Professional Documents

Culture Documents

Question 1 (1 Point) : Current Liabilities Could Include All of The Following Except: Question 1 Options

Uploaded by

Jemima TwumasiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question 1 (1 Point) : Current Liabilities Could Include All of The Following Except: Question 1 Options

Uploaded by

Jemima TwumasiCopyright:

Available Formats

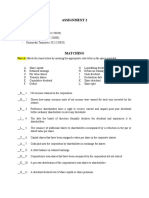

Question 1

(1 point)

Current liabilities could include all of the following except:

Question 1 options:

a bank loan due in 18 months

any part of long-term debt due during the current period

an accounts payable due in 30 days

a notes payable due in 9 months

Question 2 (1 point)

When preparing the balance sheet for AAA, Inc. for December

31, 2015, which item would not be classified as a current

liability?

Question 2 options:

The current portion of a 30-year mortgage

Income taxes due on September 15, 2016

Note payable due March 1, 2017

Accounts payable

Question 3 (1 point)

Obligations due to be paid within one year or the company’s

operating cycle, whichever is longer, are classified as

Question 3 options:

current liabilities

current assets

earned revenues

noncurrent liabilities

Question 4 (1 point)

For a business to be considered a corporation:

Question 4 options:

it must pay dividends

its stock must be sold in very large amounts

it must issue both common and preferred stock

it must be organized as a separate legal entity

Question 5 (1 point)

Advantages of the corporate form include all of the following

except:

Question 5 options:

easy to raise capital

ownership interests are transferrable

shares can be purchased in small amounts

legal liability of its owners is unlimited

Question 6 (1 point)

Which of the following statements about a corporation

is NOT correct?

Question 6 options:

A corporation has easy transferability of ownership

A corporation is a separate legal entity

A corporation’s owners have unlimited liability

A corporation may have the ability to raise large amounts of capital

Question 7 (1 point)

Which of the following is NOT a characteristic of corporate

ownership?

Question 7 options:

Shares of stock can be purchased in small increments

Ownership interests are freely transferable

Corporate earnings are distributed as interest payments

Stockholders have no liability for the debts of the corporation

Question 8 (1 point)

Which of the following statements about the benefits enjoyed by

the owners of common stock is NOT correct?

Question 8 options:

Some classes of common stock can carry more votes than others

Investors in a corporation are called stockholders

If the company ceases operations, stockholders share in any assets remaining before creditors have been

paid.

Stockholders receive a share of the corporation’s profits when distributed as dividends

Question 9 (1 point)

Corporations can raise large amounts of money because:

Question 9 options:

the unlimited liability feature makes corporate ownership attractive to investors.

corporate earnings are not taxed.

shares of stock in public companies can easily be bought and sold by investors.

all investments in corporate stock earn money for investors.

Question 10 (1 point)

Corporations can raise large amounts of money because:

Question 10 options:

stocks are always a good investment.

investors always prefer to invest in stock so they can receive dividends.

investing in the stock market is the surest way to get rich quick.

shares of stock can be purchased in small amounts, so even small investors can participate.

You might also like

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- Application of Corporate EventsDocument43 pagesApplication of Corporate EventsFrédé AmouNo ratings yet

- Dividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1From EverandDividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1No ratings yet

- Pay-Out Policies Questions & Answers: D. The Cumulative Earnings of The Company After DividendsDocument4 pagesPay-Out Policies Questions & Answers: D. The Cumulative Earnings of The Company After DividendsAhmed FathyNo ratings yet

- Sources of Finance Question Answers.Document14 pagesSources of Finance Question Answers.suyashjaiswal889No ratings yet

- On Sore InstrumentsDocument19 pagesOn Sore InstrumentsPrashant GharatNo ratings yet

- CF - Questions and Practice Problems - Chapter 15Document3 pagesCF - Questions and Practice Problems - Chapter 15Lê Hoàng Long NguyễnNo ratings yet

- Quiz1 - FinanceDocument11 pagesQuiz1 - Financerenata_oliver07100% (1)

- Assessment 2 Week 2Document5 pagesAssessment 2 Week 2Jemima TwumasiNo ratings yet

- 1 - 2 Essay FMDocument11 pages1 - 2 Essay FMPhương Chi VũNo ratings yet

- Commerce Weekly Assignment-1Document6 pagesCommerce Weekly Assignment-1Tanvi KhandelwalNo ratings yet

- Corporate Finance Assignment 2Document7 pagesCorporate Finance Assignment 2manishapatil25No ratings yet

- Shares and DebenturesDocument22 pagesShares and DebenturesDivisha AgarwalNo ratings yet

- Important Theory Q&aDocument13 pagesImportant Theory Q&amohsin razaNo ratings yet

- Burkeville Power and Light - Preference Share - Group 2 - Section1Document23 pagesBurkeville Power and Light - Preference Share - Group 2 - Section1Ashwin Mathew PhiliposeNo ratings yet

- Final SW 2Document4 pagesFinal SW 2shaggymimiyuhNo ratings yet

- Corporate Finance Week 1 Practice Problems SolutionsDocument12 pagesCorporate Finance Week 1 Practice Problems SolutionsnishitNo ratings yet

- Mogen ClassSummary 1401079Document4 pagesMogen ClassSummary 1401079Sravya DoppaniNo ratings yet

- "Report On Access To Finance": Course Title: Principles of Finance Course Code: FIN 101 Section: 8Document11 pages"Report On Access To Finance": Course Title: Principles of Finance Course Code: FIN 101 Section: 8Md Kawsarul IslamNo ratings yet

- Acctg Equity Practice QuizDocument16 pagesAcctg Equity Practice QuizJyNo ratings yet

- Assignment IN Macroeconomics: Submitted By: Jastine Quiel G. EusebioDocument12 pagesAssignment IN Macroeconomics: Submitted By: Jastine Quiel G. EusebioJhaz EusebioNo ratings yet

- 5 B 766 A 2 Ee 4 B 0 A 5 D 612149640Document11 pages5 B 766 A 2 Ee 4 B 0 A 5 D 612149640aadarsh agrawalNo ratings yet

- Different Types of Business Financing Case Study On: Great Service Cleaning and Maintenance CompanyDocument9 pagesDifferent Types of Business Financing Case Study On: Great Service Cleaning and Maintenance CompanyElias ChembeNo ratings yet

- FINMAN ReviewerDocument45 pagesFINMAN ReviewerGadfrey Doy-acNo ratings yet

- The Law of Corporate Finance & Securities RegulationDocument26 pagesThe Law of Corporate Finance & Securities Regulationchandni.ambaniandassociatesNo ratings yet

- Shares and DebenturesDocument20 pagesShares and DebenturesVíshál RánáNo ratings yet

- Finance PPT FinalDocument106 pagesFinance PPT FinalAkhil GaurNo ratings yet

- New Venture Finance Startup Funding For Entrepreneurs PDFDocument26 pagesNew Venture Finance Startup Funding For Entrepreneurs PDFBhagavan BangaloreNo ratings yet

- Tacn 2Document3 pagesTacn 2Bao MinhNo ratings yet

- Corporate AccDocument9 pagesCorporate Accpragatipradhan404No ratings yet

- Sources of FinanceDocument13 pagesSources of FinancekushalskNo ratings yet

- Ial Accounting Unit 2 TheoryDocument13 pagesIal Accounting Unit 2 TheorySterling ArcherNo ratings yet

- Business Finance: Sources of Long-Term FinanceDocument33 pagesBusiness Finance: Sources of Long-Term FinanceHibaaq AxmedNo ratings yet

- Advanced Financial AccountingDocument6 pagesAdvanced Financial AccountingsathishNo ratings yet

- Introduction To Corporate Finance Kashfia Sharmeen Corporate FinanceDocument25 pagesIntroduction To Corporate Finance Kashfia Sharmeen Corporate FinanceSarfaraj OviNo ratings yet

- Group Work 9 February 2022 MatchingDocument4 pagesGroup Work 9 February 2022 MatchingJeremy Michael HariantoNo ratings yet

- Sources of FinanceDocument6 pagesSources of FinanceNeesha NazNo ratings yet

- Strategic Finance SCDLDocument10 pagesStrategic Finance SCDLdarshansingh1979No ratings yet

- Lecture 1Document10 pagesLecture 1Ian MutukuNo ratings yet

- Ncert Solutions For Class 11 Business Studies Chapter 8 Sources of Business FinanceDocument7 pagesNcert Solutions For Class 11 Business Studies Chapter 8 Sources of Business Financeaipoint2007No ratings yet

- Financial Accounting A Business Process Approach 3Rd Edition Reimers Solutions Manual Full Chapter PDFDocument67 pagesFinancial Accounting A Business Process Approach 3Rd Edition Reimers Solutions Manual Full Chapter PDFKristieKelleyenfm100% (11)

- Advantages and Disadvantages of Shares and DebentureDocument9 pagesAdvantages and Disadvantages of Shares and Debenturekomal komal100% (1)

- Chapter 22Document9 pagesChapter 22TBCX VENONo ratings yet

- Eco 1 emDocument8 pagesEco 1 emFirdosh Khan100% (1)

- Sources of Financing: Factoring Accounts ReceivableDocument23 pagesSources of Financing: Factoring Accounts ReceivableNazmus Sakib RahatNo ratings yet

- CfatDocument12 pagesCfatSahil MakkarNo ratings yet

- Notes On Soures of FinanceDocument12 pagesNotes On Soures of FinanceavisaradigiNo ratings yet

- Assignment 2 - Group 6Document5 pagesAssignment 2 - Group 6Jeremy Michael HariantoNo ratings yet

- Finance NotesDocument246 pagesFinance NotesRL3451No ratings yet

- UGRD-ITE6301 Technopreneurship Midterm Quiz 2Document15 pagesUGRD-ITE6301 Technopreneurship Midterm Quiz 2DanicaNo ratings yet

- 134A Homework 1Document4 pages134A Homework 1TESTANo ratings yet

- Corporate Internation FinanceDocument3 pagesCorporate Internation FinanceMaliCk TaimoorNo ratings yet

- AdFM MCQsDocument16 pagesAdFM MCQsNidheena K SNo ratings yet

- FM - Sources of FinanceDocument42 pagesFM - Sources of FinanceTyson Texeira100% (1)

- Accounts For Limited CompaniesDocument4 pagesAccounts For Limited Companiesmohamed sobahNo ratings yet

- Quiz 8 - CH 15 & 16 - ACC563Document13 pagesQuiz 8 - CH 15 & 16 - ACC563scokni1973_130667106No ratings yet

- Chapters 4 and 5Document15 pagesChapters 4 and 5Estee FongNo ratings yet

- Introduction To FinanceDocument18 pagesIntroduction To FinanceЛера АношинаNo ratings yet

- Chapter 15 SolutionsDocument11 pagesChapter 15 Solutionsagctdna501750% (2)

- Da Week4 AssessmentDocument6 pagesDa Week4 AssessmentJemima TwumasiNo ratings yet

- Assessment 02Document3 pagesAssessment 02Jemima TwumasiNo ratings yet

- Quiz 6 Graded Business CommnDocument5 pagesQuiz 6 Graded Business CommnJemima TwumasiNo ratings yet

- FR Assessment Week 4Document5 pagesFR Assessment Week 4Jemima TwumasiNo ratings yet

- Assessment 2 Week 2Document5 pagesAssessment 2 Week 2Jemima TwumasiNo ratings yet

- Question 1 (1 Point) : SavedDocument6 pagesQuestion 1 (1 Point) : SavedJemima TwumasiNo ratings yet

- Data Analysis QuizDocument2 pagesData Analysis QuizJemima TwumasiNo ratings yet

- Local TaxationDocument29 pagesLocal Taxationdlo dphroNo ratings yet

- This Study Resource WasDocument8 pagesThis Study Resource WasFernanda ZapataNo ratings yet

- Acb3 11Document22 pagesAcb3 11gizachew alekaNo ratings yet

- Finance Assignment' 1Document13 pagesFinance Assignment' 1Daichi FaithNo ratings yet

- Business and Transfer Taxes SylabusDocument13 pagesBusiness and Transfer Taxes SylabusagentnicNo ratings yet

- 12 Acc c3 Prelim Exam p1 2023 QP AbDocument26 pages12 Acc c3 Prelim Exam p1 2023 QP AbPax AminiNo ratings yet

- Homework 1Document3 pagesHomework 1lizhikunNo ratings yet

- Numericals-Determination of Income and EmploymentDocument2 pagesNumericals-Determination of Income and EmploymentJustin D'souzaNo ratings yet

- Titman - PPT - CH04 - Financial Analysis v4Document68 pagesTitman - PPT - CH04 - Financial Analysis v4Hein HNo ratings yet

- BUSINESS MATHEMATICS 2ND QUARTER 5th WEEK LESSON GROSS NET INCOMEDocument15 pagesBUSINESS MATHEMATICS 2ND QUARTER 5th WEEK LESSON GROSS NET INCOMEDearla BitoonNo ratings yet

- Paseo Realty v. CADocument2 pagesPaseo Realty v. CAMary BoaquiñaNo ratings yet

- 10 CIR v. Far East Bank - Trust Company GR No. 173854 March 15, 2010Document13 pages10 CIR v. Far East Bank - Trust Company GR No. 173854 March 15, 2010AlexandraSoledadNo ratings yet

- Commissioner of Internal Revenue v. Nanox Philippines, Inc., G.R. No. 230416, May 5, 2021Document2 pagesCommissioner of Internal Revenue v. Nanox Philippines, Inc., G.R. No. 230416, May 5, 2021Meg PalerNo ratings yet

- Business Combination Final ExamDocument9 pagesBusiness Combination Final Examcharlene lizardoNo ratings yet

- 11 Pre-Review On EconomicsDocument2 pages11 Pre-Review On EconomicsAl-nashreen AbdurahimNo ratings yet

- Week 1 Income Tax Concepts-1Document53 pagesWeek 1 Income Tax Concepts-1shifana24No ratings yet

- Suggested Answers - Syl 2016 - December 2019 - Paper 10Document21 pagesSuggested Answers - Syl 2016 - December 2019 - Paper 10Kirthika GunasekaranNo ratings yet

- Income Tax Law and Accounts: Ruchi Mehta Assistant Professor Department of Commerce St. Mary's College ThrissurDocument13 pagesIncome Tax Law and Accounts: Ruchi Mehta Assistant Professor Department of Commerce St. Mary's College ThrissurAnju ShajuNo ratings yet

- Audit of LiabilitiesDocument14 pagesAudit of LiabilitiesJustine UngabNo ratings yet

- Direct Taxation: IntermediateDocument550 pagesDirect Taxation: IntermediateShreya JainNo ratings yet

- Anduril Industries IncentivesDocument5 pagesAnduril Industries IncentivesZachary HansenNo ratings yet

- Accounting Standards (1 To 29)Document76 pagesAccounting Standards (1 To 29)Vipul I. PanchasaraNo ratings yet

- IntroductionDocument85 pagesIntroductionRitika MittalNo ratings yet

- ACT103 - Topic 2Document9 pagesACT103 - Topic 2Juan FrivaldoNo ratings yet

- CHAPTER 7 Preparing, Analyzing, and Forecasting Financial StatementDocument10 pagesCHAPTER 7 Preparing, Analyzing, and Forecasting Financial StatementJoban Las PinyasNo ratings yet

- HCL Technologies Condensed Consolidated Interim Financial StatementsDocument47 pagesHCL Technologies Condensed Consolidated Interim Financial StatementsraxenNo ratings yet

- Financial ForecasterDocument11 pagesFinancial Forecastermeftuh abdiNo ratings yet

- BPLO Citizens Charter 2022Document2 pagesBPLO Citizens Charter 2022Gel Archie BrionesNo ratings yet

- Partnership Operations Enabling AssessmentDocument2 pagesPartnership Operations Enabling AssessmentJoana TrinidadNo ratings yet

- Activity 1 UTSDocument14 pagesActivity 1 UTSdoieNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- Building Your Empire: Achieve Financial Freedom with Passive IncomeFrom EverandBuilding Your Empire: Achieve Financial Freedom with Passive IncomeNo ratings yet

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- Economics and the Law: From Posner to Postmodernism and Beyond - Second EditionFrom EverandEconomics and the Law: From Posner to Postmodernism and Beyond - Second EditionRating: 1 out of 5 stars1/5 (1)

- The Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysFrom EverandThe Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysNo ratings yet

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessFrom EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessNo ratings yet