Professional Documents

Culture Documents

Audit Cash Problem 05

Uploaded by

Ivy Bautista0 ratings0% found this document useful (0 votes)

18 views1 pageThe document provides financial information from Marlon Company's cash account audit as of December 31, 2021. It lists cash balances, outstanding checks, deposits in transit, collections and payments for November and December. The cash receipts book was underfooted by P8,500 in December and the bank erroneously charged the company P11,250 which was corrected in January 2022.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial information from Marlon Company's cash account audit as of December 31, 2021. It lists cash balances, outstanding checks, deposits in transit, collections and payments for November and December. The cash receipts book was underfooted by P8,500 in December and the bank erroneously charged the company P11,250 which was corrected in January 2022.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views1 pageAudit Cash Problem 05

Uploaded by

Ivy BautistaThe document provides financial information from Marlon Company's cash account audit as of December 31, 2021. It lists cash balances, outstanding checks, deposits in transit, collections and payments for November and December. The cash receipts book was underfooted by P8,500 in December and the bank erroneously charged the company P11,250 which was corrected in January 2022.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

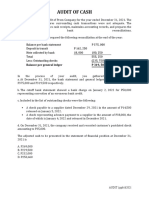

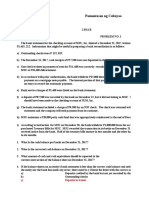

AUDIT OF CASH AND CASH EQUIVALENTS

Problem#5.

The following information was obtained in connection with the audit of

Marlon Company's cash account as of December 31, 2021:

Outstanding checks, 11/30/21 P 53, 250

Outstanding checks, 12/31/21 37, 500

Deposit in transit, 11/30/21 50, 000

Cash balance per general ledger 12/31/21 112, 500

Actual company collections from its customers during December 438, 500

Company checks paid by bank in December 375, 000

Bank service charges recorded on company books in December 9, 500

Bank service charges per December bank statement 10, 500

Deposits credited by bank during December 433, 500

November bank service charges recorded on company books in December 5, 750

The cash receipts book of December is under footed by P8,500.

The bank erroneously charged the company's account for a P11,250 check of

another depositor.

This bank error was corrected in January 2022.

How much is the deposit in transit on December 31, 2021?

A. P65,000

B. P57,500

C. P55,000

D. P60,000

Audit of Cash | jipb162021

You might also like

- Finding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificFrom EverandFinding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificNo ratings yet

- Intermediate Accounting Prelim ExamDocument3 pagesIntermediate Accounting Prelim ExamCharity Lumactod AlangcasNo ratings yet

- QUIZ Cash APDocument11 pagesQUIZ Cash APJanelleNo ratings yet

- Audit of Cash and Cash EquivalentsDocument9 pagesAudit of Cash and Cash Equivalentspatricia100% (1)

- Ap9208 Cash 3Document4 pagesAp9208 Cash 3Onids AbayaNo ratings yet

- Auditing Problems: First PreboardDocument8 pagesAuditing Problems: First PreboardCarlo AgravanteNo ratings yet

- Intermediate Accounting 1 - Cash and Cash EquivalentsDocument14 pagesIntermediate Accounting 1 - Cash and Cash EquivalentsKristine Jewel MirandaNo ratings yet

- Partnership Liquidation: Answer: (D)Document2 pagesPartnership Liquidation: Answer: (D)Ivy BautistaNo ratings yet

- ReSA B43 FAR First PB Exam Questions Answers SolutionsDocument14 pagesReSA B43 FAR First PB Exam Questions Answers Solutionsrtenaja100% (1)

- Audit of Cash and Cash Equivalents 1Document9 pagesAudit of Cash and Cash Equivalents 1nena cabañesNo ratings yet

- Cash and Cash Equivalents - ProblemsDocument47 pagesCash and Cash Equivalents - Problemscommissioned homeworkNo ratings yet

- UdD 2nd Semester PRE02 Auditing and Assurance Concepts and Applications Midterm 1Document16 pagesUdD 2nd Semester PRE02 Auditing and Assurance Concepts and Applications Midterm 1Roland CatubigNo ratings yet

- Ap9208 Cash 2Document2 pagesAp9208 Cash 2Onids AbayaNo ratings yet

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocument3 pagesAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNo ratings yet

- Cash and Proof of Cash ProblemsDocument2 pagesCash and Proof of Cash ProblemsDivine MungcalNo ratings yet

- RM - Cash and Cash EquivalentsDocument3 pagesRM - Cash and Cash Equivalentsncaacademics.nfjpia2324No ratings yet

- Proof of Cash - Sample ProblemsDocument1 pageProof of Cash - Sample ProblemsFucio, Mark JeroldNo ratings yet

- Assignment - Cash and CEDocument4 pagesAssignment - Cash and CEAleah Jehan AbuatNo ratings yet

- Reiner BraunDocument2 pagesReiner BraunXXXXXXXXXXXXXXXXXXNo ratings yet

- Audit of Cash: Problem No. 1Document4 pagesAudit of Cash: Problem No. 1Kathrina RoxasNo ratings yet

- Special Exam-Prelims: Audit of Cash and Cash Equivalents Problem No. 1Document4 pagesSpecial Exam-Prelims: Audit of Cash and Cash Equivalents Problem No. 1Ma Yra YmataNo ratings yet

- Quiz - CashDocument1 pageQuiz - CashAna Mae HernandezNo ratings yet

- Auditing 1 AssessmentDocument15 pagesAuditing 1 AssessmentEmilou AustriacoNo ratings yet

- Cash and Cash Equivalents ReviewDocument3 pagesCash and Cash Equivalents ReviewashlyNo ratings yet

- Auditing Problems: Let'S Go!Document8 pagesAuditing Problems: Let'S Go!AiahNo ratings yet

- Preliminary Exams-Aud 301A YmataDocument6 pagesPreliminary Exams-Aud 301A YmataMa Yra YmataNo ratings yet

- Practice Set - Audit of Cash and Cash EquivalentsDocument2 pagesPractice Set - Audit of Cash and Cash EquivalentsnikkaNo ratings yet

- Auditing 1 Final ExamDocument8 pagesAuditing 1 Final ExamEdemson NavalesNo ratings yet

- Midterm Answer KeyDocument9 pagesMidterm Answer Keylil mixNo ratings yet

- QUIZ 1. Audit of Cash ManuscriptDocument4 pagesQUIZ 1. Audit of Cash ManuscriptJulie Mae Caling MalitNo ratings yet

- Audit Quizzer (Cash) - 03Document1 pageAudit Quizzer (Cash) - 03Ivy BautistaNo ratings yet

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- ACP103 Task 1Document3 pagesACP103 Task 1Joshuji LaneNo ratings yet

- Local Media6674701184734179453Document2 pagesLocal Media6674701184734179453Jean TanNo ratings yet

- Chapter 1 - Cash and Cash Equivalents: Bank Service ChargesDocument3 pagesChapter 1 - Cash and Cash Equivalents: Bank Service ChargesRizalito SisonNo ratings yet

- Problem 1 Bank Reconciliation: Unadusted To Adjusted BalancesDocument4 pagesProblem 1 Bank Reconciliation: Unadusted To Adjusted BalancesKyla Herman FrancoNo ratings yet

- Midterm ExaminationDocument11 pagesMidterm ExaminationEdemson NavalesNo ratings yet

- Cash Problem 1Document3 pagesCash Problem 1Dawson Dela CruzNo ratings yet

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet

- Practice Set: Audit of Cash and Cash EquivalentsDocument2 pagesPractice Set: Audit of Cash and Cash EquivalentsANGELU RANE BAGARES INTOLNo ratings yet

- Ap-5907 CashDocument11 pagesAp-5907 CashSaoxalo ONo ratings yet

- Bank Reconciliation (IA)Document7 pagesBank Reconciliation (IA)rufamaegarcia07No ratings yet

- HO - 01 Audit of Cash (20230331100112)Document3 pagesHO - 01 Audit of Cash (20230331100112)Roque LestieNo ratings yet

- Conceptual Framework and Accounting Standards: Janesene N. Sol MWF 1:00-2:00 PMDocument4 pagesConceptual Framework and Accounting Standards: Janesene N. Sol MWF 1:00-2:00 PMJanesene SolNo ratings yet

- Assignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundDocument6 pagesAssignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundThricia Mae Lorenzo IgnacioNo ratings yet

- Quiz 1Document3 pagesQuiz 1Carmi FeceroNo ratings yet

- AIS Prelim ExamDocument4 pagesAIS Prelim Examsharielles /No ratings yet

- Bank Reconciliation HandoutsDocument7 pagesBank Reconciliation HandoutsRODELYN PERALESNo ratings yet

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNo ratings yet

- Bank Recon ProblemsDocument5 pagesBank Recon ProblemsDivine MungcalNo ratings yet

- WP - CCE and ReceivablesDocument8 pagesWP - CCE and ReceivablesHavanah Erika Dela CruzNo ratings yet

- Problem 1-21: RequiredDocument4 pagesProblem 1-21: RequiredRizalito SisonNo ratings yet

- IntAcc Quiz 1 PDFDocument9 pagesIntAcc Quiz 1 PDFMyles Ninon LazoNo ratings yet

- Auditing Application Special ExamDocument3 pagesAuditing Application Special Examnicole bancoroNo ratings yet

- Assignment No. 1 Audit of CashDocument5 pagesAssignment No. 1 Audit of CashMa Tiffany Gura RobleNo ratings yet

- Audit of Cash - SeatworkDocument4 pagesAudit of Cash - SeatworkTEOPE, EMERLIZA DE CASTRONo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- AUD 2023 2 Substantive Tests of Cash Prepaid Expenses and DeferredDocument4 pagesAUD 2023 2 Substantive Tests of Cash Prepaid Expenses and DeferredMary Rose CredoNo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash EquivalentsElla TuratoNo ratings yet

- F CFAS-EXAM - Docx 143874436Document48 pagesF CFAS-EXAM - Docx 143874436Athena AthenaNo ratings yet

- Audit Cash - Aud ProblemsDocument36 pagesAudit Cash - Aud ProblemsIvy BautistaNo ratings yet

- Partnership Liquidation: Assets Liabilities & EquityDocument2 pagesPartnership Liquidation: Assets Liabilities & EquityIvy BautistaNo ratings yet

- Audit Prob Q6 Proof of Cash 2021Document9 pagesAudit Prob Q6 Proof of Cash 2021Ivy BautistaNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet