Professional Documents

Culture Documents

Nov-Dec 2019

Nov-Dec 2019

Uploaded by

Usuf Jabed0 ratings0% found this document useful (0 votes)

16 views15 pagesOriginal Title

9. Nov-Dec 2019

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views15 pagesNov-Dec 2019

Nov-Dec 2019

Uploaded by

Usuf JabedCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 15

FINANCIAL ACCOUNTING & REPORTING

Question No. 1

BC Fruits Ltd, a fruit bottling and canning company, is planning to expand its operations. ‘The directors are

hoping to increase the range of preserved fruit products and in doing so will need to invest in new equipment.

‘They are also hoping to open a new facility in the northem part of the country.

‘The CFO has been asked to prepare a report on the following issues of conceptual framework. You are the Finance

Controller ofthe company and your CFO wants to address all issues in his report and has asked for your assistance.

Requirements:

Prepare brief notes for the CFO, addressing each of the following and using the Conceptual Framework as &

source of reference:

a) Identify potential providers of finance for BC Fruits Ltd and their information requirements in respect

of financial statements, 4

b) Explain the terms ‘performance’ and ‘position’ and identify which of the financial statements will assist

the user in evaluating performance and position, 6

©) Indicate why, for decision-making purpos:

PE

a) Potential providers of finance Information requirements

s, the financial statements alone are insufficient, 5

- The existing shareholders of the - The profit before interest of BC Fruits Ltd, to

company and potential ~— new determine risk.

shareholders - through a new issue of

share capital

- Existing and future lenders and - The trend of profitability of BC Fruits Ltd together

creditors to the company. witha history of dividend payments, This will enable

them to assess retum and risk of their investment.

- The financial structure of BC Ltd, to determine the

level of debt finance as a measure of risk.

= The company's liquidity or ability to pay out dividend

and redeem share capital

‘The company’s ability to generate cash and the timing

and certainty of its generation.

~The liquidity of the company and its ability to repay

interest and capital instalments.

~The existing level of debt and any security over that debt.

b) Performance and position and the financial statements which assist in evaluation:

Performance

‘The financial performance of a company comprises the return it obtains on the resources it controls.

Performance can be measured in terms of the profits of the company and its ability to generate cash flows.

27 | Page

Management will be assessed on their skill in achieving the highest level of performance, given the

resources available to them.

Information on performance can be found in:

= The statement of profit or loss and other comprehensive income

- The statement of changes in equity.

- The statement of cash flows

Position

‘The financial position of the company is evaluated by reference to:

(i) Its economic resources and claims

(Gi) its capital structure, ic its level of debt finance and sharcholders' fund.

(iii)its liquidity and solvency

‘The user of the financial statements can then make assessments on the level of risk, ability to generate

cash, the likely distribution of this cash and the ability of the company to adopt to changing

circumstances.

‘The statement of financial position is the prime source of information on a company's position but the

statement of cash flows will also indicate a company's cash position over a period of time.

©) Financial statements - inherent limitations as a tool of decision-making

Financials statements are prepared by reference to a relatively rigid set of accounting standards

applicable to all companies, regardless of the sectors of the economy they operate in, As a result,

information for individual and specialized companies may not be forthcoming, Further, the preparation

of financial statements is based on estimates and judgements by the management and therefore are not

a source of totally verifiable information,

Financial statements primarily use the historical cost convention. They can identify trends from the

past which may be relevant to the future, but they are not forecasts and are therefore less helpful when

‘making predictions.

In deciding whether or not to invest in a company, a decision-maker will also want access to non-

financial data not contained in the financial statements such as:

(i)_A discussion of business risks and opportunities

(ii) An evaluation of the quality of management

(iii) narrative analysis of position and performance.

or

You are the Finance Controller of PQS Limited that wholesales and distributes toys and provides services

to other companies. The following balances have been extracted from the company's books of accounts as,

at 31 December 2018.

or)

Amount in Tk

Ordinary share 800,000

5% redeemable preference shares 200,000

Share premium account 350,000

Retained earings at | January 2018 2,000,000

Revenue 11,899,000

Purchase 8,935,000

Inventories at 1 January 2018 974,000

Staff cost - distribution 270,000

Staff cost - administration 352,000

Depreciation charge for the year

Freehold land and buildings 30,000

Distribution equipment 116,000

Other plant and equipment 160,000

28 [Page

General expenses 432,000

Interest receivables 41,000

Interest payables 35,000

Taxation - charge for the year 336,000

Dividend paid

Ordinary shares - final regarding 2017 60,000

Ordinary shares - interim regarding 2018 30,000

5% redeemable preference shares - for 2018 10,000

Patent rights 200,000

Freehold land & buildings - cost 1,200,000

Distribution equipment - cost 800,000

Other plant & equipment - cost 1,400,000

Accumulated depreciation at 31 December 2018

Freehold land and buildings 130,000

Distribution equipment 320,000

Other plant and equipment 250,000

‘Trade receivables 1,600,000

Trade Payables 850,000

Cash and cash equivalents 300,000

Tax liability 400,000

Additional information

(@) Included in revenue are invoices totaling Tk. 120,000 in relation to distribution services rendered under a

contract to a customer who is very unhappy with the quality ofthe services provided, The overall outcome of

the contract is uncertain and management believes that of the Tk. 90,000 costs incurred to date under the

contract, probably only Tk. 65,000 will be reimbursed by this customer.

(b) The patent was acquired during the year, Amortization of Tk. 20,000 should be charged to

administration expenses.

(©) _ Inventories at 31 December 2018 were valued at Tk. 1,304,000

(@ Costs not specifically attributable to one of the profit or loss expenses headings should be split 50:50

between distribution costs and administrative expenses

(©) Inventories carried at Tk. 846,000 were purchased from France in Euros and payment is due on 2

March 2019. At the date of the transaction the exchange rate was Tk. 100 to €1. At 31 December 2018

the exchange rate was Tk. 95 to €1

(A final ordinary share dividend for2018 of Tk. 50,000 was proposed in May 2019, payable on 28 June 2019,

(g) Tk. 450,000 cash was received during the year as a result of a rights issue of ordinary shares. The

nominal value ofthe shares issued was Tk. 100,000,

(h) On 1 June 2018 the company made the decision to sell its loss-making soft toy division as a result of

severe competition from the Far East. The company is confident that the closure will be completed by

30 April 2019. The division's operations represent in 2018 10% of revenue (after all adjustments), 15%

of cost of sales, 10% of distribution costs and 20% of administrative expenses. No disclosure are

necessary in the statement of financial position.

Requirements:

Prepare PQS Limited's statement of profit or loss and statement of changes in equity for the year 31

December 2018, a statement of financial position at that date and movement schedules and notes in

accordance with the requirements of IFRS, to the extent the information is available. 25

29 | Page

PURao ek need

‘Workings notes:

‘Amount in Tk.

1 Revenue:

Revenue as per Trial Balance 11,899,000

Less: Contract under dispute (120,000)

Add: Recoverable cost 65,000

11,844,000

2 Analysis of expenses

Cost of sales Distribution cost Admin, Expenses

Opening inventory 974,000

Purchases 8,935,000

Staff cost 270,000 352,000

Depreciation:

Land and buildings 15,000 15,000

Distribution equipment 116,000

Other PPE, 80,000 80,000

General expenses 216,000 216,000

Amortization of patent 20,000

Foreign exchange loss (note 3) 44,526

Closing inventories 4,304,000)

8,605,000 697,000 727526

3 Foreign exchange loss:

Payable at date of transaction 846,000

Payable at year end date (846,000 x 100/95) (890,526)

Exchange loss at end of reporting period

4 Continuing / discontinuing analysis

Continuing, Discontinued Total

Operation (Tk) Operation (Tk.) Teka

Revenue (note 1 - 90:10) 10,659,600 1,184,400 11,844,000

Cost of sales ( note 2 - 85:15) (7,314,250) (1,290,750) (8,605,000)

Gross Profit 3,345,350 (106,350) 3,239,000

Distribution cost (note 2 - 90:10) (627,300) (69,700) (697,000)

Admin, Expenses (note 2 - 80:20) (582,021) (145,505) (727,526)

Profiti(loss) from operation 2,136,029 (821,555) 1,814,474

Finance cost (35,000+10,000) (45,000) - (45,000)

Investment income 41,000 - 41,000

Profivi(loss) before tax 2,132,029 (321,555) 1,810,474

Income tax (336,000) - (336,000)

‘Net profit(loss) for the year 1,796,029 (G21,555) Tara aT

30| Page

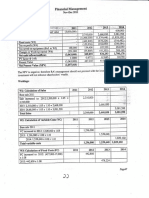

‘Statement of profit or loss for the year ended on 31 December 2018

Continuing operations

Taka

Revenue (note 4) 10,659,600

Cost of sales ( note 4 (7,314,250)

Gross Profit 3,345,350

Distribution cost (note 4) (627,300)

Admin, Expenses (note 4) (582,021)

Profit from operation 2,136,029

Finance cost (35,000+10,000) (45,000)

Investment income 41,000

Profit before tax 2,132,029

Income tax (336,000)

Profit for the year from continuing operations 1,796,029

Discontinued operations

Loss for the year from discontinued operations (note 4) (521,555)

Profit for the year 1.474474

Statement of changes in equity for the year ended on 31 December 2018

Share Share Retained Total

Capital (Tk.) Premium (Tk) Eamings (Tk) Taka

Balance at 1 January 2018 700,000 2,000,000 2,700,000

Changes in equity for 2018:

Issue of share capital 100,000 350,000 450,000

Dividends (90,000) (90,000)

Total comprehensive income 1474474 1,474,474

Balance at 31 December 2018 800,000, 350,000, 3.384.474 4 474

Notes

a) The profit from operations is arrived at after charging

Depreciation (30,000+1 16,000+160,000) 306,000

Amortization of intangibles 20,000

Employee benefits (270,000+352,000) 622,000

Foreign Exchange loss 44,526

b)

2

A final ordinary share dividend for 2018 of Tk. 50,000 is proposed for payment on 28 June 2019.

On | June 2018 the company classified its soft toy division as held for sale, The division had been loss-

making for some time duc to severe competition from the Far East. It is expected that the closure will be

completed by 30 April 2019.

Amount in Tk. attributable to the division in 2018 were: revenue Tk. 1,184,000, expenses Tk. 1,505,955

and pre-tax loss Tk. 321,555

31 | Page

Statement of financial position as at 31 December 2018

ASSETS

Non-current assets

Property, plant and equipment

Intangible

Carrent assets

Inventories

Trade and other receivables (1,600,000 - 55,000)

Cash and cash equivalents

Total assets

EQUITY AND LIABILITIES

Equity

Ordinary share capital

Share premium

Retained earnings

Total equity

‘Non-current liabilities

Preference share capital

Current liabilities

Trade and other pay.

Taxation

Les (850,000+44,526)

Total equity and liabilities

PROPERTY, PLANT AND EQUIPMENT

Freehold land

& buildings

Cost e

ALI Jenuary 2018 1,200,000

At31 December 2018 1,200,000

Depreciation

At I January 2018 100,000

Charge for the year 30,000

At31 December 2018

Carrying amount

‘At31 December 2018 1,070,000

At January 2018 1,100,000

INTANGIBLES

Cost at 31 December 2018

Amortization

Camying amount at 31 December 2018

a2 [Page

Taka

2,700,000

180,000

1,304,000

1,545,000

300,000

800,000

350,000

384,474,

Taka

2,880,000

4,534,474

894,526

400,000

200,000

1,294,526

Distribution Other plant

equipment & equipment

800,000, 1,400,000

204,000

116,000

480,000

596,000

6,029,000,

Total

200,000

(20,000)

180,000

Pragati Limited has entered into the following transactions during the year ended 31 December 2018,

@

(b)

©

@

On | October 2018, Pragati Limited received Tk, 400,000 in advance subscription. The subscriptions are for

20 monthly issues of a magazine published by Pragati Limited. Three issues of the magazine had been

dispatched by the year end. Each magazine is of the same value and cost approximately the same to produce.

A batch of unseasoned timber, which had cost Tk. 250,000 was sold to BM Limited for Tk. 100,000 on 1

January 2018. Pragati Limited has an option to repurchase the timber in 10 years'time. The repurchase price

will be Tk. 100,000 plus interest charges @ 8% per anumn from January 2018 to the date of repurchase. The

‘market value ofthe timber is expected to increase as it seasons.

Pragati Limited made a major sale on I January 2018 for a fee of Tk. 450,000 which related to a

completed sale and after-sales support for three years. The cost of providing the after-sales support is

estimated at Tk. $0,000 per anumn, and the mark-up on similar after sales only contracts is 20% on cost.

‘The food division of Pragati Limited operates its retail outlets on a franchise basis. On 1 January 2018 a new

‘outlet was opened, the franchisee paying a fee of Tk. $00,000 to cover the initial services. The franchise is

for five years, and the franchisee will pay an additional fee of Tk, 60,000 commencing on | January 2018 to

cover marketing, managerial and other support services provided by Pragati Limited during the franchise

period. Pragati Limited has estimated that the cost of providing these services is Tk. 80,000 per anumn, and

has achieved a gross margin of 20% on providing similar services on other contracts

Requirements:

a

(i

Prepare extracts from Pragati Limited's financial statements for the year ended 31 December 2018, clearly

showing how each of the above would be reflected. Notes to the financial statements are not required. 16

With reference to transaction (b) above, explain the concept of ‘substance over form 4

eee

(® Financial statement extracts

Statement of financial position as at 31 December 2018,

EQUITY AND LIABILITIES

Non-current liabilities

Borrowings (100,000+8,000) 108,000

Deferred income (note 2) 280,000

Current liabilities

Deferred income (note 2) 340,000

‘Statement of profit or loss for the year ended 31 December 2018

Revenue (note 1) 790,000,

Finance cost (8%x100,000) 8,000

Working notes:

1 Revenue

‘Transaction (a) [3/20x400,000] 60,000

‘Transaction (c)

Sales [450,000-(50,000x120%x3)] 270,000

‘Aftersales support year | (50,000x120%) 60,000

33 | Page

Transaction (4)

Initial fee [500,000-(40,000x5) 300,000

Continuing fee year 1 (80,000x100/80) 100,000

2 Deferred income Current ‘Non-current

‘Transaction (a) [400,000x12/20, $/20)] 240,000 100,000

Transaction (c) [50,000x120% for year 2 & 3) 60,000 60,000

‘Transaction (d) [100,000-60,000 for year 2 to 5] 40,000 120,000

340,000 280,000

i) Transaction (b) and substance over form

Ina straight forward transaction its commercial effects is the same as its legal form. However, in more

complex transaction the true substance of the transaction may be different from its legal form, with one

party having the risks and rewards of ownership but another party having legal title to the asset

In such circumstances recording the legal form of the transaction would not be sufficient to provide a

fair presentation in the financial statements.

‘This transaction appears unusual as the initial sale is below fair value, which raises question about its

substance, Pragati Limited has a call option significantly below the current fair value which is

expected to increase over time. The terms of the transaction are that itis almost certain that the timber

will be reacquired, hence this is essentially a sale and repurchase agreement.

Pragati Limited has retained the risks and rewards of ownership, even though legal title has passed.

The transaction is effectively a financing agreement secured on the timber, and does not give rise to

revenue, The proceeds of Tk. 100,000 are therefore recognized as borrowings in non-current liabilities.

In the year ended on 31 December 2018, Pragati limited should recognize a finance cost of Tk. 8,000

(8% of Tk. 100,000) which will increase the borrowings.

Madina Ltd, has investments in two companies, a subsidiary, Beta Ltd, and an associate, Gama Ltd. You are

the in-charge of audit team for Madina Group. While reviewing the consolidated financial statements of the

Group, following issues came to your notice-

a) The draft consolidated statement of financial position at 31 December 2018 has been prepared by

simply adding together each line of the individual statements of financial position of Madina Lt

(parent company) and Beta Ltd.

b) The investment in Gama Ltd is being carried at cost.

‘The draft consolidated statement of financial position as at 31 December 2018 is shown below, together

with the individual statement of financial position of Gama Ltd at the same date:

34] Page

Madina Group

(Draft consolidated) Gama Ltd.

ASSETS BDT BDT

‘Non-current assets

Property, plant and equipment 4,000,000] 350,000]

Investments 7,786,000] 0

11,786,000 000

Current assets

Inventories 600,000 70,000]

Trade and other receivables 1,295,000] 50,000

Cash and cash equivalents, 250,000] 17,000

107

Total assets

EQUITY AND LIABILITIES

Equity

Ordinary share capital (BDT 1 shares) 3,400,000] 300,000]

Share premium account 1,000,000} 15,000]

Revaluation surplus 750,000] |

Retained earings 1,450,000] -525,000]

6,600,000 =10,000

Current liabilities

Trade and other payables 7,206,000] 400,000]

Income tax 125,000] 67,000]

7,331,000 467,000

Total equity and liabilities 13,931,000 457,000

Additional information:

a) Madina Ltd, acquired 80% of Beta Ltd on 1 Jamuary 2018 when Beta Lid’s equity was as follows:

Equity-Beta Ltd BDT

Ordinary share capital (BDT 1 shares) 1,400,000

Share premium account 100,000

Revaluation surplus 500,000

Retained Famings

Equity

On 31 December 2018 Beta Ltd’s retained earings were BDT 1,250,000 and its revaluation surplus was

BDT 350,000. All other components of equity were unchanged.

‘The consideration for the equity stock was paid in below manner-

i) Madina Ltd, had taken over an overdue loan of BDT 7,600,000, wich Madina Ltd, had immediately paid off.

ii) Madina Ltd. handed over a sedan car with carrying amount of BDT 200,000. The car had a fair value of

BDT 1,000,000. No entry was passed in the books of Madina Ltd

b) The fair values of the assets and liabilities of Beta Ltd. at the date of acquisition were equal to their

carrying amounts, with the exception of inventory. On I January 2018 the fair value of Beta Ltd’s

inventories was BDT 125,000 but their carrying amount was BDT 108,000, At 31 December 2018 half,

of these inventories were still held by Beta Ltd.

35 | Page

©) Madina Ltd has decided to measure goodwill and the non-controlling interest using the proportionate method.

) Madina Group acquired 40% of Gama Ltd on 30 June 2018 for BDT 186,000 when the retained

earings of Gama Ltd were BDT 150,000. Gama Ltd. had declared 50% cash dividend, on 30

September 2018,

©) Gama Ltd. had a disaster in operation during the 4% quarter, which had led to negative retained earnings

at the end of the year.

1) On I January 2018 Madina Ltd. sold a machine to Beta Ltd for BDT 180,000. The machine had a

carrying amount in Madina Ltd’s books of BDT 156,000. The estimated remaining useful life of the

‘machine was reassessed on the date of sale at six years.

2) In October 2018, Madina Ltd, sold goods to Gama Ltd. for BT 20,000, making a gross profit margin

of 30%. At 31 December 2018 Gama Ltd held one-third of these goods in its inventories.

h) Inventories in the statements of financial position of all three companies at 31 December 2018 were

based on physical inventory counts carried out on 31 December 2018,

i) However, on 10 January 2019 Beta Ltd received a report from one of its customers, showing that on 31

December 2018 the customer held BDT 23,600 (at cost to the customer) of Beta Ltd’s inventories on a

sale or return basis. Beta Ltd makes a gross profit margin of 25% on all sales but has not yet raised any

invoices for this transaction.

Requirement:

Prepare the consolidated statement of financial position of Madina Ltd. as at 31 December 2018. 25

eed

Madina Lid Group

Consolidated statement of financial position

As of 31 December 2018

Assets Bor

Non-current assets

Property, plant and equipment (4,000,000-200,000(w8)-20,000(w7) 3,780,000)

Investments (w 4) 0

Goodwill (W2) 6,206,400)

70,486,400

Current assets

Inventories [600,000+(8,500+17,700) w1 626,200

‘Trade and other receivables 1,295,000]

Cash and cash equivalents 250,000

2,171,200

12,657,600

36 |Page

Equity and liabilities

Equity

Ordinary share capital (3,400,000-1,400,000)

Share premium (1,000,000-100,000)

Revaluation surplus (750,000-350,000-150,000 (w1)x80%)

Retained camings (WS)

Non-controlling interest (working 3)

Current liabilities

Trade and other payables

Income tax

‘Working 1

Net assets of Beta Ltd.

2,000,000]

900,000]

280,000]

1,521,360]

4,701,360

625,240

5,326,600

7,206,000]

125,000]

7,331,000

12,657,600

Post Post acq

Year end Acquisition acquisition Category

Ordinary share capital 1,400,000 1,400,000 0

Share premium 100,000 100,000 0

Revaluation surplus 350,000 $00,000 -150,000 -150,000

Retained earnings 1,250,000 350,000 900,000

Fair value adjustment (inventories) ((125,000-108,000)2) 8500 17,000 8,500

(125,000-108,000) at acquisition

Inventory - sale or return (23,600x75% 17,700

© 17,700 _ 909,200

126,200 2,367,000 759,200 759,200

Workings 2:

Goodwill - Subsidiary Beta Ltd.

Consideration transferred

Loan taken over

Fair value of asset (sedan car) transferred

Net assets at acquisition

Non-controlling interest at acquisition (2,367,000(w1)x20%

Workings 3

Non-controlling interest

Share of net assets at acquisition (2,367,000 (W1) x 20%]

Share of post-acquisition profits/(loss) (759,200 x 20%) [ref wl]

Workings 4:

Investment in associate

Cost:

|Add: Share of post-acquisition profits [{-325,000-(150,000-300,000x50%)} x 40%]

Less: Dividend out of reacquisition profit (150000x40%)

Less: Proportionate Unrealized Profit on sale of inventory (W6)

17,600,000

1,000,000

8,600,000

2,367,000

473,400,

706,400

473,400

151,840

625,240

186,000,

130,000]

(60,000)

(800)|

800)

37 | Page

However, Madina's share of loss wont be recognized once carrying amount of investment reduces to nil

Accordingly, post acquisition loss recognized in P&L would stand at (130,000-4,800= 125,200 and investment

value = Nil

Workings.

Retained earnings

Draft consolidated (1,450,000 ~ 1,250,000)

Gain on sale of PPE ( Car, 1,000,000-200,000)

Profit - Beta Ltd (909,000 x 80%)

Share of profit Gama Ltd (W'4)

Less: Dividend out of pre-acquisition profit of Gama (Ws)

Less: Proportionate Unrealized Profit on sale of inventory (W6)

Less: Property, plant and equipment unrealized profit (W7)

Workings 6:

Proportionate Unre:

Sales price

Cost

Gross profit

ae

Proportionate unrealized profit (40%)

Workings 7:

Proportionate Unrealized Profit - PPE.

PPE balance in Parent Company as of reporting date (180,000 x 5/6 years)

Asset would have been in Subsidiary book (156,000 x 5/6 years)

Working 8:

Loss on disposal of sedan ear

Fair value of sedan car transferred

Carrying amount as of transfer date

Gain on disposal of sedan ear

Working 9:

Equity - Beta

Ordinary share capital (BDT 1 shares)

Share premium account

Revaluation surplus

Retained camings

Equity

38| Page

%

100%

70%

30%

150,000,

130,000,

20,000,

1,000,000

200,000

800,000

Acquisition

1,400,000

100,000

300,000

200,000

800,000

727,360

(125,200)

(60,000)

(800)

(20,000)

1521360,

Associate

RDT

20,000

14,000

6,000

2,000

300

31 December 2018

1,400,000

100,000

350,000

1,250,000

(00,000

(a) CB Ltd. isa reputed multinational company in Bangladesh. The company was intially registered as a private

limited company, but very recently the company was converted to a Public Limited Company. In the

process, the company had issued shares to @ number of new investors

The Head of Reporting of CB Ltd, has just completed preparing the consolidated financial statements of

the company. During the audit kick-off meeting, the newly appointed audit manager had asked if all the

related party disclosures have been properly made. The audit junior has raised question about adequacy

of related party disclosure in below circumstances:

i, Mr. C, who owns 51% share in the company has acquired 20% stake in BZ Limited. The audit

managers view is BZ. Limited should be treated as a related party of CB Limited.

ii, CX is the only importer of raw material for the company. CB has a significant amount of dues to

CX. Mr. X, the Chair of CX, often visits CB Premises. During his last visit, he had visited company

warehouse and had wamed management about the working environment at factory premises. The

audit manager asked why CX or Mr. X has not been considered as a related party.

iii, Mr. Z is appointed as the Chief Operating Officer. His wife, Mrs. P, has a raw material supply

contract with the company since long. However, upon appointment, Mr. Z, stopped ordering further

‘material from her company, lest it should be questioned by the board. The audit manager is

convinced that the contract needs to be disclosed. Mr. Z will not like to disclose such dormant

contract as a related party disclosure.

Requirements:

You, as a newly appointed professional accountant, were asked to advise if related party disclosure

would be needed in above cases. Share your advice and underlying justification, 2x36

(b) A Limited has prepared below Profit or Loss Statement for the year ended 30 June 2019,

A Limited

Statement of Profit or Loss

For the year ended 30 June 2019

Taka

Revenue 1,000,000,

Cost of goods sold (250,000)

Gross profit

Operating expenses

Selling expense (120,000)

‘Advertisement, Promotion expense (270,000)

‘Administrative expense (300,000)

Total operating expenses (690,000)

Operating profit 604,000

Finance income, net 24,000

Profit before tax 84,000

Income tax expense 25,000

Net profit after tax 59,000

‘You are the engagement partner for the audit of the company. Your Engagement Manager is having a

review meeting with you where he has asked for your opinion on below matters:

39 | Page

a)

»)

°)

One of the suppliers of A Limited has imposed penal interest of USD 10,000 due to delay in payment of

annual maintenance fees. The bank has denied to remit the amount without permission from the

Government, Historically, the Government has never allowed remittance against penal interest.

On September 30, the Government enacted a new environment law, by virtue of which local environment

office would be able to levy Taka 200 per Kg. of by-products from its manufacturing plant. Until 30 June

2019, the company had produced 1,000 KG of such by-product. No provision was made.

An item has been produced at a manufacturing cost of Taka 18,000 against a customer's order at an

agreed price of Taka 23,000. The item was in inventory at the year-end awaiting delivery instructions

In July 2019 the customer was declared bankrupt and the most reasonable course of action seems to be

to make a modification to the unit, costing approximately Taka 3,000, which is expected to make it

‘marketable to other customers at a price of about Taka 19,000.

Requirements:

Please give your opinion in each of the above cases, in light of IFRS. Also assist your manager in re-

‘constructing the Profit or Loss account. 33-9)

Answer to the Question No. 5 (a)

ii)

Mr. C, who owns 51% share in the company has acquired 20% stake in BZ Limited. The audit

‘managers view is BZ Limited should be treated as a related party of CB Limited

‘An entity would be considered as a related party if it is under significant influence of a person who

controls or has joint control over the reporting entity, Mr.C has 51% stake in CB Ltd and has

significant influence over BZ limited (as he owns 20% of shares in the company). Accordingly, BZ and

CB are related parties.

CX supplies is the only importer of raw material for the company. CB has a significant amount of dues

to CX. Mr. X, the Chair of CX, often visits CB Premises. During his last visit, he had visited company

warehouse and had warned management about the working environment at factory premises. The audit

manager asked why CX or Mr. X has not been considered as a related party.

A supplier, with whom an entity transacts a significant volume of business, simply by virtue of the

resulting economic dependence. Even though, the supplier seems to exercise pressure/power/control

over the company, such control may be considered in any monopoly business. Accordingly, Mr. CX

will not be a related party to CB.

Mr. Z, is appointed as the Chief Operating Officer. His wife, Mrs. P has a raw material supply contract

with the company since long. However, upon appointment, Mr. Z, stopped ordering further material

from her company, lest it should be questioned by the board. The audit manager is convinced that the

contract needs to be disclosed. Mr. Z, won't like to disclose such dormant contract as a related party

disclosure

Mrs. P, being spouse of COO is a related party by definition,

‘The profit or loss and financial position of an entity may be affected by a related party relationship

even ifrelated party transactions do not occur. The mere existence of the relationship may be sufficient

to affect the transactions of the entity with other parties. For example, a subsidiary may terminate

relations with a trading partner on acquisition by the parent of a fellow subsidiary engaged in the same

activity as the former trading partner. Altematively, one party may refrain from acting because of the

significant influence of another—for example, a subsidiary may be instructed by its parent not to

engage in research and development.

Accordingly, the company should disclose the contract, if material

40|Page

ENA enue 0}

Requirement (a)

A provision is recognized iff below criteria are met«

a) an entity has a present obligation based on past even

b) itis probable that an outflow of resources embodying economic benefits will be required to settle the

obligation, and

©) _areliable estimate can be made of the amount of the obligation

In the case mentioned, even though, the entity might have present obligation against past event, outflow of

resources embodying economic benefits is uncertain. Accordingly, no provision would be needed.

Requirement (b)

The effect of possible new legislation is taken into consideration in measuring an existing obligation when

sufficient objective evidence exists that the legislation is virtually certain to be enacted. The variety of

circumstances that arise in practice makes it impossible to specify a single event that will provide sufficient,

objective evidence in every case. Evidence is required both of what legislation will demand and of whether

it is virtually certain to be enacted and implemented in due course. In many cases sufficient objective

evidence will not exist until the new legislation is enacted,

Accordingly, it may be argued that there was no present obligation based on past event, until the law was

enacted. No provision would be needed.

Requirement (C)

Bankruptcy of a customer immediately after reporting date usually indicate that the condition also prevailed

‘on the reporting date, and accordingly considered as an adjusting even,

Due to bankruptcy of the customer, the contractual amount is no longer recoverable. The net realizable

value for the item should be calculated as follows-

Expected realizable value from alternate customer 19000

Additional costs to be incurred -3000

Not realizable value 16000

Cost of inventory 18000

Lower of the above to be recognized in the financials 16000

Amount to be charged off 2000

41 | Pa

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Nov-Dec 2012Document11 pagesNov-Dec 2012Usuf JabedNo ratings yet

- May-June 2012Document11 pagesMay-June 2012Usuf JabedNo ratings yet

- Nov-Dec 2011Document9 pagesNov-Dec 2011Usuf JabedNo ratings yet

- May-June 2011Document10 pagesMay-June 2011Usuf JabedNo ratings yet

- Financial Management: Question No. 1Document17 pagesFinancial Management: Question No. 1Usuf JabedNo ratings yet