Professional Documents

Culture Documents

Translation Adjustment OCI - Prac Prob

Uploaded by

Jasper Andrew AdjaraniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Translation Adjustment OCI - Prac Prob

Uploaded by

Jasper Andrew AdjaraniCopyright:

Available Formats

Foreign Currency Accounting - Translation of Financial Statements of Foreign Subsidiaries / Associates

Basic rules:

Assets and liabilities are translated using the closing rate.

Income and expenses (i.e. net income or loss) are translated using the average rate.

Equity or net assets (i.e. issuance of shares, dividends declared) are translated using the historical or

transaction rate.

Total assets at closing rate (Assets in FCU x closing rate) xxx

Total liabilities at closing rate (Liabilities in FCU x closing rate) (xxx)

Net assets at closing rate (a) xxx

Net assets, beginning at historical rate (Equity in FCU x historical rate) xxx

Net income (loss) for the year at average rate (Net income in FCU x average rate) xxx/(xxx)

Issuance of new capital at transaction rate (Issuance in FCU x transaction rate) xxx

Dividends issued at transaction rate (Dividends in FCU x transaction rate) (xxx)

Net assets, ending xxx

Net assets, at closing rate (a) (xxx)

Translation adjustment – OCI gain or loss (balancing figure or squeeze) xxx

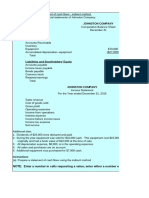

Sample problem:

On January 1, 2010 XYZ Corporation organized Avenue Company as a wholly-owned subsidiary in Hongkong with an

initial investment cost of HK$90,000. Avenue’s December 31, 2010, trial balance in HK$ is as follows:

Debit Credit

Cash HK$ 10,500

Accounts receivable (net) 30,000

Receivable from XYZ 7,500

Inventory 37,500

Plant and equipment 150,000

Accumulated depreciation HK$ 15,000

Accounts payable 18,000

Bonds payable 75,000

Common stock 90,000

Sales 225,000

Cost of goods sold 105,000

Depreciation expense 15,000

Operating expense 45,000

Dividends paid 22,500

Total HK$ 423.000 HKS423.000

Additional information:

1. Purchases of inventory goods are made evenly during the year. Items in the ending inventory were purchased

November 1.

2. Equipment is depreciated by the straight-line method with a 10-year life and no residual value. A full year’s

depreciation is taken in the year of acquisition. The equipment was acquired on March 1.

3. The dividends were declared and paid on November 1.

4. Exchanges rates were as follows:

January 1 HK$1 = P3.30

March 1 HK$1 = 3.40

November 1 HK$1 = 3.70

December 31 HK$1 = 3.00

2010 Average HK$1 = 3.50

Full and Partial ownership (with hedging):

ABC Corporation has an equity investment in a Company in Singapore, NS Company. On December 31, 2009, the

balance in ABC’s Investment in NS account is P945,000, equal to 30% of NS’s net assets of 75,000 Singapore Dollars

times a P42 year-end exchange rate. On this date, ABC has no adjustment balance relative to its investment in NS.

Assume that on November 2, 2.010, NS declares and pays a 3,750 Singapore Dollars dividend, when the spot rate is

P43.50. On December 31, 2010, P reports net income of 15,000 Singapore dollars. The weighted average exchange

rate for the year 2010 is P43, and the closing exchange rate on December 31, 2010 is P44. As a result of the hedging,

how much is the translation adjustment that will appear in the stockholders’ equity section of the balance sheet of ABC

Corporation on December 31, 2010, assuming ABC Corporation owns:

a. 100% of the Singaporean Company

b. 30% of the Singaporean Company

c. 30% of the Singaporean Company, but to hedge its net investment in NS, ABC borrows 18,750 Singapore Dollars

for one year at 12% interest on January 1, 2010 at a spot rate of P42. The loan is denominated in Singapore

Dollars, with principal and interest payable on January 1, 2011.

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Use The Following Information For The Next Three Questions:: Activity 3.2Document2 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Tine Vasiana DuermeNo ratings yet

- Intercompany Sale of PropertyDocument6 pagesIntercompany Sale of PropertyClauie BarsNo ratings yet

- Use The Following Information For The Next Three Questions:: Activity 3.2Document11 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Jade jade jadeNo ratings yet

- Mas DocumentsDocument12 pagesMas DocumentsLorie Grace LagunaNo ratings yet

- Chap 15Document17 pagesChap 15pdmallari12No ratings yet

- Mojks Uas 2010 GasalDocument13 pagesMojks Uas 2010 GasalHayyin Nur AdisaNo ratings yet

- Chapter 15: Single Entry Characteristics of Single EntryDocument12 pagesChapter 15: Single Entry Characteristics of Single EntryPaula Bautista100% (2)

- Bengal CorporationDocument2 pagesBengal CorporationTowhidul IslamNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Practice Set P2 Transalation in Not and in Hyperinflationary Economy PDFDocument3 pagesPractice Set P2 Transalation in Not and in Hyperinflationary Economy PDFPUNK BEARNo ratings yet

- Papaya Corp. - Hyperninflation Wala Pang Solution PDFDocument3 pagesPapaya Corp. - Hyperninflation Wala Pang Solution PDFLoremar Ellen Dacumos HalogNo ratings yet

- Assets: Aditional InformationDocument16 pagesAssets: Aditional Informationleeyaa aNo ratings yet

- NIIF 9 Ejercicios EspanolDocument21 pagesNIIF 9 Ejercicios EspanolVicenteMoralesLeRoyNo ratings yet

- CH 17Document6 pagesCH 17Rabie HarounNo ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Tutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityDocument5 pagesTutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- 2018-12 ICMAB FL 001 PAC Year Question December 2018Document3 pages2018-12 ICMAB FL 001 PAC Year Question December 2018Mohammad ShahidNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- CH 07 PPTsDocument30 pagesCH 07 PPTsAfifan Ahmad FaisalNo ratings yet

- Solman ch21 DayagDocument6 pagesSolman ch21 DayagMayeth BotinNo ratings yet

- Current Cost AccountingDocument23 pagesCurrent Cost AccountingToni Rose Hernandez Lualhati0% (1)

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- Financial Management 1 ProblemsDocument12 pagesFinancial Management 1 ProblemsXytusNo ratings yet

- Financial StatementDocument48 pagesFinancial StatementPhan Hải YếnNo ratings yet

- Chapter 13 (4) Additional QuestionDocument2 pagesChapter 13 (4) Additional QuestionJason BickertNo ratings yet

- Part 10 Foreign TranslationDocument3 pagesPart 10 Foreign TranslationKathlene BalicoNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Garing, Aireen - Sa No.13 Statement of CashflowsDocument3 pagesGaring, Aireen - Sa No.13 Statement of CashflowsAireen GaringNo ratings yet

- Section A - CASE QUESTIONS (Total: 50 Marks)Document9 pagesSection A - CASE QUESTIONS (Total: 50 Marks)Vong Yu Kwan EdwinNo ratings yet

- Consolidated Financial Statements - Foreign CurrencyDocument18 pagesConsolidated Financial Statements - Foreign CurrencyTaffy Isheanesu BgoniNo ratings yet

- 2020 Spring Midterm II A AnsKey PDFDocument12 pages2020 Spring Midterm II A AnsKey PDFEunice GuoNo ratings yet

- Kasus Chapter 2-AnswerDocument3 pagesKasus Chapter 2-Answermadesugandhi100% (1)

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- HW GPFS Answer PDFDocument4 pagesHW GPFS Answer PDFalyssaNo ratings yet

- Written AssignmentDocument11 pagesWritten AssignmentJoseph KamaraNo ratings yet

- Advanced Class NotesDocument32 pagesAdvanced Class NotesShiela LlenaNo ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- CH 05Document10 pagesCH 05Antonios Fahed0% (1)

- Notes For Ratios: Accounting Principles AssetsDocument14 pagesNotes For Ratios: Accounting Principles AssetsSudhanshu MathurNo ratings yet

- Week 4 PDF FreeDocument5 pagesWeek 4 PDF FreeM. Gibran KhalilNo ratings yet

- Financial Statements Analysis - Ratio AnalysisDocument44 pagesFinancial Statements Analysis - Ratio AnalysisDipanjan SenguptaNo ratings yet

- ABC FinancialPosition1Document4 pagesABC FinancialPosition1paulineNo ratings yet

- Profit For The Year PHP 3,061,500.00Document4 pagesProfit For The Year PHP 3,061,500.00charleneNo ratings yet

- Unit Number/ Heading Learning Outcomes: Intermediate Accounting Iii (Ae 17) Learning Material: Single EntryDocument5 pagesUnit Number/ Heading Learning Outcomes: Intermediate Accounting Iii (Ae 17) Learning Material: Single EntrySandia EspejoNo ratings yet

- Ch23 StatementofCashFlowExamples Zeke and ZoeDocument4 pagesCh23 StatementofCashFlowExamples Zeke and ZoeHossein ParvardehNo ratings yet

- Arendain Tp4 FinanceDocument4 pagesArendain Tp4 FinanceMgrace arendaknNo ratings yet

- Quiz - SFP With AnswersDocument4 pagesQuiz - SFP With Answersjanus lopezNo ratings yet

- Group Accounts 2 - Module AssessmentDocument25 pagesGroup Accounts 2 - Module AssessmentArn KylaNo ratings yet

- Tutorial 2Document21 pagesTutorial 2Krrish BosamiaNo ratings yet

- Task 4 - Consolidation: Patricia HarringtonDocument9 pagesTask 4 - Consolidation: Patricia HarringtonDewi Agus SukowatiNo ratings yet

- 162 PreSummative2Document4 pages162 PreSummative2Alvin John San JuanNo ratings yet

- Financial Statements and Ratio AnalysisDocument26 pagesFinancial Statements and Ratio Analysismary jean giananNo ratings yet

- For Students - Interpretation of FS - Ratio Analysis - Example, ExercisesDocument10 pagesFor Students - Interpretation of FS - Ratio Analysis - Example, ExercisesdimniousNo ratings yet

- Task AccountingDocument2 pagesTask AccountingQudsia BanoNo ratings yet

- SW 8Document4 pagesSW 8Tifanny MallariNo ratings yet

- Consolidation of Foreign Subsidiaries UpdatedDocument9 pagesConsolidation of Foreign Subsidiaries UpdateddemolaojaomoNo ratings yet

- Acc133 PQ4Document2 pagesAcc133 PQ4Karina Barretto Agnes0% (2)

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- MOD2 Corporate LiquidationDocument4 pagesMOD2 Corporate LiquidationJasper Andrew AdjaraniNo ratings yet

- Advanced Accounting Module #: Module Title: Focus Notes: Practice ProblemsDocument1 pageAdvanced Accounting Module #: Module Title: Focus Notes: Practice ProblemsJasper Andrew AdjaraniNo ratings yet

- Practice Prob - Forex - ForprintDocument1 pagePractice Prob - Forex - ForprintJasper Andrew AdjaraniNo ratings yet

- Process and Job Order Costing - ForuploadDocument2 pagesProcess and Job Order Costing - ForuploadJasper Andrew AdjaraniNo ratings yet

- Process and Job Order Costing - EditedDocument6 pagesProcess and Job Order Costing - EditedJasper Andrew AdjaraniNo ratings yet

- Statement of Financial PositionDocument36 pagesStatement of Financial PositionAbdulmajed Unda MimbantasNo ratings yet

- Determinants of External Reserves in Developing EconomiesDocument138 pagesDeterminants of External Reserves in Developing EconomiesAdewole Aliu OlusolaNo ratings yet

- Chapter 01 Introduction To M and ADocument28 pagesChapter 01 Introduction To M and ASattagouda M PatilNo ratings yet

- Coca ColaProfileDocument91 pagesCoca ColaProfileAnupOjhaNo ratings yet

- 2023 Infrastructure Plan Fact SheetDocument2 pages2023 Infrastructure Plan Fact SheetFluenceMediaNo ratings yet

- Mid Exam ReviewDocument26 pagesMid Exam Reviewmora0% (1)

- BrandingDocument5 pagesBrandingWISDOM-INGOODFAITHNo ratings yet

- Bayerische Landesbank: Global Standard FormatDocument2 pagesBayerische Landesbank: Global Standard FormatRawaaNo ratings yet

- Detail of Lead BanksDocument8 pagesDetail of Lead Banksbinay sorengNo ratings yet

- Case Studies On Group Behavior and Work PDFDocument27 pagesCase Studies On Group Behavior and Work PDFShriya Chhabra AroraNo ratings yet

- 2023 Riverside County Pension Advisory Review Committee ReportDocument24 pages2023 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- Elliot WaveDocument15 pagesElliot WaveAbhishek Chopra100% (2)

- Chapter 02 Stock Investment Investor Accounting and ReportingDocument3 pagesChapter 02 Stock Investment Investor Accounting and Reportingprins kyla SaboyNo ratings yet

- Chunnel at The End of Port TunnelDocument3 pagesChunnel at The End of Port TunnelBaren RoyNo ratings yet

- NISM Equity Derivatives Chapter - 5Document68 pagesNISM Equity Derivatives Chapter - 5AakashNo ratings yet

- Asc JulyDocument48 pagesAsc JulyOrhan Mc MillanNo ratings yet

- UntitledDocument251 pagesUntitledmrNo ratings yet

- Acting Pricey: Some Stocks' Rich Valuations Are Sticky, Irrespective of The Market's Exuberance or TurmoilDocument92 pagesActing Pricey: Some Stocks' Rich Valuations Are Sticky, Irrespective of The Market's Exuberance or TurmoilhariNo ratings yet

- Partnership Accounting Comprehensive ProblemDocument10 pagesPartnership Accounting Comprehensive ProblemNikki GarciaNo ratings yet

- Jai Jawan Salary Plus AccDocument4 pagesJai Jawan Salary Plus AccLakshmi NarasaiahNo ratings yet

- Resources - ClayTraders Tools of The Trade PDFDocument14 pagesResources - ClayTraders Tools of The Trade PDFN C NAGESH PRASAD KOTINo ratings yet

- Behavioral Finance QuestionsDocument4 pagesBehavioral Finance QuestionsJawad ShehayebNo ratings yet

- Sec. 12 Prudential Bank vs. National Labor Relations CommissionDocument11 pagesSec. 12 Prudential Bank vs. National Labor Relations Commissionjusang16No ratings yet

- Anual Report of 2019 of InterwoodDocument5 pagesAnual Report of 2019 of InterwoodAli Hussain Al SalmawiNo ratings yet

- Oracle Applications - Financials 11i - V4.2Document549 pagesOracle Applications - Financials 11i - V4.2Sunitha9No ratings yet

- Measuring Smart Mobility Readiness IndexDocument7 pagesMeasuring Smart Mobility Readiness IndexAndry Redima KurniawanNo ratings yet

- Key Financial Ratios of Shree CementsDocument2 pagesKey Financial Ratios of Shree CementsTrollNo ratings yet

- Sanmina Land Allotment in Chennai Signed by Shaktikanta Das in 2007Document7 pagesSanmina Land Allotment in Chennai Signed by Shaktikanta Das in 2007PGurusNo ratings yet

- Tbla 2016 PDFDocument281 pagesTbla 2016 PDFNanda Julyantie RatmanaNo ratings yet

- Internship Report On BRAC Bank Limited Financial Performance Analysis of BRAC Bank LTDDocument43 pagesInternship Report On BRAC Bank Limited Financial Performance Analysis of BRAC Bank LTDShowkatul Islam50% (2)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)