Professional Documents

Culture Documents

Indian Market Strategy: New Model Variants

Uploaded by

Shivani BhatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Market Strategy: New Model Variants

Uploaded by

Shivani BhatCopyright:

Available Formats

Indian Market Strategy

New model variants Tata Ace had only ventured in few areas within the Indian market. They

wanted to diversify into production of larger-tonnage cab, a passenger van, and also multiple engine

variants including gasoline and compressed natural gas (CNG).

New regional markets Tata Ace was also considering to expand its presence in other

cities of india But with the current limited production capacity, should Tata Motors saturate the

Indian regions in which the Ace had already been launched or dispatch the limited production run to

a wider market to establish a presence?

Potential competitor response While the Ace had experienced market success, the three-

wheeler manufacturers were unlikely to surrender the market so easily. Piaggio offered a four-

wheeled goods carrier called the Quargo in Italy which had a payload capacity of 0.7 tons. The

Quargo was classified as a quadricycle and, as a result, did not meet the same safety and emissions

standards as the Ace. Piaggio had planned to launch the Quargo in India by the end of 2005 at a price

of Rs. 200,000 ($4,444), but the launch had not occurred as of November 2006. 22 In addition, in April

2006, Bajaj announced its plans to launch a four-wheeled goods carrier by 2009. 23 Bajaj was

developing its first in-house diesel engine for this product. While Bajaj did not currently make any

four-wheeled products, its three wheelers enjoyed a loyal following in India, and the company had

an extensive service network

The Ace’s newfound success could also attract competition from four-wheeled commercial-vehicle

and automobile manufacturers looking to expand into this new market segment. Maruti, India’s

leading car manufacturer, offered a small passenger van called the Omni that was built on the Maruti

800 platform. This gasoline-powered vehicle was sold in cargo (one-ton-rated payload capacity) and

passenger formats and cost Rs. 200,000 ($4,444). The Omni was used by families as a minivan as well

as by small-business owners to transport goods and even as an ambulance. Competition might also

come from Japanese or Korean companies such as Daihatsu or Hyundai, which might introduce their

more powerful and expensive minitruck variants in India. Finally, the Ace’s low-cost position could

also come under attack if a Chinese competitor like Changan introduced a minitruck in India through

a joint venture.

Export Market Strategy

Ace could be successful in export markets and wanted to make sure they did not miss

this opportunity, which could be much larger than that in the Indian market. He classified

export opportunities into three segments: emerging markets similar to India (Sri Lanka,

Bangladesh, Pakistan), emerging markets that were more developed than India (China,

Russia, South Africa, and Thailand), and developed markets (Italy, Spain, and the U.K.). The

current product could be sold in markets similar to India without many modifications and

at a low freight-transportation cost. In contrast, selling into more developed emerging

markets and developed markets would require additional modifications, which would add

cost and require approximately two years. However, selling in developed markets would be

likely to generate higher margins for Tata Motors. Unlike selling in South Africa, where Tata

Motors had a distribution network and strong brand reputation, selling in developed

markets like Italy would require that the company build its presence from scratch .

Additional Considerations

The plant in Pune was running at 100% capacity and expansion would require a new

plant and high capital investment. Furthermore, with no room left on the Pune campus,

a new factory in another Indian city would be required. It was also unclear whether the

Ace’s success with outsourcing could be replicated in another location without a strong

supplier presence. Despite its low price, the Ace was profitable because it was able to

use several existing Tata Motors facilities.

New product development

The Tata Group’s chairman, Ratan Tata, had recently announced that Tata Motors

would produce a passenger car at a price of Rs. 100,000 ($2,222) by 2008 and forecast

sales of 1 million cars per year. The popular media was filled with excitement and

skepticism This was a challenge whether with this new car, Tata Motors could instantly

double the size of the Indian passenger-car market to 2 million units.

You might also like

- VOLVO EW160B-0 GeneralDocument17 pagesVOLVO EW160B-0 GeneralPIKO MOB100% (1)

- PcodesDocument1,572 pagesPcodesdiegoNo ratings yet

- Business Development Plan: Model Answer SeriesFrom EverandBusiness Development Plan: Model Answer SeriesRating: 5 out of 5 stars5/5 (1)

- Iparts 8BDRU15-36118 TY 8BRU PDF-1541174755Document160 pagesIparts 8BDRU15-36118 TY 8BRU PDF-1541174755Carlos GómezNo ratings yet

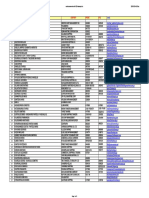

- Members 2014 01 PDFDocument3 pagesMembers 2014 01 PDFNego1975No ratings yet

- Udyam Registration CertificateDocument4 pagesUdyam Registration CertificateAvinash TiwariNo ratings yet

- STANDARD BBS FORMAT FOR 2-L (With Cushion)Document10 pagesSTANDARD BBS FORMAT FOR 2-L (With Cushion)Sreedhar BhuduruNo ratings yet

- SamsungDocument12 pagesSamsungShivani BhatNo ratings yet

- Celpip Task 5 COMPARING AND PERSUADINGDocument23 pagesCelpip Task 5 COMPARING AND PERSUADINGDaljeet Ahuja100% (2)

- Legend-Ceiling Finish: Office of The President Municipality of TigaonDocument1 pageLegend-Ceiling Finish: Office of The President Municipality of TigaonDJNo ratings yet

- Operational Management Stratergies of Tata NanoDocument15 pagesOperational Management Stratergies of Tata NanoAdv Arunima LauranceNo ratings yet

- Track Tamping MachineDocument3 pagesTrack Tamping MachineJagadeep Kumar Bhatiya100% (1)

- Company Profile: Tata Motors Limited, Formerly Known As TELCO (TATA Engineering andDocument51 pagesCompany Profile: Tata Motors Limited, Formerly Known As TELCO (TATA Engineering andRajwinder GillNo ratings yet

- Tata Group Tata Sons Daimler-BenzDocument8 pagesTata Group Tata Sons Daimler-BenzAnish TiwariNo ratings yet

- Tata Motors LTDDocument6 pagesTata Motors LTDNeeraj DharNo ratings yet

- Tata Motors: Innovation StrategyDocument5 pagesTata Motors: Innovation StrategyrajirekhaNo ratings yet

- HnuDocument3 pagesHnuPranjali PalyekarNo ratings yet

- SWOT AnalysisDocument2 pagesSWOT Analysisanila77No ratings yet

- Tata MotorsDocument18 pagesTata MotorsprekshiashuNo ratings yet

- Brand Value of Tata AceDocument10 pagesBrand Value of Tata AcesamvayNo ratings yet

- Ace ReportDocument14 pagesAce ReportArunansh SrivastavaNo ratings yet

- Tata MotorsDocument9 pagesTata MotorsVidyalaxmi BhutiNo ratings yet

- Tata Motors (Sip)Document46 pagesTata Motors (Sip)rishabhNo ratings yet

- Tata Motors F14004Document19 pagesTata Motors F14004Mainali GautamNo ratings yet

- Tata Ace AssignmentDocument5 pagesTata Ace AssignmentSatish Kumar KarnaNo ratings yet

- Opportunities GLOBAL WORLDDocument10 pagesOpportunities GLOBAL WORLDmustkimdhukkarediffmNo ratings yet

- TataDocument17 pagesTataRaghuLotlikar100% (1)

- Swot Analysis of Tata MotorsDocument2 pagesSwot Analysis of Tata MotorsSouvik MajumderNo ratings yet

- Oject ImDocument24 pagesOject ImKomal SinghNo ratings yet

- Tata Motors Limited: Swot AnalysisDocument5 pagesTata Motors Limited: Swot AnalysisAmar JajuNo ratings yet

- Demand Forecasting of Tata MotorsDocument14 pagesDemand Forecasting of Tata MotorsRoshan. l I dggBishtNo ratings yet

- Demand Forecasting of Tata MotorsDocument12 pagesDemand Forecasting of Tata Motorspreeti30789100% (3)

- Revving Up!!!: The Marketing Case StudyDocument10 pagesRevving Up!!!: The Marketing Case StudyDevashish GoelNo ratings yet

- 2 Tata AceDocument2 pages2 Tata AcePramod KokaneNo ratings yet

- Macro Economics and Business Environment Assignment: Submitted To: Dr. C.S. AdhikariDocument8 pagesMacro Economics and Business Environment Assignment: Submitted To: Dr. C.S. Adhikarigaurav880No ratings yet

- SWOT Analysis - Tata Motors Limited: StrengthsDocument3 pagesSWOT Analysis - Tata Motors Limited: StrengthsamanchandelNo ratings yet

- Tata MotorsDocument4 pagesTata MotorsKeshri DubeyNo ratings yet

- Tata Motors Case Study.Document5 pagesTata Motors Case Study.Bhumitra DeyNo ratings yet

- Marketing Strategy of Tata MotarsDocument63 pagesMarketing Strategy of Tata MotarsPriyanka SharmaNo ratings yet

- Case StudyDocument3 pagesCase StudyImran ShariffNo ratings yet

- Tata Motors Does Not Follow A Single Marketing Approach or Formula But It Believes That All Members of The Community Should Be ServedDocument5 pagesTata Motors Does Not Follow A Single Marketing Approach or Formula But It Believes That All Members of The Community Should Be ServedVasu Dev KanchetiNo ratings yet

- Tata Motor Ems ReportDocument25 pagesTata Motor Ems ReportMrhunt394 YTNo ratings yet

- SWOT AnalysisDocument6 pagesSWOT Analysisbhavesh1712No ratings yet

- Marketing Management Case 3-1Document4 pagesMarketing Management Case 3-1sumansubediNo ratings yet

- Sachin 4Document74 pagesSachin 4Sachin ChauhanNo ratings yet

- PRO ON Tata MotorsDocument25 pagesPRO ON Tata MotorsmanalisoniNo ratings yet

- Case Study: 7 Consumer Decisions Towards Brand CarsDocument2 pagesCase Study: 7 Consumer Decisions Towards Brand Carssuman v bhatNo ratings yet

- Tata Motors Brand HistoryDocument10 pagesTata Motors Brand Historyanon_563636813No ratings yet

- 466 CaseDocument10 pages466 CaseNguyễn Thị Thanh ThúyNo ratings yet

- 2356Document3 pages2356Raxilla MaxillaNo ratings yet

- Tata NanoDocument25 pagesTata Nanop01p100% (1)

- Tata MotorsDocument19 pagesTata MotorsJayanta DashNo ratings yet

- Presentation On Tata NanoDocument26 pagesPresentation On Tata NanoamardeepNo ratings yet

- Tata NanoDocument11 pagesTata NanoIshmeet SinghNo ratings yet

- Measuring The Customer Satisfaction Level Before and After Sales Service Provided by TATA Motors in PondicherryDocument5 pagesMeasuring The Customer Satisfaction Level Before and After Sales Service Provided by TATA Motors in PondicherryYASHWANTH PATIL G JNo ratings yet

- Tata Motors: Navigation SearchDocument21 pagesTata Motors: Navigation SearchJafar ShaikhNo ratings yet

- Strengths in The SWOT Analysis of Tata MotorsDocument3 pagesStrengths in The SWOT Analysis of Tata MotorsS FNo ratings yet

- Presentation On Tata Nano: Presented By: Gyan Ranjan Prabhat Mani Tripathi Shreyas LasteDocument26 pagesPresentation On Tata Nano: Presented By: Gyan Ranjan Prabhat Mani Tripathi Shreyas Lasteshreyas1111100% (2)

- Presentation On Tata Nano: Presented By: Gyan Ranjan Prabhat Mani Tripathi Rohit MishraDocument26 pagesPresentation On Tata Nano: Presented By: Gyan Ranjan Prabhat Mani Tripathi Rohit Mishranitu36No ratings yet

- Crisil For Tata MotorsDocument10 pagesCrisil For Tata MotorsDHARMAARJUN K 1828010No ratings yet

- Part I (A) Company ProfileDocument31 pagesPart I (A) Company ProfileAGRIFORCE SALES100% (1)

- Tata Motors Performance AppraisalDocument11 pagesTata Motors Performance Appraisaljanhavi kolheNo ratings yet

- Tata Motors Limited (: NSE BSE Nyse Nasdaq Multinational Automotive Mumbai Tata GroupDocument15 pagesTata Motors Limited (: NSE BSE Nyse Nasdaq Multinational Automotive Mumbai Tata Groupsk007008No ratings yet

- Overview of Indian Automobile IndustryDocument9 pagesOverview of Indian Automobile IndustrygokulNo ratings yet

- Marketing Management Project-IDocument21 pagesMarketing Management Project-INILOTPAL SARKAR (RA2152001010046)No ratings yet

- Designated Drivers: How China Plans to Dominate the Global Auto IndustryFrom EverandDesignated Drivers: How China Plans to Dominate the Global Auto IndustryNo ratings yet

- Capital ExpendituresDocument1 pageCapital ExpendituresShivani BhatNo ratings yet

- Task 4: Advertisement: Outlook SpurgeDocument3 pagesTask 4: Advertisement: Outlook SpurgeShivani BhatNo ratings yet

- 53 Shivani CIBBDocument7 pages53 Shivani CIBBShivani BhatNo ratings yet

- Task 3: Product and Brand ManagementDocument7 pagesTask 3: Product and Brand ManagementShivani BhatNo ratings yet

- Introduction To IT Sector - Shivani & RishikaDocument2 pagesIntroduction To IT Sector - Shivani & RishikaShivani BhatNo ratings yet

- 53 Shivani CIBBDocument7 pages53 Shivani CIBBShivani BhatNo ratings yet

- Chrysler Stratus Convertible JX 1998 Wiring AllDocument20 pagesChrysler Stratus Convertible JX 1998 Wiring Allgeorge100% (32)

- Practice 2022Document47 pagesPractice 2022khoa bui dangNo ratings yet

- Taxiing: Preflight: PreflightDocument8 pagesTaxiing: Preflight: PreflightSamson Hailu KNo ratings yet

- Emanage Ultimate Installation ManualDocument40 pagesEmanage Ultimate Installation Manualdcc jempolNo ratings yet

- Southington Police Blotter Feb-March 2015Document11 pagesSouthington Police Blotter Feb-March 2015Rich ScintoNo ratings yet

- PCM Products GeneralDocument6 pagesPCM Products Generalvenugopalan srinivasanNo ratings yet

- Dongyang 1926 Parts Catalog Watermark 150625104921 Lva1 App 6891Document10 pagesDongyang 1926 Parts Catalog Watermark 150625104921 Lva1 App 6891shirley100% (46)

- DP World - Investor Presentation - Mar 2020 Final PDFDocument41 pagesDP World - Investor Presentation - Mar 2020 Final PDFHusainNo ratings yet

- Aca CisbcDocument181 pagesAca CisbcMaria Venus Acuña-Boston RajNo ratings yet

- Introduction To Transportation EngineeriDocument19 pagesIntroduction To Transportation Engineeriteshome getieNo ratings yet

- Manual de Parts GTXDocument28 pagesManual de Parts GTXNicolas RiosNo ratings yet

- 010 Frank Stremaform BRDocument32 pages010 Frank Stremaform BRdiogesodreNo ratings yet

- Attachment Preposition Chart EQL ClassesDocument5 pagesAttachment Preposition Chart EQL ClassesVickey KumarNo ratings yet

- Operations Management by William J. Stevenson 11th Edition Pp. 503Document4 pagesOperations Management by William J. Stevenson 11th Edition Pp. 503JessaNo ratings yet

- International Review of Law and Economics: Rosolino A. Candela, Vincent GelosoDocument13 pagesInternational Review of Law and Economics: Rosolino A. Candela, Vincent GelosoThiviyani SivaguruNo ratings yet

- Road Note 31/ Catalogue MethodDocument29 pagesRoad Note 31/ Catalogue MethodDoughnut Chilli PiNo ratings yet

- Week2 Quiz Revise STAB IIIDocument1 pageWeek2 Quiz Revise STAB IIIRosh AlraisiNo ratings yet

- DWA Oil Gas Glossary PDFDocument35 pagesDWA Oil Gas Glossary PDFPriya ElangoNo ratings yet

- Tube Clamps 2015Document48 pagesTube Clamps 2015Peter DavidsonNo ratings yet

- The - Road - Traffic Act CAP 168Document71 pagesThe - Road - Traffic Act CAP 168Francisco Hagai GeorgeNo ratings yet

- M2 Cars RemovalDocument10 pagesM2 Cars RemovalM2 Cars RemovalsNo ratings yet