Professional Documents

Culture Documents

Old Taxation Tables

Uploaded by

Bai NiloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Old Taxation Tables

Uploaded by

Bai NiloCopyright:

Available Formats

Old Taxation Tables

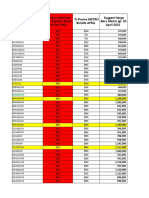

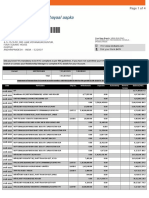

MONTHLY 1 2 3 4 5 6 7 8

Exemption 0.00 0.00 41.67 208.33 708.33 1,875.00 4,166.67 10,416.67

+10% +15% +25%

Status +0% over +5% over +20% over +30% over +32% over

over over over

A. Table for employees without qualified dependent

1. Z 0.0 1 0 833 2,500 5,833 11,667 20,833 41,667

2. S/ME 50.0 1 4,167 5,000 6,667 10,000 15,833 25,000 45,833

B. Table for single/married employee with qualified dependent child(ren)

1. ME1/S1 75.0 1 6,250 7,083 8,750 12,083 17,917 27,083 47,917

2. ME2/S2 100.0 1 8,333 9,167 10,833 14,167 20,000 29,167 50,000

3. ME3/S3 125.0 1 10,417 11,250 12,917 16,250 22,083 31,250 52,083

4. ME4/S4 150.0 1 12,500 13,333 15,000 18,333 24,167 33,333 54,167

EXEMPTIONS

:

MARRIED/SINGLE ---------------- P50,000.00

PER CHILD -------------------------- P25,000.00

ANNUAL TAX TABLE

If taxable income is Tax Due is

Not over P10,000.00 5%

Over P10,000.00 but not over P30,000.00 P 500 + 10% of the excess over 10,000.00

Over P30,000.00 but not over P70,000.00 P 2,500 + 15% of the excess over 30,000.00

Over P70,000.00 but not over P140,000.00 P 8,500 + 20% of the excess over 70,000.00

Over P140,000.00 but not over P250,000.00 P 22, 500 + 25% of the excess over 140,000.00

Over P250,000.00 but not over P500,000.00 P 50,000 + 30% of the excess over 250,000.00

Over P500,000.00 P 125,000 + 32% of the excess over 500,000.00

Train Law Tax Tables

ANNUAL TAX TABLE

You might also like

- REVISED WITHHOLDING TAX TABLESDocument1 pageREVISED WITHHOLDING TAX TABLESVita DepanteNo ratings yet

- PHILIPPINE REVISED WITHHOLDING TAX TABLESDocument1 pagePHILIPPINE REVISED WITHHOLDING TAX TABLESJhon Karl AndalNo ratings yet

- Guide to Philippine Withholding TaxesDocument33 pagesGuide to Philippine Withholding TaxesBfp Basud Camarines NorteNo ratings yet

- Withholding TaxDocument46 pagesWithholding TaxDura LexNo ratings yet

- Withholding Tax From BIR WebsiteDocument37 pagesWithholding Tax From BIR Websitepeanut47No ratings yet

- Revised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6Document3 pagesRevised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6GwenNo ratings yet

- Withholding Tax RateDocument1 pageWithholding Tax RateJamie Jimenez CerreroNo ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- Practice 1Document2 pagesPractice 1gautam48128No ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather SaleemMalikKamranAsifNo ratings yet

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- Calculate New Salary Tax by ShajarDocument2 pagesCalculate New Salary Tax by Shajarshajar-abbasNo ratings yet

- 10.23.2023 Iba El Gsis (Cacho, Villamor B.) Ext 10 + 8 Mos 61 YoDocument24 pages10.23.2023 Iba El Gsis (Cacho, Villamor B.) Ext 10 + 8 Mos 61 YoUni IbaNo ratings yet

- 04handout2 CostAcctgRecitationDocument3 pages04handout2 CostAcctgRecitationDummy GoogleNo ratings yet

- Grupo:: Seeger RenoDocument4 pagesGrupo:: Seeger RenoandrelorandiNo ratings yet

- Azucena MBCPayroll CalculatorDocument14 pagesAzucena MBCPayroll Calculatoracctg2012No ratings yet

- Anél de Retenção - TabelaDocument2 pagesAnél de Retenção - TabelaDanilo HoskenNo ratings yet

- Martin MBCPayroll CalculatorDocument12 pagesMartin MBCPayroll Calculatoracctg2012No ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather Saleemabdul_348No ratings yet

- Anéis de Retenção para Eixos: Grupo: 501Document4 pagesAnéis de Retenção para Eixos: Grupo: 501Gerson MachadoNo ratings yet

- Anéis de Retenção para Eixos: Grupo: 501Document4 pagesAnéis de Retenção para Eixos: Grupo: 501Gerson MachadoNo ratings yet

- Aneis-Elasticos Din 471 EixoDocument4 pagesAneis-Elasticos Din 471 EixoRonaldo LufixNo ratings yet

- Anéis do grupo 501 para encomendaDocument3 pagesAnéis do grupo 501 para encomendaAlexandre CorreaNo ratings yet

- Quikchex 2019 Tax Comparison PDFDocument5 pagesQuikchex 2019 Tax Comparison PDFGMFL MumbaiNo ratings yet

- Robinsons Bank Convert To Cash Processing FeesDocument1 pageRobinsons Bank Convert To Cash Processing FeesGen MacaleNo ratings yet

- Presto ProductsDocument3 pagesPresto ProductsReign Imee NortezNo ratings yet

- Tax DefinitionsDocument4 pagesTax DefinitionsrajaNo ratings yet

- PRTC - TAX-Final PB - May 2022Document16 pagesPRTC - TAX-Final PB - May 2022Luna VNo ratings yet

- Houzit Pty Ltd 1st Quarter Variance Budget ReportDocument4 pagesHouzit Pty Ltd 1st Quarter Variance Budget ReportHamza Anees100% (1)

- Gate of Aden Plan 2020Document1 pageGate of Aden Plan 2020Mohammad HanafyNo ratings yet

- Train Law PhilippinesDocument64 pagesTrain Law PhilippinesThe BeatlessNo ratings yet

- Network Check ACS880-04-585A-3: Network and Transformer Data Supply Unit DataDocument2 pagesNetwork Check ACS880-04-585A-3: Network and Transformer Data Supply Unit DataKrishna JashaNo ratings yet

- Tabela Anel Elástico InternoDocument2 pagesTabela Anel Elástico InternoJuvenal CorreiaNo ratings yet

- Tax Final Exam Practice Material - CompressDocument10 pagesTax Final Exam Practice Material - CompressNovemae CollamatNo ratings yet

- Final IannaDocument83 pagesFinal IannaJuzetteValerieSarceNo ratings yet

- Hindustan Unilever LTD.: Cash Flow Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument2 pagesHindustan Unilever LTD.: Cash Flow Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldNo ratings yet

- Arnaez MBCPayroll CalculatorDocument12 pagesArnaez MBCPayroll Calculatoracctg2012No ratings yet

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Document6 pagesPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNo ratings yet

- Tax TablesDocument6 pagesTax TablesGeromil HernandezNo ratings yet

- Us TaxDocument5 pagesUs TaxPaddireddySatyamNo ratings yet

- Promo Dan Harga Metro AprilDocument7 pagesPromo Dan Harga Metro Aprilachmad faizalNo ratings yet

- Duthch Cone Penetration Test (DCPT) : Soil Investigation and TopographyDocument2 pagesDuthch Cone Penetration Test (DCPT) : Soil Investigation and TopographyUlfi AlmizNo ratings yet

- BPS Salary CalculatorDocument5 pagesBPS Salary CalculatorAshfaqNo ratings yet

- 14Document1 page14Iqbal RamadhanNo ratings yet

- Perkiraan Investasi KlinikDocument2 pagesPerkiraan Investasi KlinikFadilla LeeNo ratings yet

- Calculate expected loss for loan portfolioDocument6 pagesCalculate expected loss for loan portfoliodevilsnitchNo ratings yet

- IE255 Tables BookletDocument107 pagesIE255 Tables BookletMuhammad AdilNo ratings yet

- Espectro de Pseudoaceleraciones - Norma Tecnica de Edificacion E.030Document1 pageEspectro de Pseudoaceleraciones - Norma Tecnica de Edificacion E.030Yonel NúñezNo ratings yet

- Notes B3 Alglin1Document4 pagesNotes B3 Alglin1Violet PromissNo ratings yet

- Tax TablesDocument1 pageTax TablesEmman NepacenaNo ratings yet

- Jam Corporation: InformationDocument35 pagesJam Corporation: InformationMon CuiNo ratings yet

- Lampiran ReturnDocument12 pagesLampiran ReturnGus Suma Arta SevenmanNo ratings yet

- Anel de Retenção para Furos Din 472Document2 pagesAnel de Retenção para Furos Din 472Evandro AntonettiNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Nómina de Estudiantes: Nota Original Sobre Puntaje CorrespondienteDocument1 pageNómina de Estudiantes: Nota Original Sobre Puntaje CorrespondientemamanichaveznohemiNo ratings yet

- Financial StatementDocument2 pagesFinancial StatementAlisha OberoiNo ratings yet

- Pract.1 y 2Document36 pagesPract.1 y 2Jese LópezNo ratings yet

- Seagate Crystal Reports - R - IvaDocument2 pagesSeagate Crystal Reports - R - IvarodrigoNo ratings yet

- Madhumeh Illaj: Madhumeh Ke Bhojan, Viyama Evam Prakitik Chikitsh SahitFrom EverandMadhumeh Illaj: Madhumeh Ke Bhojan, Viyama Evam Prakitik Chikitsh SahitRating: 5 out of 5 stars5/5 (1)

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Econ 0-Mudule 2 (2022-2023)Document8 pagesEcon 0-Mudule 2 (2022-2023)Bai NiloNo ratings yet

- Resolution Approving The DTPDocument3 pagesResolution Approving The DTPBai NiloNo ratings yet

- Business Finance For Video Module 4Document9 pagesBusiness Finance For Video Module 4Bai NiloNo ratings yet

- EO For DTPDocument5 pagesEO For DTPBai NiloNo ratings yet

- Business Finance For Video Module 3Document21 pagesBusiness Finance For Video Module 3Bai NiloNo ratings yet

- Econ 0-Mudule 1 (2022-2023)Document26 pagesEcon 0-Mudule 1 (2022-2023)Bai NiloNo ratings yet

- Econ 0-Mudule 3 (2022-2023)Document11 pagesEcon 0-Mudule 3 (2022-2023)Bai NiloNo ratings yet

- Business Finance For Video Module 1Document11 pagesBusiness Finance For Video Module 1Bai NiloNo ratings yet

- Econ 0-Mudule 4 (2022-2023)Document22 pagesEcon 0-Mudule 4 (2022-2023)Bai NiloNo ratings yet

- Lesson 4: Environmental Sccanning: Swot and Pest AnalysisDocument11 pagesLesson 4: Environmental Sccanning: Swot and Pest AnalysisBai NiloNo ratings yet

- Om Lesson 12Document9 pagesOm Lesson 12Bai NiloNo ratings yet

- Om Lesson 10Document12 pagesOm Lesson 10Bai NiloNo ratings yet

- Lesson 9: Nature and Structures of OrganizationsDocument25 pagesLesson 9: Nature and Structures of OrganizationsBai NiloNo ratings yet

- Lesson 8: Planning and Decision MakingDocument36 pagesLesson 8: Planning and Decision MakingBai NiloNo ratings yet

- Lesson 6: The Business OrganizationDocument5 pagesLesson 6: The Business OrganizationBai NiloNo ratings yet

- Lesson 7: The Ethical Environment of The FirmDocument6 pagesLesson 7: The Ethical Environment of The FirmBai NiloNo ratings yet

- Lesson 5: The Local and International Business EnvironmentsDocument6 pagesLesson 5: The Local and International Business EnvironmentsBai NiloNo ratings yet

- Article No. 04: D I R e C T I o N: Read The Article Below and Answer The Questions That FollowDocument2 pagesArticle No. 04: D I R e C T I o N: Read The Article Below and Answer The Questions That FollowBai NiloNo ratings yet

- Om Lesson 3Document12 pagesOm Lesson 3Bai NiloNo ratings yet

- Om Article No. 10Document1 pageOm Article No. 10Bai NiloNo ratings yet

- Om Activity No. 01Document5 pagesOm Activity No. 01Bai NiloNo ratings yet

- Lesson 2 The Evolution of Management TheoriesDocument11 pagesLesson 2 The Evolution of Management TheoriesBai NiloNo ratings yet

- D I R e C T I o N: Read The Article Below and Answer The Questions That FollowDocument2 pagesD I R e C T I o N: Read The Article Below and Answer The Questions That FollowBai NiloNo ratings yet

- D I R e C T I o N: Read The Article Below and Answer The Questions That FollowDocument2 pagesD I R e C T I o N: Read The Article Below and Answer The Questions That FollowBai NiloNo ratings yet

- Om Article No. 05Document1 pageOm Article No. 05Bai NiloNo ratings yet

- Article No. 03: D I R e C T I o N: Read The Article Below and Answer The Questions That FollowDocument2 pagesArticle No. 03: D I R e C T I o N: Read The Article Below and Answer The Questions That FollowBai NiloNo ratings yet

- D I R e C T I o N: Read The Article Below and Answer The Questions That FollowDocument2 pagesD I R e C T I o N: Read The Article Below and Answer The Questions That FollowBai NiloNo ratings yet

- Activity No. 02: NAME: - SCORE: - DATEDocument3 pagesActivity No. 02: NAME: - SCORE: - DATEBai NiloNo ratings yet

- Resolution Cutting of Trees FinalDocument3 pagesResolution Cutting of Trees FinalBai NiloNo ratings yet

- Om Activity No. 01Document5 pagesOm Activity No. 01Bai NiloNo ratings yet

- Assignment On BCG Matrix OFDocument5 pagesAssignment On BCG Matrix OFIrfanul Kibria100% (1)

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- Global Market Integration History and InstitutionsDocument23 pagesGlobal Market Integration History and InstitutionsBianca Joy AquinoNo ratings yet

- Payment Instructions: 535,296.00 INR GGC402155814Document4 pagesPayment Instructions: 535,296.00 INR GGC402155814Neelam 123No ratings yet

- CN CPTPP PresentationDocument12 pagesCN CPTPP PresentationThanh Duy TranNo ratings yet

- 13.4 Changes in Exchange Rate and The Balance of Payments Answer KeyDocument5 pages13.4 Changes in Exchange Rate and The Balance of Payments Answer KeySOURAV MONDALNo ratings yet

- Investment in Food Processing in India-Kolhapur-IDistrict 1Document14 pagesInvestment in Food Processing in India-Kolhapur-IDistrict 1Rohit PawarNo ratings yet

- PDF EngDocument25 pagesPDF EngFrankie BravoNo ratings yet

- Activity 1 T Accounts Allyssa Marie Gascon GA 2ADocument2 pagesActivity 1 T Accounts Allyssa Marie Gascon GA 2AAlyssum MarieNo ratings yet

- Positive Effects of Train Law On The PhilippinesDocument1 pagePositive Effects of Train Law On The PhilippinesRHIANA SMILE LOPEZNo ratings yet

- OpTransactionHistory06 02 2022Document16 pagesOpTransactionHistory06 02 2022Fashion EntertainmentNo ratings yet

- Indian EconomyDocument19 pagesIndian EconomyAlex CaplerNo ratings yet

- Cons Up TionDocument14 pagesCons Up TionElif TaşdövenNo ratings yet

- Trip and TrimDocument12 pagesTrip and Trimketanrana2No ratings yet

- Taxation WorksheetDocument2 pagesTaxation WorksheetMuhammad Fareed0% (1)

- 1 Abdul Rasheed JanmohammadDocument20 pages1 Abdul Rasheed JanmohammadUsman MahmoodNo ratings yet

- Written Report On Classical Gold Standard and Bretton Woods SystemDocument5 pagesWritten Report On Classical Gold Standard and Bretton Woods SystemMarc Jalen ReladorNo ratings yet

- Class 12 CBSE Economics Sample Paper 2023Document8 pagesClass 12 CBSE Economics Sample Paper 2023yazhinirekha4444No ratings yet

- Babita Tiwari's bank statement summaryDocument5 pagesBabita Tiwari's bank statement summaryRohit raagNo ratings yet

- Daimler Trucks Ghana Market OpportunityDocument19 pagesDaimler Trucks Ghana Market OpportunityBalavignesh VenugopalNo ratings yet

- Uruguay BankingDocument13 pagesUruguay BankingKanikaGaurNo ratings yet

- Acfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxDocument1 pageAcfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxHarpreetNo ratings yet

- Afab Quick Statistics 2017.05.31 PDFDocument2 pagesAfab Quick Statistics 2017.05.31 PDFHerojoseNo ratings yet

- CH 10Document41 pagesCH 10Lihle SetiNo ratings yet

- Spotlight On Southern Africa: Investment Case Study: Merec Industries SADocument1 pageSpotlight On Southern Africa: Investment Case Study: Merec Industries SAethernalxNo ratings yet

- FEM Facts Europe 2007Document1 pageFEM Facts Europe 2007AhmedNo ratings yet

- Report For Export Ceramic ProductsDocument4 pagesReport For Export Ceramic ProductsMd. Saiful IslamNo ratings yet

- International Trade Theories ExplainedDocument10 pagesInternational Trade Theories ExplainedLikith RNo ratings yet

- Type of Account Account Number Balance (INR) Micr Ifsc NominationDocument2 pagesType of Account Account Number Balance (INR) Micr Ifsc Nominationrajaj ambaiNo ratings yet

- Types of Industries and Economic SectorsDocument14 pagesTypes of Industries and Economic SectorsJoshua Manalon100% (1)