Professional Documents

Culture Documents

The Oriental Insurance Company LTD: Fms-Du

Uploaded by

nikitasahaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Oriental Insurance Company LTD: Fms-Du

Uploaded by

nikitasahaCopyright:

Available Formats

The Oriental Insurance Company Ltd

M.L. Singla

FMS-DU

(Strictly for Limited & Private Circulation)

The Oriental Insurance Company Ltd. was incorporated at Mumbai on 12th September 1947. The

Company was a wholly owned subsidiary of The Oriental Government Security Life Assurance

Company Ltd and was formed to carry out General Insurance business. The Company was a

subsidiary of Life Insurance Corporation of India from 1956 to 1973 ( till the General Insurance

Business was nationalized in the country). In 2003 all shares of our Company held by the General

Insurance Corporation of India were transferred to the Central Government.

The Company is a pioneer in laying down systems for smooth and orderly conduct of the business.

The strength of the Company lies in its highly trained and motivated work force that covers various

disciplines and has vast expertise. Oriental specializes in devising special covers for large projects

like power plants, petrochemical, steel and chemical plants. The Company has developed various

types of insurance covers to cater to the needs of both the urban and rural population of India. The

Company has a technically qualified and competent team of professionals to render the best customer

service.

Oriental Insurance made a modest beginning with a first year premium of Rs.99,946 in 1950. The

goal of the Company was “Service to clients” and achievement thereof was helped by the strong

traditions built up overtime.

ORIENTAL with its Head Office at New Delhi has 29 Regional Offices and nearly 1800+ operating

offices in various cities of the country. The Company has overseas operations in Nepal, Kuwait and

Dubai and has a total strength of around 13500 employees. From less than a lakh at its inception, the

gross premium went up to Rs.58 crores in 1973 and at the end of the year 2018-19 the premium

figure stood at Rs.13199 crores.

OIC’s Corporate Mission:

• To be the most respected & preferred Non-Life Insurer in the markets we operate.

OIC’s Corporate Objectives:

• Act as a financially sound corporate entity with high business ethics

OIC-Architecture Case Page 1

• Implement best human resource development practices to build a highly efficient, dedicated

and motivated workforce with high morale and moral values

• Optimally utilize the information technology infrastructure

• Provide excellent customer service

• Run the business profitably through prudent underwriting and efficient & proper claim

management

• Effectively manage our reinsurance operations

• Effectively manage our investments for optimising yield

• Have effective risk management systems

• Improve the penetration of non-life insurance by proper underwriting, innovation &

marketing

• To evolve as a vibrant & dynamic leading non-life insurer

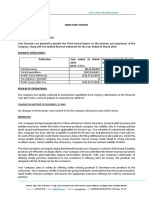

OIC’s Financial Results:

(Amount in Rs.Lacs)

2008-09 2017-18 2018-19

Gross Direct Premium 407790 1145201 1319932

Net Premium 323510 1002823 1084539

305719 822122 1124808

Net Claims

(94.50%) (81.98%) (103.71%)

91444 260943 244864

Operating Expenses (28.27%) (26.02%) (22.58%)

Profit on Sale of Investments (Policy

-39651 19021 38310

Holders’)

Interest, Dividend and Rent ** 17197 119065 106512

Profit Before Tax -8842 138228 -42899

Profit After Tax -5266 150989 -29366

* % means percentage to net premium

OIC-Architecture Case Page 2

You might also like

- Sap HR Business Blue PrintDocument58 pagesSap HR Business Blue PrintAnonymous 3ZvXNhY86% (7)

- Securitas Annual and Sustainability Report 2019Document168 pagesSecuritas Annual and Sustainability Report 2019Edna Julieth Beltran CastañedaNo ratings yet

- MIS Assignment On Metlife AlicoDocument20 pagesMIS Assignment On Metlife Alicosalman KomorNo ratings yet

- Sime Darby BerhadDocument16 pagesSime Darby Berhadjue -No ratings yet

- The Mystery of Belicena Villca - Nimrod de Rosario - Part-1Document418 pagesThe Mystery of Belicena Villca - Nimrod de Rosario - Part-1Pablo Adolfo Santa Cruz de la Vega100% (1)

- Eric H Monkkonen Police in Urban America 1860 1920 Interdisciplinary Perspectives On Modern History 2004 PDFDocument233 pagesEric H Monkkonen Police in Urban America 1860 1920 Interdisciplinary Perspectives On Modern History 2004 PDFHispania fcsNo ratings yet

- Acko 157 Annual Report 2018 19Document89 pagesAcko 157 Annual Report 2018 19sdfsadfdsas223No ratings yet

- AI Business Update - 9M23Document30 pagesAI Business Update - 9M23Timothy GracianovNo ratings yet

- 2022 CMZDocument20 pages2022 CMZAdemuyiwa OlaniyiNo ratings yet

- Tata AIGDocument125 pagesTata AIGMilan Kumar Pandey100% (3)

- Data AnalysisDocument4 pagesData Analysis61Rohit PotdarNo ratings yet

- AR201920Document185 pagesAR201920utkarsh tripathiNo ratings yet

- Investment AnalysisDocument11 pagesInvestment AnalysisFendi SamsudinNo ratings yet

- Annual Report For The FY 2017-18Document117 pagesAnnual Report For The FY 2017-18AJNo ratings yet

- Pakistan: Market InformationDocument11 pagesPakistan: Market InformationUsman HabibNo ratings yet

- Pakistan: Market InformationDocument11 pagesPakistan: Market InformationsilverskillsNo ratings yet

- Business Feasibility AfzalDocument6 pagesBusiness Feasibility AfzalSonam RajKumarNo ratings yet

- Q1. How The Training of Insurance Plays An Important Role in The Development of Insurance BusinessDocument9 pagesQ1. How The Training of Insurance Plays An Important Role in The Development of Insurance BusinessWasim1987100% (1)

- Service Sector: - Ali Meezan - Arushi Christopher - Rohan Kumar GuptaDocument34 pagesService Sector: - Ali Meezan - Arushi Christopher - Rohan Kumar GuptaRohan GuptaNo ratings yet

- Siemens Annual Report 2009Document139 pagesSiemens Annual Report 2009shweta_bajpai_2No ratings yet

- Project Report ON Infosys Technologies LTD.: Ms. Sandhya PrakashDocument8 pagesProject Report ON Infosys Technologies LTD.: Ms. Sandhya PrakashRavindra ChauhanNo ratings yet

- Swot Analysis On Reliance InsuranceDocument37 pagesSwot Analysis On Reliance InsuranceDhananjay SharmaNo ratings yet

- Bussines Plan Century Insurance: Presented By: Samiya Shaikh Submitted To: Ms Fozia SaleemDocument32 pagesBussines Plan Century Insurance: Presented By: Samiya Shaikh Submitted To: Ms Fozia SaleemSamiya ShaikhNo ratings yet

- Compensation & Benefits: A Strategy PerspectiveDocument37 pagesCompensation & Benefits: A Strategy PerspectiveNishtha SinghNo ratings yet

- D.G. Khan CementDocument11 pagesD.G. Khan Cementkanwal_bawaNo ratings yet

- Company Analysis 1Document17 pagesCompany Analysis 1Anirban BhattacharyaNo ratings yet

- Annual Report Fy 2019 20Document85 pagesAnnual Report Fy 2019 20sdfsadfdsas223No ratings yet

- Company Analysis of Unitech LimitedDocument21 pagesCompany Analysis of Unitech LimitedashwiniabhaykordeNo ratings yet

- Group 23 FAC102 Final ProjectDocument19 pagesGroup 23 FAC102 Final ProjectrajeshNo ratings yet

- Energomera Insurance - Business Plan (Example)Document25 pagesEnergomera Insurance - Business Plan (Example)HenryNo ratings yet

- Acc466 - Group G - Project 1Document28 pagesAcc466 - Group G - Project 1Nur SyafiqahNo ratings yet

- Preface: Submitted By:-Jimmy Sachde 08bba038 S.Y.B.B.ADocument27 pagesPreface: Submitted By:-Jimmy Sachde 08bba038 S.Y.B.B.AJimmy SachdeNo ratings yet

- Klaus SMDocument24 pagesKlaus SMMugilanNo ratings yet

- One 97 Communications (Parent Org. of Paytm) - A Stock StoryDocument10 pagesOne 97 Communications (Parent Org. of Paytm) - A Stock StoryHariomNo ratings yet

- Presentation On Financial Performance Evaluation of Meghna Lif Insurance LimitedDocument10 pagesPresentation On Financial Performance Evaluation of Meghna Lif Insurance LimitedMurshid IqbalNo ratings yet

- Separation of Muridke FootwearDocument10 pagesSeparation of Muridke FootwearabdullahNo ratings yet

- ANZN Annual Results 291009Document2 pagesANZN Annual Results 291009bernardchickeyNo ratings yet

- Asahi India Glass LimitedDocument11 pagesAsahi India Glass LimitedALEN CHRISTINNo ratings yet

- Company Guide 2016 PDFDocument302 pagesCompany Guide 2016 PDFDharmendra SinghNo ratings yet

- 7.chap 3Document29 pages7.chap 3Manish KumarNo ratings yet

- Access Bank InfoDocument7 pagesAccess Bank InfoSeun -nuga DanielNo ratings yet

- GS Business ModelDocument4 pagesGS Business ModelHaiderNo ratings yet

- DocumentDocument171 pagesDocumentShivam KumarNo ratings yet

- You Are Making: A Good Choice!Document4 pagesYou Are Making: A Good Choice!Gaurang GoswamiNo ratings yet

- Insurance Solutionsby EtiqaDocument30 pagesInsurance Solutionsby EtiqaAdam TanNo ratings yet

- 30 - Financial Statements 2010Document119 pages30 - Financial Statements 2010born2prayNo ratings yet

- Amal Annual Report 2017 18Document104 pagesAmal Annual Report 2017 18Kumar RajputNo ratings yet

- Company Screening - 2022 10 22 - 18 46 33Document25 pagesCompany Screening - 2022 10 22 - 18 46 33Shuchita AgarwalNo ratings yet

- Massy Digital Annual Report 2022 UpdatedDocument193 pagesMassy Digital Annual Report 2022 UpdatedNot TGTNo ratings yet

- AIRTELDocument12 pagesAIRTELDJ GAMERNo ratings yet

- Financial Accounting: Group-1 Industry - Cement Lead Company-Ultratech Cement LTDDocument19 pagesFinancial Accounting: Group-1 Industry - Cement Lead Company-Ultratech Cement LTDArpita GuptaNo ratings yet

- Project On Ratio AnalysisDocument41 pagesProject On Ratio AnalysisSiddik ShaikNo ratings yet

- Fervensiness Sutnga ME Research AssignmentDocument11 pagesFervensiness Sutnga ME Research AssignmentFerven SutngaNo ratings yet

- Etisalat Group Annual Report English 2019Document88 pagesEtisalat Group Annual Report English 2019RamiNo ratings yet

- M& M PresentationDocument12 pagesM& M PresentationPratik AgarwalNo ratings yet

- M&M PresentationDocument12 pagesM&M PresentationPratik AgarwalNo ratings yet

- Company ProfileDocument9 pagesCompany ProfileEr Prakash BasakNo ratings yet

- Fin 201 Body FinalDocument26 pagesFin 201 Body FinalNasrullah Khan AbidNo ratings yet

- Assurtech Fintech Global 2019Document69 pagesAssurtech Fintech Global 2019Argus de l'Assurance100% (3)

- Lather, Rinse, Succeed: Master The Art of Mobile Car DetailingFrom EverandLather, Rinse, Succeed: Master The Art of Mobile Car DetailingNo ratings yet

- The Correlation Between Poverty and Reading SuccessDocument18 pagesThe Correlation Between Poverty and Reading SuccessocledachingchingNo ratings yet

- 2018 Management Accounting Ibm2 PrepDocument9 pages2018 Management Accounting Ibm2 PrepВероника КулякNo ratings yet

- Coconut - WikipediaDocument22 pagesCoconut - WikipediaZam DresNo ratings yet

- Amado v. Hernandez ReportDocument22 pagesAmado v. Hernandez Reportlady ann apple colipano0% (1)

- Corpus v. CA 98 SCRA 424 (1980)Document2 pagesCorpus v. CA 98 SCRA 424 (1980)Rizchelle Sampang-Manaog100% (1)

- Christian 71 Example Road Center of The City Dublin IrelandDocument7 pagesChristian 71 Example Road Center of The City Dublin Irelandapi-25886097No ratings yet

- How To Pray For The LostDocument2 pagesHow To Pray For The LostDanny HockingNo ratings yet

- At The Butcher's, A Sample DialogueDocument1 pageAt The Butcher's, A Sample DialogueZine Edeb100% (1)

- SBI Clerk Previous Year Exam Papers e Book PDFDocument186 pagesSBI Clerk Previous Year Exam Papers e Book PDFthirumal0% (1)

- Final PaperDocument6 pagesFinal Paperapi-543853977No ratings yet

- BFS Property Listing For Posting As of 06.09.2017-Public-Final PDFDocument28 pagesBFS Property Listing For Posting As of 06.09.2017-Public-Final PDFkerwin100% (1)

- LAW 3100 - Persons & Family Relations - JD 33. G.R. No. 221029 - Republic vs. Manalo - Case Digest 8Document5 pagesLAW 3100 - Persons & Family Relations - JD 33. G.R. No. 221029 - Republic vs. Manalo - Case Digest 8John Kenneth ContrerasNo ratings yet

- Basics of Accounting Notes MBA 2nd SemDocument30 pagesBasics of Accounting Notes MBA 2nd SemVikash ChauhanNo ratings yet

- (Asian Connections) Prasenjit Duara - The Crisis of Global Modernity - Asian Traditions and A Sustainable Future-Cambridge University Press (2015)Document339 pages(Asian Connections) Prasenjit Duara - The Crisis of Global Modernity - Asian Traditions and A Sustainable Future-Cambridge University Press (2015)MichaelCarloVillasNo ratings yet

- IAS 08 PPSlidesDocument44 pagesIAS 08 PPSlideschaieihnNo ratings yet

- Omore ReportDocument38 pagesOmore ReportSameer Ur RahmanNo ratings yet

- Motivation, Budgets and Responsibility AccountingDocument5 pagesMotivation, Budgets and Responsibility AccountingDesak Putu Kenanga PutriNo ratings yet

- Cyborg Urbanization - Matthew GandyDocument24 pagesCyborg Urbanization - Matthew GandyAngeles Maqueira YamasakiNo ratings yet

- Modul 1 - Let - S ExploreDocument48 pagesModul 1 - Let - S ExploreJo NienieNo ratings yet

- Kevin The Dino: Free Crochet PatternDocument3 pagesKevin The Dino: Free Crochet PatternMarina Assa100% (4)

- 001) Each Sentence Given Below Is in The Active Voice. Change It Into Passive Voice. (10 Marks)Document14 pages001) Each Sentence Given Below Is in The Active Voice. Change It Into Passive Voice. (10 Marks)Raahim NajmiNo ratings yet

- 42-Luke SorensonDocument338 pages42-Luke SorensonEmmanuel ChristopherNo ratings yet

- Yield CurveDocument9 pagesYield Curvejackie555No ratings yet

- Daniela Aya Course Title/Number: Education 42 - The Teaching Profession With FSDocument2 pagesDaniela Aya Course Title/Number: Education 42 - The Teaching Profession With FSJhunalyn AlvaradoNo ratings yet

- UNEP Directory March 2021Document34 pagesUNEP Directory March 2021Perera KusalNo ratings yet

- The University of Alabama PowerpointDocument18 pagesThe University of Alabama Powerpointapi-305346442No ratings yet

- SCM - Case Assin Group 2 Sec - BDocument8 pagesSCM - Case Assin Group 2 Sec - BHarmeet kapoorNo ratings yet