Professional Documents

Culture Documents

Book-Building Process: An Efficient Mechanism For Management of Mega Public Issues in India

Book-Building Process: An Efficient Mechanism For Management of Mega Public Issues in India

Uploaded by

Narayanan BhaskaranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book-Building Process: An Efficient Mechanism For Management of Mega Public Issues in India

Book-Building Process: An Efficient Mechanism For Management of Mega Public Issues in India

Uploaded by

Narayanan BhaskaranCopyright:

Available Formats

THEME

BOOK-BUILDING PROCESS: AN EFFICIENT

MECHANISM FOR MANAGEMENT OF

MEGA PUBLIC ISSUES IN INDIA

T

he stock market has mechanism named as Book- ment or information memo-

been acknowledged Building in the system of Ini- randa or offer document”.

all over the world as tial Public Offerings (IPOs) In general, the word “Book-

vital for long-term economic was introduced by SEBI in building” is a method of mar-

growth. Several empiri- India on the basis of the rec- keting the shares of a com-

cal studies have proved that ommendations of the com- pany whereby the quantum

there is a strong positive cor- mittee constituted under the and the price of the securities

relation between the level of chairmanship of YH Male- to be issued will be decided on

the basis of the ‘bids’ received

from the prospective share-

The book-building system is part of Initial Public Offer holders by the lead merchant

(IPO) of Indian Capital Market. It was introduced by SEBI bankers. According to this

Dr. V. Gangadhar* on recommendations of Mr. Y.H. Malegam in October 1995. method, share prices are de-

It is most practical, fast and efficient management of Mega termined on the basis of real

Issues. Book Building involves sale of securities to the public demand for the shares at vari-

and the institutional bidders on the basis of predetermined ous price levels in the market.

price range. It is an innovative method of marketing securi-

ties involving price determination and quantum of securities Objectives

G. Naresh Reddy** on the basis of the demand from the prospective sharehold- The main objectives of

*The author is Convener

ers. In this process the SEBI (Market Regulator) has issued this article are as follows:

ICET 2005, Professor of various guidelines for control and regulation of book-building 1. To understand the con-

Commerce and Business

Management, Kakatiya

process. Since, inception of book-building process in India, ceptual framework of

University, Warangal. Share of Mega Issues in total capital mobilised has increased Book-Building.

**The author is a faculty

Member and Research from 60.1 per cent in 1994-95 to 92.3 per cent in 2003-04. 2. To study the regulatory

Scholar of Department of

Commerce and Business guidelines of SEBI for

Management, University

Arts & Science College in

Book-Building Issues.

Warangal. sophistication of a country’s gam in October 1995. The 3. To examine the recent de-

stock market and its level of Book-Building is the most velopments in the Book-

economic growth and de- practical mechanism for the Building Process.

velopment. Countries with quick and efficient manage- 4. To analyse the Trends in

well-developed stock mar- ment of mega issues1 (includ- the Book-Building Issues

kets generally tend to enjoy ing offers for sale). in India.

higher economic growth and

development than those with Meaning Malegam Panel’s

underdeveloped stock mar- SEBI guidelines, 1995 Recommendations:

kets (Frank). There was a vital defined book-building as The introduction of

need to strengthen the capital “a process undertaken by book-building in India in

market, which could only be which a demand for the se- 1995 was on account of the

achieved through structural curities proposed to be issued recommendations of an ex-

modifications, introducing by a body of corporate is elic- pert committee appointed by

new market mechanism, in- ited and built up and the price SEBI under Chairmanship

struments, and by taking steps for such securities is assessed of YH Malegam “to review

for safeguarding the interest for the determination of the the (then) existing disclosure

of the investors through more quantum of such securities to requirements in offer docu-

disclosures and transparency. be issued by means of a notice, ments.” Two of the terms of

In this context, an important circular, advertisement, docu- reference being “the basis of

1

Mega Issue is an Initial Public Offer with a capital offered to public exceeds more than Rs. 100 crore.

676 The Chartered Accountant November 2005

pricing the issue” and “wheth- extended to 100 percent of the a continuous three days

er substantial reduction was issue, available only if the is- containing, inter alia, the

possible in the time taken for sue amount was Rs. 100 crore price as well as a table

processing applications by and above, compulsorily offer- showing the number of

SEBI.” The committee has ing an additional 10 percent securities and the amount

submitted its report with sev- of the issue sise to the public payable by an investor,

eral recommendations and through prospectus, and re- based on the price deter-

the SEBI accepted the same serving at least 15 percent of mined, shall be issued and

in November 1995. The book- the issue size to individual the interval between the

building route should be open investors applying up to ten advertisement and issue

to issuer companies, subject to tradable lots. Further, audited opening date should be a

certain terms and conditions. financial ratios had to be dis- minimum of five days.”

Some of them are presented closed, namely, EPS, P/E, av- 2. The draft prospectus to

below: erage return on net worth for be circulated has to indi-

1. The option should be the last three years and net cate the price band within

available only to issues ex- asset value based on last year’s which the securities are

ceeding Rs. 100 crore; balance sheet. being offered for sub-

2. The book-building issuer However, there were no scription. The bids have

companies could either takers for the 100 percent to be within the price

reserve the securities for book-building facility. Based bands. Bidding is permis-

firm allotment or avail on suggestions made by lead- sible only if an electroni-

themselves of the book- ing merchant bankers, the cally-linked transparent

building process; following amendments were facility is used. An issu-

3. Draft prospectus to be made to the guidelines in ing company can also fix

submitted to SEBI could 1999: a minimum bid size. An

exclude information 1. The issuer may be allowed initial bid can be changed

about the offer price; to disclose either the is- before the final rate is

4. A book runner to be sue size or the number of determined. The mega

nominated from among securities to be offered to issues such as Petronet

the lead merchant bank- the public; LNG and Biocon were

ers, charged with specific 2. Allotment should be in successfully launched

responsibilities and the demat mode only; and through the 100 percent

name is to be submitted 3. Reservation of 15 percent book-building route.

to the SEBI’s approval; of issue amount for indi- 3. The Prospective bidders

and vidual investors need to were advised to read the

5. The requirement of 25 the public at a fixed price. “Red herring prospec-

percent of the securities Some of the earliest mega tus” carefully. According

to be offered to the public issues through the book- to the Act, a “Red her-

will be continued. building route were those ring prospectus” means

There have been sev- of Larsen & Toubro, ICI- a prospectus that does

eral amendments/revisions CI, Tisco and others. not have complete par-

to the above guidelines; the ticulars on the price and

first one in December 1996 SEBI Guidelines: the quantum of securi-

made available the option of 1. In January 2000, SEBI ties offered. The Concise

book-building to all corporate has issued a compen- Oxford Dictionary gives

bodies which were otherwise dium of guidelines, cir- the meaning of ‘red her-

eligible to make an issue of culars and instructions ring’ as a misleading clue

capital to the public, and in to merchant bankers re- or distraction, so named

case of under subscription, the lating to issue of capital, from the practice of using

spill-over from the public por- including those on the the scent of red herring in

tion could be permitted to the book-building mecha- training hands.

placement area and vice-versa. nism. The compendium 4. The year 2000, Amend-

In 1997, the restriction of the includes a model time ment to the Act gave legal

facility to 75 percent of the frame for book-building: cloak to the book-build-

issue was thought to severely “After the price has been ing route by allowing cir-

constrain the benefits aris- determined on the ba- culation of the informa-

ing out of price and demand sis of bidding, statutory tion memorandum and

discovery, and the facility was public advertisements for the red herring prospec-

November 2005 The Chartered Accountant 677

tus. According to the Act, disclosure requirements, Recent Changes in Book-

a process is to be under- allocation/allotment pro- Building Mechanism:

taken prior to the filing cedure and maintenance The Securities and Ex-

of a prospectus by which of books and records. change Board of India on

a demand for the securi- March 29, 2005 announced

ties proposed to be issued Types of Book-Building sweeping changes in the IPO

by a company is elicited, Process: norms. They are as follows:

the price and the terms of The Companies are bound 1. Increased allocation for

the issue of such securi- to adhere to the SEBI’s guide- retail investors in book-

ties are assessed by means lines for book building offers built issue from 25 per

of a notice, circular, ad- in the following manner: cent to 35 per cent and

vertisement or document. 1. 75 per cent Book-Building has also changed the defi-

Incidentally, the working Process: nition of the retail cat-

group on the Compre- Under this process 25 egory.

hensive Companies Bill, per cent of the issue is to be 2. The market regulator has

1997 (since lapsed) had sold at a fixed price and the now permitted retail in-

advocated introduction balance of 75 per cent through vestors to apply for Rs. 1

Chart-1: 75 per cent Book-building Process

of book-building. It de- the Book Building process. lakh worth of shares in a

fined the term as “an in- Chart-1 indicates this pro- book-built issue against

ternational practice that cess. Rs. 50,000 earlier. For

refers to collecting orders 2. Offer to Public through Book- this purpose, SEBI has

from investment bankers Building Process: redefined the retail in-

and large investors based The process specifies that dividual investor as one

on an indicative price an issuer company may make who applies or bids for

range. In capital markets, an issue of securities to the securities of or for a value

with sufficient width and public through prospectus in not exceeding Rs. 1 lakh.

depth, such a pre-issue the following manner: 3. It has reduced the non-

exercise often allows the a. 100 per cent of the net of- institutional category,

issue to get a better idea fer to the public through popularly known as high

of the demand and the book building process, net worth individuals

final offer price of an in- or (HNI), allocation from 25

tended public offer.” b. 75 per cent of the net of- per cent to 15 per cent.

5. SEBI (Disclosure and In- fer to the public through 4. Institutional investors

vestor Protection) Guide- book building process include foreign financial

lines, 2000 contains pro- and 25 per cent of the institutions (FII) banks,

visions for book building net offer to the public at a mutual funds and Indian

under chapter XI that price determined through financial institutions like

includes guidelines for book building process. LIC or IDBI.

75 per cent book-build- (Please refer to Chart 2 5. The changes have been

ing process, 100 per cent & 3 on the next page). made in the SEBI (DIP)

book-building process, Guidelines, 2000 on the

678 The Chartered Accountant November 2005

Chart-2: 100% of the Net Offer to the Public are:

Through 100% Book Building Process (a) The issuer company,

(b) The Book Run-

ning Lead Manager

(BRLM) who is a

Category I Mer-

chant Banker reg-

istered with SEBI,

and

(c) The Syndicate

Members who are

intermediaries regis-

tered with SEBI and

who are permitted

to carry on activi-

ties as underwriters.

Syndicate Members

Chart- 3: 75% of the Net Offer to the Public are appointed by

Through Book- Building Process: Book Running Lead

Manager.

(ii) The steps for book build-

ing process (Chart 5) are:

(a) Preparation of draft

prospectus,

(b) Formation of Syndi-

cate,

(c) Record of orders,

(d) Consolidation,

(e) Closure of order

book,

(f ) Determination of

price,

(g) Agreement with

basis of recommendations syndicate members,

made by SEBI’s primary (h) Payment in ad-

market advisory commit- band in RHP/application vance,

tee. form/abridged prospectus (i) Filling of prospec-

6. The new norms will be (current practice) or to tus,

applicable to all public disclose the price band/ (j) Two Separate ac-

issues whose draft offers floor price at least one day counts are opened by

documents are filed with before bid opening. the issuer company

SEBI on or after April 4, 10. It is proposed to amend for collection of ap-

2005. the guidelines to improve plication money,

7. SEBI has decided to re- contents and ensure uni-

duce the bidding period (k) Collection of appli-

formity in data display on cation for securities,

from the current 5 to 10 the websites of the stock

days (including holidays) (l) Allotment of place-

exchanges. The date will ment and public

to 3 to 7 working days. be made available for a

8. It has also provided more portions,

further period of three

flexibility for listed com- (m) The placement por-

days after the closure of

panies to disclose price tion may be used to

the bids/issue.

band/floor price for pub- adjust under sub-

lic issues one day before Book Building Process in scription,

bid opening. India: (n) Rate of allotment,

9. SEBI has decided to give (i) The principal parties/in- and

an option to listed issu- termediaries involved in (o) Maintenance of re-

ers to either disclose price a book building process cords.

November 2005 The Chartered Accountant 679

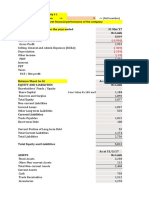

Chart-4: Steps Involved in Book-Building Process Rs. 450-540 to Rs. 500-

580. The final price of-

Nominate Book Runner fered was Rs. 580 for the

t shares.

Form Syndicate of Brokers, Arrangers,Underwriters, Financial Institutions, etc. 6. Other companies which

t have accepted the book-

Submit Draft Offer Document to SEBI without mentioning Coupon Rate or Price building mechanism

t were Shree Rama Multi

Circulate offer Document among the Syndicate Members Tech Ltd., Sydus Cadila

t Healthcare Ltd., Mas-

Ask for Bids on Price and Quality of Securities cot Systems Ltd., Cre-

t ative Eye Ltd., MosChip

Aggregate and forward all offers to Book Runner Semiconductor Technol-

t

ogy Ltd., SIP Technolo-

Run the Book to maintain a record of Subscribers and their Orders

gies and Exports Ltd.,

t

Hughes Tele. Com India

Consult with Issuer and Determine the issue Price as Weighted Average of the Offers Received

Ltd., MRO TEK Ltd.,

t

Pritish Nandy Com-

Firm up Underwriting Commitments

munications Ltd., Balaji

t

Telefilms Ltd., ASTEC

Allot Securities Among Syndicate Members

t

Software & Technol-

Securities Issued and Listed

ogy Services Ltd., Mid-

t

Day Multimedia Ltd.,

Trading Commences on Exchanges

D-Link (India) Ltd., Jet

Source: Agarwal, Sanjib: Bharat’s Manual of Indian Capital Market, Bharat Law House, New Delhi, 1997, p.578. Airways (India) Ltd.,

UTV Software Commu-

nications Ltd., Punjab

Recent Trends in Book- and the procedure is still

National Bank, Gateway

Building Issues in India evolving. ICICI was

Distriparks Ltd., IVRCL

1. The book-building pro- the first company to use

Infrastructure & Projects

cess in India is very trans- Book-building method

Ltd.

parent. All investors (in- for its Rs. 1000 crore-

The Pattern of Mega Is-

cluding small investors) bond issue in April 1996

can see on an hourly basis sues and their role in relation

followed by Rs. 4,323

where the book is be- crore Larsen & Toubro to total amount of capital mo-

ing built before applying. issue and Rs. 5,878 crore bilised by Indian companies

Therefore, no asymmetry TISCO bond issue for were presented in Table-1. We

as far as information dis- the placement portion. observed that 112 mega issues

semination is concerned. 4. The recent issue of raised Rs. 51,823 crores form-

2. The year 2004 was a Hughes Software made ing 93 per cent of total capi-

significant and bumper history in more than one tal mobilised through public

because companies have way. It was the first In- issue in the year 2003-04.

raised Rs. 30,511 crore dian IPO in IT indus- This year accounted for high-

through public issue and tries to adopt the “Book- est amount and percentage of

99 per cent of this being Building” process and the capital mobilised. However,

good quality securities issue was highly over sub- 1999-00 accounted for high-

from established compa- scribed. est number of mega issues

nies and almost all issues 5. In November 1999 the at 192 where as the highest

were through book-build- HCL technologies has amount of capital mobilised

ing. The Pattern of Mega raised capital through was in the year 2000-01 at

Issues during 1992-93 to IPO Book-building Rs. 69,764 crore. The share of

2003-04 was presented in method, investors gave mega issues in the total capi-

Table-1 and large issues an enthusiastic response. tal mobilised through public

were presented in Table- The issue got over sub- issues increased almost two

2. scribed by 27 times. This times from 45.25 per cent in

3. The practice of book- was despite the fact that 1992-93 to 92.3 per cent in

building is new to the the company revised its 2003-04.

Indian capital market original price band of If we observe the growth

680 The Chartered Accountant November 2005

However,

book-build-

ing process

has got its NA = Not Available

inherent Source: CMIE Capital Markets Issues, August 2003 and June.

deficien-

cies. For

example, rate in the amount of capi- for sale is significantly higher 72 times, Indoco Remedies

it is only tal raised during the decade, than the public offer. Further, Ltd., by 68 times, Power Trad-

applicable the year 1997-98 recorded at types of instruments issued by ing Corporation of India,

for Mega an increase of 69.2 per cent the companies are equity and Dishman Pharmaceuticals &

Issues, the and 2001-02 recorded high- bonds. Amount contributed Chemicals Ltd., by 38 times

risk return est decline at -38.6 per cent. through equity is 80.5 per cent each, NDTV 37 times, Bio-

preference The amount of total capi- as compared to 19.5 per cent con Ltd., 32 times. All other

of the inves- tal mobilised from the public of bonds. Hence, the finan- mega issues have also recorded

tors cannot issues as shown significantly cial year 2003-04 has claimed their over subscription rang-

be estimat- ing from 6 to 30 times. It is

wide fluctuations from 186.7 highest amount of funds raised

ed system- evident that some of the mega

per cent in 1994-95 and -35.8 through mega as well as large

atically, it issues were over subscribed by

per cent in 2001-02. This indi- issues in the Indian capital

works only many times within couple of

cates that there is no clear-cut market.

in efficient minutes from opening of the

consistency in the number and The Kotak Mahindra Cap-

and ma- issue due to enormous support

tured mar- amount of public issues. Apart ital Services Company fol-

from this the amount raised lowed by DSP Merrill Lynch from corporate enterprises, fi-

kets and, nancial institutions and high

possibility through mega issues was also Ltd., have become prominent

recorded similar trends. Based Book Running Lead Manag- net worth investors.

of price rig-

ging by the on this, we can highlight ers (BRLM) of mega issues,

that through book-building since, the former has handled Limitations of Book-

promoters Building System

before pub- process is highly commend- 18 and the later has managed

able. 14 mega issues successfully. The book-building system

lic issue. has various limitations. Some

We observe from the data JM Morgan Stanley Private

of the table-2, that the total of- Ltd., Enam Financial Con- of them are as are as follows:

fer sise was Rs. 19,452 crore sultants Pvt. Ltd., has success- 1. Book-building is appro-

from 12 companies during fully managed 11 mega issues priate for mega issues

only. In the case of the

2003-04. Among them, 54.98 each and became third highest

potential investors, the

per cent was raised by ONGC Book Running Lead Manag-

companies can adjust the

alone and the remaining is from ers. All other merchant bank-

attributes of the offer ac-

the rest of 11 companies. ers have handled few of the

cording to the preferences

The types of issues are mega issues ranging from 1 to

of the potential investors.

consisting of voluntary offer 9 each. It may not be possible in

for sale and public issue. The IPO of Bharat Shipyard big issues since the risk-

contribution of voluntary offer Ltd. was over subscribed by return preference of the

682 The Chartered Accountant November 2005

12-06-04

09-03-04

Note: Large Issues are deemed to be of Rs. 300 Crore and above.

Source: CMIE Reports.

investors cannot be esti- building mechanism can avail the price stabilisation process,

mated easily; of the GSO for stabilising if required. It owes its origin

2. The issuer company the post-listing price of its to the Green Shoe Company,

should be fundamentally shares. The GSO means “an which used this option for

strong and well known to option of allocating shares in the first time throughout the

the investors; excess of the shares included world. Recently, ICICI Bank

3. The book-building sys- in the public issue and oper- has, perhaps, used GSO in the

tem works very efficiently ating a post-listing price sta- first time in case of its public

in matured market con- bilising mechanism through a issue through book-building

ditions. In such circum- stabilising agent (SA).” GSO mechanism in India.

stances, the investors in the system of IPO using

are aware of the various book-building method was Conclusion

parameters affecting the recognised by SEBI in India The spirit beyond the

market price of the securi- through its new guidelines introduction of book-build-

ties. But, such conditions on 14th August 2003 (Vide ing mechanism in India is to

are not commonly found SEBI/CFD/DIL/DIP/Circu- discover the right price for

in practice; lar No.11). According to SEBI a public issue, which in turn

4. There is a possibility of guidelines, “a company desir- would eliminate unreason-

price rigging on listing as ous of availing the GSO shall able issue pricing by greedy

promoters may try to bail in the resolution of the general promoters. The success of the

out syndicate members. meeting authorising the pub- book-building system depends

lic issue, seek authorisation on co-operation among the

Green Shoe Option (GSO) also for the possibility of allot- Book Runner Lead Manager,

A Company making an ment of further shares to the Issuing Company, Securities

initial public offer of equity management team, as the SA”, and Exchange Board of India

shares through the book- who will be responsible for (Regulator), and Investors. r

November 2005 The Chartered Accountant 683

You might also like

- Value Creation Principles: The Pragmatic Theory of the Firm Begins with Purpose and Ends with Sustainable CapitalismFrom EverandValue Creation Principles: The Pragmatic Theory of the Firm Begins with Purpose and Ends with Sustainable CapitalismNo ratings yet

- Lakian Petition BankruptcyDocument44 pagesLakian Petition BankruptcyWendy LiberatoreNo ratings yet

- Engel, Louis & Boyd, Brendan - How To Buy StocksDocument364 pagesEngel, Louis & Boyd, Brendan - How To Buy StocksJoao Vicente Oliveira100% (2)

- Structuring Introduction To Luxembourg Alternative Investment Vehicles (PWC)Document21 pagesStructuring Introduction To Luxembourg Alternative Investment Vehicles (PWC)pierrefranc100% (1)

- Book Building Process: A Mechanism For Efficient Pricing in IndiaDocument5 pagesBook Building Process: A Mechanism For Efficient Pricing in IndiaKurapati VenkatkrishnaNo ratings yet

- An Excellent Book On Corporate GovernanceDocument1 pageAn Excellent Book On Corporate GovernanceSnigdha BakshiNo ratings yet

- Nse Research Initiative: Paper No.: 5Document20 pagesNse Research Initiative: Paper No.: 5Prerana BhavsarNo ratings yet

- Puneet Kaur, McomDocument26 pagesPuneet Kaur, McomharsimarbarringNo ratings yet

- Cost Management Practices in India An Empirical STDocument32 pagesCost Management Practices in India An Empirical STJuvy ParaguyaNo ratings yet

- Corporate Governance Practices in SBI - A Case Study: Dr. Santanu Kumar DasDocument8 pagesCorporate Governance Practices in SBI - A Case Study: Dr. Santanu Kumar DasMd MajidNo ratings yet

- Title: To Study The Importance of Stock Control in Business OperationsDocument5 pagesTitle: To Study The Importance of Stock Control in Business OperationsHarshit AgarwalNo ratings yet

- PosterDocument1 pagePosterbhoomikahv31No ratings yet

- Book-Building Process: An Efficient Mechanism For Management of Mega Public Issues in IndiaDocument3 pagesBook-Building Process: An Efficient Mechanism For Management of Mega Public Issues in IndiaMUdeet Arora ΨNo ratings yet

- A Non-Parametric Index of Corporate Governance in The Banking Industry - An Application To Indian DataDocument13 pagesA Non-Parametric Index of Corporate Governance in The Banking Industry - An Application To Indian DataSilviaNo ratings yet

- Analysis of Optimal Portfolio Management Using HieDocument5 pagesAnalysis of Optimal Portfolio Management Using Hiejacch123No ratings yet

- The Financial Sector and Corporate Governance: The UK Case: Chris Mallin, Andy Mullineux and Clas WihlborgDocument10 pagesThe Financial Sector and Corporate Governance: The UK Case: Chris Mallin, Andy Mullineux and Clas WihlborgImi MaximNo ratings yet

- Vik354 02 ResGSabarinathan PDFDocument14 pagesVik354 02 ResGSabarinathan PDFPerumbhudurumaruNo ratings yet

- Corporate Governance and IPO Underpricing - 1Document23 pagesCorporate Governance and IPO Underpricing - 1BIMONo ratings yet

- Ashulekha Bank Merging PragyaanDocument8 pagesAshulekha Bank Merging PragyaanSanjay SolankiNo ratings yet

- RP 2Document18 pagesRP 2Nagori SejalNo ratings yet

- Role of Corporate Governance and Strategic Leadership PDFDocument11 pagesRole of Corporate Governance and Strategic Leadership PDFanup shresthaNo ratings yet

- CG InitiativesDocument5 pagesCG InitiativesBhargaviNo ratings yet

- Corp GovDocument20 pagesCorp GovShraddha ParabNo ratings yet

- Corporate Governance in Indian Banking SectorDocument11 pagesCorporate Governance in Indian Banking SectorFàrhàt HossainNo ratings yet

- Agency Theory and Corporate GovernanceDocument17 pagesAgency Theory and Corporate GovernancePutra IskandarNo ratings yet

- Brand Value-36574997Document7 pagesBrand Value-36574997blessingNo ratings yet

- Challenges and Concerns in The Progressive Regulatory Structure For Corporate Governance in IndiaDocument7 pagesChallenges and Concerns in The Progressive Regulatory Structure For Corporate Governance in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Chapter 27 Corporate Governance and Capital Structure: Evidence From PakistanDocument3 pagesChapter 27 Corporate Governance and Capital Structure: Evidence From PakistanZara ShoukatNo ratings yet

- Bhaduri 2002Document12 pagesBhaduri 2002Guru's Academy of Commerce ErodeNo ratings yet

- StrategyDocument13 pagesStrategyShashidhar AkkihebbalNo ratings yet

- Ipos in India ReportDocument32 pagesIpos in India ReportVikram VickyNo ratings yet

- Insider Trading & Moral Reasoning PDFDocument10 pagesInsider Trading & Moral Reasoning PDFrizqikaNo ratings yet

- A Value-Based Management SystemDocument5 pagesA Value-Based Management SystemAishwarya RaoNo ratings yet

- FWD Sample PosterDocument1 pageFWD Sample PosterExpert WriterNo ratings yet

- Benchmarks and IndicesDocument20 pagesBenchmarks and IndicesPaulo Edson AlbuquerqueNo ratings yet

- Review of Innovation Management Frameworks and Assessment Tools - Publishedon17oc2021Document8 pagesReview of Innovation Management Frameworks and Assessment Tools - Publishedon17oc2021juliana muneraNo ratings yet

- Board Diversity and Financial Performance PDFDocument15 pagesBoard Diversity and Financial Performance PDFOasis International Consulting Ltd100% (1)

- Ipo Procedure: An Analysis On The Book Building Method in BangladeshDocument9 pagesIpo Procedure: An Analysis On The Book Building Method in BangladeshMuhaiminul IslamNo ratings yet

- Corporate Governanceand Indian Stock Market Asian Journalof ManagementDocument8 pagesCorporate Governanceand Indian Stock Market Asian Journalof ManagementAfnanParkerNo ratings yet

- Kumar Mangalam Committe ReportDocument26 pagesKumar Mangalam Committe Reportrahul_singh128854436No ratings yet

- Sukuk in Focus: The Necessity For Global Common PracticesDocument44 pagesSukuk in Focus: The Necessity For Global Common Practicesahmad farhanNo ratings yet

- Ramakrishnan MRR 2010Document13 pagesRamakrishnan MRR 2010Astro AshaNo ratings yet

- Corporate Governance MechanismsDocument7 pagesCorporate Governance MechanismsIjcams PublicationNo ratings yet

- Predicting Acquisitions in India: ResearchDocument21 pagesPredicting Acquisitions in India: ResearchAruna RoyNo ratings yet

- Basel II Capital Accord SlidesDocument25 pagesBasel II Capital Accord SlidesAamir RazaNo ratings yet

- Technology Chapter 7Document29 pagesTechnology Chapter 7Uzma NaumanNo ratings yet

- Business FinanceDocument4 pagesBusiness FinanceSammie CaneteNo ratings yet

- Untuk Ukuran Dewan BuktiDocument11 pagesUntuk Ukuran Dewan BuktiVergadilian IDNo ratings yet

- Post Graduate Programme For Executives For Visionary Leadership in Manufacturing (Pgpex-Vlm)Document10 pagesPost Graduate Programme For Executives For Visionary Leadership in Manufacturing (Pgpex-Vlm)harshagarwal5No ratings yet

- Corporate GovernanceDocument8 pagesCorporate GovernanceAngelica SabungeyNo ratings yet

- 1991 AFrameworkForConductingAServicesMarketingAudit JAMSDocument15 pages1991 AFrameworkForConductingAServicesMarketingAudit JAMSyuki ulfhaNo ratings yet

- Baker Mckenzie Promoting Good Internal GovernanceDocument7 pagesBaker Mckenzie Promoting Good Internal GovernanceImanuel Christianto Wibi SanaNo ratings yet

- Role of Corporate Governance in Indian Banking Sector: Puneet KaurDocument15 pagesRole of Corporate Governance in Indian Banking Sector: Puneet KaurMariya ZamanNo ratings yet

- Research PaperDocument6 pagesResearch PaperAkshat UniyalNo ratings yet

- Finding A Winning Private Banking Strategy in India: RoundtableDocument13 pagesFinding A Winning Private Banking Strategy in India: RoundtablenaniNo ratings yet

- PDFDocument13 pagesPDFKishore KumarNo ratings yet

- SemIX Devanshu CorporateFinanceHons ProjectDocument18 pagesSemIX Devanshu CorporateFinanceHons ProjectarpitborkarNo ratings yet

- The Good Corporate Governance Effect Towards FirmValue Mediated by Bank Soundness RatioDocument5 pagesThe Good Corporate Governance Effect Towards FirmValue Mediated by Bank Soundness RatioInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Inventory Management A Tool For EfficienDocument4 pagesInventory Management A Tool For Efficienaddis bekeleNo ratings yet

- JPSP - 2022 - 169Document10 pagesJPSP - 2022 - 169mohsen heidariNo ratings yet

- Wealth Creation: A Systems Mindset for Building and Investing in Businesses for the Long TermFrom EverandWealth Creation: A Systems Mindset for Building and Investing in Businesses for the Long TermNo ratings yet

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- Recent Trends in Valuation: From Strategy to ValueFrom EverandRecent Trends in Valuation: From Strategy to ValueLuc KeuleneerNo ratings yet

- Obligations and Contracts Exam QuestionsDocument5 pagesObligations and Contracts Exam QuestionsReyrhye Ropa80% (5)

- Ibe Steve Godspower 0071436323 20221018071544Document102 pagesIbe Steve Godspower 0071436323 20221018071544IK Steve ChinedumNo ratings yet

- Оleksii+Vlasenko 0503472695Document4 pagesОleksii+Vlasenko 0503472695Alexandra VlasiukNo ratings yet

- West Bengal Student Credit Card SchemeDocument17 pagesWest Bengal Student Credit Card SchemeSwapnanil GuinNo ratings yet

- Credit TransactionsDocument116 pagesCredit TransactionsAraceliNo ratings yet

- Detecting Accounting Fraud - The Case of Let's Gowex SA: Document de RecercaDocument47 pagesDetecting Accounting Fraud - The Case of Let's Gowex SA: Document de RecercaAshraf Uz ZamanNo ratings yet

- Larsen & Toubro Limited, Construction.: Bill Summary - E8419FBL6000070 WOMDocument2 pagesLarsen & Toubro Limited, Construction.: Bill Summary - E8419FBL6000070 WOMKannan GnanaprakasamNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument6 pagesRequest For Taxpayer Identification Number and CertificationTaj R.100% (1)

- Fin StatementsDocument10 pagesFin StatementsABHISHEK CHOUBEYNo ratings yet

- Foreign Exchange Regulation ActDocument3 pagesForeign Exchange Regulation ActHIMANSHU DARGANNo ratings yet

- TAXATION 2 Chapter 11 Output VAT RegularDocument2 pagesTAXATION 2 Chapter 11 Output VAT RegularKim Cristian MaañoNo ratings yet

- APM Assignment 2 - by SameeraDocument18 pagesAPM Assignment 2 - by SameeraRahull GurnaniNo ratings yet

- H20124 - Ajay VermaDocument13 pagesH20124 - Ajay VermaajayNo ratings yet

- Cash and Cash EquivalentsDocument21 pagesCash and Cash EquivalentsAiko E. Lara100% (2)

- AE16-IA2 - Module 2Document13 pagesAE16-IA2 - Module 2Jemalyn PiliNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Working Capital Management of Yahama Motor Co. LTDDocument55 pagesWorking Capital Management of Yahama Motor Co. LTDKrishna NaikNo ratings yet

- Unit 2 Capital BudgetingDocument24 pagesUnit 2 Capital BudgetingShreya DikshitNo ratings yet

- Money Market Products & Opportunities: R. A. Kamath Chief Dealer, Abhyudaya BankDocument69 pagesMoney Market Products & Opportunities: R. A. Kamath Chief Dealer, Abhyudaya BankNikhil KediaNo ratings yet

- Describe The Following and Explain Their Importance in Project FinanceDocument10 pagesDescribe The Following and Explain Their Importance in Project FinanceflichuchaNo ratings yet

- WP47 Kelton PDFDocument30 pagesWP47 Kelton PDFEugenio MartinezNo ratings yet

- Issue of Shares Comprehensive Questions - Part IDocument9 pagesIssue of Shares Comprehensive Questions - Part IHamza MudassirNo ratings yet

- Espresso Cash Flow Statement SolutionDocument2 pagesEspresso Cash Flow Statement SolutionraviNo ratings yet

- Iob Rtgs FormDocument2 pagesIob Rtgs FormApuri Rammohan Reddy100% (1)

- CV Nihir NemaniDocument1 pageCV Nihir NemaniMazin AbdullahNo ratings yet

- Fabozzi Bmas7 Ch23 ImDocument37 pagesFabozzi Bmas7 Ch23 ImSandeep SidanaNo ratings yet

- 03 Chapter03Document51 pages03 Chapter03moshee082789No ratings yet