Professional Documents

Culture Documents

Adv Acc

Adv Acc

Uploaded by

Sivasankari0 ratings0% found this document useful (0 votes)

6 views15 pagesOriginal Title

adv acc

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views15 pagesAdv Acc

Adv Acc

Uploaded by

SivasankariCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 15

|

|

|

|

|

Roll No.

Total No. of Questions — 7 Total No. of Printed Pages — 15

Time Allowed — 3 Hours Maximum Marks - 100

LON

‘Answers to questions are to be given only in English except in the case of candidates who

have opted for Hindi Medium. If a candidate has not opted for Hindi Medium, his/her

Question No. 1 is compulsory.

Candidates are also required to answer any five questions from the remaining six

questions.

Incase, any candidate answers extra questions(s)/sub-question(s) over and above the

required number, then only the requisite number of questions first answered in the answer

book shall be valued and subsequent extra question(s) answered shall be ignored.

Where appropriate, suitable assumption/s should be made by the candidate.

Working notes should form part of the respective answers.

LON P.T.O.

@Q)

LON

1. Answer the following questions :

@

b)

Desire Limited acquired a patent for producing a product at a cost of

% 1,00,00,000 for a period of 5 years. The life cycle of the product is

also 5 years. The cost of the patent was capitalized by the company

and it was amortized on straight line method. After 2 years, the

company found that the product life-cycle may continue for another

5 years from then. The net cash flows from the product during these

5 years were expected to be % 45,00,000, % 42,00,000, % 40,00,000,

% 38,00,000 and % 35,00,000. Patent is renewable and company

changed amortization method from 3 year (i.e. From straight line

Method to the ratio of expected net cash flows). Find out the

amortization cost of the patent for each of the years (I" year to

7” year).

The following information is available for TON Ltd. for the

accounting year 2015-16 and 2016-17 :

No. of shares outstanding prior to right issue — 15,00,000 shares;

Right Issue - one new share for each three shares outstanding i.e.

5,00,000 Shares; 4

Right issue price - & 25;

Last date to exercise right - 31" July 2016;

Fair value of one equity share immediately prior to the exercise of

rights on 31° July 2016 is & 35;

Net profit for the year 2015-16 % 35,00,000

Net profit for the year 2016-17 7 45,00,000

You are required to compute :

(® Basic earnings per share for the year 2015-16.

(ii) Restated basic earnings per share for the year 2015-16 for right

issue.

(iii) Basic earnings per share for the year 2016-17.

LON

©

@

@)

LON

{A specific government grant of € 15 Lakhs was received by USB Ltd.

for acquisition of Hi-Tech Dairy Plant of % 95 ‘Lakhs during the year

2014-15. Plant has useful life of 10 years. The grant received was

credited to deferred grant account. However during the year 2017-18,

due to non-compliance of conditions laid down for the grant, the

company had to refund the whole grant to the Government. Balance of

the deferred grant account on that date was % 10.50 lakhs and written

down value of plant was € 66.50 lakhs.

(i) What should be the treatment of the refund of the grant, the effect

on cost of the plant and the amount of depreciation to be charged

during the year 2017-18 in the Profit and Loss account ?

(ii) What should be the treatment of the refund of the grant and the

amount of depreciation to be charged, if grant was deducted from

the cost of the plant during the year 2014-15 assuming plant

account showed balanced of € 56 lakhs as on 1.4.2017 ?

Superbright Ltd, issued 10% debentures of & 25 lakhs on 30.06.2016.

‘These debentures have floating charge on fixed assets. Money raised

from debentures to be utilized as under :

Particulars ‘Amount

(Zin lakhs)

Construction of factory building 8

Purchase of Machinery 107

Working Capital Y

Additional Information :

Marks

(j) Interest on debentures forthe year 2016-17 was paid by the company.

Gi) In March 2017, Machinery was installed and ready for its

intended use.

ii) During the year, the company invested idle fund of % 4 lakhs

(out of money raised from debentures) in bank’s fixed deposit

and eared interest of € 24,000.

(iv) The construction of the factory building was completed in July

2017.

You are required to show the treatment of interest for the year ended

2016-17 as per AS-16.

LON P.T.O.

@)

LON

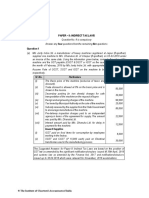

A,B, C and D were sharing profits and losses in the ratio of 3:2: 2:3.

Due to fraud committed by C during the year, it was decided to dissolve the

partnership on 31* March, 2017 when their Balance Sheet was as under :

Liabilities ‘Amount ‘Assets ‘Amount

® @.

Capital Building 95,000

A 60,000 |. Stock 60,900

B 40,000 | Investments 20,000

Debtors 29,800

D 55,000 | Cash 7,300

General reserve 15,000 | C’s Capital A/c 12,000

Trade creditors 39,000

Bills payable 16,000

2,25,000 2,28,000

Following information is given to you :

(iC sold an investment costing % 3,900 at © 5,500 and the funds

transferred to his personal account, No entry was made in firm’s book

to record this transaction.

Gi) C misappropriated a cheque for € 2,400 received from debtor and it

was not recorded in the books.

Gii) A creditor agreed to take over investments of book value of % 3,500 at

% 4,800. The rest of the creditors were paid off at a discount of 2%.

(iv) The other assets realized as follows :

Building 105% of Book value

Stock 75,000

Investments The rest of the investments were sold at a profit of 10%.

Debtors The rest of the debtors were realized at a discount of 12%

(v) The bills payable were settled at a discount of € 800.

(vi) The expenses of dissolution amounted to € 5,200,

(vii) It was found that realization from C’s private assets would only be 2,500.

‘You are required to prepare the following Ledger Accounts :

(A) Realisation Account

(B) Cash Account

(©) Partners’ Capital Accounts

LON

Marks

16

6)

LON Marks

The summarised balance-sheet of Pee Limited as on 31% March, 2017

is as under:

Equity and Liabilities ‘Amount

@. ®

Share Capital :

Authorised Capital

2,50,000 Equity Shares of 10 each 25,00,000

5,000 Preference Shares of ® 100 each 5,00,000| _30,00,000

Issued, Subscribed and Paid up Capital :

2,40,000 Equity Shares of € 10 cach fully

paid 24,00,000

3,000 Preference Shares of € 100 each

fully paid 3,00,000] 27,00,000

(Issued two months back for the purpose

of buy back)

Reserves and Surplus

Capital Reserve 10,00,000

Revenue Reserve 25,00,000

Securities Premium 27,00,000

Profit and Loss Account 35,00,000| 97,00,000

Current Liabilities

Trade Payables 13,00,000

Other Current Liabilities 3,00,000| _16,00,000

1,40,00,000

‘Assets Amount

@), ®@

Fixed Assets

Tangible Assets

Building 25,00,000

Machinery 31,00,000

Furniture 20,00,000} 76,00,000

Non-Current investments 30,00,000

Current Assets

Inventory 12,00,000

Trade Receivables 7,00,000

Cash at Bank 15,00,000 | _34,00,000

1,40,00,000

P.T.O.

)

©

LON

On 1* April, 2017, the company announced the buy-back of 20% of its

equity shares @ 60 per share. For this purpose, the company sold all

of its investments for ® 25,00,000.

The company achieved its target of buy back. You are required to :

(@® Pass necessary Journal Entries for the above transactions.

(ii) Prepare Balance Sheet of the company after buy back of shares.

The summarized Balance Sheet of Spices Ltd. as on 31" March, 2018

is as under :

Equity and Liabilities ‘Amount

®

Share Capital ; 9,000 equity shares of © 10 each fully

paid up 90,000

General Reserve 38,000

Debenture Redemption Reserve 35,000

12% Convertible Debentures : 1200 Debentures of % 50

each 60,000

Unsecured Loans 28,000

Short Term Borrowings 19,000

‘ 2,70,000

‘Assets ‘Amount

®,

Fixed Assets (at cost less depreciation) 72,000

Debentures Redemption Reserve Investments 34,000

Cash and Bank Balances 86,000

Other Current Assets 78,000

2,70,000

‘The debentures are due for redemption on 1* April, 2018. The terms of

issue of debentures provided that they were redeemable at a premium

of 10% and also conferred option to the debenture holders to convert

40% of their holding into equity shares at a predetermined price of

% 11 per share and the balance payment in cash.

LON

Marks

4.

@

LON

Further following information are given :

‘Marks

(i) Except for debenture holders holding 200 debentures in

aggregate, rest of them exercised the option for maximum

conversion.

Gi) The investments sold for € 56,000.

(iii) All transactions were executed on 1" April, 2018.

(iv) Premium on redemption of debentures is to be adjusted against

General Reserve.

You are required to :

(A) Prepare the Balance Sheet of Spices Ltd. as on 01.04.2018 after

giving effect to the redemption.

(B) Show your calculations in respect of the number of equity shares

to be allotted.

‘The summarised Balance Sheet of M/s Venus Ltd. as on 31 March, 2018 is

riven below

Liabilities Amount

Ec

‘Share Capital 3

35,000 Equity Shares of € 50 each fully paid up 17,50,000

Reserves & Surplus

Profit & Loss Statement (Debit Balance) (2,42,375)

‘Non-Current Liabilities :

5% Debentures 2,80,000

Interest Accured 7,000 2,87,000

(Secured by floating charge on all assets)

Current Liabilites :

Bank Overdraft 43,750

(Secured by hypothecation of stock)

Trade payables 63,000

Total 19,01,375

16

P.T.O.

8)

LON

Assets Amount

®

‘Non-Current Assets :

Tangible Assets :

Land & Building 7,87,500

Plant & Machinery 962,500

Fumiture & Fixtures 40,250

Current Assets :

Stock 66,500

Trade Receivables 43,750

Cash & Bank Balance 875

Total 19,01,375

Ws Venus Lid, went into voluntary li on on 31* March, 2018. ‘The

following assets are estimated to be realised :

Particulars ‘Amount

®@ ’

Tand & Building 5,26,750

Plant & Machinery 9,18,750

Furniture & Fixtures 17,500

Stock 54,250

Trade Receivables 35,000

Trade payables included :

© Salaries of 5 employees for 4

winding up) € 21,000.

months (immediately before the date of

Godown rent for last six months amounting to 75,250.

‘Income tax deducted out of salaries of employees @ 1,750.

© Directors fees ¥ 875.

LON

Marks

5

@)

LON

‘Three years ago, the debit balance of Statement of Profit & Loss was

£ 1,36,369 and since that date the accounts of company have shown the

following figures =

lf ‘Year ended | Year ended | Year ended

31.03.2016 | 31.03.2017 | 31.03.2018

® ® ®,

Total Revenue 1,13,750 78,750 70,000

Salaries 70,875 63,000 60,200

Electricity and Water Charges 10,063 11,165 9,205

Debenture Interest 14,000 14,000 14,000

Bad debts 14,945 13,300 =

Depreciation 11,725 11,725 11,725

Director's Fee 1,750 1,750 1,750

Miscellaneous Expenses 18,375 988 13,965

Total Expenses 741,733 _1,15,928| __1,10,845

in addition, itis estimated that the company would have to pay © 8,750 as

compensation to an employee for injuries suffered by him which was

contingent liability not accepted by the company.

Prepare the Statement of Affairs and the Deficiency Account.

(@ From the following information furnished to you by Bharat Insurance

Co. Ltd., you are required to pass Journal Entries relating to Unexpired

Risk Reserve and show “Unexpired Risks Reserve Account” for the

year ending 31" March, 2017 in columnar form.

(@ On 01.04.2016, it had reserve for unexpired risks amounting t0

2 55 crores, It comprised of € 21 crores in respect of marine

insurance business, % 28 crores in respect of fire insurance

business and % 6 crores in respect of miscellaneous insurance

business.

(Gi) The Bharat Insurance Co. Ltd. creates reserves at 100% of net

premium income in respect of marine insurance policies and at

'50% of net premium income in respect of fire and miscellaneous

insurance policies.

Marks

LON P.T.O.

)

(10)

LON

(ii) During the year 2016-17, the following business was conducted :

(®in crores)

Particulars

Marine | Fire | Miscellaneous

insureds in respect

2) Premium from

business ceded

issued (Direct Business)

insurance companies in

other insurance companies on

(1) Premium collected from] 22.0 46.0 13.0

of policies

other

respect of risks undertaken :

Received during the year us | 92 55

Receivable ~ 01.04.16 70 | 3.0 15

Receivable ~ 31.03.17 40 | 10 10

@) Premium paid/payable to] 7.5 | 53 8.0

From the following information, calculate the amount of Provisions

and Contingencies and prepare Profit and Loss Account of Supreme

Bank Limited for the year ending 31" March, 2018 :

Income @in Expenditure @in

lakhs lakhs

Interest and discount | 1835 | Interest expended 1136

Interest accrued on Printing & Stationery 18

Investments

8

Commission, Repairs & Maintenance 2

exchange and

brokerage 12

Profit on sale of Payment to and

Investments provision for employees

1 | Galaries, bonus etc,) 80

Rent received 2 | Other operating

expenses 5

LON

Marks

is

ay

Marks

LON

Additional Information =

in lakhs

@ Rebate on bills discounted to be provided for 3

Gi) Classification of Advances =

Standard Assets 4,100

‘Sub-Standard Assets (Fully secured) 380

Doubtful Assets not covered by security 155

Doubtful Assets fully covered by security

Less than 1 year 10

More than 1 year, but less than 2 years 18

More than 2 years, but less than 3 years 35

‘More than 3 years 2

Loss Assets 50

ii) Make tax provisions @ 35% of the profit.

(iy) Profit and Loss Account (Cr.) brought forward 65

from the previous year.

(a) XYZ Lid. has three departments R, S and

31° Mi

arch, 2018, the following information is given :

T. For the year ended

Particulars Department) Department | Department

R s T

® ® ®@.

(Opening stock 6,000 70,000 | 21,000

Opening reserve. for], — 2,500 3,500

[unrealised profit

[Materials purchased 18,000 | 22,000 =

|Direct labour 11,000 12,000 -

‘Closing stock 5,000 20,000 5,000

‘Sales - - 1,15,000

Area occupied (sq. mtr.) 2,700 1,400 900

No. of employees 40 30 20

LON

P.T.O.

(b)

(12)

LON

Stocks of each department are valued at costs to the department

concerned. Stocks of Department R are transferred to Department Sat

cost plus 20% and stocks of Department S are transferred to

Department T at a gross profit of 25% on sales. Other common

expenses are salaries € 18,000, staff welfare € 9,000 and rent %9,000.

‘You are required to prepare :

(1) Departmental Trading and Profit & Loss Account.

(2) General Profit and Loss Account.

Pass necessary Journal Entries in the books of an Independent Branch

of M/s TPL Sons, to rectify or adjust the following transactions :

@ Branch paid % 5,000 as salary to a Head Office Manager, but the

amount paid has been debited by the Branch to Salaries Account.

(i) A remittance of % 1,50,000 sent by the Branch has not been

received by Head Office till date of reconciliation:

ii) Branch assets accounts retained at Head Office, depreciation

charged for the year ® 15,000 not recorded by Branch.

(iv) Head Office expenses ¥ 55,000 allocated to the Branch, but not

recorded by the Branch.

(v)_ Head Office collected % 60,000 directly from a Branch Customer,

but no intimation of this fact has been received by the Branch.

(vi) Goods dispatched by the Head Office amounting to % 50,000, but

not received by the Branch till date of reconciliation.

(vii) Branch incurred advertisement expenses of & 10,000 on behalf of

Head Office and debited to advertisement expenses account.

(viii) Head Office made payment of % 16,000 for purchase of goods by

branch, but not recorded in branch books.

LON

Marks

(13)

LON Marks

7. Answer any four of the followings : 4

@

JKS Ltd. has its share capital divided into equity shares of € 10 each.

On 1.1.2018 it granted 5,000 employees’ stock option at % 30 per

share, when the market price was % 50 per share. The options were to

be exercised between 15" March, 2018 and 31 March, 2018. The

employees exercised their options for 3,600 shares only and the

remaining options lapsed. Show Journal Entries (with narration) as

would appear in the books of JKS Ltd, upto 31" March, 2018.

Sham Chaurasi who is appointed as liquidator is entitled to receive 4

remuneration at 2% on the assets realised, 3% on the amount

distributed to Preferential Creditors and 3% on the payment made to

Unsecured Creditors. The assets were realized for € 12,00,000 against

which payment was made as follows : ;

7

Liquidation expenses 65,000

Secured Creditors 6,00,000

Preferential Creditors 4,00,000

The amount due to Unsecured Creditors was @ 5,00,000.

Calculate the total remuneration payable to liquidator.

LON P.T.O,

©

@®

a4)

LON Marks

‘The following balances are extracted from the books of a commercial 4

bank, You are required to segregate the capital funds into Tier I and

Tier II capitals :

Particulars re

(@ in Crores)

Equity Share Capital 600

Statutory Reserve 375

Capital Reserve (of which % 27 Crores were due to

revaluation of assets and the balance due to sale of

capital assets) 90

Loan and advances 75

Cash balance with RBI 15

Other Investments 25

Off Balance Sheet item :

(@) Guarantee and other obligations 100

(b) Acceptances, endorsements and letter of 50

credit

ABC Ltd. sold a machine having written down value of 19 Lakhs to 4

XYZ Ltd. for % 22 lakhs and the same machinery was Jeased back by

XYZ Ltd. to ABC Ltd, The lease back is operating lease.

What should be the treatment in the books of ABC Ltd. in the

following cases ?

(1) Sale price of € 22 Lakhs is equal to fair value.

(2) Fair value is @ 22 Lakhs and sale price is 24 Lakhs.

(3). Fair value is € 17 Lakhs and sale price is € 18 Lakhs.

(4) Fair value is 19 Lakhs and sale price is 24 Lakhs.

LON

(15)

LON Marks

(©) Differentiate between Branch Accounts and Departmental Accounts on 4

the basis of :

(@) Maintenance of accounts

Gi) Allocation of common expenses

(iii) Reconciliation

(iv) Conversion of foreign currency figures

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- GST RegistrationDocument46 pagesGST RegistrationSivasankari100% (1)

- FinApp FR Imp QuestionsDocument6 pagesFinApp FR Imp QuestionsSivasankariNo ratings yet

- Strategic Cost Management and Performance Evaluation New Additions To Edition 2 (MARCH 2020) by Ca - Dinesh JainDocument62 pagesStrategic Cost Management and Performance Evaluation New Additions To Edition 2 (MARCH 2020) by Ca - Dinesh JainSivasankariNo ratings yet

- Oil and Natural Gas Corporation Limited Corporate Recruitment Section Green Hills, Tel Bhavan, DehradunDocument2 pagesOil and Natural Gas Corporation Limited Corporate Recruitment Section Green Hills, Tel Bhavan, DehradunSivasankariNo ratings yet

- CA Final DT Revision 2Document88 pagesCA Final DT Revision 2SivasankariNo ratings yet

- Audit - MCQs of ICAI Compiled by CA Pankaj Garg SirDocument61 pagesAudit - MCQs of ICAI Compiled by CA Pankaj Garg SirSivasankariNo ratings yet

- Aggregation of Income, Set Off or Carry Forward of Losses: After Studying This Chapter, You Would Be Able ToDocument31 pagesAggregation of Income, Set Off or Carry Forward of Losses: After Studying This Chapter, You Would Be Able ToSivasankariNo ratings yet

- CPCL TA 2020 21 Advt Final WebDocument5 pagesCPCL TA 2020 21 Advt Final WebSivasankariNo ratings yet

- Board of Studies The Institute of Chartered Accountants of India AnnouncementDocument6 pagesBoard of Studies The Institute of Chartered Accountants of India AnnouncementSivasankariNo ratings yet

- ET - 2019 - Finance ResultDocument4 pagesET - 2019 - Finance ResultSivasankariNo ratings yet

- Referencer For Quick Revision: Final Course Paper-6E: Global Financial Reporting StandardsDocument16 pagesReferencer For Quick Revision: Final Course Paper-6E: Global Financial Reporting StandardsSivasankariNo ratings yet

- Paper - 8: Indirect Tax Laws: Sl. No. Particulars Amount inDocument25 pagesPaper - 8: Indirect Tax Laws: Sl. No. Particulars Amount inSivasankariNo ratings yet

- Brochure of Career Ascent September 2020Document4 pagesBrochure of Career Ascent September 2020SivasankariNo ratings yet

- Lenovo Back To School Iim OfferDocument4 pagesLenovo Back To School Iim OfferSivasankariNo ratings yet

- FAQs On IGST Refunds 31090Document5 pagesFAQs On IGST Refunds 31090SivasankariNo ratings yet

- IPCC Crash Schedule 310717 6pmDocument1 pageIPCC Crash Schedule 310717 6pmSivasankariNo ratings yet

- Chapter-1 Computati Onoftaxli ABI LI TYDocument3 pagesChapter-1 Computati Onoftaxli ABI LI TYSivasankariNo ratings yet

- Vehicle Loan ProjectionDocument3 pagesVehicle Loan ProjectionMuhAmmed JaZimNo ratings yet