Professional Documents

Culture Documents

Application Form: Info@taxgenius - Co.in

Uploaded by

Imran A ShareefOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application Form: Info@taxgenius - Co.in

Uploaded by

Imran A ShareefCopyright:

Available Formats

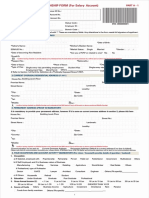

APPLICATION FORM

(For Filing of Income Tax Return)

Applicant Details as per PAN Card. Please fill in BLOCK Letters.

ITD Portal

PAN *

Password *

Assessment AY 2021-22 p Salaried/ Salaried p Self-Employed/ p

Year* (01-04-2020 to 31-03-2021) Sef Employed Business Persons

Full Name *

Father Name*

Date of Birth * / / Mobile*

Address *

State* PIN Code *

Email *

Aadhaar Number*

Bank Account Number *

Type of A/C

Name of Bank * Savings Bank A/C. o Current Account

IFSC CODE (Verify your ChequeBook or Bank Passbook for this Code) *

Applicant Annual Income & Deductions

Annual Income * Deductions *

Income from Salary/ Pension

(Attach Form 16 Part A & Part B) Rs. Life Insurance Policy Premimum Paid Rs.

Income from Business/Profession Rs. Medical Insurance 80D Rs.

Income from House Property (Rental Income) Rs. House Rent Paid 80GG(Only for Self-Employed) Rs.

Income from Capital Gains (Sales of Assets) Rs. PF/PPF/NPS/Bank Fixed Deposits Rs.

Income from Other Sources

(Bank Interest, Lottery, Etc.) Rs. Kids School Fee Rs.

Agricultural Income (Tax Free) Rs. Interest On Housing Loan Rs.

Gross Total Income (Total Of above 6 Columns) Rs. Housing Loan Principal Payment Rs.

Note*: For Salaried Persons Form 16 Part A & Part B is compulsory.

Any Other Deductions Rs.

TDS Particulars

If TDS is deducted TAN number of

TDS If Any (Yes/No)*

Deductor/Employer Rs.

Name of the Deductor / Employer

Self Employed Only

Profit & Loss, BS Required? p

Note: Tax Genius calls the Applicant for collecting required information necessary for processing the Application. Income Tax Return will be filed within 10 working days subject to receipt of

required full information from Applicant. Any missing Information can be sent to info@taxgenius.co.in. Tax Genius reserves the right to reject any Application on any technical grounds

beyond the control of Tax Genius / CSC SPV and refund the service charges collected. Applicant can collect the user charges for rejected transactions at concerned CSC Centre. E-filing

Acknowledgements will be send to Applicant's email ID or they can be collected from Concerned CSC Center. After receiving the Acknowledgements, Applicant shall send the signed ITR V form to

CPC Bangalore address by post / e-Verify the same. This service is only for Individual and Non-Audit cases. No Audit stamp will be provided.Tax Genius is not responsible for late payment fee or

penalties. The Applicant and the Tax Genius LLP agree to submit to the exclusive jurisdiction of the Courts located in Hyderabad, India as regards any claims or matters arising under these terms &

conditions.

** DECLARATION: I here by declare that the details furnished above are ture and

correct to the best of my knowledge. Further I hereby authorize Tax Genius LLP to

Register / Alter my Profile at www.incometaxindiaefiling.gov.in for accesing TDS

particulars and filing my Income Tax Return. ** (Signature of the Applicant) *

Head Office: M/S. Tax Genius LLP, 5-7-1/599, Plot No 599WP, Hariharapuram, Vanasthalipuram, Hyderabad-500070. Ph: 8019448888

You might also like

- 61 Producer Manager ContractDocument1 page61 Producer Manager Contractcdproduction100% (3)

- Intermediate Accounting Stice 18th Edition Solutions ManualDocument36 pagesIntermediate Accounting Stice 18th Edition Solutions Manualdireful.trunnionmnwf5100% (34)

- Subscriber Registration Form: (Administered by Pension Fund Regulatory and Development Authority)Document4 pagesSubscriber Registration Form: (Administered by Pension Fund Regulatory and Development Authority)Arun RockyNo ratings yet

- Re Kyc Form For Nri Amp Pio CustomersDocument3 pagesRe Kyc Form For Nri Amp Pio CustomerskishoreperlaNo ratings yet

- B Exercises: E3-1B (Transaction Analysis-Service Company)Document8 pagesB Exercises: E3-1B (Transaction Analysis-Service Company)Saleh RaoufNo ratings yet

- Ebook Ebook PDF Short Term Financial Management Fifth Edition PDFDocument41 pagesEbook Ebook PDF Short Term Financial Management Fifth Edition PDFlaura.gray126100% (40)

- Common Account Opening Form For Resident Individual (Common Aof Other Than Ckyc)Document9 pagesCommon Account Opening Form For Resident Individual (Common Aof Other Than Ckyc)iamyandmoorifanNo ratings yet

- Aof 1 2Document2 pagesAof 1 2AbhilashInumellaNo ratings yet

- Health Insurance Plan DetailsDocument4 pagesHealth Insurance Plan DetailsHarish HuddarNo ratings yet

- Account Opening Form SummaryDocument14 pagesAccount Opening Form SummarySan ThiyaNo ratings yet

- Savings & Current AccountsDocument6 pagesSavings & Current AccountsAXIS Section GNo ratings yet

- HDFC Ergo: General Insurance Company LimitedDocument2 pagesHDFC Ergo: General Insurance Company Limitedईश्वर हैNo ratings yet

- Axis Bank FormDocument14 pagesAxis Bank FormTokuto Vitoi ZhimomiNo ratings yet

- Account Opening FormDocument14 pagesAccount Opening FormAbdirahman mohamed100% (1)

- AIG World Gold FundDocument8 pagesAIG World Gold FundDrashti Investments100% (1)

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNo ratings yet

- AXIS-New Common Application Form 2023 1Document4 pagesAXIS-New Common Application Form 2023 1Brahmbhatt ConsultancyNo ratings yet

- National Pension System (NPS) : SR - No ParticularDocument8 pagesNational Pension System (NPS) : SR - No ParticularLalita PhegadeNo ratings yet

- Bank of Bhutan Limited Visa Credit Card Application FormDocument10 pagesBank of Bhutan Limited Visa Credit Card Application FormTempa Jikme0% (1)

- Account Opening Form For Non Individuals IDBIDocument8 pagesAccount Opening Form For Non Individuals IDBISR TechnologiesNo ratings yet

- C 192 17 B Exit - Due - To - Premature PDFDocument6 pagesC 192 17 B Exit - Due - To - Premature PDFVipin Kumar ChandelNo ratings yet

- Otpauthenticate 110149643235 11917499 eNPSFormDocument15 pagesOtpauthenticate 110149643235 11917499 eNPSFormfaizdel1234No ratings yet

- Vehicle Insurance Certificate in IndiaDocument2 pagesVehicle Insurance Certificate in IndiaED STORYNo ratings yet

- NPS Withdrawal FormDocument6 pagesNPS Withdrawal FormPUNAM RNDNo ratings yet

- Application For Permanent Account Number (Pan) : IndividualsDocument3 pagesApplication For Permanent Account Number (Pan) : IndividualsBharat PangeniNo ratings yet

- State of North Carolina Sub W-9 01292019Document4 pagesState of North Carolina Sub W-9 01292019Mistor WilliamsNo ratings yet

- Income-Tax Declaration FormDocument5 pagesIncome-Tax Declaration FormGanesh MaddipotiNo ratings yet

- FATCA & CRS Self Certification FormDocument3 pagesFATCA & CRS Self Certification Formvenkatesh801No ratings yet

- CSB - Sme - Application From - Final VersionDocument9 pagesCSB - Sme - Application From - Final Versionsnigdha.sanaboinaNo ratings yet

- customer-information-updation-form-individual-customersDocument2 pagescustomer-information-updation-form-individual-customersMohammed Ameen SaudagarNo ratings yet

- Account Opening FormDocument22 pagesAccount Opening FormTarun BhardwajNo ratings yet

- Atal Pension Yojana (Apy) : Registration Form For Existing Swavalamban Yojana SubscribersDocument4 pagesAtal Pension Yojana (Apy) : Registration Form For Existing Swavalamban Yojana SubscribersFrogon FloorNo ratings yet

- IDBI Nifty Index Fund Application FormDocument8 pagesIDBI Nifty Index Fund Application Formrkdgr87880No ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- SBI Account Opening Form Without Cut Mark 02.08.2018Document20 pagesSBI Account Opening Form Without Cut Mark 02.08.2018Shishir Kant SinghNo ratings yet

- Account Opening Form NR IndividualDocument2 pagesAccount Opening Form NR IndividualGraham EvansNo ratings yet

- 12BB-Employee Proof Submission Form 2022-23Document5 pages12BB-Employee Proof Submission Form 2022-23Masood AhmadNo ratings yet

- Account Opening Form For Non IndividualsDocument16 pagesAccount Opening Form For Non IndividualsSunilkumarNo ratings yet

- Application Form: International Banking For Non-Resident IndiansDocument44 pagesApplication Form: International Banking For Non-Resident IndiansAmit SharmaNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- Investment and tax saving proofs for 2017-18Document5 pagesInvestment and tax saving proofs for 2017-18vishalkavi18No ratings yet

- Form PDF 656505621171020Document59 pagesForm PDF 656505621171020advisewise associatesNo ratings yet

- Customer Request Form UpdateDocument2 pagesCustomer Request Form UpdateJ ANo ratings yet

- Customer Request Form UpdateDocument2 pagesCustomer Request Form UpdateSaidi ReddyNo ratings yet

- Customer Request FormDocument2 pagesCustomer Request FormJ ANo ratings yet

- Customer Request FormDocument2 pagesCustomer Request FormJ ANo ratings yet

- Exit From National Pension System Due To Superannuation and Incapacitation...Document6 pagesExit From National Pension System Due To Superannuation and Incapacitation...Kiran AlluriNo ratings yet

- It 000142649015 2022 00Document1 pageIt 000142649015 2022 00MUHAMMAD TABRAIZNo ratings yet

- IT Declaration Form 2019-20Document1 pageIT Declaration Form 2019-20KarunaNo ratings yet

- Salary Account Opening FormDocument12 pagesSalary Account Opening FormVijay DhanarajNo ratings yet

- Account Opening FormDocument9 pagesAccount Opening FormTej AsNo ratings yet

- Form PDF 363610600300521Document62 pagesForm PDF 363610600300521Darsh DoshiNo ratings yet

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanWasimNo ratings yet

- Consumer Application SampleDocument1 pageConsumer Application Sampleahmed02_99No ratings yet

- Assignment Form: InstructionsDocument2 pagesAssignment Form: InstructionsjahgfNo ratings yet

- ProHealth Prosal FormDocument7 pagesProHealth Prosal FormHarsha VijaykumarNo ratings yet

- Income Tax Payment Challan DetailsDocument1 pageIncome Tax Payment Challan DetailsAsif JavidNo ratings yet

- Edieweiss Common Application FormDocument3 pagesEdieweiss Common Application FormNitinNo ratings yet

- Aditya Birla Health Insurance Co. LimitedDocument5 pagesAditya Birla Health Insurance Co. LimitedAkshay MaparaNo ratings yet

- HDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantDocument7 pagesHDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantAltamash FaridNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Retail investment: Addressing timing and pricing issues through SIPsDocument52 pagesRetail investment: Addressing timing and pricing issues through SIPsMauryanNo ratings yet

- GROSS INCOME Inclusions and Exclusions: Tel. Nos. (043) 980-6659Document24 pagesGROSS INCOME Inclusions and Exclusions: Tel. Nos. (043) 980-6659MaeNo ratings yet

- Chapter 10 Statement of Cash Flows PAS 7Document6 pagesChapter 10 Statement of Cash Flows PAS 7MicsjadeCastilloNo ratings yet

- Accounting Concepts MCQsDocument1 pageAccounting Concepts MCQsAdil IqbalNo ratings yet

- Iqmethod ValuationDocument48 pagesIqmethod ValuationAkash VaidNo ratings yet

- Financial Management Analysis of Financial PlansDocument11 pagesFinancial Management Analysis of Financial Plansaasim aghaNo ratings yet

- Analysis of Financial StatementDocument47 pagesAnalysis of Financial StatementViransh Coaching ClassesNo ratings yet

- PT Freeport Indonesia 31 Dec 2019 Released PDFDocument73 pagesPT Freeport Indonesia 31 Dec 2019 Released PDFIndra YuNo ratings yet

- Template 16 4 30 21Document85 pagesTemplate 16 4 30 21Ahmad Juma SuleimanNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument18 pagesFinal Examination: Suggested Answers To Questionsamit jangraNo ratings yet

- Far670 Tutorial Basis of AnalysisDocument3 pagesFar670 Tutorial Basis of Analysis2020482736No ratings yet

- The Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Document4 pagesThe Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Rahul VenugopalanNo ratings yet

- Fabm 2: Quarter 3 - Module 1 The Statement of Financial Position (Elements, Forms and Its Classifications)Document23 pagesFabm 2: Quarter 3 - Module 1 The Statement of Financial Position (Elements, Forms and Its Classifications)Maria Nikka GarciaNo ratings yet

- Accountingdefinition: Financial Accounting Accounting Accounting Accounting Accounting InstallationDocument5 pagesAccountingdefinition: Financial Accounting Accounting Accounting Accounting Accounting InstallationRahul Kumar RajakNo ratings yet

- Corporate Finance Assignment Questions PDFDocument5 pagesCorporate Finance Assignment Questions PDFPaul NdegNo ratings yet

- Term Question HUM279Document49 pagesTerm Question HUM279sanathNo ratings yet

- Accounts Receivable Job Interview Preparation GuideDocument8 pagesAccounts Receivable Job Interview Preparation Guideganesanmani1985No ratings yet

- 200 500 Imo Board Meeting 20230215Document19 pages200 500 Imo Board Meeting 20230215Contra Value BetsNo ratings yet

- Patrick T. Barena: Chapter 32 - Investment in AssociateDocument9 pagesPatrick T. Barena: Chapter 32 - Investment in AssociateKimberly Claire AtienzaNo ratings yet

- How to Calculate Hotel Room Rates with the Hubbart FormulaDocument3 pagesHow to Calculate Hotel Room Rates with the Hubbart FormulaJoseph NtambaraNo ratings yet

- Part 5Document4 pagesPart 5Kath LeynesNo ratings yet

- MODUL 1 PELAKOR SEP 2020 - Dari Bu RatnaDocument47 pagesMODUL 1 PELAKOR SEP 2020 - Dari Bu Ratnapradana arif kurniawanNo ratings yet

- Decision Making - Relevant Costs & BenefitsDocument38 pagesDecision Making - Relevant Costs & BenefitsReshu BediaNo ratings yet

- Compensation of Special GroupsDocument22 pagesCompensation of Special GroupsNassir Mehmood100% (1)

- Working Capital Management Objectives Set 1 McqsDocument13 pagesWorking Capital Management Objectives Set 1 McqsAmit Kumar75% (4)

- Brand New Accounting Books (Softbound) /BAKER LEMBKE KING - Advanced Financial Accounting 8e/baker - Ab - Az.chap013Document40 pagesBrand New Accounting Books (Softbound) /BAKER LEMBKE KING - Advanced Financial Accounting 8e/baker - Ab - Az.chap013Alyssa KyleNo ratings yet