Professional Documents

Culture Documents

Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluru

Uploaded by

Chinmay BhattOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluru

Uploaded by

Chinmay BhattCopyright:

Available Formats

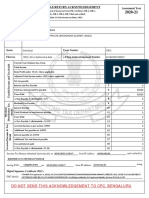

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment Year

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 filed and verified]

2020-21

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN AEAPB4830P

Name VINOD KUMAR BHATT

LIC OF INDIA, AGENCY MOHALLA, BADRINATH ROAD, SRINAGAR, PAURI GARHWAL, Uttarakhand, 246174

Address

Status Individual Form Number ITR-1

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 760683270291120

Current Year business loss, if any 1 0

Taxable Income and Tax details

Total Income 1393550

Book Profit under MAT, where applicable 2 0

Adjusted Total Income under AMT, where applicable 3 0

Net tax payable 4 239788

Interest and Fee Payable 5 0

Total tax, interest and Fee payable 6 239788

Taxes Paid 7 240028

(+)Tax Payable /(-)Refundable (6-7) 8 -240

Dividend Tax Payable 9 0

Distribution Tax

Interest Payable 10 0

Dividend

details

Total Dividend tax and interest payable 11 0

Taxes Paid 12 0

(+)Tax Payable /(-)Refundable (11-12) 13 0

Accreted Income & Tax

Accreted Income as per section 115TD 14 0

Additional Tax payable u/s 115TD 15 0

16 0

Detail

Interest payable u/s 115TE

Additional Tax and interest payable 17 0

Tax and interest paid 18 0

(+)Tax Payable /(-)Refundable (17-18) 19 0

Income Tax Return submitted electronically on 29-11-2020 13:41:11 from IP address 103.52.209.68 and verified by

VINOD KUMAR BHATT

having PAN AEAPB4830P on 29-11-2020 13:41:12 from IP address 103.52.209.68 using

Electronic Verification Code 6A9EC1WLSI generated through Aadhaar OTP mode.

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

- Assignment On S&S Air Goes Public: ProfessorDocument5 pagesAssignment On S&S Air Goes Public: ProfessorNazmul HossainNo ratings yet

- Smart Money Concepts in The Forex Market: Bikesh MaskeyDocument67 pagesSmart Money Concepts in The Forex Market: Bikesh MaskeyBerk Eren Tepe100% (1)

- Problem #3Document16 pagesProblem #3hehehehehloo42% (12)

- 2020 12 19 21 04 28 561 - 1608392068561 - XXXPM1087X - AcknowledgementDocument1 page2020 12 19 21 04 28 561 - 1608392068561 - XXXPM1087X - AcknowledgementSanjay KNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBijendra KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusachinkotadiyaaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurujitendra39.kumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRahul SrivastavaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMohammad WaseemNo ratings yet

- Alok Jha ITR AY2020-21Document1 pageAlok Jha ITR AY2020-21Akash VarmaNo ratings yet

- PDF 298947820220321Document1 pagePDF 298947820220321savitakant13600No ratings yet

- Digiomate ITR AcknowledgementDocument1 pageDigiomate ITR AcknowledgementranjitNo ratings yet

- PDF 153942470090121Document1 pagePDF 153942470090121Rajveer AutoNo ratings yet

- PDF 796371500091220Document1 pagePDF 796371500091220dimplevats1982No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruvishnu ksNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAbhishek SaxenaNo ratings yet

- 2021 05 09 19 19 45 309 - 1620568185309 - XXXPK6024X - ItrvDocument1 page2021 05 09 19 19 45 309 - 1620568185309 - XXXPK6024X - ItrvRohan KapurNo ratings yet

- Ramavath A.Y 2020-21 Tax - AcknowledgementDocument1 pageRamavath A.Y 2020-21 Tax - AcknowledgementBhashya RamavathNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJashan BrarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurudibyan dasNo ratings yet

- 2020 07 01 19 02 26 404 - 1593610346404 - XXXPD2732X - AcknowledgementDocument1 page2020 07 01 19 02 26 404 - 1593610346404 - XXXPD2732X - Acknowledgementraju1965.dNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSaurabh GholapNo ratings yet

- PDF 960046120301220Document1 pagePDF 960046120301220Ender gamerNo ratings yet

- Itr RCPT-19-20Document1 pageItr RCPT-19-20homcoactNo ratings yet

- 2020 08 20 15 29 32 099 - 1597917572099 - XXXPK1485X - Acknowledgement PDFDocument1 page2020 08 20 15 29 32 099 - 1597917572099 - XXXPK1485X - Acknowledgement PDFCDO DLTNo ratings yet

- LJ Huf FinancialDocument21 pagesLJ Huf Financialsunil jadhavNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJai GaneshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruUsha Kiran PNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruYogesh SainiNo ratings yet

- PDF 487599040240820Document1 pagePDF 487599040240820kotasrihariNo ratings yet

- PDF 928543220281220Document1 pagePDF 928543220281220Rajendra Prasad sahaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruTed Mosby100% (1)

- 2020 11 28 13 48 32 813 - 1606551512813 - XXXPM2440X - AcknowledgementDocument1 page2020 11 28 13 48 32 813 - 1606551512813 - XXXPM2440X - AcknowledgementMadhu HarshithaNo ratings yet

- ITR Ack. AY 2020-21Document1 pageITR Ack. AY 2020-21Amit ShawNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradip ShindeNo ratings yet

- 2020 10 13 16 14 03 443 - 1602585843443 - XXXPS4444X - Acknowledgement PDFDocument1 page2020 10 13 16 14 03 443 - 1602585843443 - XXXPS4444X - Acknowledgement PDFPradip ShindeNo ratings yet

- 2020 06 08 19 47 48 243 - 1591625868243 - XXXPS2911X - Acknowledgement PDFDocument1 page2020 06 08 19 47 48 243 - 1591625868243 - XXXPS2911X - Acknowledgement PDFBaljit SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPrashant MalaviyaNo ratings yet

- ITR Slip 20-21Document1 pageITR Slip 20-21Mukesh Kumar GuptaNo ratings yet

- 2020 12 12 23 10 30 664 - 1607794830664 - XXXPR2886X - Acknowledgement PDFDocument1 page2020 12 12 23 10 30 664 - 1607794830664 - XXXPR2886X - Acknowledgement PDFJagesh RanjanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusam kapoorNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruADITYA KUMAR MISHRANo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurudarshilNo ratings yet

- PDF - 173919020100121 Ad 1Document1 pagePDF - 173919020100121 Ad 1Abhishek GUPTANo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruProfit MartNo ratings yet

- 2020 12 15 12 04 44 882 - 1608014084882 - XXXPM7948X - AcknowledgementDocument1 page2020 12 15 12 04 44 882 - 1608014084882 - XXXPM7948X - Acknowledgementarpan mukherjeeNo ratings yet

- PDF 332384320310321 PDFDocument1 pagePDF 332384320310321 PDFSekharNo ratings yet

- Atul Rana 20Document1 pageAtul Rana 20Manu ChopraNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAfak KhanNo ratings yet

- Itr-V Angpr4495r 2020-21 711888880101120Document1 pageItr-V Angpr4495r 2020-21 711888880101120mpgpt6dfm2No ratings yet

- Pranjal - Itr VDocument1 pagePranjal - Itr VPradnyesh GuramNo ratings yet

- Itr A.Y 2020-21Document1 pageItr A.Y 2020-21kishan bhalodiyaNo ratings yet

- Emailing PDF - 133712590080121Document1 pageEmailing PDF - 133712590080121Manisha JangidNo ratings yet

- RACS Itr 2020-2021Document1 pageRACS Itr 2020-2021Lakshay SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurumahesh bhorNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNavis AntonyNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghNo ratings yet

- 2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFDocument1 page2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFParmeshwar PrasadNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAyush AgarwalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurucpe plNo ratings yet

- PDF 912540700271220Document1 pagePDF 912540700271220Dhruv KNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 760683270291120 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 760683270291120 Assessment Year: 2020-21Chinmay BhattNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 760683270291120 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 760683270291120 Assessment Year: 2020-21Chinmay BhattNo ratings yet

- NEST 2020 Session 2Document52 pagesNEST 2020 Session 2Saurabh SarkarNo ratings yet

- IRT Study Guide For Dial M For MurderDocument19 pagesIRT Study Guide For Dial M For MurderChinmay Bhatt100% (1)

- Problem Sets Human ResourcesDocument2 pagesProblem Sets Human ResourcesHiếu NguyễnNo ratings yet

- Rfox DC Apc CJHX 58 NDocument14 pagesRfox DC Apc CJHX 58 NAnuj AnujNo ratings yet

- Module 7.1 - Investment Property - My Students' Copy - BenildeDocument13 pagesModule 7.1 - Investment Property - My Students' Copy - BenildeMarjorie LopezNo ratings yet

- Public Policy and The Developments in The Small and Medium-Sized Enterprises Sector in Tanzania During The Ujamaa' Ideology, 1967-1985Document336 pagesPublic Policy and The Developments in The Small and Medium-Sized Enterprises Sector in Tanzania During The Ujamaa' Ideology, 1967-1985wynfredNo ratings yet

- Boon or BaneDocument2 pagesBoon or BaneLucifer RoxxNo ratings yet

- Bureau - Veritas - ESMA Service Card - May - 2021Document7 pagesBureau - Veritas - ESMA Service Card - May - 2021Balakrishna GopinathNo ratings yet

- Last 6 Months Govt Schemes & Initiatives Top 150 Mcqs NotesDocument324 pagesLast 6 Months Govt Schemes & Initiatives Top 150 Mcqs Notescdtsharma99No ratings yet

- Gujarat Labour Welfare Board: This Is A Computer Generated Receipt. Hence, Doesn't Required SignatureDocument1 pageGujarat Labour Welfare Board: This Is A Computer Generated Receipt. Hence, Doesn't Required SignatureS S Electricals DahejNo ratings yet

- Proforma Ata#119 7 02 2022Document32 pagesProforma Ata#119 7 02 2022Jamir FloresNo ratings yet

- Market Failure and Non Communicable DiseasesDocument3 pagesMarket Failure and Non Communicable DiseasesPatrick Louie MaglayaNo ratings yet

- EXCERSE 1. What Are The Internal Incentives For Choosing An Unrelated Diversification Strategy (At Corporate-Level) ?Document3 pagesEXCERSE 1. What Are The Internal Incentives For Choosing An Unrelated Diversification Strategy (At Corporate-Level) ?Nhi TuyếtNo ratings yet

- Topics On Income TaxationDocument4 pagesTopics On Income TaxationJessa Lopez GarciaNo ratings yet

- Alienation, Hindu Joint Family SystemDocument2 pagesAlienation, Hindu Joint Family Systemathisaya CGNo ratings yet

- Modeling Business DecisionDocument3 pagesModeling Business Decision7xdbbnnhqmNo ratings yet

- National Security: The Role of Investment Screening MechanismsDocument37 pagesNational Security: The Role of Investment Screening MechanismsRocking MeNo ratings yet

- Far1 Chapter 4Document61 pagesFar1 Chapter 4Erik NavarroNo ratings yet

- Required:: Answer: The Optimal Transaction Size Is P70,711Document2 pagesRequired:: Answer: The Optimal Transaction Size Is P70,711Unknowingly AnonymousNo ratings yet

- Hana Leulseged 2324 Intl Student Fin Aid App PDFDocument5 pagesHana Leulseged 2324 Intl Student Fin Aid App PDFHana LeulsegedNo ratings yet

- Lecture Plan REM311 Oct 22 - MFMDocument4 pagesLecture Plan REM311 Oct 22 - MFMSITI MARIAM MAILNo ratings yet

- Invoice 24748777-24648536 DD1503-100 14.07.2021Document3 pagesInvoice 24748777-24648536 DD1503-100 14.07.2021Adrian Cordova LopezNo ratings yet

- Lahore Commerce Academy: 2 114-Allama Iqbal Road, Ghari Shahu, Lahore. (In-Front of Warid Franchise)Document21 pagesLahore Commerce Academy: 2 114-Allama Iqbal Road, Ghari Shahu, Lahore. (In-Front of Warid Franchise)Waqas AwaisNo ratings yet

- LODR NotesDocument33 pagesLODR NotestirthankarNo ratings yet

- Thom22e ch05 FinalDocument41 pagesThom22e ch05 FinalKevin BornicaNo ratings yet

- Spatial Access To Pedestrians and Retail Sales in Seoul, KoreaDocument11 pagesSpatial Access To Pedestrians and Retail Sales in Seoul, KoreaParth PasheklNo ratings yet

- Assignments Topics SYBA A Indian EconomyDocument3 pagesAssignments Topics SYBA A Indian EconomyMohil DaveraNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- Activity Based Costing: Performance ManagementDocument8 pagesActivity Based Costing: Performance Managementmy moviesNo ratings yet