Professional Documents

Culture Documents

BS 140 Classwork Seven

Uploaded by

YvonneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BS 140 Classwork Seven

Uploaded by

YvonneCopyright:

Available Formats

1

THE COPPERBELT UNIVERSITY

SCHOOL OF BUSSINESS

BS/BF/BSP/BEC/HRM/BIS 140 Mathematical Analysis

-

ACADEMIC YEAR 2020 - 2021

WORKSHEET SEVEN

FINANCIAL MATHEMATICS

Annuities

EXAMPLE ONE

1

Find the present value of an annuity of K500 per month for 3 years at an

2

interest rate of 28% compounded monthly.

EXAMPLE TWO

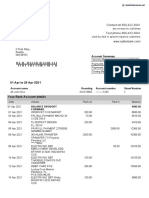

A savings and loans offers the two accounts shown in the table. Find the

effective rates

Annual rate Compounding Effective rate

Now account 7.2% Quarterly

Money market 6.9% monthly

Tailoka Frank Patson Mathematical Analysis Academic Year 2020 - 2021

2

EXAMPLE THREE

Given an interest rate of 5% compounded annually, find the present value

of the following annuity: K2 000 due at the end of each year for 3 years,

and K5 000 due thereafter at the end of each year for 4 years.

EXAMPLE FOUR

If K10 000 is used to purchase an annuity consisting of equal payments at

the end of each year for the next 4 years and the interest rate is 6%

compounded annually. Find the amount of each payment.

EXAMPLE FIVE

The premiums on an insurance policy are K175 a quarter, payable at the

beginning of each quarter. If the policyholder wishes to pay 1 years

premium in advance, how much should be paid provided that the interest

rate is 5% compounded quarterly.

EXAMPLE SIX

Find the amount of an annuity consisting of payments K175 at the end of

every 3 months for three years at the rate of 21% compounded quarterly.

Also find the compound interest.

EXAMPLE SEVEN

At the beginning of each quarter, K175 is deposited into a savings account

that pays 21% compounded quarterly. Find the balance in the account at

the end of 3 years.

Tailoka Frank Patson Mathematical Analysis Academic Year 2020 - 2021

3

EXAMPLE EIGHT

A city has a debt of K 1 000 000 due in 15 years. How much money must it

deposit at the end of each half year into a sinking fund at 4% interest

compounded semiannually in order to pay off the debt.

EXAMPLE NINE

The Mumbi family takes a 15- year mortgage of K2 000 000 for their new

home, at 10.8%, compounded monthly.

(a) Find their monthly payments

(b) Find the total of their payments over the full term.

EXAMPLE TEN

Construct a schedule for amortization of a debt of K10 000 with interest of

6.5% by 5 equal payments.

Tailoka Frank Patson Mathematical Analysis Academic Year 2020 - 2021

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- LECTURE 7 - Asset - Liability ManagementDocument19 pagesLECTURE 7 - Asset - Liability ManagementYvonneNo ratings yet

- Lecture 4 - Syndicated - LoansDocument12 pagesLecture 4 - Syndicated - LoansYvonneNo ratings yet

- LECTURE 8 - Mergers - AcquisitionDocument34 pagesLECTURE 8 - Mergers - AcquisitionYvonneNo ratings yet

- LECTURE 1 - IntroductionDocument11 pagesLECTURE 1 - IntroductionEmmanuel MwapeNo ratings yet

- Lecture 5 - Banker AcceptancesDocument14 pagesLecture 5 - Banker AcceptancesYvonneNo ratings yet

- BS 140 Classwork Twelve 2020 - 2021-1Document4 pagesBS 140 Classwork Twelve 2020 - 2021-1YvonneNo ratings yet

- Lecture 2 - Financial MKTSDocument18 pagesLecture 2 - Financial MKTSEmmanuel MwapeNo ratings yet

- Lecture 6 - Cash ManagementDocument14 pagesLecture 6 - Cash ManagementYvonneNo ratings yet

- BS 140 Classwwork Eleven 2020 - 2021Document2 pagesBS 140 Classwwork Eleven 2020 - 2021YvonneNo ratings yet

- Lecture 3 - Loans - AdvancesDocument16 pagesLecture 3 - Loans - AdvancesYvonneNo ratings yet

- BS 140 Classwork Two 2020 - 2021-1Document2 pagesBS 140 Classwork Two 2020 - 2021-1YvonneNo ratings yet

- BS 140 Classwork Nine 2020 - 2021Document1 pageBS 140 Classwork Nine 2020 - 2021YvonneNo ratings yet

- BS 140 Classwork Two 2020 - 2021Document2 pagesBS 140 Classwork Two 2020 - 2021YvonneNo ratings yet

- BS 140 Classwork Thirteen 2020 - 2021Document4 pagesBS 140 Classwork Thirteen 2020 - 2021YvonneNo ratings yet

- BS 140 Classwork Twelve 2020 - 2021Document4 pagesBS 140 Classwork Twelve 2020 - 2021YvonneNo ratings yet

- BS 140 Classwork Five 2020 - 2021Document3 pagesBS 140 Classwork Five 2020 - 2021YvonneNo ratings yet

- BS 140 Classwork Four 2020 - 2021Document3 pagesBS 140 Classwork Four 2020 - 2021YvonneNo ratings yet

- BS 140 Classwork 2020 - 2021Document2 pagesBS 140 Classwork 2020 - 2021YvonneNo ratings yet

- BS 140 Classwork Ten 2020 - 2021Document2 pagesBS 140 Classwork Ten 2020 - 2021YvonneNo ratings yet

- BS 140 Classwork Six 2020 - 2021Document4 pagesBS 140 Classwork Six 2020 - 2021YvonneNo ratings yet

- End of Chapter Exercises - Answers: Chapter 18: Spot and Forward MarketsDocument4 pagesEnd of Chapter Exercises - Answers: Chapter 18: Spot and Forward MarketsYvonneNo ratings yet

- End of Chapter Exercises - AnswersDocument3 pagesEnd of Chapter Exercises - AnswersYvonneNo ratings yet

- BS 140 Classwork Six 2020 - 2021Document4 pagesBS 140 Classwork Six 2020 - 2021YvonneNo ratings yet

- BS 140 Classwork Eight 2020 - 2021Document3 pagesBS 140 Classwork Eight 2020 - 2021YvonneNo ratings yet

- Answers CH14Document5 pagesAnswers CH14daongocphapNo ratings yet

- End of Chapter Exercises - AnswersDocument3 pagesEnd of Chapter Exercises - AnswersYvonneNo ratings yet

- End of Chapter Exercises - Answers: Chapter 16: Predicting Stock ReturnsDocument2 pagesEnd of Chapter Exercises - Answers: Chapter 16: Predicting Stock ReturnsYvonneNo ratings yet

- End of Chapter Exercises - Answers: Chapter 2: Markets and PlayersDocument2 pagesEnd of Chapter Exercises - Answers: Chapter 2: Markets and PlayersYvonneNo ratings yet

- Answers CH21Document5 pagesAnswers CH21TodweNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Extras de Cont: Data Document Contra Parte Cod Fiscal Contraparte Debit (MDL) Credit (MDL)Document1 pageExtras de Cont: Data Document Contra Parte Cod Fiscal Contraparte Debit (MDL) Credit (MDL)Sasa VieruNo ratings yet

- Metrobank-OTC Payment of Fee (Aug20)Document1 pageMetrobank-OTC Payment of Fee (Aug20)CJ SorianoNo ratings yet

- Notes On The Overview of Money Market SecuritiesDocument2 pagesNotes On The Overview of Money Market SecuritiesjeanneNo ratings yet

- 2012 UCPB Annual ReportDocument81 pages2012 UCPB Annual ReportPat Dela CruzNo ratings yet

- JPMorgan Chase Mortgage Settlement DocumentsDocument291 pagesJPMorgan Chase Mortgage Settlement DocumentsFindLaw100% (2)

- Mathematics With Applications in The Management Natural and Social Sciences 11th Edition Lial Solutions Manual DownloadDocument77 pagesMathematics With Applications in The Management Natural and Social Sciences 11th Edition Lial Solutions Manual DownloadJames McclendonNo ratings yet

- Bank account details and contact infoDocument2 pagesBank account details and contact infoNadiia AvetisianNo ratings yet

- Sme BookDocument397 pagesSme BookVivek Godgift J0% (1)

- Calculate Future and Present Values of InvestmentsDocument12 pagesCalculate Future and Present Values of InvestmentsAzman Scx100% (1)

- What Is Wholesale Banking ?Document10 pagesWhat Is Wholesale Banking ?Anonymous So5qPSnNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsKiran SNo ratings yet

- Application Form - Supplementary Exam, June-2020Document4 pagesApplication Form - Supplementary Exam, June-2020Prakash KumarNo ratings yet

- Renewal Premium Receipt: Benefit Opted For Tax Benefit Available Under The Income Tax Act, Premium PayableDocument1 pageRenewal Premium Receipt: Benefit Opted For Tax Benefit Available Under The Income Tax Act, Premium PayableAmit MishraNo ratings yet

- Direct Deposit FormDocument2 pagesDirect Deposit FormCherylBalazsNo ratings yet

- ECN 111 Chapter 12 Lecture Notes: 12.1 How Banks Create MoneyDocument2 pagesECN 111 Chapter 12 Lecture Notes: 12.1 How Banks Create MoneyShivendu AnandNo ratings yet

- Negotiable Instrument: Private International LawDocument20 pagesNegotiable Instrument: Private International LawAnkita SinhaNo ratings yet

- A Study On Mobilization of Deposit and Investment of Nabil Bank LTDDocument68 pagesA Study On Mobilization of Deposit and Investment of Nabil Bank LTDPadamNo ratings yet

- Img 0001Document1 pageImg 0001Austin VaughanNo ratings yet

- SSO 1plusDocument1 pageSSO 1plusashuNo ratings yet

- Internship Report On National Bank of Pakistan (NBP)Document41 pagesInternship Report On National Bank of Pakistan (NBP)Saad KhanNo ratings yet

- No. Akun Nama Tipe Mata UangDocument5 pagesNo. Akun Nama Tipe Mata Uangbunga engeline br siagianNo ratings yet

- JP Morgan Chase & Co History, Products, WorkforceDocument15 pagesJP Morgan Chase & Co History, Products, WorkforceAjeet YadavNo ratings yet

- The Impact of Covid in The Banking SectorDocument18 pagesThe Impact of Covid in The Banking SectorAbenezer BirhanuNo ratings yet

- UVAS Cash Voucher Payment DetailsDocument2 pagesUVAS Cash Voucher Payment DetailsNaeem ur rehmanNo ratings yet

- GPF Calculator 2.4Document19 pagesGPF Calculator 2.4Vageesha Shantha Veerabhadra SwamyNo ratings yet

- Institution Collects Funds Public Financial Assets Deposits Loans Bonds Tangible PropertyDocument4 pagesInstitution Collects Funds Public Financial Assets Deposits Loans Bonds Tangible PropertyDibakar DasNo ratings yet

- Unit Test: The Accounting Cycle Part A: Completing The Accounting CycleDocument7 pagesUnit Test: The Accounting Cycle Part A: Completing The Accounting CycleKevin PanesarNo ratings yet

- AgendaDocument3 pagesAgendaashish srivastavaNo ratings yet

- Rupali Bank StatementDocument1 pageRupali Bank Statementbengal timesNo ratings yet

- History of State Bank of IndiaDocument29 pagesHistory of State Bank of IndiaDiksha SadanaNo ratings yet