Professional Documents

Culture Documents

Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, Bengaluru

Uploaded by

2020MSM022 NilabjaSahaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, Bengaluru

Uploaded by

2020MSM022 NilabjaSahaCopyright:

Available Formats

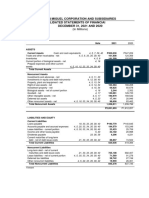

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment Year

2021-22

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 filed and verified]

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN ASZPS9972Q

Name SUTAPA SAHA

Address 11/1 , VIVEKANANDA ROAD, Piarapur (P) , HOOGHLY, Sheoraphuli S.O, 32-West Bengal, 91-India , 712223

Status Individual Form Number ITR-1

Filed u/s 139(1)Return filed on or before due date e-Filing Acknowledgement Number 219948170310721

Current Year business loss, if any 1 0

Total Income 1,50,050

TaxableIncome and Tax details

Book Profit under MAT, where applicable 2 0

Adjusted Total Income under AMT, where applicable 3 0

Net tax payable 4 0

Interest and Fee Payable 5 0

Total tax, interest and Fee payable 6 0

Taxes Paid 7 10,697

(+)Tax Payable /(-)Refundable (6-7) 8

Dividend Tax Payable 9 0

Interest Payable 10 0

DistributionTax details

Total Dividend tax and interest payable 11 0

Taxes Paid 12 0

(+)Tax Payable /(-)Refundable (11-12) 13 0

Accreted Income as per section 115TD 14 0

AccretedIncome & Tax Detail

Additional Tax payable u/s 115TD 15 0

Interest payable u/s 115TE 16 0

Additional Tax and interest payable 17 0

Tax and interest paid 18 0

(+)Tax Payable /(-)Refundable (17-18) 19 0

Income Tax Return submitted electronically on 31-07-2021 23:25:32 from IP address 116.193.129.201 and verified by SUTAPA SAHA having PAN ASZPS9972Q on 31-Jul-2021 using * paper ITR-Verification

Form /Electronic Verification Code CULX33HJ9I generated through Digital mode

System Generated Barcode/QR Code

* Strike of whichever is not applicable

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Economic Development MCQS PDFDocument49 pagesEconomic Development MCQS PDFYousuf Aboya100% (1)

- Case Study - Destin Brass Products CoDocument6 pagesCase Study - Destin Brass Products CoMISRET 2018 IEI JSCNo ratings yet

- Indian Income Tax Return: Part A General InformationDocument5 pagesIndian Income Tax Return: Part A General Information2020MSM022 NilabjaSahaNo ratings yet

- Cbse - All India Engineering - Architecture Entrance Examination 2011Document1 pageCbse - All India Engineering - Architecture Entrance Examination 20112020MSM022 NilabjaSahaNo ratings yet

- ISI M. Tech CRS Admit CardDocument1 pageISI M. Tech CRS Admit Card2020MSM022 NilabjaSahaNo ratings yet

- Login ID: 2631000804 Password: 87232051 DATE OF EXAMINATION: 31/07/19 Wednesday Reporting Time: 10:30 AMDocument2 pagesLogin ID: 2631000804 Password: 87232051 DATE OF EXAMINATION: 31/07/19 Wednesday Reporting Time: 10:30 AM2020MSM022 NilabjaSahaNo ratings yet

- (SSC CGL 2019 Result) PrintDocument1 page(SSC CGL 2019 Result) Print2020MSM022 NilabjaSahaNo ratings yet

- (SSC CGL 2018 Result Raw and Normalisation Marks From RTI) PrintDocument1 page(SSC CGL 2018 Result Raw and Normalisation Marks From RTI) Print2020MSM022 NilabjaSahaNo ratings yet

- Impact of Socioeconomic Factors On The Saving Culture in Muranga CountyDocument51 pagesImpact of Socioeconomic Factors On The Saving Culture in Muranga CountyjamesNo ratings yet

- Lab 3-1 Adaptive Solutions Online Eight-Year Financial Projection - WilliamsDocument2 pagesLab 3-1 Adaptive Solutions Online Eight-Year Financial Projection - WilliamsJack WestNo ratings yet

- Economic Development Key To Poverty AssigmentDocument7 pagesEconomic Development Key To Poverty AssigmentNighat PervezNo ratings yet

- Cfas PetaDocument13 pagesCfas PetaSamantha AzueloNo ratings yet

- Chap3 - Benefits, Costs, and DecisionsDocument10 pagesChap3 - Benefits, Costs, and DecisionsAnthony DyNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Personal Finance ModuleDocument19 pagesPersonal Finance ModuleBianca CoNo ratings yet

- Comparison Chart of Thrift, Rural and Cooperative Banks and Nssla Thrift Banks Rural Banks Cooperative Banks NsslasDocument1 pageComparison Chart of Thrift, Rural and Cooperative Banks and Nssla Thrift Banks Rural Banks Cooperative Banks NsslasReginald Matt Aquino SantiagoNo ratings yet

- ArthaYantra Buy vs. Rent Score (ABRS) - ChennaiDocument24 pagesArthaYantra Buy vs. Rent Score (ABRS) - ChennaiArthaYantraNo ratings yet

- Income Tax Quiz 3 and Quiz 4 Answers PDFDocument32 pagesIncome Tax Quiz 3 and Quiz 4 Answers PDFJeda UsonNo ratings yet

- Transfer To Benefit of Unborn Child Section 13-20: Submitted To: D.R. Nisha JindalDocument25 pagesTransfer To Benefit of Unborn Child Section 13-20: Submitted To: D.R. Nisha JindalriyaNo ratings yet

- RWANDA National Savings Mobilization StrategyDocument72 pagesRWANDA National Savings Mobilization Strategygodwin SemunyuNo ratings yet

- Week 7Document16 pagesWeek 7Hannah Rae ChingNo ratings yet

- Gr12 - Eco - Ch2 - National Income Accounting - 230419 - 153117Document163 pagesGr12 - Eco - Ch2 - National Income Accounting - 230419 - 153117Dudes GamerNo ratings yet

- Longoria Inez (115) $999.25 Wed Oct 28 19 08 00 EDT 2020Document1 pageLongoria Inez (115) $999.25 Wed Oct 28 19 08 00 EDT 2020nelson menaNo ratings yet

- Tax Planning Strategies and Financial Performance of Listed Deposit Money Banks in NigeriaDocument13 pagesTax Planning Strategies and Financial Performance of Listed Deposit Money Banks in NigeriaEditor IJTSRDNo ratings yet

- GEA Chapter6 Economy HiresDocument37 pagesGEA Chapter6 Economy HiresMike LassaNo ratings yet

- DocumentDocument7 pagesDocumentWayne GodioNo ratings yet

- Pag-Ibig MP2 SavingsDocument15 pagesPag-Ibig MP2 SavingsblehNo ratings yet

- Financial AccountingDocument135 pagesFinancial AccountingAkshita Jain100% (1)

- Mas-07: Responsibility Accounting & Transfer PricingDocument7 pagesMas-07: Responsibility Accounting & Transfer PricingClint AbenojaNo ratings yet

- Chapter 03 STDocument27 pagesChapter 03 STHoàng KhôiNo ratings yet

- Horizontal Analaysis GLOBEDocument2 pagesHorizontal Analaysis GLOBEjerameelnacalaban1No ratings yet

- Section C:-Essay Questions: Q. Differentiate Between Economies of Scale and Diseconomies of ScaleDocument6 pagesSection C:-Essay Questions: Q. Differentiate Between Economies of Scale and Diseconomies of ScaleIqa IsyiqaNo ratings yet

- Thermodynamics Equation 1Document36 pagesThermodynamics Equation 1RawlinsonNo ratings yet

- Deloitte - EVM Overview EGADEDocument23 pagesDeloitte - EVM Overview EGADEAlejandro BravoNo ratings yet

- Calculate Taxes, Fees and ChargesDocument81 pagesCalculate Taxes, Fees and ChargesrameNo ratings yet

- Gross IncomeDocument21 pagesGross IncomeRey ViloriaNo ratings yet