Professional Documents

Culture Documents

Russell Clark On Clearing House Mispricing

Uploaded by

u5647Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Russell Clark On Clearing House Mispricing

Uploaded by

u5647Copyright:

Available Formats

Central clearing houses did very well during the financial crisis.

As LCH (London Clearing House – the largest

interest rate derivative clearing house) states on its website, “LCH has a proven track record of handling

defaults, managing the Lehman default ($9 trillion portfolio of 66,390 trades) and using only 35% of Lehman’s

Initial Margin across all assets held at LCH.” Impressed with this performance, regulators have forced more

and more of the financial markets to be cleared by central clearing parties (CCP). This has led to clearing

houses and exchanges outperforming banks substantially since the financial crisis.

Clearing houses do not take a forward-looking view on risk. In fact, for the success of their commercial

operations, their incentive structure is to make trading as easy as possible. Initial margins are the main limiting

factor in trading for exchanges. How much do you need to put upfront to trade an asset? The higher the cost,

the lower trading volumes will likely be. While clearing house individual initial margin models are proprietary,

ISDA has been releasing an initial margin model for non-cleared futures since January 2017. This model has

RUSSELL CLARK – MARKET VIEWS

been licensed to all the main clearinghouses for their use so would likely be very similar to their own initial

margin models. However the ISDA-SIMM model is reactive rather than proactive. An example of this can be

seen in early 2018, when a spike in VIX caused the overnight bankruptcy of the short volatility ETN – XIV.

ISDA-SIMM models show how risky each asset is, how correlated it is to other assets, and give strict limits on

the amount of concentration that should be allowed to a single counterparty. The idea is to limit the risk of a

one day move wiping out either the exchange or other counterparties. The first risk weighting for volatility

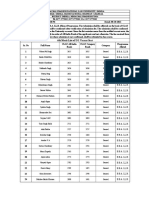

indices began in ISDA-SIMM model 2.0. Volatility indices at that time are given a risk weighting of 16 (this

would be lower than a blue chip equity) and a correlation of 62% (meaning that two different volatility indices

are highly correlated, so netting positions can reduce need for initial margin). The table below shows how the

backward looking ISDA-SIMM model adjusted by lowering the correlation offset after the event.

Later on in 2018, as detailed by BIS, a single trader in European power markets nearly bankrupted a central

clearing party in Sweden. (https://www.bis.org/publ/qtrpdf/r_qt1812h.pdf) . In essence a trader had a very

large long position in Nordic power hedged with a short German power position which had very high historic

correlation. The relative move in the price of these two power markets is shown below.

Page | 2 RUSSELL CLARK – MARKET VIEWS

Unlike with volatility, the ISDA-SIMM gave correlation and risk weightings for European power from version

1. Somewhat inexplicably, European power started with low risk weights, and low correlation discounts, but in

July 2017, the correlation discount was raised to 100%. After the near bankruptcy of the CCP, and spread

blowout, this was then reduced back to 73%.

While this may seem esoteric, the growing use of algorithmic trading, and passive investing means we can

generalise some lessons. Initial margins will be very low during periods of low volatility, but will rise as

volatility rises. In addition, if the price of the assets being traded is falling then the ratio of margin to position

value rises further. This then forces deleveraging throughout the system. For example, even though the S&P

was falling through 2008, the cost of holding the S&P future rose.

Page | 3 RUSSELL CLARK – MARKET VIEWS

If we compare the cost of S&P Future margin to the price of the S&P 500 and VIX, then the relationship

becomes clear. As volatility rises we would expect the margin as a percentage of the future to also rise sharply.

As we have seen from the ISDA-SIMM model, margins are set with a backward focus, typically between a

three to five-year time frame. 2017 was the year of least average volatility ever, with average VIX of 11, which

compares to a an average VIX in 2016 of 16. 2018 Average VIX was 16.6, and 2019 so far has an average VIX

of 16. As we enter 2020, even if we only assume an average VIX for the year of 15, the back ward looking

models will begin to raise margins, as the very low volatility 2017 rolls off the back of the look back period.

Risks are all to the downside.

Page | 4 RUSSELL CLARK – MARKET VIEWS

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 6 - Strategy Analysis and ChoiceDocument28 pagesChapter 6 - Strategy Analysis and ChoiceSadaqat AliNo ratings yet

- Joint Venture (JV) Agreement: For Providing Consultancy Services For "Project Name"Document4 pagesJoint Venture (JV) Agreement: For Providing Consultancy Services For "Project Name"Asadur Rahman100% (1)

- Draft Consultancy Contract For Design and Construction Supervision Final 21.2.2019Document24 pagesDraft Consultancy Contract For Design and Construction Supervision Final 21.2.2019brk manNo ratings yet

- AST MidtermsDocument12 pagesAST MidtermsRica Regoris100% (1)

- Environment of Financial Accounting and Reporting: FalseDocument6 pagesEnvironment of Financial Accounting and Reporting: Falsekris mNo ratings yet

- Convexity Maven: "For Propeller Heads Only"Document7 pagesConvexity Maven: "For Propeller Heads Only"u5647No ratings yet

- Size and Complexity in Model Financial SystemsDocument6 pagesSize and Complexity in Model Financial Systemsu5647No ratings yet

- Thoughts From The Divide - October 23Document1 pageThoughts From The Divide - October 23u5647No ratings yet

- What Is Behind The Recent Slowdown?: Pmis For The Manufacturing SectorDocument8 pagesWhat Is Behind The Recent Slowdown?: Pmis For The Manufacturing Sectoru5647No ratings yet

- On Money, Debt, Trust and Central Banking: What Institutions Build, They Can DestroyDocument22 pagesOn Money, Debt, Trust and Central Banking: What Institutions Build, They Can Destroyu5647No ratings yet

- Statistical Release: BIS Global Liquidity Indicators at End-June 2018Document6 pagesStatistical Release: BIS Global Liquidity Indicators at End-June 2018u5647No ratings yet

- Forecasting - and Prospect: RetrospectDocument33 pagesForecasting - and Prospect: Retrospectu5647No ratings yet

- BIS Working Papers: Predicting Recessions: Financial Cycle Versus Term SpreadDocument29 pagesBIS Working Papers: Predicting Recessions: Financial Cycle Versus Term Spreadu5647No ratings yet

- Working Paper Research: Review Essay: Central Banking Through The CenturiesDocument17 pagesWorking Paper Research: Review Essay: Central Banking Through The Centuriesu5647No ratings yet

- Twitter Mining For Discovery, Prediction and Causality: Applications and MethodologiesDocument21 pagesTwitter Mining For Discovery, Prediction and Causality: Applications and Methodologiesu5647No ratings yet

- Statistical Release: OTC Derivatives Statistics at End-December 2018Document8 pagesStatistical Release: OTC Derivatives Statistics at End-December 2018u5647No ratings yet

- BIS Working Papers: Measuring Financial Cycle TimeDocument32 pagesBIS Working Papers: Measuring Financial Cycle Timeu5647No ratings yet

- The Financial Cycle and Recession RiskDocument13 pagesThe Financial Cycle and Recession Risku5647No ratings yet

- BIS Working Papers: Dollar Exchange Rate As A Credit Supply Factor - Evidence From Firm-Level ExportsDocument53 pagesBIS Working Papers: Dollar Exchange Rate As A Credit Supply Factor - Evidence From Firm-Level Exportsu5647No ratings yet

- Statistical Release: BIS International Banking Statistics at End-June 2018Document11 pagesStatistical Release: BIS International Banking Statistics at End-June 2018u5647No ratings yet

- Work 740Document50 pagesWork 740u5647No ratings yet

- Guest Comment Report - AnalysisDocument119 pagesGuest Comment Report - AnalysisHenov Rizzky PratamaNo ratings yet

- AND Partners Profile AD@Jan'20 PDFDocument23 pagesAND Partners Profile AD@Jan'20 PDFSquisito LLCNo ratings yet

- Dayang Nur Amira PT - 3Document6 pagesDayang Nur Amira PT - 3Mira PhFeNo ratings yet

- We Care: Mega Lifesciences Public Company Limited (MEGA)Document14 pagesWe Care: Mega Lifesciences Public Company Limited (MEGA)hau vuvanNo ratings yet

- Qaqr 3Document3 pagesQaqr 3Kadek Yuki AndikaNo ratings yet

- Chapter 19 Partnership DissolutionDocument70 pagesChapter 19 Partnership DissolutionhallieNo ratings yet

- Harman Kaur 2557 - Harman - Kaur - WAC - II.1 - 7440 - 731909587Document8 pagesHarman Kaur 2557 - Harman - Kaur - WAC - II.1 - 7440 - 731909587Harman JosanNo ratings yet

- 6th Merit List of UG Vacant SeatDocument4 pages6th Merit List of UG Vacant SeatRavindra RathoreNo ratings yet

- Micro Matic Student ManualDocument86 pagesMicro Matic Student ManualrtkobyNo ratings yet

- Creation, Not Construction,: Kolte-Patil Developers LTDDocument12 pagesCreation, Not Construction,: Kolte-Patil Developers LTDrahulNo ratings yet

- The Health and Growth Potential of The Steel Manufacturing Industries in SADocument94 pagesThe Health and Growth Potential of The Steel Manufacturing Industries in SAShumani PharamelaNo ratings yet

- Lean and Industry 4.0Document9 pagesLean and Industry 4.0lucas washingtonNo ratings yet

- L 01019900112en00470052.pdf - enDocument6 pagesL 01019900112en00470052.pdf - enChristinaNo ratings yet

- Kasneb Entrepreneurship and Communication For More Free Past Papers Visit May 2014 Section 1 Question OneDocument1 pageKasneb Entrepreneurship and Communication For More Free Past Papers Visit May 2014 Section 1 Question OneTimo PaulNo ratings yet

- General Mining CableDocument68 pagesGeneral Mining CableJuan AdrianzenNo ratings yet

- Costing Accounting Practice SetDocument2 pagesCosting Accounting Practice SetKristel SumabatNo ratings yet

- QLD0jkEvSzGvQxXU5ynp W Activity Template Project Status ReportDocument2 pagesQLD0jkEvSzGvQxXU5ynp W Activity Template Project Status ReportAhmad HussainNo ratings yet

- Astragraphia - IA ITB 2017Document10 pagesAstragraphia - IA ITB 2017Ade FajarNo ratings yet

- Opsession GD-PI CompendiumDocument10 pagesOpsession GD-PI CompendiumvidishaniallerNo ratings yet

- After Effect of Corona Virus in Garments Industry PDFDocument9 pagesAfter Effect of Corona Virus in Garments Industry PDF360 degree TextileNo ratings yet

- Worldwide VAT, GST and Sales Tax GuideDocument2,080 pagesWorldwide VAT, GST and Sales Tax Guideİsmayil AlizadaNo ratings yet

- Automation Solution Guide PDFDocument282 pagesAutomation Solution Guide PDFTariq SaeedNo ratings yet

- 2021 - MDS - Hillrom - Distributor Business Plan 2021 v1Document18 pages2021 - MDS - Hillrom - Distributor Business Plan 2021 v1Paweł GoławskiNo ratings yet

- Luxury Fusionwear at Citrine, KolkataDocument36 pagesLuxury Fusionwear at Citrine, KolkataCitrine KolkataNo ratings yet

- 1-4 LectureDocument146 pages1-4 LectureAmal MobarakiNo ratings yet