Professional Documents

Culture Documents

Syllabus For Auditing Subjects

Uploaded by

Sutnek Isly0 ratings0% found this document useful (0 votes)

32 views2 pagesOriginal Title

Syllabus for Auditing Subjects

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views2 pagesSyllabus For Auditing Subjects

Uploaded by

Sutnek IslyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

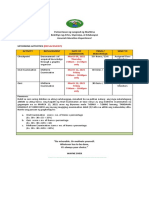

Course Coverage in Selected BSA Subjects

PrE 101 – Auditing and Assurance Principles

I. Audit – An Overview

II. Professional Standard

III. Auditor’s Responsibilities

IV. Audit Process- Accepting an Engagement

V. Audit Planning

VI. Consideration of Internal Control

VII. Auditing in Computerized Environment

VIII. Performing Substantive Test

IX. Audit Sampling

X. Completing the Audit

XI. Audit Reports on Financial Statements

XII. Assurance and Related Services

XIII. The Code of Ethics and RA 9298

PrE 102- Auditing and Assurance Concepts and Application

I. Audit of Cash & Cash Equivalents

II. Audit of Receivables

III. Audit of Inventories

IV. Audit of Investments

V. Audit of Property, Plant and Equipment

VI. Audit of Prepayments and Intangibles

VII. Audit of Liabilities

VIII. Audit of Shareholders’ Equity

IX. Audit of Other Income Statement Items

X. Accounting Policies, Estimates and Errors

XI. Statement of Cash Flows

ELE 102N – Professional Elective 2 (Operational Audit)

I. Introduction to Operational Audits

II. Objective of Operational Audit

III. Benefits of Operational Audits

IV. Operational Audit Challenges

V. Different Types of Operational Audits

VI. Operational Audit Process and checklist

VII. Operational Audit Activities

VIII. Conducting Audit Activities

IX. Engagement Process and Planning

X. Key Planning Process/Activities

XI. Internal Audit Management

XII. Principles of Internal Auditing

XIII. Internal Audit Techniques

XIV. Internal Audit Procedures

You might also like

- Principles of Auditing overviewDocument37 pagesPrinciples of Auditing overviewfreebirdovkNo ratings yet

- Iso 9001 Audit Trail: A Practical Guide to Process Auditing Following an Audit TrailFrom EverandIso 9001 Audit Trail: A Practical Guide to Process Auditing Following an Audit TrailRating: 5 out of 5 stars5/5 (3)

- Module 1 - ContentDocument9 pagesModule 1 - ContentRotimi Shitta-BeyNo ratings yet

- Auditing Internal Audit PresentationDocument40 pagesAuditing Internal Audit PresentationSamsuNo ratings yet

- Planning, Materiality and Audit Risk Handout - 2Document38 pagesPlanning, Materiality and Audit Risk Handout - 2Innocent escoNo ratings yet

- AUDIT MANUAL - HassenDocument161 pagesAUDIT MANUAL - HassendesktopmarsNo ratings yet

- Auditing For Non-AccountantsDocument229 pagesAuditing For Non-AccountantsRheneir Mora100% (1)

- I. Auditing Objectives of Owner's EquityDocument1 pageI. Auditing Objectives of Owner's EquitytemedebereNo ratings yet

- IntroductionDocument44 pagesIntroductionSaiful IslamNo ratings yet

- Revision Week: Auditing and Assurance 2 21 Mar 2019Document56 pagesRevision Week: Auditing and Assurance 2 21 Mar 2019Fatimah AzzahraNo ratings yet

- Auditing Principles Textbook Solutions Under 40 CharactersDocument32 pagesAuditing Principles Textbook Solutions Under 40 CharactersNia100% (2)

- Advanced Auditing and Assurance: Professional Conduct and Audit ProceduresDocument27 pagesAdvanced Auditing and Assurance: Professional Conduct and Audit ProceduresGABRIEL KAMAU KUNG'UNo ratings yet

- Auditing Course Covers Financial Statement AuditDocument9 pagesAuditing Course Covers Financial Statement AuditErik YongNo ratings yet

- Internal financial controlDocument145 pagesInternal financial controlpramodmurkya13No ratings yet

- International Auditing Standards GuideDocument32 pagesInternational Auditing Standards GuideNurul FajriyahNo ratings yet

- Chapter 4.2022.englishDocument44 pagesChapter 4.2022.english26 Đỗ Kim NgọcNo ratings yet

- Topic 5 - Planning, Risk Assessment and Audit RiskDocument20 pagesTopic 5 - Planning, Risk Assessment and Audit RiskSandile Henry DlaminiNo ratings yet

- CISA Chapter 1Document169 pagesCISA Chapter 1Nyange MashamNo ratings yet

- Chapter One On ScreenDocument60 pagesChapter One On Screenadane24No ratings yet

- HayesDocument36 pagesHayesBilal AhmadNo ratings yet

- 4 Audit Objectives, Audit Evidence & Staffing An AuditDocument30 pages4 Audit Objectives, Audit Evidence & Staffing An AuditSiham OsmanNo ratings yet

- Auditing Theory ModuleDocument42 pagesAuditing Theory Modulenickosalas3No ratings yet

- LectureNote AudiImpl UjiKompre 2022Document87 pagesLectureNote AudiImpl UjiKompre 2022ANDI MUHAMMAD RAYHANNo ratings yet

- Internal ControlDocument6 pagesInternal ControlSumbul SammoNo ratings yet

- Manual 2Document30 pagesManual 2Gideon HilardeNo ratings yet

- Acca FDocument26 pagesAcca FLinkon PeterNo ratings yet

- 3rd Chapter AssuranceDocument9 pages3rd Chapter AssuranceRashed AliNo ratings yet

- Book of AuditDocument294 pagesBook of Auditsabit hussenNo ratings yet

- Risk AsssesmentDocument13 pagesRisk Asssesmentutkarsh agarwalNo ratings yet

- Revision Slides June 2018: Lecturer Contact DetailsDocument44 pagesRevision Slides June 2018: Lecturer Contact Detailsstephen chinogaramombe100% (1)

- ACC 410 Advanced Auditing Module GuideDocument230 pagesACC 410 Advanced Auditing Module GuideArtwell Zulu100% (1)

- Entity-Level Controls Audit Work ProgramDocument31 pagesEntity-Level Controls Audit Work ProgramKevinNo ratings yet

- CA Inter Audit JKSCDocument358 pagesCA Inter Audit JKSCvishnuverma50% (2)

- Audit As A Control ToolDocument33 pagesAudit As A Control Toolprakar2No ratings yet

- Advance Auditing TechniquesDocument9 pagesAdvance Auditing TechniquesAbhishek PareekNo ratings yet

- 2017-1 Acct7103 01 L-BB PDFDocument7 pages2017-1 Acct7103 01 L-BB PDFStephanie XieNo ratings yet

- 330 - Korupsi Di IndonesiaDocument2 pages330 - Korupsi Di Indonesianur ahdiyahNo ratings yet

- Auditing and Assurance Services SyllabusDocument10 pagesAuditing and Assurance Services SyllabusMalathi accountsNo ratings yet

- ERT ProcedureDocument7 pagesERT ProcedureHaris RisdianaNo ratings yet

- IIA Standard 1110 states that the chief audit executive (CAE) "must confirm to the board, at least annually, the organizational independence of the internal audit activityDocument49 pagesIIA Standard 1110 states that the chief audit executive (CAE) "must confirm to the board, at least annually, the organizational independence of the internal audit activityJunior BakerigaNo ratings yet

- Study Scheme for Audit & Assurance S2 Strategic Level-1Document3 pagesStudy Scheme for Audit & Assurance S2 Strategic Level-1Salman Ahmed RabbaniNo ratings yet

- CH 4Document65 pagesCH 4Ram KumarNo ratings yet

- Internal Audit Manual: Ministry of Finance Royal Government of Bhutan 2014Document130 pagesInternal Audit Manual: Ministry of Finance Royal Government of Bhutan 2014Juan Frivaldo100% (1)

- Audit Snd Corporate Governance Kind 1Document176 pagesAudit Snd Corporate Governance Kind 1pradhanssah16220No ratings yet

- 1-Knowledge Assurance SM PDFDocument350 pages1-Knowledge Assurance SM PDFShahid MahmudNo ratings yet

- ACCA AA PER Support Sept23 - Jun24Document3 pagesACCA AA PER Support Sept23 - Jun24Abdo MustafaNo ratings yet

- Statement of Auditing StandardsDocument2 pagesStatement of Auditing StandardsMikaela SalvadorNo ratings yet

- Audit Plan New OkDocument32 pagesAudit Plan New OkSilvia zaharaNo ratings yet

- Auditing in Computer Environment System, Chapter 1 by James HallDocument22 pagesAuditing in Computer Environment System, Chapter 1 by James HallRobert Castillo100% (6)

- Sacmdd PDFDocument379 pagesSacmdd PDFYash ModiNo ratings yet

- Auditing KnecDocument2 pagesAuditing Kneckarekonjoki45No ratings yet

- QMS Internal Auditor Training ProgramDocument43 pagesQMS Internal Auditor Training ProgramJan Francis Wilson MapacpacNo ratings yet

- Kirk Report Adtng 422Document21 pagesKirk Report Adtng 422Pritz Marc Bautista MorataNo ratings yet

- Assignment - 1 - AuditDocument9 pagesAssignment - 1 - AuditMuskan singh RajputNo ratings yet

- IFC PPT AhmedabadDocument57 pagesIFC PPT AhmedabadPrashant JainNo ratings yet

- Internal Audit Summer Project ReportDocument75 pagesInternal Audit Summer Project ReportShikhil SharmaNo ratings yet

- CH 1 - Performing The IA EngagementDocument17 pagesCH 1 - Performing The IA EngagementSakhiwo MlumaNo ratings yet

- Auditing 1: Internal AuditDocument45 pagesAuditing 1: Internal AuditChrizt ChrisNo ratings yet

- (Replacement) : General Education DepartmentDocument3 pages(Replacement) : General Education DepartmentSutnek IslyNo ratings yet

- Activity 5 - Template - Ecological RelationshipsDocument2 pagesActivity 5 - Template - Ecological RelationshipsSutnek Isly33% (3)

- College of Business Management and Technology Learning ModulesDocument29 pagesCollege of Business Management and Technology Learning ModulesSutnek IslyNo ratings yet

- 7 Environmental PrinciplesDocument1 page7 Environmental PrinciplesSutnek Isly100% (1)

- Sec X143.2Document1 pageSec X143.2Sutnek IslyNo ratings yet

- Volleyball - History and Rules PDFDocument2 pagesVolleyball - History and Rules PDFSutnek IslyNo ratings yet

- Sec X143.2Document1 pageSec X143.2Sutnek IslyNo ratings yet

- Michaela L. Payong 1BSA1C Managerial Economics Oct. 21,2019 Dr. Cesar C. Estaquio Profit of Philippines Banks Up 28% in Jan-MarchDocument4 pagesMichaela L. Payong 1BSA1C Managerial Economics Oct. 21,2019 Dr. Cesar C. Estaquio Profit of Philippines Banks Up 28% in Jan-MarchSutnek IslyNo ratings yet

- Economic ForecastingDocument37 pagesEconomic ForecastingSutnek IslyNo ratings yet

- Models of CompetitionDocument35 pagesModels of CompetitionSheila Bliss Goc-ongNo ratings yet

- Chapter 1 - Guide to Current Liabilities, Provisions and ContingenciesDocument86 pagesChapter 1 - Guide to Current Liabilities, Provisions and ContingenciesSutnek Isly94% (17)