Professional Documents

Culture Documents

Business and Transfer Taxation Business Taxation (Students' Handouts)

Business and Transfer Taxation Business Taxation (Students' Handouts)

Uploaded by

Angelica Jem Ballesterol CarandangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business and Transfer Taxation Business Taxation (Students' Handouts)

Business and Transfer Taxation Business Taxation (Students' Handouts)

Uploaded by

Angelica Jem Ballesterol CarandangCopyright:

Available Formats

BUSINESS AND TRANSFER TAXATION

Business Taxation (Students’ Handouts)

CHAPTER 4 – EXEMPT SALES OF GOODS, PROPERTIES AND SERVICES

Exempt sales are not subject to VAT and percentage tax. Hence, VAT taxpayer shall not bill any output

VAT and non-VAT person shall not be subject to 3% percentage tax.

Exempt Sales of Goods, Properties or Services

1. Sale of agricultural and marine food products in their original state

2. Sale of fertilizers, seeds, seedlings and fingerlings, fish, prawn, livestock and poultry feeds,

including ingredients used in the manufacture of finished feeds

3. Services by agricultural contract growers and milling for others of palay into rice, corn into corn

grits, and sugar cane into raw sugar

4. Educational services rendered by private educational institution duly accredited by the

Department of Education, the Commission on Higher Education and Technical Education and

Skills Development Authority and those rendered by government educational institution

5. Services performed by individuals in pursuant to an employer and employee relationship

6. Medical, dental, hospital and veterinary services, except those rendered by professionals and

sales of drug by a hospital drug store

7. Transport of passengers by international carriers (RA 10378)

8. Services rendered by regional or area headquarters established in the Philippines by

multinational corporations which acts as supervisory, communications and coordinating centers

for their affiliates, subsidiaries or branches in the Asia Pacific Region and do not or derive income

from the Philippines

9. Sales by agricultural cooperatives duly registered in good standing with the Cooperative

Development Academy to their members, as well as sales of their produce, whether in its original

state or processed form, to non-members; their importation of direct farm inputs, machineries

and equipment, including spare parts thereof, to be used directly and exclusively in the

production and or processing of their produce

10. Gross receipts from lending activities by credit or multi-purpose cooperatives duly registered

and in good standing with the Cooperative Development Authority

11. Sales by non-agricultural, non-electric and non-credit cooperative duly registered and in good

standing with the CDA

12. Exempt sales of real properties:

b. Sale of real properties not primarily held for sale to customers or held for lease in the

ordinary course of business

c. Sale of real properties utilized for low-cost housing

d. Sale of real properties utilized for socialized housing

e. Sale of residential lot valued at P 1,500,000 and below and other residential dwelling

valued at P2,500,000 and below

13. Lease of residential unit with monthly rental not exceeding P15,000

14. Sale, printing or publication of books and any newspaper, magazine, review, or bulletin which

appear at regular intervals with fixed prices for subscription and sale and which is not devoted

principally to the publication of paid advertisements

15. Sale or lease of passenger or cargo vessels and aircraft, including engine, equipment and spare

parts thereof for domestic or international transport operation

16. Export sales by non-VAT persons

17. Transactions which are exempt under international agreement to which the Philippine is a

signatory or under special laws

Based on R.B.Banggawan’s Business and Transfer Taxation (2019) Page 1 of 2

BUSINESS AND TRANSFER TAXATION

Business Taxation (Students’ Handouts)

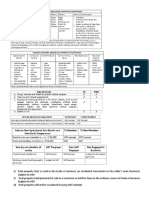

Illustrations

Agricorp is engaged in the farming and horticulture business, It earned the following during a quarter:

Sale of palay and rice P 1,000,000

Sale of banana and mushrooms 100,000

Sale of firewood and charcoal 150,000

Sale of orchids, flowers and bonsai 250,000

The following relates to the sales of Mr. B, a poultry operator:

Sales of chicken P 400,000

Sale of one-day old chicks 120,000

Sale of egg for penoy and balot 180,000

Sale of chicken manure 100,000

Bethany Hospital, a private hospital, had the following receipts and sales during a month:

In-Patient revenue P 1,000,000

Out-patient revenue 1,200,000

Laboratory services 800,000

Sales of drugs and medicines from pharmacy 400,000

Jet Bookstore reported the following sales during the month:

Sales of book inventories P 400,000

Sales of periodicals 200,000

Sales of school supplies 300,000

Commission income from book publishers 30,000

*Sale of adjacent lots

A farming cooperative which transacts business with members and non-members reported the following:

Related Unrelated

Receipts from members P 200,000 P 100,000

Receipts form non-members 300,000 20,000

A VAT-registered restaurant sold foods and beverages totaling P2,240.00 to a senior citizen who

presented a senior citizen identification card. The senior citizen was accompanied by three other non-

senior citizens.

Based on R.B.Banggawan’s Business and Transfer Taxation (2019) Page 2 of 2

You might also like

- Tax QuizzerDocument33 pagesTax QuizzerClarisse Peter86% (14)

- Solution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, RaoDocument5 pagesSolution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, Raoa289899847No ratings yet

- Chapter 4 Exempt SalesDocument23 pagesChapter 4 Exempt SalesHazel Jane Esclamada0% (2)

- Universal College of Parañaque: Value Added TaxDocument14 pagesUniversal College of Parañaque: Value Added TaxDin Rose Gonzales67% (3)

- Exercises On Value Added TaxDocument20 pagesExercises On Value Added TaxIan Jamero100% (2)

- Cir v. Menguito DigestDocument3 pagesCir v. Menguito Digestkathrynmaydeveza100% (1)

- Working Papers in Value Added TaxDocument20 pagesWorking Papers in Value Added TaxLucy HeartfiliaNo ratings yet

- TBLTAX Chapter 2 Percentage Tax Exempt Sales of Goods or Properties and ServicesDocument6 pagesTBLTAX Chapter 2 Percentage Tax Exempt Sales of Goods or Properties and ServicesBeny MiraflorNo ratings yet

- TAXATION 2 Chapter 9 Exempt SalesDocument5 pagesTAXATION 2 Chapter 9 Exempt SalesKim Cristian MaañoNo ratings yet

- Chapter 4 1Document19 pagesChapter 4 1RenalynOsuyaGutierrezNo ratings yet

- 2nd Statement: Sale of A Stock Dealer of Shares of Stocks Directly To A Buyer Is Subject To TheDocument9 pages2nd Statement: Sale of A Stock Dealer of Shares of Stocks Directly To A Buyer Is Subject To Theishinoya keishiNo ratings yet

- 1.2. Problems On VAT - For Tax ReviewDocument19 pages1.2. Problems On VAT - For Tax ReviewJem ValmonteNo ratings yet

- VAT - OPT Illustrative ExamplesDocument6 pagesVAT - OPT Illustrative ExamplesFerb CruzadaNo ratings yet

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDocument32 pagesSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzNo ratings yet

- Chapter 4 Part 2Document13 pagesChapter 4 Part 2rylNo ratings yet

- Business and Transfer Taxation Business Taxation (Students' Handouts)Document2 pagesBusiness and Transfer Taxation Business Taxation (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Vat ReviewDocument4 pagesVat ReviewVensen FuentesNo ratings yet

- 08 Handout 1 PDFDocument6 pages08 Handout 1 PDFJanleoRosalesPraxidesNo ratings yet

- Taxation Elims 1Document3 pagesTaxation Elims 1Valerie Faye BadajosNo ratings yet

- Bustamante TAX CDocument19 pagesBustamante TAX CJean Rose Tabagay BustamanteNo ratings yet

- Percentage-Taxes SeatworkDocument2 pagesPercentage-Taxes Seatworkrick owensNo ratings yet

- VAT Exempt SalesDocument14 pagesVAT Exempt SalesJuvanni SantosNo ratings yet

- Review in Business Law and TaxationDocument4 pagesReview in Business Law and TaxationFery AnnNo ratings yet

- Tax CDocument18 pagesTax Calmira garciaNo ratings yet

- Introduction To Business Taxation, Exclusions and Other Percentage TaxDocument20 pagesIntroduction To Business Taxation, Exclusions and Other Percentage TaxDharel GannabanNo ratings yet

- SalesDocument8 pagesSalesKeith GuzmanNo ratings yet

- Exempt Sales - NotesDocument28 pagesExempt Sales - NotesSunny DaeNo ratings yet

- Busi Tax 3Document2 pagesBusi Tax 3Jason MalikNo ratings yet

- DocxDocument6 pagesDocxnena cabañesNo ratings yet

- TAXATION 2 Chapter 12 Output VAT Zero Rated SalesDocument4 pagesTAXATION 2 Chapter 12 Output VAT Zero Rated SalesKim Cristian MaañoNo ratings yet

- Output Vat - Zero-Rated SalesDocument36 pagesOutput Vat - Zero-Rated SalesCoreen Samaniego0% (2)

- Chapter 11 Prob 11-27Document8 pagesChapter 11 Prob 11-27CelineAbbeyMangalindanNo ratings yet

- Exercise 3 Percentage Taxes SendDocument2 pagesExercise 3 Percentage Taxes SendLexuz GatonNo ratings yet

- Frequency of ReportingDocument5 pagesFrequency of ReportingNeriza maningasNo ratings yet

- Tax2 Seatworks-03.30.2020Document4 pagesTax2 Seatworks-03.30.2020Allen Fey De JesusNo ratings yet

- Response: P50,000Document10 pagesResponse: P50,000JaehyunnssNo ratings yet

- Chapter 6 Banggawan RevierwerDocument9 pagesChapter 6 Banggawan RevierwerKyleZapantaNo ratings yet

- Taxation CPALE by WMGDocument19 pagesTaxation CPALE by WMGJona Celle Castillo100% (1)

- Chapter 4Document3 pagesChapter 4Marinelle DiazNo ratings yet

- TAXATION 2 Chapter 11 Output VAT RegularDocument2 pagesTAXATION 2 Chapter 11 Output VAT RegularKim Cristian MaañoNo ratings yet

- Exempt SalesDocument46 pagesExempt SalesKheianne DaveighNo ratings yet

- Exempt Sales of Goods, Properties and Services: Anie P Martinez, CpaDocument56 pagesExempt Sales of Goods, Properties and Services: Anie P Martinez, CpaAnie MartinezNo ratings yet

- 84881793Document6 pages84881793Joel Christian MascariñaNo ratings yet

- ACT 184 - QUIZ 4 (SET A) - 50 CopiesDocument3 pagesACT 184 - QUIZ 4 (SET A) - 50 CopiesAthena Fatmah AmpuanNo ratings yet

- Exempt SalesDocument4 pagesExempt SalesMary Joy DenostaNo ratings yet

- VAT Exempt SalesDocument5 pagesVAT Exempt SalesNEstandaNo ratings yet

- VATable Transaction Practice PDFDocument2 pagesVATable Transaction Practice PDFJester LimNo ratings yet

- Chapter 4: Exempt Sales of Goods, Properties and Services Exempt SalesDocument7 pagesChapter 4: Exempt Sales of Goods, Properties and Services Exempt SalesWearIt Co.No ratings yet

- Activity 1 VatDocument7 pagesActivity 1 VatLayca Clarice Germino BrimbuelaNo ratings yet

- Tax 2 PDFDocument16 pagesTax 2 PDFLeah MoscareNo ratings yet

- M11 Exempt Sales StudentsDocument33 pagesM11 Exempt Sales StudentsTokis SabaNo ratings yet

- Tax FinalDocument7 pagesTax FinalDinosaur KoreanNo ratings yet

- VAT ExercisesDocument3 pagesVAT ExercisesRonald MojadoNo ratings yet

- Corresponding Supporting ScheduleDocument3 pagesCorresponding Supporting Schedulealmira garciaNo ratings yet

- Income Taxation Semi-Final ExaminationDocument12 pagesIncome Taxation Semi-Final ExaminationlalagunajoyNo ratings yet

- Tax2 Seatworks-03.23.2020Document2 pagesTax2 Seatworks-03.23.2020Allen Fey De JesusNo ratings yet

- Chapter 7 - TBTDocument14 pagesChapter 7 - TBTKatKat Olarte0% (3)

- Food Outlook: Biannual Report on Global Food Markets May 2019From EverandFood Outlook: Biannual Report on Global Food Markets May 2019No ratings yet

- Food Outlook: Biannual Report on Global Food Markets: June 2020From EverandFood Outlook: Biannual Report on Global Food Markets: June 2020No ratings yet

- HO.11 - Introduction To Transfer TaxationDocument1 pageHO.11 - Introduction To Transfer TaxationAngelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Gross Estate (Students' Handouts)Document2 pagesBusiness and Transfer Taxation Gross Estate (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- HO.15 - Donation and Donors TaxationDocument3 pagesHO.15 - Donation and Donors TaxationAngelica Jem Ballesterol CarandangNo ratings yet

- HO.16 - Taxation RemediesDocument2 pagesHO.16 - Taxation RemediesAngelica Jem Ballesterol CarandangNo ratings yet

- HO.14 - Deductions From Gross Estate and Estate Tax PayableDocument3 pagesHO.14 - Deductions From Gross Estate and Estate Tax PayableAngelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation - VAT (Students' Handouts)Document1 pageBusiness and Transfer Taxation Business Taxation - VAT (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation (Students' Handouts)Document2 pagesBusiness and Transfer Taxation Business Taxation (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation - VAT (Students' Handouts)Document1 pageBusiness and Transfer Taxation Business Taxation - VAT (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Indiamart May 2021Document1 pageIndiamart May 2021Solomon PasulaNo ratings yet

- Invoice: Klaravik ABDocument1 pageInvoice: Klaravik ABIvar JuanNo ratings yet

- TEST-TABLE (All Tables Only For Rating, Billing, Payment&collectionsDocument1 pageTEST-TABLE (All Tables Only For Rating, Billing, Payment&collectionsBhaskar SenNo ratings yet

- Case Digest of GR No 153204Document1 pageCase Digest of GR No 153204Ivan ChuaNo ratings yet

- Tax Types PDFDocument11 pagesTax Types PDFyebegashetNo ratings yet

- Property Investment Buytolet SampleDocument53 pagesProperty Investment Buytolet SampleAtta Ur RahmanNo ratings yet

- Maven Minds Budget Brief 2022Document24 pagesMaven Minds Budget Brief 2022Salman AhmedNo ratings yet

- U.S. vs. Tommy CryerDocument7 pagesU.S. vs. Tommy CryerBetty TaylorNo ratings yet

- P03B. Government Budget & Fiscal PolicyDocument4 pagesP03B. Government Budget & Fiscal PolicyNhư ÝNo ratings yet

- Light Air Transmission Pvt. Ltd. ANIB032223 00582Document2 pagesLight Air Transmission Pvt. Ltd. ANIB032223 00582kanishkakhanna.inboxNo ratings yet

- Quiz 1-Principles of TaxationDocument1 pageQuiz 1-Principles of TaxationMelany Permosil GalauraNo ratings yet

- Cir v. LancasterDocument2 pagesCir v. LancasterGlyza Kaye Zorilla PatiagNo ratings yet

- Level+11+&+10 Non+Flexi Ops+Tfo+Atci+Ops v1Document5 pagesLevel+11+&+10 Non+Flexi Ops+Tfo+Atci+Ops v1bskapoor68No ratings yet

- Formula For Intercompany Transactions 2Document6 pagesFormula For Intercompany Transactions 2konyatanNo ratings yet

- IllustrationDocument3 pagesIllustrationBLOODY ASHHERNo ratings yet

- America First Legal - 2021 Irs990Document37 pagesAmerica First Legal - 2021 Irs990File 411No ratings yet

- Yutivo Sons Hardware Co. vs. CTA: Nature of The CaseDocument3 pagesYutivo Sons Hardware Co. vs. CTA: Nature of The CaseNorma BayonetaNo ratings yet

- WO - Crane 50 MT - QWDocument2 pagesWO - Crane 50 MT - QWkNo ratings yet

- rc151 Fill 22eDocument4 pagesrc151 Fill 22etebeck bertran forbitNo ratings yet

- CIR vs. PhoenixDocument4 pagesCIR vs. PhoenixJelissa GalvezNo ratings yet

- Quiz Donor S Tax ACT 193Document14 pagesQuiz Donor S Tax ACT 193Haks MashtiNo ratings yet

- Macroeconomics Tuto c2Document1 pageMacroeconomics Tuto c2Nazri AnaszNo ratings yet

- 568 - LLC Tax Return FormDocument7 pages568 - LLC Tax Return FormAndreana Dumpling WilliamsNo ratings yet

- Income Taxation Unit 2 - PreludeDocument8 pagesIncome Taxation Unit 2 - PreludeEllieNo ratings yet

- ThnyanDocument4 pagesThnyanMohamedNo ratings yet

- 4 Omnibus InvestmentsDocument36 pages4 Omnibus InvestmentsBret BalbuenaNo ratings yet

- LML4804-Tax Law Notes 2014Document93 pagesLML4804-Tax Law Notes 2014nigelNo ratings yet

- Payslip - 2021 03 29Document1 pagePayslip - 2021 03 29Loan LoanNo ratings yet