Professional Documents

Culture Documents

Partnership Liquidation Question#4

Uploaded by

Ivy BautistaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Liquidation Question#4

Uploaded by

Ivy BautistaCopyright:

Available Formats

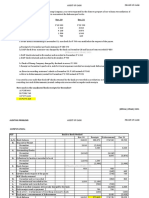

PARTNERSHIP LIQUIDATION

Q1. Larry, Marsha, and Natalie are partners in a company that is being liquidated.

They share profits and losses 55 percent, 20 percent, and 25 percent, respectively.

When the liquidation begins they have capital account balances of P108,000, P62,000,

and P56,000, respectively. The partnership just sold equipment with a historical cost

and accumulated depreciation of P25.000 and P18,000, respectively for P10,000. What

is the balance in Marsha's capital account after the transaction is completed?

a. P62,000 c. P62,600

b. P61,400 d. P65,000

Answer: (c)

P62,000 + [P10,000 - (P25,000 - P18,000)] (.20)

P62,000 + (P3,000) (.20)

P62,000 + (P600)

P62,600 (c)

Q2. After operating for five years, the books of the partnership of Bo and By

showed the following balances:

Net assets P 169,000

Bo, Capital 110,500

By, Capital 58,500

If liquidation takes place at this point and the net assets are realized at book value, the

partners are entitled to:

a. Bo to receive P117,000 & By to receive P52,000

b. Bo to receive P126,750 & By to receive P42,250

c. Bo to receive P84,500 & By to receive P84,500

d. Bo to receive P110,500 & By to receive P58,500

(PhilCPA)

Answer: (d)

The non-cash assets are realized at book value therefore: There is no gain or loss, in

which case partners are entitled to receive an amount equivalent to their capital interest.

Partnership Liquidation | ©jipb162021

Q3. RR, SS and I decided to dissolve the partnership on November 30, 20x5. Their

capital balances and profit ratio on this date, follow:

Capital Balances Profit Ratio

RR P 50,000 40%

SS 60,000 30%

TT 20,000 30%

The net income from January 1 to November 30, 20x5 is P44,000. Also, on this date,

cash and liabilities are P40,000 and P90,000, respectively. For RR to receive P55,200 in

full settlement of his interest in the firm, how much must be realized from the sale of

the firm's non-cash assets?

a. P196,000 c. P193,000

b. 177,000 d. 187,000

(Adapted)

Answer: (c)

Total Capital ( P50,000 + P60,000 + P20,000 + P44,000) P174,000

Total Liabilities 90,000

Total Assets P264,000

Less: Cash 40,000

Non-cash assets P224,000

Less: Loss on realization: (P55,200 - P67,600*) / 40% 31,000

Proceeds from sale P 193,000

* [P50,000 + (P44,000 x 40%)]

(P50,00 + P17,600)

P67,600

Partnership Liquidation | ©jipb162021

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 2.1 Multiple Choice Questions (Circle The Correct Answer, 2 Points Each)Document3 pages2.1 Multiple Choice Questions (Circle The Correct Answer, 2 Points Each)Kyle Lee UyNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Statement of Account: Total SharesDocument7 pagesStatement of Account: Total Sharesking Jorex ComedyNo ratings yet

- Ats StrategyDocument9 pagesAts StrategypradeephdNo ratings yet

- Audit Cash - Aud ProblemsDocument36 pagesAudit Cash - Aud ProblemsIvy BautistaNo ratings yet

- Partnership Liquidation: Answer: (D)Document2 pagesPartnership Liquidation: Answer: (D)Ivy BautistaNo ratings yet

- Partnership Liquidation: Assets Liabilities & EquityDocument2 pagesPartnership Liquidation: Assets Liabilities & EquityIvy BautistaNo ratings yet

- Audit Prob Q6 Proof of Cash 2021Document9 pagesAudit Prob Q6 Proof of Cash 2021Ivy BautistaNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet

- Marking SchemeDocument2 pagesMarking SchemeCornelius AdormNo ratings yet

- A Study On Investors' Perception Towards Mutual Funds and Its Scopes in IndiaDocument5 pagesA Study On Investors' Perception Towards Mutual Funds and Its Scopes in IndiaEditor IJTSRDNo ratings yet

- IAS 16 PPE - LectureDocument11 pagesIAS 16 PPE - LectureBeatrice Ella DomingoNo ratings yet

- Presentation On Harshad MehtaDocument14 pagesPresentation On Harshad Mehtarupesh_nair14No ratings yet

- FIN222 Autumn2016 Tutorials Tutorial 8Document8 pagesFIN222 Autumn2016 Tutorials Tutorial 8HELENANo ratings yet

- Answers COST of CAPITAL Exercises 2Document2 pagesAnswers COST of CAPITAL Exercises 2fatehahNo ratings yet

- Annexure Car IvDocument3 pagesAnnexure Car IvRahul kumarNo ratings yet

- Payroll Advance PolicyDocument3 pagesPayroll Advance Policysvyasjaydip1990No ratings yet

- Technical AnalysisDocument43 pagesTechnical Analysissarakhan0622No ratings yet

- ConcDocument2 pagesConcTestingNo ratings yet

- What Is Without Recourse?Document1 pageWhat Is Without Recourse?johngaultNo ratings yet

- Modigliani, F. and Miller, M.H. (1958) The Cost of Capital, Corporation Finance and The Theory of Investment.Document16 pagesModigliani, F. and Miller, M.H. (1958) The Cost of Capital, Corporation Finance and The Theory of Investment.TrangNo ratings yet

- Electronic Banking and Customer Satisfaction - A Case Study On NRB Commercial Bank Limited, Dhanmondi Mohila Branch PDFDocument81 pagesElectronic Banking and Customer Satisfaction - A Case Study On NRB Commercial Bank Limited, Dhanmondi Mohila Branch PDFShopnomoy Dip100% (2)

- Beyond NumbersDocument28 pagesBeyond NumbersGurjeevNo ratings yet

- Strategic Corporate Finance Assignemnt 2Document5 pagesStrategic Corporate Finance Assignemnt 2Sukrit NagpalNo ratings yet

- Indian Capital Market and Financial System Book 1Document47 pagesIndian Capital Market and Financial System Book 1akash deepNo ratings yet

- ThesisDocument17 pagesThesisKritiNo ratings yet

- Latihan Soal Pertemuan Ke-6Document15 pagesLatihan Soal Pertemuan Ke-6gloria rachelNo ratings yet

- Hindustan Uniliver - FMDocument9 pagesHindustan Uniliver - FMrachitaNo ratings yet

- Chapter 9: The Capital Asset Pricing ModelDocument6 pagesChapter 9: The Capital Asset Pricing ModelJohn FrandoligNo ratings yet

- Housing FinanceDocument7 pagesHousing FinanceRachamalla KrishnareddyNo ratings yet

- Report Income TaxDocument6 pagesReport Income TaxLudmila DorojanNo ratings yet

- Mirae Asset Emerging Bluechip Fund-2Document1 pageMirae Asset Emerging Bluechip Fund-2Saurabh KothariNo ratings yet

- Financial Statements and Analysis: N Learning GoalsDocument3 pagesFinancial Statements and Analysis: N Learning GoalsJoyce De LunaNo ratings yet

- New Microsoft PowerPoint PresentationDocument18 pagesNew Microsoft PowerPoint Presentationmusaraza890No ratings yet

- Assignment On Financial ManagementDocument22 pagesAssignment On Financial ManagementSimran VirmaniNo ratings yet

- Answer CBM Ch2Document5 pagesAnswer CBM Ch2Visal ChinNo ratings yet