Professional Documents

Culture Documents

Depreciation 420 Depreciation 46 Depreciation 882 Depreciation 50

Uploaded by

Ali MohamedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation 420 Depreciation 46 Depreciation 882 Depreciation 50

Uploaded by

Ali MohamedCopyright:

Available Formats

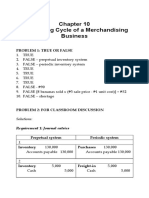

27.

3A

(a) Machinery A/C

2016 2016

1/1 Bank 2,800 31/12 Balance c/d 2,800

2017 2015

1/1 Balance b/d 2,800 31/12 Balance c/d 6,300

1. 10 Bank 3,500

6,300 6,300

2018 2018

1/1 Balance b/d 6,300

(b) Fixtures A/C

2016 2016

1/1 Bank 290 31/12 Balance c/d 910

1/7 Bank 620

910 910

2017 2017

1/1 Balance b/d 910 31/12 Balance c/d 1,040

1/12 Bank 130

1,040 1,040

2018 2018

1/1 Balance b/d 1,040

(c-1) Accumulated provision for depreciation: Machinery A/C

2016 2016

31/12 Balance c/d 420 31/12 Profit and loss A/C 420

2017 2017

31/12 Balance c/d 1,302 1/1 Balance b/d 420

31/12 Profit and loss A/C 882

1,302 1,302

2018 2018

1/1 Balance b/d 1,302

(c-2) Accumulated provision for depreciation: Fixtures A/C

2016 2016

31/12 Balance c/d 46 31/12 Profit and loss A/C 46

2017 2017

31/12 Balance c/d 96 1/1 Balance b/d 46

31/12 Profit and loss A/C 50

96 96

2018 2018

1/1 Balance b/d 96

Working paper : Calculate depreciation

2016

Cost of Machinery 2,800

depreciation (2800*15%) 420

Cost of Fixtures 910

depreciation (910*5%) 46

2017

Net book-value of Machinery (2800-420)+3500) 5,880

depreciation (5880*15%) 882

Net book-value of Fixtures (910-46)+130) 994

depreciation (910*5%) 50

(d) Statement of Financial Position (Extracts) for the year ending 31/12

$ $

2016 Machinery at cost 2800

less: Accumulated depreciation (420) 2,380

Fixtures at cost 910

less: Accumulated depreciation (46) 864

2016 Machinery at cost 6300

less: Accumulated depreciation (1,302) 4,998

Fixtures at cost 1040

less: Accumulated depreciation (96) 944

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Revolving Line of Credit AgreementDocument9 pagesRevolving Line of Credit AgreementRobert ArkinNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Forbes USA - 21 March 2016Document164 pagesForbes USA - 21 March 2016Luke93% (14)

- Sol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument65 pagesSol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessPeter Piper67% (3)

- Amit Bhuwania Resume JPDocument1 pageAmit Bhuwania Resume JPGaurav JainNo ratings yet

- Case AnalysisDocument22 pagesCase AnalysisJosephine MargarettaNo ratings yet

- Managerial Policy Report On Panasonic CorporationDocument14 pagesManagerial Policy Report On Panasonic CorporationMurtaza Moiz100% (4)

- Chapter 6 - Strategy Analysis & ChoiceDocument10 pagesChapter 6 - Strategy Analysis & ChoiceHimangee Gupta0% (1)

- Chapter 01Document8 pagesChapter 01Anh MusicNo ratings yet

- Real-Time Integration of Controlling With Financial Accounting - General Ledger Accounting (FI-GL) (New) - SAP LibraryDocument3 pagesReal-Time Integration of Controlling With Financial Accounting - General Ledger Accounting (FI-GL) (New) - SAP LibraryRaksha RaniNo ratings yet

- SWOT Analysis Template - CMDDocument8 pagesSWOT Analysis Template - CMDAgung AlbayssagNo ratings yet

- Saep 1634Document9 pagesSaep 1634Anonymous 4IpmN7OnNo ratings yet

- Chap 006Document28 pagesChap 006Rafael GarciaNo ratings yet

- Oblicon Midterms Bar Q&ADocument7 pagesOblicon Midterms Bar Q&Aj50% (2)

- Financial Management Formula TableDocument5 pagesFinancial Management Formula TableKumar SaurabhNo ratings yet

- Problem 2-14-AccountingDocument3 pagesProblem 2-14-AccountingSofia Gwen VenturaNo ratings yet

- Operations, Service and Parts Manual: 5000 Path Master PaverDocument93 pagesOperations, Service and Parts Manual: 5000 Path Master PaverjeevaNo ratings yet

- ROI Office 365Document14 pagesROI Office 365dgalvis_1No ratings yet

- 53B Intro To TPM Six Big LossesDocument32 pages53B Intro To TPM Six Big Lossesechsan dwi nugrohoNo ratings yet

- Data Market Inquiry SummaryDocument24 pagesData Market Inquiry SummaryJanice Healing100% (4)

- Individual AssignmentDocument5 pagesIndividual AssignmentLina Syazana Md RadziNo ratings yet

- Rule 02 - Cause of ActionDocument29 pagesRule 02 - Cause of ActionJereca Ubando Juba100% (1)

- Oracle FMW - System Administrator's Guide For OBIEE 11gR1Document560 pagesOracle FMW - System Administrator's Guide For OBIEE 11gR1hoangthanhquocNo ratings yet

- 07 Chapter2Document16 pages07 Chapter2Jigar JaniNo ratings yet

- Project Profile On Photography Studio: Production Capacity Per AnnumDocument5 pagesProject Profile On Photography Studio: Production Capacity Per Annumamit100% (1)

- Acknowledgement of DebtDocument3 pagesAcknowledgement of DebtNidhi DesaiNo ratings yet

- Appointment, Rights, Dismissal and Auditor's ResignationDocument17 pagesAppointment, Rights, Dismissal and Auditor's ResignationcleophacerevivalNo ratings yet

- Vocabulary in Context Questions ExerciseDocument3 pagesVocabulary in Context Questions ExercisePoedjie bohayNo ratings yet

- 2015 - SALN - Form GARDOQUEDocument2 pages2015 - SALN - Form GARDOQUEbokanegNo ratings yet

- Bajaj Auto LTDDocument16 pagesBajaj Auto LTDnigam34No ratings yet

- Sagan 1955Document2 pagesSagan 1955sanyakapNo ratings yet