Professional Documents

Culture Documents

For Claiming Deduction Under Section 24 (B) & 80 (C) of The Incom-Tax Act, 1961 For The Period 01-04-2020 To 31-03-2021

Uploaded by

Yeditha Satyanarayana MurthyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

For Claiming Deduction Under Section 24 (B) & 80 (C) of The Incom-Tax Act, 1961 For The Period 01-04-2020 To 31-03-2021

Uploaded by

Yeditha Satyanarayana MurthyCopyright:

Available Formats

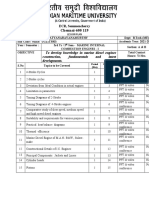

For claiming deduction under section 24(b) & 80(c) of the Incom-Tax Act,1961 for the period 01-04-2020

to 31-03-2021

This is to certify that MR VEERA VENKATA SATYANARAYANA MURTHY Y has/have been granted a Housing

Loan(having Account Number 534306650051063) of 2095722.00 @ 7.30% per annum in respect of following

property:

Property Address:

PLOT NO 11 GROUND FLOOR

AP HOUSING BOARD COLONY PM PALEM MADHURAWADA

VISHAKAPATNAM

ANDHRA PRADESH

The above loan is Repayable in Equated Monthly Installments (EMIs) comprising Principle and Interest together.

The total amount of EMIs is payable from 01-04-2020 to 31-03-2021 is Rs.237060.00

The break-up of amount into principle and interest is given below:

PRINCIPLE COMPONENT : Rs.182229.69

INTEREST COMPONENT : Rs.54830.32

DATE: 15-10-2020

Note:-

1. Interest is calculated on monthly rests.

2. Interest and Principle amounts are subjected to changes in case of Prepayment/s and/or change in repayment

schedule.

3. Principle repayment through EMIs and/or Payments qualify for deduction under Section 80C if the amounts are

Actually Paid on or before 31-03-2021

4. Deduction under 80C can be claimed only if:

I. The repayment of loan is made out of the income chargeable to Tax.

II.The Property for which the loan is taken is not transferred before the expiry of 5 years from the end of the

financial year in which the possession of such propertyis obtained.

For these conditions, account holder should give self certification or declaration to employer.

5. Interest Payable on loan is allowed as a deduction under Section 24(b).

Address of Account Holder:

D NO 20-117-18 CHENGALARAO PETA,MAIN ROAD I TOWN AREA

VISHAKAPATNAM-530001

ANDHRA PRADESH

-------------------------------------------------------------------------------------------------------

GANDHI INSITUTE OF TECHNOLOGY AND MANGT.,,GANDHI NAGAR CAMPUS, RISHIKONDA,

VISHAKAPATNAM-VISHAKAPATNAM,ANDHRA PRADESH

Website Address: www.unionbankofindia.com

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Bunkering - MeoiDocument16 pagesBunkering - MeoiYeditha Satyanarayana MurthyNo ratings yet

- Material Today Proceedings - YVVSN MurthyDocument5 pagesMaterial Today Proceedings - YVVSN MurthyYeditha Satyanarayana MurthyNo ratings yet

- ActivityDocument1 pageActivityYeditha Satyanarayana MurthyNo ratings yet

- Material Today Proceedings - YVVSN MurthyDocument5 pagesMaterial Today Proceedings - YVVSN MurthyYeditha Satyanarayana MurthyNo ratings yet

- ActivityDocument1 pageActivityYeditha Satyanarayana MurthyNo ratings yet

- Effective CommunicationDocument2 pagesEffective CommunicationYeditha Satyanarayana MurthyNo ratings yet

- Bunkering - MeoiDocument16 pagesBunkering - MeoiYeditha Satyanarayana MurthyNo ratings yet

- Effective CommunicationDocument2 pagesEffective CommunicationYeditha Satyanarayana MurthyNo ratings yet

- EPSPE1030 - Research Fellow in Production of Advanced BiofuelsDocument5 pagesEPSPE1030 - Research Fellow in Production of Advanced BiofuelsYeditha Satyanarayana MurthyNo ratings yet

- Mentor Mentee SchemeDocument9 pagesMentor Mentee SchemeYeditha Satyanarayana MurthyNo ratings yet

- ActivityDocument1 pageActivityYeditha Satyanarayana MurthyNo ratings yet

- Program Name: Institution'S Innovation Council Implementing Agency Name: Moe'S Innovation Cell, AicteDocument5 pagesProgram Name: Institution'S Innovation Council Implementing Agency Name: Moe'S Innovation Cell, AicteYeditha Satyanarayana MurthyNo ratings yet

- Please Look For AAA+ Logo On Your Report For Apollo Assured QualityDocument1 pagePlease Look For AAA+ Logo On Your Report For Apollo Assured QualityYeditha Satyanarayana MurthyNo ratings yet

- Cea Hostel 20200731113538Document3 pagesCea Hostel 20200731113538Yeditha Satyanarayana MurthyNo ratings yet

- Blade Profile Equation VvimpDocument17 pagesBlade Profile Equation VvimpYeditha Satyanarayana MurthyNo ratings yet

- Marine Internal Combustion Engines Lesson PlanDocument4 pagesMarine Internal Combustion Engines Lesson PlanYeditha Satyanarayana MurthyNo ratings yet

- Mice-1 SyllabusDocument1 pageMice-1 SyllabusYeditha Satyanarayana MurthyNo ratings yet

- Importance of Delegation and Steps in Delegation: What Is Delegating?Document10 pagesImportance of Delegation and Steps in Delegation: What Is Delegating?Yeditha Satyanarayana MurthyNo ratings yet

- Lesson Plan MICE 1 Semester VDocument4 pagesLesson Plan MICE 1 Semester VYeditha Satyanarayana MurthyNo ratings yet

- Indian Maritime University Claim For Question Paper Setting (With Key)Document1 pageIndian Maritime University Claim For Question Paper Setting (With Key)Yeditha Satyanarayana MurthyNo ratings yet

- Sulzer RT Flex Marine Diesel Engine: The Common Rail System DescribedDocument4 pagesSulzer RT Flex Marine Diesel Engine: The Common Rail System DescribedYeditha Satyanarayana MurthyNo ratings yet

- Sulzer RT Flex Marine Diesel Engine: The Common Rail System DescribedDocument4 pagesSulzer RT Flex Marine Diesel Engine: The Common Rail System DescribedYeditha Satyanarayana MurthyNo ratings yet

- Machine Safety 0 0Document32 pagesMachine Safety 0 0Adam RossNo ratings yet

- Lesson Plan Google Class Room Code: Mmswb2XDocument3 pagesLesson Plan Google Class Room Code: Mmswb2XYeditha Satyanarayana MurthyNo ratings yet

- Function: Marine Engineering at Operational Level: (Steam) (Time Allowed - 3 Hours) INDIA (2001) Afternoon PaperDocument3 pagesFunction: Marine Engineering at Operational Level: (Steam) (Time Allowed - 3 Hours) INDIA (2001) Afternoon PaperCarolina Acibar AcquiatNo ratings yet

- CFturbo CT2 2011Document5 pagesCFturbo CT2 2011Umarani PittalaNo ratings yet

- Lesson Plan MICE 1 Semester VDocument4 pagesLesson Plan MICE 1 Semester VYeditha Satyanarayana MurthyNo ratings yet

- Basics of ThermodynamicsDocument36 pagesBasics of ThermodynamicsYeditha Satyanarayana MurthyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)