Professional Documents

Culture Documents

No.812016 Fin RC3626 Dated 25.10.2017 Regarding Adoption of Guidelines Office Memoranda Pertaining To ALLOWANCES by Government of Goa

No.812016 Fin RC3626 Dated 25.10.2017 Regarding Adoption of Guidelines Office Memoranda Pertaining To ALLOWANCES by Government of Goa

Uploaded by

Sanjiv Kubal0 ratings0% found this document useful (0 votes)

400 views14 pagesOriginal Title

No.812016 Fin RC3626 Dated 25.10.2017 Regarding Adoption of Guidelines Office Memoranda Pertaining to ALLOWANCES by Government of Goa

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

400 views14 pagesNo.812016 Fin RC3626 Dated 25.10.2017 Regarding Adoption of Guidelines Office Memoranda Pertaining To ALLOWANCES by Government of Goa

No.812016 Fin RC3626 Dated 25.10.2017 Regarding Adoption of Guidelines Office Memoranda Pertaining To ALLOWANCES by Government of Goa

Uploaded by

Sanjiv KubalCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 14

Gow

Department of Finance (Revenue & Control)

‘Secretariat, Porvorim

Barder— Goa. 403821

Tower REQLSS _____ Dated 25.10.2017

Read; Order No. 8/1/2016-Fin(R&C)(A) dated 30.11.2016.

Order No. 8/1/2016-Fin(R&C) dated 25.07.2017,

Order No, 8/1/2016-Fin{R&C) dated 10.08.2017,

wy

ir

ORDER

In pursuance to the Order's read above, the following guidelines / Office

Memoranda issued by the Government of India has been adopted by the State

Government for its implementation prospectively we. 01.10.2017.

ms vo

(0. A-27012/02/2017-Estt (AL) dated 16" August, 2017 regarding ,

1, Letter

grant of Children Educ:

OM, No. 17014/2/2014-Trg.(7" CPC) dated 23" July, 2017 regarding -

ion Allowance.

abolishment of Sumptuary Allowance.

of Sumptuary Allowance,

3. OM. No. 19030/1/2017-E.1V dated 13% July, 2017 regarding Travelling ,

4. OM. No, 19030/1/2017-EV dated 18" August, 2017 regarding Travel

2

Allowance Rules (clarification regarding admissibility of Composite

‘Transfer Grant (CTG) and TADaily Allowance (DA)).

5. OM. No. 19030/1/2017-EIV dated 04" September, 2017 regarding

‘Travelling Allowance Rules (clarification regarding TA/DA entitlements 7

1

Mocs chy of Oiersin Level 13A)

ae “

Vo)6 OM. No. 31011/8/2017-Est- AAV dated 19" September, 2017 clarification

ach regarding travel entitlements of Government employees for the purpose

of LTC post Si

nth Central Pay Commission.

n the website of the

All the guidelines / OMs, referred to above is avilable

/

/

Directorate of Accounts, www.tceountsgoa.gov-in.

/

Mabon

pee reptere| lg R314 [732 _ a siete BES

TTS BPA SE ane

py 6 Crs in ptadad Ue all elim,

a ont Trani, Sr dACSG ab SOs k

oe

No.A-27012/02/2017-Estt (AL)

Government of India

Ministry of Personnel, P.G. and Pensions

Department of Personnel & Training

x

New Delhi, 6 August,2017.

Subject: Recommendations of the Seventh Central Pay Commission —

Implementation of decision relating to the grant of Children

Education Allowance.

Consequent upon the decision taken by the Government on the

recommendations made by the Seventh Central Pay Commission on the subject of

Children Education Allowance Scheme, the following instructions are being

issued in supersession of this Department's OM dated 28-4-2014 :

(a) The amount fixed for reimbursement of Children Education allowance will be

Rs.2250/-pm.

(b) The amount fixed for reimbursement of Hostel Subsidy will be Rs. 6750/-pm.

() In case both the spouses are Government servants, ony one of them can avail

reimbursement under Children Education Allowance,

{@) The above limits would be automatically raised by 25% every time the

Deamess Allowance on the revised pay structure goes up by 50%. The allowance

will be double for differently abled children.

>. Further, reimbursement will be done just once a year, after completion of

‘the financial year. For reimbursement of CEA, a certificate from the head of

institution, where the ward of government employee studies, will be sufficient for

this purpose. The certificate should confirm that the child studied in the school

during the previous academic year. For Hostel Subsidy, a similar certificate from

the head of institution will suffice, with the additional requirement that the

certificate should mention the amount of expenditure incurred by the government

servant towards lodging and boarding in the residential complex. The amount of

expenditure mentioned, or the ceiling as mentioned above, whichever is lower,

shall be paid to the employee.

3. These orders shall be effective from Ist July, 2017,

4, Insofar as persons serving in the Indian Audit and Accounts Department are

Concerned, these orders issue in consultation with the Comptroller and auditor

General of India.

Hindi version will follow.

(Navneet Misra)

Under Secretary to the Govt. of India

To

1. All Ministries/Departments as per standard mailing list.

2. NIC with a request to upload the OM on the website of DoPT.

No. 17014/2/2014-Trg.(7" CPC)

Government of India

Ministry of Personnel, Public Grievances & Pensions

Department of Personnel & Training

Block-IV, Old JNU Campus, New Delhi,

Date: July 2502017

)EFICE MEMORANDUM

Subject: Implementation of the recommendations ‘of 7 Central Pay Commission — abolishment

cof Sumptuary Allowance.

Consequent upon the acceptance of the recommendations of Seventh Central Pay

‘Commission by the Government conveyed vide Ministry of Finance, Department of Expenditure

Resolution No, 11-1/2016-IC dated July 6, 2017, the President, in supersession of all existing

orders issued on the subject from time to time, is pleased to decide that Sumptuary Allowance in

all the Training Establishments/ Academies/Institutes stands abolished.

2. These orders shall be effective from Ist July, 2017.

3. In so far as the employees working in the Indian Audit and Accounts Department are

‘concemed, these orders arc issued with the concurrence of the Comptroller and Auditor General

(Bet

(Biswajit Banerjee)

Under Secretary to the Government of India.

Distribution:

1, All Ministries/Departments of the Government of India.

2. AILCTIS/ATIS

No, 19030/1/2017-€ IV

Government af India

Minstry of Finance

Department of Expenditure

New Delhi, the 13° July 2017

OFFICE MEMORANDUM

‘Subject: Travelling Allowance Rules - implementation of the Seventh Central Pay Commission.

CConsequent upon the decisions taken by the Government on the recommendations of the Seventh Central

Pay Commission reiting 1o Traveling Alowance entitements to ciilan employees of Central Government, President

is pleased to decide the revision in the rates of Traveling Allowance 2s set out in the Annexure to ths Office

Memarandum,

2. The Pay Leve for determining the TA/DA entttemen is as indicated in Central Civil Service (Revised Pay)

Ruses 2016

3. The term Pay inthe Level fo: the purpose ofthese orders refer to Basie Pay drawn in appropiate Pay evel

in the Pay Matrix as defined in Rule 3(8) of Central Civ Services (Rewsed Pay) Rules, 2016 and does not include

[Non Practising Alowance (NPA), Miltary Service Pay (MSP) or any other type of pay ike special pay. etc

4. However, if tne Traveling Allowance enilemen's in tems othe revs enlements row prescribed result in

4 lowering of the existing enitements inthe case of ary idivaual, groups or cases of employees, the entlements

partciary in respect of mode of ravel, cass of accomodation, etc, shall rot be lowered. They wil instead contnue

{oe governed by the arier orders on tre subject ti Suen time a5 they become eigbe, nthe norma! course, or the

hghe entitlements

5. The claims submitted in respect of journey made on or after 1* July, 2017, may be reguated in accordance

‘wih these orders. n respect of ourneys performed prior 0 1% July, 2017, the claims may be regulated in accordance

withthe previous orders dated 23.09.2008

6 _Itmay be noted that no additonal funds wil be provided on account of revision in TADA enttlements. It may

therefore be ensured that permission to offcial travel is given judicousy and restricted only to absolutely essental

offical requirements.

7 These orders shall take effect from 01 July, 2017

8 Separate orders wil be issued by Minstry of Defence and Ministry of Railways in respect of Armod Forces

personne! and Raiway employees, respectively.

eee eee

oes Wer

Mee

a

(Deputy Secretary tothe Goverment of India

1,

[Al Ministries and Departments of the Govt. of India etc. as per standard distribution list

Copy to: CRAG and UP.SC,, etc a per standard endorsement lst,

‘ANNEXURE

‘Annexure to Ministry of Finance, Department of Expenditure

OM No.1803011/2017-E.V dated 10° July 2047,

J supersession of Deparment of Exzendtue's OM, No. 19030:42008-€ 1 dated 2309 2008, in respect of

Traveling Alowarce te folowing provisons wil be apicable wih efect rom O1 07 or

2 Entitlements for Journeys on Tour or Training

Ali) Travel Entitlements within the Country

Pay Lovolin Pay Matrix ‘Travel entitlement

‘Wand above Business/Club class by air oF AC: y train |

and 13 Economy class by air or AC: by rain

Btott Economy cass by ar or AC by train =

Sand below Firs CassiAC-IUAC Chair car by train ]

1 aids, 280 been decded to alow the Goverment ofcis to tavel by Premium TiainsPremium Tail

Frens'Suida Trains the rembursement to Premium Tatal Charges for booking of tetets and the reimbursement

CinaelFes fare in Shatab/RechariDuronto Trains while on ofical tou taining, Reimbursement of Talal Seve

Charges which has fred fore, wil remain continue to be alowed. Travel entitlement for te joumey in

Premium/Premium TatkalSuvidhal ShatabdiRajdhani/Duronto Trans will be as under

Pay Levelin Pay matrix | Travel Entitlements in PremiunvPremium Taikal/Suvidhal Shatabdif

Rajdhanif Duronto Trains

12 and above | ExecutvelAC 1 Cass (incase of PremiumiPremium

JatkalSuvdna/ShatabdiRajdhari Train as per avaiable highest class)

6 ott AG 2° ClassiCharr Car (in Shatatai Trains)

5 & below AC 35 ClassiChait Car

(il) The revised Travel entitlements are subect 0 folowing

(2) In case of places not connected by ral, travel by AC bus for ll those entitled to travel by AC Il Tier and

‘above by train and by Deluxoordinary bus for others is alowed

(©) In case of road rave! between places connected by ra, trave! by any means of public transport is

allowed provided the tota fare does not exceed the tran fare by the entived cass

(©) All mileage points eared by Govemment employees on tickets purchased for official travel shal be

utlized by the concerned desartment for other offcial travel by thei offcers. Any usage of these

mileage points for purposes of prvate travel by an ofcer will atract departmental acton. This is 10

ensure thatthe benefits out of oficial travel, which is funded by the Government, should aconue fo the

Goverment

(6) In case of non-avaiabilty of seats in ented class, Govt. servants may travel inthe class below their

ented ciass

International Travel Entitlement

Pay Levelin Pay Matrix ‘Travel entitlement

17 and above First class

141018 BusinossiClub class

13 and below Economy cass

2

. Entitlement for journeys by Sea or by River Steamer

(i) For laces other than A&N Group of Islands and Lakshadweep Group of Island

Pay Level in Pay Matrix Travel entitiement

| Sand above Highest class

6108 Loner class i there be two classes only onthe steamer

‘and iftwo classes only, the lower clas. three classes, the mile

for second class there be four classes, th tid cass

Band below Lowest cass

(il) For travel between the mainland and the A&N Group of Islands and Lakshadweep

Group of island by ships operated by the Shipping Corporation of India Limited ==

Pay Level in Pay Matrix Travel entitlement

9 and above Deluxe ciass

508 First ‘8’ Cabin class

4and5 ‘Second! 8’ Cabin class

| 3and below Bunk class

0. Mileage Allowance for Journeys by Road

()_Atplaces where specifi rates have been prescribed

| Pay Levin Pay Marx Entitlements

| orabove ‘Actual fare by any type of public bus including AC bus

OR

[At prescrbed rates of AC taxi when tne journey 's actualy performed by AC taxi

OR

motor eye, moped, et.

[At prescribed rates for auto rickshaw for journeys by auto rckshaw, own car, scooter,

61013 ‘Same as above wth the exception that journeys by AC taxi wil not be permissible.

‘4 and 5 ‘Actual fae by any type of pubsc bus otner than AC bus.

OR

[At presenbed rates for auto nekshaw for journeys by auto rckshaw, own ca, scooter,

motor eycle, moped, etc

and below ‘Actual fare by ordinary public bus or

oR

[At prescribed rates for auto rickshaw for journeys by autoickshaw, own scooter,

ator eycie, moped, ete

(i) At places where no specific rates have been prescribed either by the Directorate of Transport of the

concerned State or of the ne.ghboring States

For journeys performed in own cartax! Rs. 24) por km

For journeys performed by auto rickshaw Rs. 12. por km

| own scooter, ett

[At places where no specific rates have been prescribed, the rato por km wil futher rise by 25 percent whenever OA

increases by 80 percent

Ei. Daily Allowance on Tour

Pay level in Entitlement

pay matrix

"#and above | Reimbursement for hotel accommodatnlguest house of uo &7, S001 per day

Reimbursement of AC taxi charges a8 per actual expenditure commensurate wih offcal

‘engagements for travel wthin the cy and

Reimbursement of food bis rot exceeding 21200! per day

Teard 13 | Reimbursement for hotel accomedatoniguest house of up to 4,500. per dey,

Reimbursement of AC tax charges of up to 50 km por day for travel win the ely,

Reimbursement of food bils not exceeding 21000 per day

Stott | Reimbursement for ote! accommodaton/quest house of up to 822801: er day,

Reimbursement ofnon-AC tx charges of up to 8338 er day for travel within the cy

Reimbursement o! food bils not exceeding 2900). per day.

6i08 Reimbursement for hotel accommodation/guest house of up to 8750 per day,

Reimbursement of ron-AC taxi charges of up to %225/- per day for travel within the ct

Reimbursement of food bil rot exceeding #800)" por day.

Sandbelow "Reimbursement fr hotel accommodatoniguest house of upto 8450 per day,

| Reimbursorrent of non/AC taxi charges of up to 21131. per day for travel within the city,

Reimbursement of food bils ro! exceeding 2500/- per day.

(i) Reimbursement of Hotel charges - For levels 8 and below the amour of caim (up the clin) may be

bald without production of vouchers agains! se certfed claim only. The sa-cerfed caim should ceary indicate the

period of stay, name of awoling, ele. Adetonaly or stayin Class x ces, the cling for all employees upto Love! 8

woulé be 21,000 per day, but it wi ony be in the form of reimbursement upon production of relevant vouchers. The

Celing for reimbursement of hotel charges wil iter ris by 25 percent whenever DA increases by 80 persent

(i) ___ Reimbursement of Traveling charges :- Siar to Reimbursement of saying accommodation charges, for

leves 8 and below, the claim (up tothe ceing} may be paid wihout production of vouchers against se certified cam

any. The sel'certited claim shoud clear indicate the period of travel, vehicle numbe, ete. The ceing for evels 11

and below wil futher nse by 25 percent whenever DA increases by 80 percent. For joumeys on foot, an alowance of

°s.12/- per kiometerravlled on fot shal be payable adktonally. Ths rate wil further increase by 25% whenever DA

increases by 50%

(iv) _ Reimbursement of Food charges :- There willbe no separate ermoursement of food bils. Instead. the lump

‘sum amount payable wil be as per Tabie E() above and, depending on the length of absence from headquarters,

would be regulated as per Table (v) below Since the concept of reimbursement has been done away wth. no vouchers

wil be required. This methodology isin line with tat folowed by Indian Railways at present (with suitable enhancement

of rales) @. Lump sum amount payable. The lump sum amount wil increase by 25 percent whenever OA increase by

50 percent

(¥) Timing restrictions

Length of absence ‘Amount Payable

# absence from headquarters is <5 hours 30% of Lump sum amount |

If absence from headquarters is botween 6-12 hours | 70% ef Lump sum amount

Hf absence from headquarters is >12 hours 100% of Lump sum amount i

‘Absence ftom Head Quarter willbe reckoned from midnight :o midnight and will be calculated on a per day

basis.

4

(w) ___In case of stay/jourey on Government ships, boats etc. or ourney to remote places on footimules ele for

‘scientieidata collection purposes in organizaton ike FSI, Survey of india, GSI etc. daily alowance wil be pad at rate

equivalent to that provided for reimbursement of food bil. However. in ths case, the amount will be sanctioned

imespecive of the actual expenditure incued on ths account withthe approval ofthe Head of Deparimentcontroling

officer

Note A rates for foreign travel wi be roguiated as presebed by Misty of Exteal Aas

a ‘A. on Transf

Ron Transerinciuces 4 components: (i) Travel enierent fr se and family (i) Composite Transler and

Backing grant (CTG) (i) Reimbursement of charges on transportation of personal effects (vu) Reimbursement of

charges on ranspotaton of conveyance

() Travel Entitlements

(2) Travel entitlements as prescribed for our in Para 2 above, except for Intemational Travel, wi be

applicable in case of joumys on transfer. The general conditions of admssibity prescribed vn

SR 114 wil, however, continue to be eppicable,

(0) The provisions relating to smal family norms as contained in para 4(A) of Annexure to Mi Finance

OM. F No 10/298.1C & F.No. 19030/287-E'V at 1/1, Ap 1998. shall contnue tobe applicable

(ii) Composite Transfer and Packing Grant (CTG) :

(a) The Compost Transfer Grant shal be pai at the rate of 80% of the last month's basic payin case of

transfer involving a change of station located at a dstance of or more than 20 kms from each other

However, for transfer to and trom the Island terrtones of Andaman, Nicobar & Lakshadweep, CTS

shall be paid at the rate of 100% of last month's basic pay. Further, NPA ard MSP shall not be

Included as part of basic pay while determining enttement for C76

(©) _In-cases of transfer to stations which are ata distance of less than 20 kms from the old staton and of

transfer wthin the same city. one third of the composite transfer grant will be admissible, provided a

change of residence is actualy involved

(©) In cases where the transfer of husband and wife ‘ates place within six months, but ater 80 days of

the transfer of the spouse. fity percent of the transle” grant on transfer shal be allowed to the spouse

transferred later. No transfer grant shall be admissibe tothe spouse transterred later, in case both the

transfers are ordered within 60 cays. The existing provisions shall continue tobe applicable in case of

transfers after @ period of sx months or more. Other rules precluding transter grant in case of transter

‘at own request or transfer otner than in pubic intrest, shal continue to apply unchanged in theit

case

(ii) Transportation of Personal Effects

Level | By TrainSteamer | By Road

12 and above | 8000 Kg by goods vain’ wheeler wagor’ 1 double container Rs. 50° per km

bot | 6000 kg by goods trav4 wheeler wagori single container Rs. 50! per km

5 | 3000 kg Rs. 25! per km

4andbelow | 1500Kg Rs 15: perkm

The rates wil further rise by 25 percent wnenever DA increases by 80 percent The rates for transporting the

entitled weight by Steamer wil be equal to the prevailing rats prescribed by such transport in ships operated

by Shipping Corporation of india The ciam for rembursement shall be admissible subject 1o the producton of

‘actual receipts) vouche’s by the Govt servant. Producton of receipts'vouchers i$ mandatory in ro transfer

cases of Nortn Eastem Region, Andaman & Nicobar Islands ard Lakshadweep also,

5

‘Transportation of personal etfecs by road is as per kilometer basis only. The classification of cites owns for

the purpose of transportation of personal effects is done away with

(iv) Transportation of Conveyance.

4

| Level Reimbursement

S and above * metor ar ee. or motor eylescaotr |

5 and below + motoelescootermoped ble }

‘The general conditions of admissibllty of TA on Transfer as prescribed in SR. 116 wil, however, continue to

be applicable.

LA Entitlement of Retiring Employees

‘TA.on Retirement includes 4 components - - (i) Travel entitlement for self and family (i) Composite Transfer and

packing grant (CTG) (i) Reimbursement of charges on transportation of personal effects (iv) Reimbursement of

charges on transportation of conveyance

0

(i

Travel Entitlements

Travel enttiements as prescribed for tourtranster in Para 2 above, except for Intemational Travel, ill be

applicable in case of journeys on retirement. The general conditions of admissibility prescrbed in SR.147 wal

however, contirue to be applicable

i) Composite Transfer Grant(CTG)

(a) The Composite Transfer Grant shall be paid atthe rate of 80% ofthe ast month's basic pay in case of

those employees, who on retirement , settled down at places other than last station(s) of their duty

located at a distance of or more than 20 km. However, in case of settement to and from the Island

teritones of Andaman, Nicobar & Lakshadweep, CTG shall be paid atthe rate of 100% of last month's

basic pay. Further, NPA and MSP shall not be included as part of basic pay while determining

enttlement for CTG. The transfer incdentals and road mieage for journeys between the residence and

the railway staton’bus stand, etc, atthe old and new staton, are already subsumed inthe composite

transfer grant and wil not be separately admissible

(0) Asin the case of serving employees, Government servants who, on retirement. sete atthe last station

(of duy ise or within a distance of less than 20 kms may be paid one third of the CTG subject to the

‘condition that a change of residence is actually involved

(ii) Transportation of Personal Effects =» Same as Para 3) above

(iv) Transportation of Conveyance - Same as Para Sv) above

‘The general conditions of admissibility of TA on Retirement as prescribed in SR. 147 will however, continue to be

appleabe

No, 19030/1/2017-€.1V

Government of india,

Ministry of Finance

Department of Expenditure

‘New Delhi, the 18° August, 2017

OFFICE MEMORANDUM

Subject :- Traveling Allowance Rules ~ implementation of the Recommendations of the Seventh Central Pay

Commission,

Consequent upon the issuance of this Departments OM. of even number dated 12.07.2017 regarding

implementaton of recommendations of 7* CPC on Traveling Alowance (TA), vais relerences are being received in ths

Department seeking clarifications regarding admissibity of Composite Transtar Grant (CT) and TA/Daly Alowance (DA)

2 ‘The matter has been considered in tis Department and withthe approval of Competent Authority, it has been

decided that admissibility of CTG and Transportaton of personal effects on Transfer and Retirement wil be regulated as

under

|. Incase, the employee has been transfered prior to 01.07.2017 and has assumed charge prio to 01.07.2017, the

employee will be ebgle for CTG at pre-evised scale of pay. Ifthe personal effects have been shied after

01.07 2017, revised rates for transportation of personal effects wil be admissible

i. Incase, the employee nas been transferred prior to 01.07.2017 and has assumed charge onlatter 01.07 2017, the

employee will be eigibe for CTG at revised scale of pay. As the personal effects would be shifted ater 01.07 2017,

revised rates for transportation of personal effects wil be admissible

li, In case of retrement, it an employee has retted prior to 01.07.2017, the employee wil be elgitie for CTG at pre

Tevised scale of pay. If the personal effects have shifted after 01.07.2017, revsed rates for transportation of

Personal effects wil be admissible,

ing version is attached ff

ae

(Nirmala Dev)

Deputy Secretary tothe Government of India

0,

‘Al Ministries and Departments ofthe Govt of India ec. as per standard dstrbuton ls.

Copy to: C&AG and U.P.S.C ete. as per standard endorsement ist

F. No, 19030/172017-E.1V

Government of india

Ministry of Finance

Department of Expenditure

"New Delhi, dated the 04" September, 2017

OFFICE MEMORANDUM

Subject ‘= Travelling Allowance Rules - implementation of the Recommendations of the Seventh Central

Pay Commission.

Consequent upon the issuance of this Departments O.M, of even number dated 1307-2017 regarding

implementation of recommendations of 7* CPC on Traveling Allowance (TA), vaious references are being received in

this Department seeking clatications regarding TA/Daily Allowance (DA) enttiements of Oficers in Level 13A. Level 134,

(pre-tevised Grade Pay of Rs. 8900/) has been included in the Pay Matrix vide Notification No. GSR §92(E) dated

18.06.2017,

2 ‘The matter has been considered in ths Department and withthe approval of Competent Authority, i has been

Cecided that TA/DA enttements of Oficer in Pay Level 13A (pre-revsed Grade Pay of Rs, 8900!) shall be equivalent to

TAIDA enttlements of Oficers in Pay Level 13 (pre-evised Grade Pay of Rs, 8700/-) as mentioned inthis Departments

OM of even number dated 13.07.2017

Hindi version is atached i

Mer

“5994

(wirmaia Dev)

Deputy Secretary tothe Government of India

Te,

All Ministries and Departments of the Govt. of india etc. as per standard distribution list

Copy to: C&AG and U-P.S.C, ete. as per standard endorsement lst

No. 31011/8/2017-Estt.A-IV

Government of India

Ministry of Personnel, Public Grievances & Pensions

Department of Personnel & Training

Establishment A-IV Desk

North Block New Delhi

Dated September 19, 2017

OFFICE MEMORANDUM

Subject: Travel entitlements of Government employees for the purpose of LTC

post Seventh Central Pay Commission-clarification re:

The undersigned is directed to refer to this Department's O.M. No.

31011/4/2008-Estt.A-IV dated 23.09.2008, which inter-alia provides that travel

entitlements for the purpose of official tour/transfer or LTC, will be the same but no

daily allowance shall be admissible for travel on LTC. Further, the facility shall be

admissible only in respect of journeys performed in vehicles operated by the

Government or any Corporation in the public sector run by the Central or State

Government or a local body.

2. Consequent upon the decisions taken by Government on the

recommendations of Seventh CPC relating to Travelling Allowance entitlements of

Central Government employees, TA Rules have undergone changes vide Ministry of

Finance's O.M. No. 19030/1/2017-E.1V dated 13.07.2017.

3. In this regard, it is clarified that the travel entitlements of Government servants

for the purpose of LTC shall be the same as TA entitlements as notified vide Ministry

of Finance’s O.M. dated 13.07.2017, except the air travel entitlement for Level 6 to

Level 8 of the Pay Matrix, which is allowed in respect of TA only and not for LTC.

4. Further, the following conditions may also be noted:

i. No daily allowance shall be admissible for travel on LTC.

ji, Any incidental expenses and the expenditure incurred on local journeys shall

not be admissible

iii, Reimbursement for the purpose of LTC shall be admissible in respect of

journeys performed in vehicles operated by the Government or any Corporation

in the public sector run by the Central or State Government or a local body.

iv. Incase of journey between the places not connected by any public/Government

means of transport, the Government servant shall be allowed reimbursement as

per his entitlement for journey on transfer for a maximum limit of 100 Kms.

covered by the private/personal transport based on a self-certification from the

Government servant. Beyond this, the expenditure shall be borne by the

Government servant,

Contd,

From pre-page:

v. Travel by Premium trains/Premium Tatkal trains/Suvidha trains is now allowed

on LTC. Further, reimbursement of tatkal charges or premium tatkal charges

shall also be admissible for the purpose of LTC.

vi. Flexi fare (dynamic fare) applicable in Rajdhani/Shatabdi/Duronto trains shall be

admissible for the journey(s) performed by these trains on LTC. This dynamic

fare component shall not be admissible in cases where a non-entitled

Government servant travels by air and claims reimbursement for the entitled

class of Rajdhani/Shatabdi/Duronto trains.

5. This O.M. will take effect from July 1, 2017.

6. Hindi version will follow.

mt yesh

Wh

(Suryé Narayan Jha)

Under Secretary to the Government of india

To

The Secretaries

All Ministries/Departments of Government of India

(As per the standard list)

Copy to:-

Comptroller & Aucitor General of india, New Delhi

Union Public Service Commission, New Delhi

Central Vigilance Commission, New Delhi

Central Bureau of Investigations, New Delhi.

Parliament Library, New Delhi

All Union Territory Administrations.

Lok Sabha/Rajya Sabha Secreteriat.

All attached and Subordinate Offices of Ministry of Personnel, P.G. & Pensions,

NIC, DoP&q with the request to upload this OM on Department's website

(Notifications << OMs/Orders << Establishment << LTC Rules).

10.Hindi section for Hindi version.

Cusae apne

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 4Document39 pagesChapter 4Sanjiv KubalNo ratings yet

- NOC For Family Pension - Annexure NOC - DDocument1 pageNOC For Family Pension - Annexure NOC - DSanjiv KubalNo ratings yet

- 7TH Pay Revised Pay RulesDocument10 pages7TH Pay Revised Pay RulesSanjiv KubalNo ratings yet

- Connectivity Matrix CircularDocument2 pagesConnectivity Matrix CircularSanjiv KubalNo ratings yet

- Circular Reg Accounting Procedure For Procurement of Printin Statioinery Items Through The DepartmentDocument2 pagesCircular Reg Accounting Procedure For Procurement of Printin Statioinery Items Through The DepartmentSanjiv KubalNo ratings yet

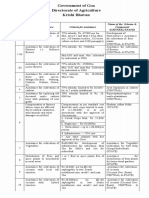

- List of Schemes Agriculture DepartmentDocument9 pagesList of Schemes Agriculture DepartmentSanjiv KubalNo ratings yet

- The Manual of Contingent Expenditure, 1958: Financial Commissioner and Secretary To Government, Finance DepartmentDocument97 pagesThe Manual of Contingent Expenditure, 1958: Financial Commissioner and Secretary To Government, Finance DepartmentSanjiv KubalNo ratings yet

- NoticeDocument1 pageNoticeSanjiv KubalNo ratings yet

- Standardization of Detailed Heads of AccountsDocument20 pagesStandardization of Detailed Heads of AccountsSanjiv KubalNo ratings yet

- SO-I - 2013-17 GoaDocument139 pagesSO-I - 2013-17 GoaSanjiv KubalNo ratings yet

- Revision of Time Limit For Submission of Final Claims For Reimbursement of Medical Expenses Under CGHS (June 2020) PDFDocument2 pagesRevision of Time Limit For Submission of Final Claims For Reimbursement of Medical Expenses Under CGHS (June 2020) PDFSanjiv Kubal100% (1)

- India As The Heritage of Medicinal Plant and Their Use: Gangola S, Khati P, Bhatt P, Parul and Anita SharmaDocument2 pagesIndia As The Heritage of Medicinal Plant and Their Use: Gangola S, Khati P, Bhatt P, Parul and Anita SharmaSanjiv KubalNo ratings yet

- Medicinal Plants of Rural India: A Review of Use by Indian FolksDocument20 pagesMedicinal Plants of Rural India: A Review of Use by Indian FolksSanjiv KubalNo ratings yet

- The Goa Panchayat Raj (Application of Panchayat and Zilla Panchayat Funds) (Conditions and Limitations) Rules, 2006Document6 pagesThe Goa Panchayat Raj (Application of Panchayat and Zilla Panchayat Funds) (Conditions and Limitations) Rules, 2006Sanjiv KubalNo ratings yet

- Nivadak Rugnachikitsa PDFDocument274 pagesNivadak Rugnachikitsa PDFSanjiv KubalNo ratings yet