Professional Documents

Culture Documents

Chapter 34 - Solutions

Chapter 34 - Solutions

Uploaded by

Đức TiếnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 34 - Solutions

Chapter 34 - Solutions

Uploaded by

Đức TiếnCopyright:

Available Formats

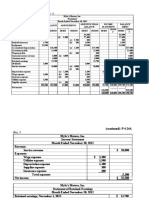

Chapter 3 + 4:

Ex 6: Closing entries for Beauty Salon:

Date Account name Dr Cr

31/12 Rent earned 3400

Closing revenues Fees earned 24400

Income summary 27800

(3400 = 3200+200(e) + 800(f); 24400 =

23400+1000 (j) )

31/12 Income Summary 14680

Closing expenses Insurance expense 1240

Supplies expense 780

Depreciation expense (c+d) 2570

Wages expense (3200+ 200 (g)) 3400

Utility expense 690

Property taxes expense (600+450 (h)) 1050

Interest expense (4350 + 600 (i)) 4950

31/12 Income Summary 13120

Closing Income Retained earnings 13120

summary

Ex9:

Date Account name Dr Cr

31/12 Depreciation expense 200

a Accumulated depreciation 200

31/12 Unearned rent 700

b Rent earned 700

31/12 Insurance expense 200

c Prepaid insurance 200

31/12 d Salary expense 1000

Salary payable 1000

31/12 Supplies expense 500

Supplies 500

31/12 Rent earned 700

Closing revenues Consulting revenue 4000

Income summary 4700

31/12 Income Summary 3900

Closing expenses Insurance expense 200

Supplies expense 500

Depreciation expense 200

Salary expense 2000

Advertising expense 1000

31/12 Income Summary 800

Closing Income Retained earnings 800

summary

You might also like

- Personnel Polices Guide Enterprise HoldingsDocument44 pagesPersonnel Polices Guide Enterprise HoldingsJulia McGowan80% (5)

- Chapter 5, 6 ExercisesDocument7 pagesChapter 5, 6 ExercisesĐức TiếnNo ratings yet

- Answer Question 3Document27 pagesAnswer Question 3ummi sabrina100% (1)

- CH 005 AIA 5eDocument20 pagesCH 005 AIA 5eNadine MillaminaNo ratings yet

- UntitledDocument8 pagesUntitledMingxNo ratings yet

- Format IS and BSDocument2 pagesFormat IS and BSckyn greenleafNo ratings yet

- PT BaDocument18 pagesPT BaJasmine Merthel Masmila ObstaculoNo ratings yet

- PT BaDocument18 pagesPT BaJasmine Merthel Masmila ObstaculoNo ratings yet

- Unit 3 Worksheet: AnswerDocument23 pagesUnit 3 Worksheet: AnswerMingxNo ratings yet

- Ex Chapter03Document5 pagesEx Chapter03buikimhoangoanhtqkNo ratings yet

- Item (A) Type of Adjustment (B) Accounts Before AdjustmentDocument11 pagesItem (A) Type of Adjustment (B) Accounts Before Adjustmentsuci monalia putriNo ratings yet

- 77 FDocument3 pages77 FJohn CalvinNo ratings yet

- Chapter 5 Quiz-AnswerDocument4 pagesChapter 5 Quiz-AnswerkakaoNo ratings yet

- Tutorial On AdjustmentsDocument8 pagesTutorial On AdjustmentsPushpa ValliNo ratings yet

- Identify Elements of Corporate Report and Explain The Purpose of Each ElementDocument6 pagesIdentify Elements of Corporate Report and Explain The Purpose of Each ElementwsndichaonaNo ratings yet

- Accounting Group Assignment 1Document7 pagesAccounting Group Assignment 1Muntasir AhmmedNo ratings yet

- Flynn Design AgencyDocument4 pagesFlynn Design Agencycalsey azzahraNo ratings yet

- Chapter 4, Accounting CycleDocument23 pagesChapter 4, Accounting Cyclemuhammad.g27254No ratings yet

- Faraz DeroDocument22 pagesFaraz DeroMr FarazNo ratings yet

- Touchtone Talent Agency: ParticularsDocument4 pagesTouchtone Talent Agency: Particulars003amirNo ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- Handout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyDocument3 pagesHandout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyKris Dela CruzNo ratings yet

- Trial Balance Account Tittles Dr. CR.: P4-1A/a. Work Sheet of Wareen Roofing For The Month Ended March 31,2017Document40 pagesTrial Balance Account Tittles Dr. CR.: P4-1A/a. Work Sheet of Wareen Roofing For The Month Ended March 31,2017Nguyễn Ngọc Phương HằngNo ratings yet

- Financial StatementDocument20 pagesFinancial StatementMarielle CambaNo ratings yet

- ComprehensiveaccountinghwDocument11 pagesComprehensiveaccountinghwapi-348361031No ratings yet

- Principles of Accounting (A B E)Document3 pagesPrinciples of Accounting (A B E)r kNo ratings yet

- Chapter 3 ExercisesDocument8 pagesChapter 3 ExercisesNguyen Khanh Ly K17 HLNo ratings yet

- JEROME LEGASPI Activity Sheet 10Document3 pagesJEROME LEGASPI Activity Sheet 10RICARDO JOSE VALENCIANo ratings yet

- Chapter 3Document3 pagesChapter 3Hussein BaidounNo ratings yet

- Unit 3 Tutorial Worksheet (Session 1)Document15 pagesUnit 3 Tutorial Worksheet (Session 1)MingxNo ratings yet

- Act101 Comprehensive ProblemDocument11 pagesAct101 Comprehensive ProblemAMNEERA SHANIA LALANTONo ratings yet

- Powerjob Inc CaseDocument6 pagesPowerjob Inc CaseGloryNo ratings yet

- Vertical Format Final Accounts - SolutionsDocument6 pagesVertical Format Final Accounts - SolutionsASHIFNo ratings yet

- 5 Income Statament BSE (1A)Document8 pages5 Income Statament BSE (1A)Armaan BalochNo ratings yet

- VoidDocument8 pagesVoidAn Phi Ngoc HuyNo ratings yet

- Chapter 4Document35 pagesChapter 4Mohammad Mostafa MostafaNo ratings yet

- Accounting Chapter 4 SolutionsDocument14 pagesAccounting Chapter 4 Solutionsali sherNo ratings yet

- Abdirahman Assign 1Document8 pagesAbdirahman Assign 1Mazlax YareNo ratings yet

- A 4Document5 pagesA 4Thùy NguyễnNo ratings yet

- Empire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMDocument3 pagesEmpire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMJasmin JimmyNo ratings yet

- Jawaban Pengantar Akuntansi KiesooDocument13 pagesJawaban Pengantar Akuntansi KiesooRazer FanaNo ratings yet

- Step 5: Compute Net Income or Net LossDocument29 pagesStep 5: Compute Net Income or Net LossTanvir Islam100% (1)

- Solution Example 3Document2 pagesSolution Example 3ashish panwarNo ratings yet

- Use Perpetual Inventory System For P6.3Document15 pagesUse Perpetual Inventory System For P6.3Giang LinhNo ratings yet

- POADocument7 pagesPOAjohnnyNo ratings yet

- Accounting Assigment 1 WordDocument7 pagesAccounting Assigment 1 WordlemisiatulihaleniNo ratings yet

- ACT 501 AssignmentDocument6 pagesACT 501 AssignmentEasin Mohammad RomanNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- Assignment 3 - Financial Accounting - February 4Document7 pagesAssignment 3 - Financial Accounting - February 4Ednalyn PascualNo ratings yet

- Name: Muhammad Usman Zafar I.D: 17278. SEAT NO. 721 Program: Mba (W) Course: Accounting For ManagerDocument6 pagesName: Muhammad Usman Zafar I.D: 17278. SEAT NO. 721 Program: Mba (W) Course: Accounting For ManagerUsman KhanNo ratings yet

- Ad. Entry PRB 2Document3 pagesAd. Entry PRB 2Shuvro ChakravortyNo ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Interest Expense Interest PayableDocument23 pagesInterest Expense Interest PayableBM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- Tyasa Putri R - Tugas Akl 1 TM 4Document6 pagesTyasa Putri R - Tugas Akl 1 TM 4Rayhan MametNo ratings yet

- Bacc210 Assig 1Document6 pagesBacc210 Assig 1TarusengaNo ratings yet

- Excel AssignmentDocument9 pagesExcel AssignmentRafia TasnimNo ratings yet

- FA Assignment # 1Document8 pagesFA Assignment # 1Saad AhmedNo ratings yet

- Solution Past Year Exam Financial Statements GCDocument12 pagesSolution Past Year Exam Financial Statements GCFara husnaNo ratings yet

- Fac2601-2013-10 - Answers PDFDocument12 pagesFac2601-2013-10 - Answers PDFcandiceNo ratings yet

- POA Online Final Revion - Paper 2Document13 pagesPOA Online Final Revion - Paper 2ricardogibbs9o9No ratings yet

- Tugas 14 SepDocument5 pagesTugas 14 Sepmelvina siregar100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesĐức TiếnNo ratings yet

- De Bai-Dn Binh Minh-Dn Thuong MaiDocument4 pagesDe Bai-Dn Binh Minh-Dn Thuong MaiĐức TiếnNo ratings yet

- Customer Services Are Changing The World: How H As Cus Tomer Servic e Chang Ed? Cus Tom Ers No T Lik Ea T Fir ST?Document1 pageCustomer Services Are Changing The World: How H As Cus Tomer Servic e Chang Ed? Cus Tom Ers No T Lik Ea T Fir ST?Đức TiếnNo ratings yet

- Chapter 11 ExercisesDocument2 pagesChapter 11 ExercisesĐức TiếnNo ratings yet

- Sanitation For AllDocument136 pagesSanitation For AllAnoushkaBanavarNo ratings yet

- PMG - GE QuesnDocument8 pagesPMG - GE QuesnRito ChakrabortyNo ratings yet

- Solution Brief:: 2checkout Subscription BillingDocument18 pagesSolution Brief:: 2checkout Subscription BillinghmeyoyanNo ratings yet

- Reflection Paper - Waste SegregationDocument1 pageReflection Paper - Waste SegregationadelainedaphneNo ratings yet

- Make Something You Love: Hamin Lee, Jeremy Ostrow, Claire Shannon, Bryan ZakalikDocument16 pagesMake Something You Love: Hamin Lee, Jeremy Ostrow, Claire Shannon, Bryan ZakalikTushar BallabhNo ratings yet

- Cost of Capital 2Document29 pagesCost of Capital 2BSA 1A100% (2)

- Government As A Contracting PartyDocument3 pagesGovernment As A Contracting Partyaniketpavlekar100% (3)

- What Are The Causes of Depreciation?Document10 pagesWhat Are The Causes of Depreciation?Everyday LearnNo ratings yet

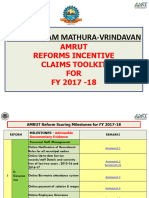

- Mathura Amrut Reforms - 2017-18Document53 pagesMathura Amrut Reforms - 2017-18Ceo DutiNo ratings yet

- Workmen Unions Circular DT 24 09 22Document2 pagesWorkmen Unions Circular DT 24 09 22Nishant SinhaNo ratings yet

- Lao Customs Law (2012-Final)Document40 pagesLao Customs Law (2012-Final)Sonny Tabot RaymundoNo ratings yet

- Monetary PolicyDocument32 pagesMonetary PolicyAbhi JainNo ratings yet

- The Taj's Peope Philosophy and Star SysemDocument17 pagesThe Taj's Peope Philosophy and Star Sysemrm025No ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingSatish Kumar SonwaniNo ratings yet

- Buffe BussDocument49 pagesBuffe BussAbhi TiwariNo ratings yet

- Ministry of Finance - Sri Lanka - Annual Report - 2017Document412 pagesMinistry of Finance - Sri Lanka - Annual Report - 2017lkwriterNo ratings yet

- SIDS COP26&Beyond The Private Finance Agenda Fin25.10.2021Document16 pagesSIDS COP26&Beyond The Private Finance Agenda Fin25.10.2021SIED.ORGNo ratings yet

- To Maintain Quality of Work LifeDocument2 pagesTo Maintain Quality of Work LifeNazmul HasanNo ratings yet

- Transfer Register All: Bangladesh Krishi BankDocument13 pagesTransfer Register All: Bangladesh Krishi Bankabdul kuddusNo ratings yet

- M&W Shipping Limited - ProfileDocument25 pagesM&W Shipping Limited - ProfilevikaNo ratings yet

- Ezekiel CV - 6Document6 pagesEzekiel CV - 6Obadofin Faith AduragbemiNo ratings yet

- University of Tishk: Construction Management Week 4 Module Code: CE 324 Module Credits: 4 By: Awesar AbidDocument24 pagesUniversity of Tishk: Construction Management Week 4 Module Code: CE 324 Module Credits: 4 By: Awesar Abidkurdish falconNo ratings yet

- MGT 102 Engineering Management FLM Activity 1 Name & Section: Rolando O. Carasco III - E-Signature: - Questions For ReviewDocument2 pagesMGT 102 Engineering Management FLM Activity 1 Name & Section: Rolando O. Carasco III - E-Signature: - Questions For Reviewrolando carascoNo ratings yet

- CIMA F1 Notes DetailsDocument160 pagesCIMA F1 Notes DetailsMohammad Lutfor Rahaman Khan100% (3)

- Road and Building Department From Ahmedabad - GujaratDocument4 pagesRoad and Building Department From Ahmedabad - GujaratHussain ShaikhNo ratings yet

- Infrastructure Shortage: A Gap ApproachDocument33 pagesInfrastructure Shortage: A Gap ApproachTony BuNo ratings yet

- Option Symposium AgendaDocument16 pagesOption Symposium AgendaraveeNo ratings yet

- Asset Transactions: 1. Make Various Non-Integrated Asset Acquisition Postings Business ExampleDocument57 pagesAsset Transactions: 1. Make Various Non-Integrated Asset Acquisition Postings Business ExampleBharat KumarNo ratings yet

- CE 22 Engineering Economy Problems in Inflation and Dealing With Uncertainty Solution To HW #4Document1 pageCE 22 Engineering Economy Problems in Inflation and Dealing With Uncertainty Solution To HW #4Christian Alfred SorianoNo ratings yet