Professional Documents

Culture Documents

Prepayments Liabilites

Uploaded by

Krishele G. GotejerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prepayments Liabilites

Uploaded by

Krishele G. GotejerCopyright:

Available Formats

Problem 1 – Prepayments

The following information was discovered in connection with the Dec 31. 2020 examination of the

accounts of Good Inc.

a. December 31, 2020 Prepayment of advertising contract for 2020 was debited to advertising

b. Balance of the office supplies expense account, Dec, 31, 2020, P500,000.

Balance of office supplies on hand account, Dec. 31, 2020, P50,000.

Inventory value of office supplies Dec. 31, 2020, P75,000.

c. June 1, 2020 – Payment of 3, year insurance policy for fire loss on inventory was charged to

prepaid insurance, P180,000.

d. Balance of factory supplies expense account, Dec 31, 2020 P330,000. Physical inventory of

factory supplies Dec, 31, 2020 is P110,000.

e. On May 1, 2020 a 3 year subscription to the Professional Journal in the amount of P5,400 was

paid. Dues and subscription expense was charged to the entire amount.

f. The company leases the building it is occupying at an annual rental of P300,000. It paid a

security deposit equivalent to 3 months rental and one year advance rental totaling P375,000 on

June 25, 2020 effective July 1, 2020. These were booked as Prepaid rent.

g. Paid annual dues of P5,000 on Sept 1. 2020 to the Chamber of Commerce and charged to Dues

and Subscription expense

Required: Prepare the proposed adjusting and explanation for the above information.

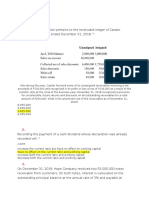

Problem 2 Liabilities

a. Salaries which are paid on the 15 th of the each month, were P135,700 for the period ended Dec.

31, 2020

b. BJ purchased P275,000 of inventory between Dec 23 and 31. 85% of the purchases were on

account . all purchases on account have terms of 3/12, net 30. BJ has a perpetual inventory

system and records accounts payable net of discount . no accounts were paid on Dec. 31, 2020

c. On Nov. 15, BJ borrowed cash from a local savings and loan bank in exchange for a 90 day

P2,000,000 note discounted at 12%.

d. December sales were P782,880, including a 12% sales tax that must be paid to the government

during the first quarter of 2021.

e. On Dec 1, 2020 a P550,000 forklift truck was purchased for use in the warehouse. The

equipment was paid for with P150,000 cash and by signing a P400,000, one year, 10% note.

f. During 2020, estimated income tax expense of P78,750 were paid each quarter. On Dec. 31,

2020, it was determined that actual income tax expense or both accounting and tax return for

2020 was P347,500.

Required:

1. Prepare the necessary journal entries to record the above transactions

2. Prepare 2020 year end adjusting entries related to interest on notes payable

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- ReSA B46 AFAR Final PB Exam Questions Answers SolutionsDocument24 pagesReSA B46 AFAR Final PB Exam Questions Answers SolutionsJohair BilaoNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- ReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsDocument25 pagesReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaNo ratings yet

- AUDProb TEST BANKDocument28 pagesAUDProb TEST BANKFrancine HollerNo ratings yet

- EX Broker Carrier - PacketDocument17 pagesEX Broker Carrier - PacketJor JisNo ratings yet

- Auditing Problem ReviewerDocument10 pagesAuditing Problem ReviewerTina Llorca83% (6)

- ReSA B42 FAR Final PB Exam - Questions, Answers - SolutionsDocument24 pagesReSA B42 FAR Final PB Exam - Questions, Answers - SolutionsLuna V100% (2)

- Pas 8811 2017Document42 pagesPas 8811 2017Mohammed HafizNo ratings yet

- RESA FAR PreWeek (B43)Document10 pagesRESA FAR PreWeek (B43)MellaniNo ratings yet

- FAR Problem SET A PDFDocument11 pagesFAR Problem SET A PDFNicole Aragon0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Prelim Lecture 1 Assignment: Multiple ChoiceDocument4 pagesPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNo ratings yet

- Far: Mock Qualifying Quiz 2 (Cash and Cash Equivalents & Loans and Receivables)Document8 pagesFar: Mock Qualifying Quiz 2 (Cash and Cash Equivalents & Loans and Receivables)RodelLaborNo ratings yet

- Accounting Sample ProblemsDocument9 pagesAccounting Sample Problemsjoong wanNo ratings yet

- AP-PW 91: Review Problems-1Document9 pagesAP-PW 91: Review Problems-1Joris YapNo ratings yet

- Internship ReportDocument48 pagesInternship Reportansar67% (3)

- Adjustments Quiz 1Document5 pagesAdjustments Quiz 1Christine Mae BurgosNo ratings yet

- GaBi Education Installation InstructionsDocument12 pagesGaBi Education Installation InstructionsCarlos Nemesio Paredes A.No ratings yet

- Test AfarDocument24 pagesTest AfarZyrelle Delgado100% (3)

- BL, 3rd, DhakapowerDocument2 pagesBL, 3rd, DhakapowerbappysaNo ratings yet

- Kemper B52453 2017 07 25Document157 pagesKemper B52453 2017 07 25Laura StylesNo ratings yet

- NonesDocument15 pagesNonesMary Rose Nones100% (3)

- FAR Preweek Lecture (B42)Document14 pagesFAR Preweek Lecture (B42)Ciarie Mae Salgado50% (4)

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessMichael Vincent Buan Suico100% (1)

- Adjusting EntriesDocument6 pagesAdjusting EntriesJanna PleteNo ratings yet

- Exercises. Correction of ErrorsDocument7 pagesExercises. Correction of ErrorsGia Sarah Barillo BandolaNo ratings yet

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- Cfas Fs PreparationDocument3 pagesCfas Fs PreparationEvelina Del RosarioNo ratings yet

- Quiz 1 - ACPRE3 - 03.01.22Document4 pagesQuiz 1 - ACPRE3 - 03.01.22Cristal CristobalNo ratings yet

- Acctg 205A Quiz NOV. 6,2020Document3 pagesAcctg 205A Quiz NOV. 6,2020Rheu ReyesNo ratings yet

- Sample Problem AdjustingDocument17 pagesSample Problem AdjustingHanna Mae CatudayNo ratings yet

- Intangibles: Problem 1Document7 pagesIntangibles: Problem 1Jeric Lagyaban AstrologioNo ratings yet

- At December 31Document9 pagesAt December 31Josephine MercadoNo ratings yet

- 5 6079864208529295481Document4 pages5 6079864208529295481Razel MhinNo ratings yet

- Practice Problems - Notes and Loans Receivable: General InstructionsDocument2 pagesPractice Problems - Notes and Loans Receivable: General Instructionseia aieNo ratings yet

- 91 - Final Preaboard Afar (Weekends)Document18 pages91 - Final Preaboard Afar (Weekends)Joris YapNo ratings yet

- 02 FAR02 Accounting-for-ReceivablesDocument3 pages02 FAR02 Accounting-for-ReceivablesBea GarciaNo ratings yet

- Long Quiz 2Document8 pagesLong Quiz 2CattleyaNo ratings yet

- Effects of Errors 2021Document2 pagesEffects of Errors 2021Ali SwizzleNo ratings yet

- Afar Construction Franchise and Hoba Q3Document5 pagesAfar Construction Franchise and Hoba Q3Heinie Joy PauleNo ratings yet

- 5 6145300324501422418 PDFDocument2 pages5 6145300324501422418 PDFBeverly MindoroNo ratings yet

- Exercises Reversing EntriesDocument2 pagesExercises Reversing EntriesAndrea Bercy CoballesNo ratings yet

- ACC 226 Expanded OpportunityDocument4 pagesACC 226 Expanded OpportunityEllen MNo ratings yet

- Notes ReceivableDocument3 pagesNotes Receivablepcdesktop.brarNo ratings yet

- Financial LiabilitiesDocument4 pagesFinancial LiabilitiesNicah AcojonNo ratings yet

- Prob Basic AcctDocument3 pagesProb Basic AcctSamuel Ferolino50% (2)

- Quiz 5 ReceivablesDocument1 pageQuiz 5 ReceivablesPanda ErarNo ratings yet

- Seatwork in Audit 2-3Document8 pagesSeatwork in Audit 2-3Shr BnNo ratings yet

- Acctg 9a Midterm Exam CH 9 15 CabreraDocument4 pagesAcctg 9a Midterm Exam CH 9 15 CabreraDonalyn BannagaoNo ratings yet

- Activity 1b - Current LiabilitiesDocument2 pagesActivity 1b - Current LiabilitiesUchayyaNo ratings yet

- 2ND Online Quiz Level 1 Set B (Answers)Document5 pages2ND Online Quiz Level 1 Set B (Answers)Vincent Larrie Moldez100% (1)

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- Accounting 4 Module 1 3Document3 pagesAccounting 4 Module 1 3Micaela EncinasNo ratings yet

- Intermediate Accounting 2 Prelim Exam Part II PDF FreeDocument5 pagesIntermediate Accounting 2 Prelim Exam Part II PDF FreeShairine AquinoNo ratings yet

- Diagnostic AssessmentDocument7 pagesDiagnostic AssessmentChristine JoyceNo ratings yet

- Far Drill2Document4 pagesFar Drill2Jung Hwan SoNo ratings yet

- FDNACCT Quiz-3 Set-C Answer-KeyDocument4 pagesFDNACCT Quiz-3 Set-C Answer-KeyPia DigaNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- Acctg 323 MT ExamDocument10 pagesAcctg 323 MT ExamJoyluxxiNo ratings yet

- Chapter 2Document8 pagesChapter 2cindyNo ratings yet

- Financial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)Document2 pagesFinancial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)ashleydelmundo14No ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Chapter 8 Risk and Return Krishele G. Gotejer BSA III-A: Principles of Managerial Finance, 15e, Global Edition (Zutter)Document5 pagesChapter 8 Risk and Return Krishele G. Gotejer BSA III-A: Principles of Managerial Finance, 15e, Global Edition (Zutter)Krishele G. GotejerNo ratings yet

- Ba 112 ReportDocument6 pagesBa 112 ReportKrishele G. GotejerNo ratings yet

- Activity 5 ENG100Document2 pagesActivity 5 ENG100Krishele G. GotejerNo ratings yet

- Ba 75 Irereport KoDocument5 pagesBa 75 Irereport KoKrishele G. GotejerNo ratings yet

- Chapter OneDocument6 pagesChapter OneKrishele G. GotejerNo ratings yet

- Quiz BudgetingDocument1 pageQuiz BudgetingKrishele G. GotejerNo ratings yet

- On The Space Provided For Before Each Number.)Document5 pagesOn The Space Provided For Before Each Number.)Krishele G. GotejerNo ratings yet

- Chapter 4 FeasibilityDocument13 pagesChapter 4 FeasibilityKrishele G. GotejerNo ratings yet

- Straight Problems 1Document3 pagesStraight Problems 1Krishele G. GotejerNo ratings yet

- On The Space Provided For Before Each Number.)Document5 pagesOn The Space Provided For Before Each Number.)Krishele G. GotejerNo ratings yet

- Problem 3Document7 pagesProblem 3Krishele G. GotejerNo ratings yet

- Problem 2 BA 74Document5 pagesProblem 2 BA 74Krishele G. GotejerNo ratings yet

- Chapter 3 V2Document12 pagesChapter 3 V2Krishele G. GotejerNo ratings yet

- Earnings Per Share 2021Document2 pagesEarnings Per Share 2021Ali SwizzleNo ratings yet

- Required Rate of Return 8% Required Rate of Return 11%Document3 pagesRequired Rate of Return 8% Required Rate of Return 11%Krishele G. GotejerNo ratings yet

- BA 53 Chapter 21 An 22Document4 pagesBA 53 Chapter 21 An 22Krishele G. GotejerNo ratings yet

- Tomas Claudio Colleges: College of Business and AccountancyDocument4 pagesTomas Claudio Colleges: College of Business and AccountancyKrishele G. GotejerNo ratings yet

- Chapter 26 FinalDocument11 pagesChapter 26 FinalLenlen VersozaNo ratings yet

- Tomas Claudio Colleges College of Business and Accountancy: Taghangin, Morong, RizalDocument4 pagesTomas Claudio Colleges College of Business and Accountancy: Taghangin, Morong, RizalKrishele G. GotejerNo ratings yet

- Table 21 Projected Income Statement December 31, 2021-2025 2021 2022 2023 2024 2025Document3 pagesTable 21 Projected Income Statement December 31, 2021-2025 2021 2022 2023 2024 2025Krishele G. GotejerNo ratings yet

- Operations Management ConceptsDocument10 pagesOperations Management ConceptsKrishele G. GotejerNo ratings yet

- Bsa A Ba75 Agriculture Group1Document38 pagesBsa A Ba75 Agriculture Group1Krishele G. GotejerNo ratings yet

- IA Reviewer 2Document25 pagesIA Reviewer 2Krishele G. GotejerNo ratings yet

- Intermediate AccountingDocument12 pagesIntermediate AccountingKrishele G. GotejerNo ratings yet

- TezpurDocument16 pagesTezpurnandini kalitaNo ratings yet

- University of Delhi: Semester Examination Nov-Dec 2018 TranscriptDocument1 pageUniversity of Delhi: Semester Examination Nov-Dec 2018 TranscriptVarun SinghNo ratings yet

- General Process Audit QuestionsDocument8 pagesGeneral Process Audit QuestionsTracy TreacherNo ratings yet

- As 1788-2-1987 Abrasive Wheels Selection Care and UseDocument6 pagesAs 1788-2-1987 Abrasive Wheels Selection Care and UseyowiskieNo ratings yet

- Kant 9 ThesisDocument6 pagesKant 9 ThesisMary Montoya100% (1)

- Supreme Court: Tañada, Sanchez, Tañada, Tañada For Petitioner. N.M. Lapuz For RespondentDocument10 pagesSupreme Court: Tañada, Sanchez, Tañada, Tañada For Petitioner. N.M. Lapuz For RespondentDiannee RomanoNo ratings yet

- Install Erdas Imagine 2018 Off Campus - WindowsDocument11 pagesInstall Erdas Imagine 2018 Off Campus - WindowsDan GheorghițăNo ratings yet

- 5 Challenges in SG's Social Compact (Tham YC and Goh YH)Document5 pages5 Challenges in SG's Social Compact (Tham YC and Goh YH)Ping LiNo ratings yet

- Writ HK NarulaDocument24 pagesWrit HK NarulasagarNo ratings yet

- TCS 10 Year Financial Statement FinalDocument14 pagesTCS 10 Year Financial Statement Finalgaurav sahuNo ratings yet

- Grade 11 Entreprenuership Module 1Document24 pagesGrade 11 Entreprenuership Module 1raymart fajiculayNo ratings yet

- FY22 IPEC Annual Report - FinalDocument163 pagesFY22 IPEC Annual Report - Finallars cupecNo ratings yet

- Bài Tập Unit 4Document7 pagesBài Tập Unit 4Nguyễn Lanh AnhNo ratings yet

- Components of A Balance Sheet AssetsDocument3 pagesComponents of A Balance Sheet AssetsAhmed Nawaz KhanNo ratings yet

- Kevin Murphy V Onondaga County (Doc 157) Criminal Acts Implicate Dominick AlbaneseDocument11 pagesKevin Murphy V Onondaga County (Doc 157) Criminal Acts Implicate Dominick AlbaneseDesiree YaganNo ratings yet

- COA 10 March 2020Document2 pagesCOA 10 March 2020Gabriel TalosNo ratings yet

- EY Philippines Tax Bulletin July 2016Document26 pagesEY Philippines Tax Bulletin July 2016evealyn.gloria.wat20No ratings yet

- Shri Niwas and Sons: Tax InvoiceDocument1 pageShri Niwas and Sons: Tax Invoicenitin guptaNo ratings yet

- Example Question Paper and Examiners' Feedback On Expected Answers (NGC1)Document12 pagesExample Question Paper and Examiners' Feedback On Expected Answers (NGC1)hamidsohailNo ratings yet

- 1 Ptot07awDocument40 pages1 Ptot07awSanket RoutNo ratings yet

- Reevaluation FormDocument2 pagesReevaluation FormkanchankonwarNo ratings yet

- Summary Procedure Under CPCDocument17 pagesSummary Procedure Under CPCmuatassimfarooqNo ratings yet

- उच्चत्तर शिक्षा शिभाग शिक्षा मंत्रालय भारत सरकार के तहत एक स्वायत्त संगठन ( (An Autonomous Organization under the Department of Higher Education, Ministry of Education, Government of India)Document1 pageउच्चत्तर शिक्षा शिभाग शिक्षा मंत्रालय भारत सरकार के तहत एक स्वायत्त संगठन ( (An Autonomous Organization under the Department of Higher Education, Ministry of Education, Government of India)DivyanshNo ratings yet

- Chapter 7Document24 pagesChapter 7Ranin, Manilac Melissa SNo ratings yet