Professional Documents

Culture Documents

Costing MCQ

Uploaded by

Sahil PatilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Costing MCQ

Uploaded by

Sahil PatilCopyright:

Available Formats

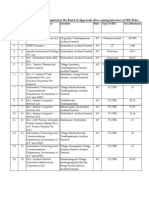

The total of all direct expenses is known as a) Total cost b) Overhead c) Prime cost d) Work cost e) None of

these

74The process of distribution of overheads allotted to a particular department or cost center over the

units produced is called: a. Allocation b. Apportionment c. Absorption d. Departmentalization

75.Which of the following is not included in the objectives of maintenance of plant and machinery? a.

Reducing idle time b. Reducing breakdown c. Maintaining efficiency d. Increasing life

76. Regular maintenance expenses are : a. Capitalized b. Part of manufacturing overheads c. Written-off to

costing profit and loss account d. Part of prime cost

77. Functionally, administration expenses may comprise expenses of the following activities: a. Secretarial

and board of directors b. Accounting, financing, tax and legal c. Audit and personnel d. All of these

78.If an item of overhead expenditure is charged specifically to a single department this would be an

example of: a. Apportionment b. Allocation c. Re-apportionment d. Absorption

79. Interest on own capital is a: a. Cash cost b. Notional cost c. Sunk cost d. Part of prime cost

80. Which of the following is not a possible method of accounting for administration overheads? a. Include

as part of production overheads b. Apportion to production, selling and distribution functions c. Treat

administration as a separate entity and treat the costs as such d. Transfer to costing profit and loss account

81. Which of the following is not used as a base for apportionment of administration overheads? a. Direct

wages b. Works cost c. Conversion cost d. Sales value

82. In account ting for labourcost: a. A. direct labour cost and indirect labour cost are charged to prime cost

b. Direct labour cost and indirect labour cost are charged to overheads c. Direct labour cost is charged to

prime cost and indirect labour cost is charged to overheads d. All of the above

83. Productive causes of idle time include the following except : a. Power failure b. Fall in demand c.

Machine breakdown d. Waiting for materials, tools, instructions, etc.

84. The treatment of idle time in cost includes the following: a. Cost of normal and controllable idle time is

charged to factory overheads b. Cost of normal but uncontrollable idle time is treated as prime cost c. Cost of

abnormal and uncontrollable idle time is charged to costing profit and loss account d. All of the above

85. normal Overtime may be treated, as: a. Part of direct wages b. Part of production overheads c. Part of

capital order d. All of the above

86. A manufacturing firm is very busy and is working overtime. The amount of overtime premium

contained in direct wages would normally be classed as: a. Part of prime cost b. Factory overheads c. Direct

labour cost d. Administrative overheads

18. Depreciation is ...........expenditure. A) variable b) Fixed c) Direct d) Indirect e) Semi-variable

19. Out of pocket payment involves payment to a) Managers b) Promoters c) Directors d) Shareholders e)

Outsiders

You might also like

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesFrom EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesRating: 4.5 out of 5 stars4.5/5 (3)

- Unit I A. Cost AscertainmentDocument37 pagesUnit I A. Cost AscertainmentRajanNo ratings yet

- Cost Accounting MCQDocument9 pagesCost Accounting MCQlindakutty100% (3)

- AbcDocument9 pagesAbcTheresa Fe MacasiebNo ratings yet

- Quali ExamDocument7 pagesQuali ExamLovenia Magpatoc50% (2)

- Basic ConceptsDocument3 pagesBasic ConceptsRosemarie CruzNo ratings yet

- CH 07Document33 pagesCH 07James BarzoNo ratings yet

- A-2 Final Review 15-16 KeyDocument10 pagesA-2 Final Review 15-16 KeydanNo ratings yet

- The Cost of Quality and Accounting For Production LossesDocument19 pagesThe Cost of Quality and Accounting For Production Lossesjammy AgnoNo ratings yet

- CH 06Document39 pagesCH 06JOEMAR LEGRESONo ratings yet

- Sem VI - Cost Accounting - TY. BcomDocument7 pagesSem VI - Cost Accounting - TY. Bcommahesh patilNo ratings yet

- University of Caloocan City Cost Accounting & Control Midterm ExaminationDocument8 pagesUniversity of Caloocan City Cost Accounting & Control Midterm ExaminationAlexandra Nicole IsaacNo ratings yet

- Xin ChaoDocument10 pagesXin ChaoQuế Hoàng Hoài ThươngNo ratings yet

- Multiple Choice QuestionsDocument136 pagesMultiple Choice QuestionsEllen100% (3)

- 07 The Cost of Quality Accounting For Production LossesDocument15 pages07 The Cost of Quality Accounting For Production LossesChristian Blanza Lleva100% (2)

- Job Order Costing Seatwork (121316)Document11 pagesJob Order Costing Seatwork (121316)AllyzzaBuhainNo ratings yet

- Cma & Cs Costing McqsDocument35 pagesCma & Cs Costing Mcqskumar udayNo ratings yet

- Manufacturing - Quiz WeygantDocument26 pagesManufacturing - Quiz WeygantAlta SophiaNo ratings yet

- Acctg 201 - Assignment 2Document11 pagesAcctg 201 - Assignment 2sarahbee75% (4)

- Exercise Chap 18 (1,2,3)Document7 pagesExercise Chap 18 (1,2,3)Anh PhạmNo ratings yet

- MIDTERMDocument23 pagesMIDTERMJanine LerumNo ratings yet

- Simulated Midterm Exam - Cost Accounting PDFDocument13 pagesSimulated Midterm Exam - Cost Accounting PDFMarcus MonocayNo ratings yet

- Test Bank Chap 7Document14 pagesTest Bank Chap 7Paula Dionisio100% (3)

- Quiz 3 SolutionDocument2 pagesQuiz 3 SolutionimagineimfNo ratings yet

- Chapter 003, Systems Design Job-Order CostingDocument222 pagesChapter 003, Systems Design Job-Order CostingHo Yuen Chi EugeneNo ratings yet

- Management Accounting Practice QuestionsDocument6 pagesManagement Accounting Practice QuestionsSayantan NandyNo ratings yet

- Cost and Management Accounting 01 - Class NotesDocument114 pagesCost and Management Accounting 01 - Class NotessaurabhNo ratings yet

- Comprehensive Exam in Cost Accounting and Control 2022Document8 pagesComprehensive Exam in Cost Accounting and Control 2022Maui EquizaNo ratings yet

- 07 - Costacctng 07 - CostacctngDocument20 pages07 - Costacctng 07 - Costacctngatty lesNo ratings yet

- Process and Job Order TheoriesDocument12 pagesProcess and Job Order TheoriesAngelica ManaoisNo ratings yet

- Cost of Quality & Accounting For Production Losses (Theories and Problems)Document19 pagesCost of Quality & Accounting For Production Losses (Theories and Problems)Cassandra Dianne Ferolino MacadoNo ratings yet

- 10 Just-In-Time & BackflushingDocument12 pages10 Just-In-Time & BackflushingMaviel Maratas Sarsaba73% (11)

- Cost Accounting by Carter (14e) Ch07Document19 pagesCost Accounting by Carter (14e) Ch07Rica Joyce Pasco Garcia100% (1)

- Handout 4 - Job Order Costing PDFDocument11 pagesHandout 4 - Job Order Costing PDFKurt CaneroNo ratings yet

- OLABISI ONABANJO Cost Accounting Second Semester ExamDocument6 pagesOLABISI ONABANJO Cost Accounting Second Semester Examonaneye ayodejiNo ratings yet

- Cost SheetDocument20 pagesCost SheetKeshviNo ratings yet

- CostDocument17 pagesCostRomiline UmayamNo ratings yet

- Review 1Document6 pagesReview 1Phuong DungNo ratings yet

- 02-08-2022 CRC-ACE - AFAR - Week 05 - Factory OverheadDocument14 pages02-08-2022 CRC-ACE - AFAR - Week 05 - Factory Overheadjohn francisNo ratings yet

- Ejers Tema 2Document17 pagesEjers Tema 2David MajánNo ratings yet

- Thank Kuya Lloyd LaterDocument20 pagesThank Kuya Lloyd LaterGerald Lloyd M. SudarioNo ratings yet

- Test Bank - Chapter 3 Job Order CostingDocument36 pagesTest Bank - Chapter 3 Job Order CostingAiko E. Lara81% (21)

- Mcqs On Accounting For Business Decision (Chapter 3 To 5) : (A) Can Not (B) Can (C) May or May Not (D) MustDocument10 pagesMcqs On Accounting For Business Decision (Chapter 3 To 5) : (A) Can Not (B) Can (C) May or May Not (D) MustUsha Ananda ramugadeNo ratings yet

- Akbi MCDocument13 pagesAkbi MCGita SagitaNo ratings yet

- Comprehensive CostDocument8 pagesComprehensive CostTilahun GirmaNo ratings yet

- Cost Old DeptalsDocument9 pagesCost Old Deptalsyugyeom rojas0% (1)

- Ch.2 - Test Bank - 2Document13 pagesCh.2 - Test Bank - 2ahmedgalalabdalbaath2003No ratings yet

- Job Order Costing Multiple ChoiceDocument3 pagesJob Order Costing Multiple ChoiceM CkNo ratings yet

- MC 6-10-Problem 20Document3 pagesMC 6-10-Problem 20Robert GarlandNo ratings yet

- Far Eastern Univrsity Cost Accounting CanvassDocument8 pagesFar Eastern Univrsity Cost Accounting CanvassSharmaine FranciscoNo ratings yet

- Ch10TB PDFDocument13 pagesCh10TB PDFMico Duñas CruzNo ratings yet

- 16-Classifications of CostsDocument16 pages16-Classifications of CostsCha MonteroNo ratings yet

- Paper 5 - Corporate & MGMT Acs MCQs Part 1 PDFDocument60 pagesPaper 5 - Corporate & MGMT Acs MCQs Part 1 PDFSeema NaharNo ratings yet

- A03 - Chapter 5 Job Order Costing (Theories)Document4 pagesA03 - Chapter 5 Job Order Costing (Theories)Rigel Kent MansuetoNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Creating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowFrom EverandCreating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowRating: 4 out of 5 stars4/5 (1)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Sep 22Document1 pageSep 22K2Rankon K2RankonNo ratings yet

- Trade Lic-2021-2024Document1 pageTrade Lic-2021-2024Sadam KhanNo ratings yet

- Balance Sheet of Hindustan UnileverDocument7 pagesBalance Sheet of Hindustan UnileverPranjal JoshiNo ratings yet

- Company Name Buyer/Supplier/Both Company Email: Ganesan.v@vgindustries - Co.inDocument13 pagesCompany Name Buyer/Supplier/Both Company Email: Ganesan.v@vgindustries - Co.inzoheb jafriNo ratings yet

- Lecture 4 - Insurance Company Operations (FULL)Document31 pagesLecture 4 - Insurance Company Operations (FULL)Ziyi YinNo ratings yet

- On U Boot Beton TechnologyDocument16 pagesOn U Boot Beton TechnologyJHLIKNo ratings yet

- 00 Opd Circular 2021Document1 page00 Opd Circular 2021AnshulNo ratings yet

- List of Formal Approval SEZDocument34 pagesList of Formal Approval SEZsampuran.das@gmail.comNo ratings yet

- Regression & Elasticity 1Document11 pagesRegression & Elasticity 1biggykhairNo ratings yet

- II. Compilation of GDP by Income ApproachDocument15 pagesII. Compilation of GDP by Income ApproachPreetiNo ratings yet

- Tax Reform in Nepal: A Study of Nepalese VATDocument118 pagesTax Reform in Nepal: A Study of Nepalese VATMilan Shakya91% (47)

- M 16 Forecasting Financial Statements in ExcelDocument12 pagesM 16 Forecasting Financial Statements in ExcelAnrag Tiwari100% (1)

- Johnson & Johnson By-Laws: Article 1 Meetings of ShareholdersDocument26 pagesJohnson & Johnson By-Laws: Article 1 Meetings of ShareholdersVanessita TarapuesNo ratings yet

- Micro Perspective of Tourism and Hospitality (Thc1)Document11 pagesMicro Perspective of Tourism and Hospitality (Thc1)Jomharey Agotana BalisiNo ratings yet

- EIB-551 - Summer 2020 - PP - Exporting - Bangladeshi - VegetableDocument14 pagesEIB-551 - Summer 2020 - PP - Exporting - Bangladeshi - VegetableFarhan TanvirNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Sahil SharmaNo ratings yet

- Chapter# 5 Accounting Transaction CycleDocument16 pagesChapter# 5 Accounting Transaction CycleMuhammad IrshadNo ratings yet

- SWOT Analysis PhilippinesDocument2 pagesSWOT Analysis Philippinesjerelleenrodriguez80% (20)

- Steve Romick SpeechDocument28 pagesSteve Romick SpeechCanadianValueNo ratings yet

- International Pepper Community: Report of The 36 Peppertech MeetingDocument26 pagesInternational Pepper Community: Report of The 36 Peppertech MeetingV Lotus Hbk0% (1)

- Market Ratios - Practice QuestionsDocument16 pagesMarket Ratios - Practice QuestionsOsama Saleem0% (1)

- NOBO ParagraphDocument1 pageNOBO ParagraphMustafa Nabeel ZamanNo ratings yet

- A Commissioners Primer To Economics of Competition Law in India Geeta Gouri Full ChapterDocument67 pagesA Commissioners Primer To Economics of Competition Law in India Geeta Gouri Full Chapterlarry.calder828100% (7)

- Chapter 6 - Far - Adjusting EntriesDocument14 pagesChapter 6 - Far - Adjusting EntriesDianna Lynn MolinaNo ratings yet

- Elettra Stimilli - Debt and Guilt (2018, Bloomsbury)Document183 pagesElettra Stimilli - Debt and Guilt (2018, Bloomsbury)Stephen K. Scott100% (2)

- ECOM074: Bond Market StrategiesDocument87 pagesECOM074: Bond Market StrategiesBen OusoNo ratings yet

- Lesson 8 and 9Document4 pagesLesson 8 and 9RalfNo ratings yet

- Chapter Four The Theory of Production and CostDocument15 pagesChapter Four The Theory of Production and CostTadesse Ayalew100% (1)

- Eco Group AssignmentDocument10 pagesEco Group AssignmentMr ArmadilloNo ratings yet

- RDO No. 57 - Biคan City, West Laguna 2Document298 pagesRDO No. 57 - Biคan City, West Laguna 2Yana PynNo ratings yet