Professional Documents

Culture Documents

Investment Management Min

Uploaded by

Abhishek DA0 ratings0% found this document useful (0 votes)

4 views2 pagesIM

Original Title

Investment-Management-min (2)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIM

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesInvestment Management Min

Uploaded by

Abhishek DAIM

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

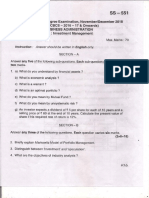

(AE SN - 537

V Semester B.B.A. Degree Examination, Nov/Dec. 2017

(F+R) (CBCS) (2016-17 and Onwards)

BUSINESS ADMINISTRATION

5.3 : Investment Management

Time : 3 Hours Max, Marks : 70

Instruction: Answers should be written in English only.

SECTION—A

Answer any five of the following sub-questions. Each sub-question carries

‘two marks, (8x2=10)

1. a) Whatis Beta of a Stock ?

b) Give the meaning of Risk.

¢) Define portfolio.

d) Give the meaning of ‘Mutual Funds’.

e) Expand FCCB.

1) What do you mean by Capital Gain ?

9) Mention any four Mutual Fund Companies in India.

SECTION-B

Answerany three of the following questions. Each question carries sixmarks. (3x6=18)

Briefly explain ADR's.

eB

3. Explain company analysis under Fundamental Analysis of securities.

4. Briefly explain Markowitz Model of portfolio management.

5.

Write a short note on :

a) Options

b) Futures and

¢) Forwards. PTO.

SN-537 {Ea

6. From the following details, compute expected rate of returns.

Situation Probability Returns (%)

Inflation 04 8

Deflation 03 6

Normal 0.3 #

SECTION-C

Answerany three of the following questions. Each question carries fourteen marks.

(3x14=42)

7. Explain the different types of risks in detail.

8. Explain the capital market instruments.

9. Whatis technical analysis ? Explain.

10. Explain security selection process in detail.

11. From the following information calculate

a) Expected rate of returns and

b) Risk in terms of standard deviation.

Returns (%) Probability

0 0.25

32 0.18

2B 0.22

2 0.17

24 0.18

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Investment Management MinDocument2 pagesInvestment Management MinAbhishek DANo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- EM Solved QPDocument37 pagesEM Solved QPAbhishek DANo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- VI SEM B.B.M Subject BRAND MANAGEMENTDocument42 pagesVI SEM B.B.M Subject BRAND MANAGEMENTAbhishek DANo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Computer Application in Business MinDocument2 pagesComputer Application in Business MinAbhishek DANo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Anil Kumar-13Document2 pagesAnil Kumar-13Abhishek DANo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Bengaluru North University: Exam Application FormDocument1 pageBengaluru North University: Exam Application FormAbhishek DANo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 04 - Assignment (17.06.2021) - Question PaperDocument4 pages04 - Assignment (17.06.2021) - Question PaperAbhishek DANo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Kyc - Customer Profile FormDocument1 pageKyc - Customer Profile FormAbhishek DANo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 03 - Assignment (16.06.2021) - Keys & SolutionsDocument2 pages03 - Assignment (16.06.2021) - Keys & SolutionsAbhishek DANo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Abhishek DaDocument1 pageAbhishek DaAbhishek DANo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)