyNo ratings yet

- Date Cross On Unappropriate: Cash Payment VoucherDocument2 pagesDate Cross On Unappropriate: Cash Payment VoucherAsim Namat AliNo ratings yet

- The Collapse of Lehman BrothersDocument16 pagesThe Collapse of Lehman BrothersAkash BafnaNo ratings yet

- Wami Nduka Kingsley: Customer StatementDocument188 pagesWami Nduka Kingsley: Customer StatementNowwe HireNo ratings yet

- 2 Interest - For STUDENTSDocument4 pages2 Interest - For STUDENTSSandy BellNo ratings yet

- Ab5431 20220105 Combined Margin StatementDocument1 pageAb5431 20220105 Combined Margin Statementthotada durga prasadNo ratings yet

- Unit 4: BankingDocument10 pagesUnit 4: BankingUrsu FeodosiiNo ratings yet

- Soneri BankDocument28 pagesSoneri Bankfahadali966No ratings yet

- Vertex42 Money Manager 2.1: INSTRUCTIONS - For Excel 2010 or LaterDocument29 pagesVertex42 Money Manager 2.1: INSTRUCTIONS - For Excel 2010 or LaterMohamed AfsalNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Economics 101: How the World WorksFrom EverandEconomics 101: How the World WorksRating: 4.5 out of 5 stars4.5/5 (34)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- This Changes Everything: Capitalism vs. The ClimateFrom EverandThis Changes Everything: Capitalism vs. The ClimateRating: 4 out of 5 stars4/5 (349)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Anarchy, State, and Utopia: Second EditionFrom EverandAnarchy, State, and Utopia: Second EditionRating: 3.5 out of 5 stars3.5/5 (180)

- The Meth Lunches: Food and Longing in an American CityFrom EverandThe Meth Lunches: Food and Longing in an American CityRating: 5 out of 5 stars5/5 (5)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsFrom EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsRating: 5 out of 5 stars5/5 (3)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyFrom EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyRating: 4.5 out of 5 stars4.5/5 (263)