Professional Documents

Culture Documents

Treasury

Uploaded by

Alex MuriithiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Treasury

Uploaded by

Alex MuriithiCopyright:

Available Formats

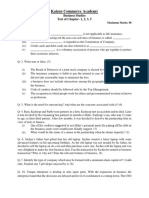

Date: 23-Jul-21

LOCAL NEWS

The Kenya shilling was stable during yesterday’s trading session amid increased activity in the markets.

The pair opened the day at 108.05-35 same as previous sessions close. Demand for the greenback picked

up in yesterday’s session with the energy sector orders trickling in early morning. Flows from money

transfer agents helped support the local unit and the same levels held for the session. USDKES closed the

day at 108.05-35.

CENTRAL BANK RATE (%)

COUNTRY 91-Day 182-Day 364-Day CBR INFLATION

Kenya 6.477 6.955 7.432 7.00 6.32

Uganda 7.18 10.45 11.60 10.00 3.60

Tanzania 2.25 3.23 5.12 7.00 3.30

Rwanda 6.57 6.96 8.21 4.50 7.70

Majors Indicative Cross Rates

Currency Buy Sell Currency Buy Sell

USD/KES 108.10 108.30 GBP/USD 1.3761 1.3764

148.76 149.06

GBP/KES EUR/USD 1.1771 1.1772

127.24 127.49

EUR/KES USD/ZAR 14.7081 14.7363

98.05 98.22

JPY/KES USD/JPY 110.25 110.26

7.34 7.36

ZAR/KES

Regional Currencies Regional Currencies

Currency Buy Sell Currency Buy Sell

KES/UGX 32.68 32.89 USD/UGX 3545.00 3555.00

KES/TZS 21.37 21.50 USD/TZS 2319.00 2324.00

KES/RWF 9.27 9.33 USD/RWF 979.44 999.03

KES/SSP 0.2583 0.3724 USD/SSP 311.99 448.97

INTERNATIONAL NEWS

GBP/USD bottoms out from intraday low surrounding 1.3750 to 1.3764, mostly unchanged ahead of today’s

London open. In doing so, the cable pair struggles to extend the two-day rebound as Brexit jitters join the covid

woes to tame the bulls. Even so, cautious optimism in the markets, coupled with upbeat UK fundamentals, seem

to keep the bulls hopeful ahead of UK Retail Sales and preliminary readings of this month’s Purchasing

Managers' Index (PMIs).

EUR/USD remains pressured around 1.1770, unchanged on a day, heading into today’s European session. The

sellers keep reins following the European Central Bank’s (ECB) bearish bias and amid the covid woes but a

cautious optimism in the market seem to put a floor under the prices ahead of the key activity numbers from

Germany, Eurozone and the US.

OUR PRODUCTS

> Treasury Sales (Forex) > EazzyFx

> Interest Rates > Derivatives and Structured Solutions

CONTACT US

Email: TMU@equitybank.co.ke Tel: 0763 026 944

Disclaimer: Whilst all care has been taken by Equity Bank Limited in the preparation of this newsletter, the Bank does not make any

representations or give any warranties as to their correctness, accuracy or completeness, nor does the Bank assume liability for any losses

arising from errors or omissions in the opinions, forecasts or information given whether such losses be direct, indirect or consequential.

You might also like

- Forex RateDocument1 pageForex RateNayem PoshariNo ratings yet

- Forex RateDocument1 pageForex Rateself sayidNo ratings yet

- Bank Indonesia Closing Rate Code MID Code Code Rate: CloseDocument1 pageBank Indonesia Closing Rate Code MID Code Code Rate: CloseOka PrasetyoNo ratings yet

- EconomyDocument7 pagesEconomypresencabNo ratings yet

- Exchange Rate 07 February 2023Document2 pagesExchange Rate 07 February 2023Faisal MahbubNo ratings yet

- Exchange Rate 06 March 2023Document2 pagesExchange Rate 06 March 2023M Tariqul Islam MishuNo ratings yet

- Forex RateDocument1 pageForex Ratetanvir.arman12No ratings yet

- Monthly FX Outlook: USD Still The King of CurrenciesDocument11 pagesMonthly FX Outlook: USD Still The King of CurrencieszushiiiNo ratings yet

- Exchange Rate 30 January 2023Document1 pageExchange Rate 30 January 2023Intisar reza AbirNo ratings yet

- Daily Exchange Rate 12-May-2022Document1 pageDaily Exchange Rate 12-May-2022Faisal AkhlaqNo ratings yet

- Exchange RateDocument1 pageExchange RateFaisal MahbubNo ratings yet

- Exchange Rate 31 May 2023Document2 pagesExchange Rate 31 May 2023BRTA SCSNo ratings yet

- Exchange Rate 11 January 2024Document2 pagesExchange Rate 11 January 2024nasim1761No ratings yet

- HDFC Bank Treasury Forex Card Rates: Currency Type Currency (In RS.)Document1 pageHDFC Bank Treasury Forex Card Rates: Currency Type Currency (In RS.)tgfamit19No ratings yet

- Currency TT Buying TT SellingDocument2 pagesCurrency TT Buying TT SellingJay BhushanNo ratings yet

- Exchange Rate 16 April 2023Document2 pagesExchange Rate 16 April 2023Shraboni ShormiNo ratings yet

- Exchange RateDocument1 pageExchange RateBRTA SCSNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateJeetNo ratings yet

- Card RateDocument2 pagesCard RateAm JadhavNo ratings yet

- BankhdDocument1 pageBankhdsrikanthbitra1412No ratings yet

- Foreign Exchange Rates Apr 17 2023Document1 pageForeign Exchange Rates Apr 17 2023Winda PradnyaNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateabcdeNo ratings yet

- Exchange Rate 20 December 2022Document2 pagesExchange Rate 20 December 2022Intisar reza AbirNo ratings yet

- Exchange Rate 29 February 2024Document2 pagesExchange Rate 29 February 2024princemilon098No ratings yet

- Exchange Rate 30 January 2024Document2 pagesExchange Rate 30 January 2024mail.bdoaa2022No ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateJeetNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateKhandaker Shefat NoorNo ratings yet

- Exchange Rate 21 March 2024Document2 pagesExchange Rate 21 March 2024jubrajNo ratings yet

- Forexcardratesenglish PDFDocument1 pageForexcardratesenglish PDFAm JadhavNo ratings yet

- Exchange Rate 03 January 2023Document2 pagesExchange Rate 03 January 2023Intisar reza AbirNo ratings yet

- Exchange Rate 22 December 2022Document2 pagesExchange Rate 22 December 2022JsjsNo ratings yet

- Exchange Rate Sheet 04.10.2023Document1 pageExchange Rate Sheet 04.10.2023Badhon RahmanNo ratings yet

- Exchange Rate 13 January, 2019Document2 pagesExchange Rate 13 January, 2019Hoque AnamulNo ratings yet

- Dubakoor 1Document1 pageDubakoor 1Am JadhavNo ratings yet

- Total Strength USD EUR GBP CHF CAD AUD 3.5 5.6 3.3 6.3 5.0 5.5Document5 pagesTotal Strength USD EUR GBP CHF CAD AUD 3.5 5.6 3.3 6.3 5.0 5.5revolutionaryonesNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateMAHMUDUR RAHMANNo ratings yet

- Exchange RateDocument1 pageExchange Rateaacustomerservice.coNo ratings yet

- Forex RateDocument1 pageForex Ratenasim1761No ratings yet

- Foreign Exchange Rates 18 Jan 24Document1 pageForeign Exchange Rates 18 Jan 24Social ShoutNo ratings yet

- NBP RateSheet 01 09 2023Document1 pageNBP RateSheet 01 09 2023Zaryab AliNo ratings yet

- LK Exchange RateDocument1 pageLK Exchange RateCaine RodrigoNo ratings yet

- NBP RateSheet 03 04 2023Document1 pageNBP RateSheet 03 04 2023Awais AslamNo ratings yet

- FX Rates Sheet Treasury & Capital Markets Group: Ready Transaction Rates Indicative FBP RatesDocument1 pageFX Rates Sheet Treasury & Capital Markets Group: Ready Transaction Rates Indicative FBP RatesUmair AhmedNo ratings yet

- Rates For Gov't 28.12.2021Document1 pageRates For Gov't 28.12.2021Jude MulindwaNo ratings yet

- Exc Rate As On Aug 01, 2023Document1 pageExc Rate As On Aug 01, 2023kutyranisNo ratings yet

- Daily Exchange Rate Sheet 18-02-2024 - 1708228292Document1 pageDaily Exchange Rate Sheet 18-02-2024 - 1708228292Abid HossainNo ratings yet

- Bill Buying Rates Per Unit of Currency: Treasury & Capital Markets GroupDocument1 pageBill Buying Rates Per Unit of Currency: Treasury & Capital Markets GroupFaizanNo ratings yet

- Bill Buying Rates Per Unit of Currency: Treasury & Capital Markets GroupDocument1 pageBill Buying Rates Per Unit of Currency: Treasury & Capital Markets GroupFaizanNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RatedustbinNo ratings yet

- Exchange RateDocument1 pageExchange RateAli Hossen VoltaNo ratings yet

- Exchange Rate 08 September 2022Document2 pagesExchange Rate 08 September 2022Md. Shahriar Mahmud RakibNo ratings yet

- FX Rates Sheet Treasury & Capital Markets Group: Ready Transaction Rates Indicative FBP RatesDocument1 pageFX Rates Sheet Treasury & Capital Markets Group: Ready Transaction Rates Indicative FBP Ratescallraza19No ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateVikinguddin AhmedNo ratings yet

- Exchange Rate 23 October 2022Document2 pagesExchange Rate 23 October 2022JsjsNo ratings yet

- Exchange Rate 05 September 2023Document2 pagesExchange Rate 05 September 2023Ziauddin AhmedNo ratings yet

- HDFC Bank Treasury Forex Card Rates: Date: 26/03/2019 TimeDocument1 pageHDFC Bank Treasury Forex Card Rates: Date: 26/03/2019 Timekang_warsadNo ratings yet

- Best Time To Trade The Forex MarketDocument1 pageBest Time To Trade The Forex Marketkang_warsadNo ratings yet

- Finanzas - 1Document19 pagesFinanzas - 1CHAVEZ CABANILLAS LIZBETH JAQUELINNo ratings yet

- Sample Literature Review PDFDocument5 pagesSample Literature Review PDFRidhwan RahmanNo ratings yet

- Fees-Statement-EAAE 02736 2019Document2 pagesFees-Statement-EAAE 02736 2019Alex MuriithiNo ratings yet

- Lectures No4-472-2008Document13 pagesLectures No4-472-2008Alex MuriithiNo ratings yet

- Pen SetsDocument1 pagePen SetsAlex MuriithiNo ratings yet

- Pen SetsDocument1 pagePen SetsAlex MuriithiNo ratings yet

- India Road Network The Second Largest Road NetworkDocument19 pagesIndia Road Network The Second Largest Road NetworkKushal rajNo ratings yet

- Business Listing SitesDocument8 pagesBusiness Listing SitesMuhammad UmerNo ratings yet

- Aging PopulationDocument2 pagesAging PopulationquynhhueNo ratings yet

- Test Bank For Principles of Macroeconomics 5th Edition N Gregory MankiwDocument3 pagesTest Bank For Principles of Macroeconomics 5th Edition N Gregory MankiwMarlys Campbell100% (29)

- CET Analysis of SamsungDocument9 pagesCET Analysis of SamsungMj PayalNo ratings yet

- BES4-Assignment 3Document2 pagesBES4-Assignment 3look porrNo ratings yet

- Ceramic Tiles - Official Gazette 27 (10234)Document16 pagesCeramic Tiles - Official Gazette 27 (10234)NajeebNo ratings yet

- Invitation To Bid: Dvertisement ArticularsDocument2 pagesInvitation To Bid: Dvertisement ArticularsBDO3 3J SolutionsNo ratings yet

- BARC CertificationDocument1 pageBARC CertificationsPringShock100% (6)

- Downtown Design ExhibitorsDocument21 pagesDowntown Design ExhibitorsIan DañgananNo ratings yet

- WWW - Referat.ro England5093366fDocument13 pagesWWW - Referat.ro England5093366fJoanne LeeNo ratings yet

- Principles of Effective Governance ECOSOCDocument3 pagesPrinciples of Effective Governance ECOSOCIsabella RamiaNo ratings yet

- Presentation - Sacli 2018Document10 pagesPresentation - Sacli 2018Marius OosthuizenNo ratings yet

- Gender Wise Classification of RespondentsDocument34 pagesGender Wise Classification of Respondentspavith ranNo ratings yet

- Digital Transformation A Road-Map For Billion-Dollar OrganizationsDocument68 pagesDigital Transformation A Road-Map For Billion-Dollar OrganizationsApurv YadavNo ratings yet

- Nama Peserta BPPDocument53 pagesNama Peserta BPPInge Syahla KearyNo ratings yet

- Immigration To CanadaDocument2 pagesImmigration To Canadaapi-361579456No ratings yet

- Resume of SirducdinhDocument1 pageResume of Sirducdinhapi-25690844No ratings yet

- A Very Brief History of Perfect CompetitionDocument14 pagesA Very Brief History of Perfect CompetitionPaul WalkerNo ratings yet

- Price and Output Determination Under Monopoly MarketDocument16 pagesPrice and Output Determination Under Monopoly MarketManak Ram SingariyaNo ratings yet

- Business StudiesDocument2 pagesBusiness StudiesSonal JhaNo ratings yet

- Jun 16 Bill-AnandDocument1 pageJun 16 Bill-AnandanandNo ratings yet

- Thesis Chapter 1Document5 pagesThesis Chapter 1Erialc SomarNo ratings yet

- 2013b Blanchard Latvia CrisisDocument64 pages2013b Blanchard Latvia CrisisrajaytNo ratings yet

- WEG India Staff Contact Numbers PDFDocument10 pagesWEG India Staff Contact Numbers PDFM.DINESH KUMARNo ratings yet

- Global Batrch 11Document57 pagesGlobal Batrch 11mohanNo ratings yet

- Liebherr Annual-Report 2017 en Klein PDFDocument82 pagesLiebherr Annual-Report 2017 en Klein PDFPradeep AdsareNo ratings yet

- I. Convertible Currencies With Bangko Sentral:: Run Date/timeDocument1 pageI. Convertible Currencies With Bangko Sentral:: Run Date/timeLucito FalloriaNo ratings yet

- Game Theory (2) - Mechanism Design With TransfersDocument60 pagesGame Theory (2) - Mechanism Design With Transfersjm15yNo ratings yet

- H1 / H2 Model Economics Essay (SAMPLE MICROECONOMICS QUESTION)Document2 pagesH1 / H2 Model Economics Essay (SAMPLE MICROECONOMICS QUESTION)ohyeajcrocksNo ratings yet