Professional Documents

Culture Documents

Negotiable Instruments Act

Uploaded by

Soumya Mukherjee0 ratings0% found this document useful (0 votes)

20 views28 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views28 pagesNegotiable Instruments Act

Uploaded by

Soumya MukherjeeCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 28

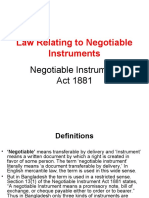

NEGOTIABLE INSTRUMENTS ACT

OF 1881

Prof. (CS) Monica Suri

Fellow Member of the Institute of

Company Secretaries of India

NEGOTIABLE INSTRUMENTS ACT,

1881

Negotiable Instrument means any

document transferable from one person

to another.

• Definition

• Section 13 states negotiable instrument means:

• “ promissory note or bill of exchange or

cheque payable to order or the bearer whether

the words oredr or bearer appear on the

instrument or not.”

• Negotiable Instrument means any document

transferable from one person to another.

• Essential features of negotiable

instrument:

1. Free transferability

2. Offer better title to the transferee.

3. Holder in due course is the owner.

4. Holder in due course can file recovery

on suits

5. The instrument is transferable till

maturity

TYPES OF NEGOTIABLE

INSTRUMENTS

• PROMISSORY • BILLS OF • CHEQUES

NOTES EXCHANGE

• DISHONOUR

• SECTION 4 • SECTION 5 UNDER SEC

138

• *PROMISSORY NOTES…… SECTION 4

• “Instrument in writing containing unconditional

undertaking signed by the maker to pay a

certain sum of money to or to the order of a

certain person or to only the bearer of the

instrument”

• Parties : Maker, payee, holder,

endorser, endorsee.

• Essentials of Promissory note:

1. Instrument in writing

2. Undertaking to pay

3. The undertaking to pay is unconditional.

4. It must be signed by the maker.

5. Amount payable must be certain and in

money form.

6. The payee must be certain.

7. Must be duly stamped as per the Stamp

Act.

• LETS TEST OUR UNDERSTANDING

IS IT PN ?

• Q1. I OWE YOU RS. 50000 RUPEES

TO BE PAID BY END OF NEXT MONTH

• Q2. I PROMISE TO PAY RS. 1 LAC IF

YOU MAKE ME A JOINT OWNER IN

COMPANY HOLDINGS.

BILLS OF EXCHANGE

…SECTION 5

• IS AN INSTRUMENT IN WRITING

UNCONDITIONAL ORDER SIGNED BY THE

MAKER DIRECTING A CERTAIN PERSON TO

PAY A CERTAIN SUM OF MONEY ONLY TO

OR THE ORDER OF CERTAIN SUM OR TO THE

BEARER OF THE INSTRUMENT.

• Parties: Drawer, Drawee, Acceptor, payee, holder,

endorser, endorsee, drawee, acceptor

• Essentials of Bills of Exchange

1. It must be in writing

2. It must be an order to pay

3. The order to pay must be unconditional

4. It must be signed by the drawer.

5. The parties to the bill must be certain.

6. The oder to pay must be in money.

7. The formalities like date , stamp and

others should be there

SPECIMEN OF B/E

• FORMS OF BILL OF EXCHANGE

Inland Bill

Foreign Bill

Trade Bill

Accomodation Bill

Bank Draft

Negotiation and

Endorsement

• Negotiation is a process of transfering

from one person to another ( first hand

transfer). Thus also confirms the right of

the owner to bring a legal suit if necessary.

• Indorsement ( endorsement) means

writing of the persons name on the back of

the instrument for the purpose of

negotiation.The person who signs is

endorser, who recives is called endorsee.

NEGOTIATION BY ENDORSEMENT AND DELIVERY

Types:

-BLANK OR GENERAL: SIGNS OR WRITES AT THE BACK

PAYABLE TO BEARER.

-SPECIAL OR FULL: ORDERED TO SPECIFIC PERSON

-RESTRICTIVE : PROHIBITS OR RESTRICTS FURTHER

NEGOTIATION OF INSTRUMENTS.

-PARTIAL : ENDORSEMENT OF HALF OF THE AMOUNT

-CONDITIONAL OR QUALIFIED : CONDITIONS STIPULATED

CHEQUE

A cheque is a bill of exchange drawn on a specified banker

and not expressed to be paid otherwise than on

demand.

-It is a B/E with two additional features:

-Always drawn on a banker.

-Always payable on demand.

A cheque could be open cheque( payable across counter ) or

closed cheque ( named with two parallel lines.)

TYPES OF CROSSINGS

General Crossing-

shown by two parallel lines

Special Crossings-

• mentions name of the banker on the face of

cheque

• Not negotiable may or may not be written.

Restrictive Crossings-

• Adopted for commercial or banking usage.

Section 138

• Section 138 of the act talks about punishment for

dishonoring of cheques.

• Section 138 was introduced as a criminal offence in

1989 by way of an amendment to the Negotiable

Instruments Act, 1881.

• The main objective of introduction of this section was to

encourage the use of cheques and increasing the

credibility of transactions through cheques by making

the dishonoring of the cheques as an offence.

• Section 138 provides that when the

cheque is dishonored for insufficiency of

funds or for any of the prescribed reasons,

the one who is at defaulter can be

punished with imprisonment for a term

which may extend to two years, or with

fine which may extend to twice the

amount of the cheque, or both. This is also

a non-cognizable offence.

•

• LETS TEST OUR UNDERSTANDING

• Q1. What is endorsement of Instrument

• Q2. Any one difference between Bills of

Exchange and PN.

• Q3. What does Section 138 state ?

You might also like

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- A Group Presentation of Business Law OnDocument43 pagesA Group Presentation of Business Law OnvakhariajimmyNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- 10 Concept and Importance of Negotiable InstrumentsDocument7 pages10 Concept and Importance of Negotiable InstrumentsdeveshwerNo ratings yet

- Just Fell Out of Escrow: Top 5 reasons a property does not sellFrom EverandJust Fell Out of Escrow: Top 5 reasons a property does not sellNo ratings yet

- Unit-4 Negotiable Instruments ActDocument27 pagesUnit-4 Negotiable Instruments Actfa7041898908100% (1)

- Negotiable Instruments Law (BLAW 3)Document24 pagesNegotiable Instruments Law (BLAW 3)Aura Garcia-GabrielNo ratings yet

- New York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]From EverandNew York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]No ratings yet

- The Negotiable Instruments Act 1881Document32 pagesThe Negotiable Instruments Act 1881Mahenaz AnsariNo ratings yet

- Unit 4 - Contracts 2-1Document30 pagesUnit 4 - Contracts 2-1sarthak chughNo ratings yet

- BY: 37 MBA 09 43 MBA 09: Venika Saini Anuj GuptaDocument31 pagesBY: 37 MBA 09 43 MBA 09: Venika Saini Anuj GuptaaditibakshiNo ratings yet

- Chapter 05 Negotiable Instruments Act 1881 1229869805849562 1Document11 pagesChapter 05 Negotiable Instruments Act 1881 1229869805849562 1अरुण शर्माNo ratings yet

- Marking of ChecksDocument11 pagesMarking of ChecksPavel LahaNo ratings yet

- NEGOTIABLE INSTRUMENTS ACT DEFINITIONDocument11 pagesNEGOTIABLE INSTRUMENTS ACT DEFINITIONkallasanjay100% (1)

- Negotiable InstrumentsDocument17 pagesNegotiable InstrumentsShamaarajShankerNo ratings yet

- Unit 3 Negotiable InstrumentDocument37 pagesUnit 3 Negotiable InstrumentsourabhdangarhNo ratings yet

- Commercial Paper BasicsDocument45 pagesCommercial Paper BasicsSimranNo ratings yet

- Negotiable Instrument Act, 1881Document12 pagesNegotiable Instrument Act, 1881sagarg94gmailcomNo ratings yet

- 4 4 09negotiable Instrument Act, 1881Document30 pages4 4 09negotiable Instrument Act, 1881Mohit AgrawalNo ratings yet

- BL Mod 3Document32 pagesBL Mod 3godlistengideon7No ratings yet

- Business LawDocument76 pagesBusiness LawAbinash MNo ratings yet

- Instruments of CreditDocument30 pagesInstruments of CreditNuman Rox100% (1)

- The Negotiable Instruments Law (Act No. 2031) PART 1Document86 pagesThe Negotiable Instruments Law (Act No. 2031) PART 1Kelvin CulajaraNo ratings yet

- 4-NMIMS Banking 4 of 5Document69 pages4-NMIMS Banking 4 of 5raghav singhalNo ratings yet

- Negotiable InstrumentsDocument18 pagesNegotiable InstrumentsPankaj DograNo ratings yet

- Law Relating to Negotiable Instruments in BangladeshDocument67 pagesLaw Relating to Negotiable Instruments in BangladeshChowdhury AnupamNo ratings yet

- Negotiable Instruments Act 123Document10 pagesNegotiable Instruments Act 123sagarsavlaNo ratings yet

- Unit 4 BL MadeDocument38 pagesUnit 4 BL Madesagar dafareNo ratings yet

- PDF&Rendition 1 1Document73 pagesPDF&Rendition 1 1Srividya SNo ratings yet

- Negotiable Instruments Act of 1881 ExplainedDocument12 pagesNegotiable Instruments Act of 1881 ExplainedrahulggnNo ratings yet

- Negotiable Instruments (MSL706) PDFDocument60 pagesNegotiable Instruments (MSL706) PDFharshaliNo ratings yet

- Negotiable Instruments LawDocument11 pagesNegotiable Instruments LawSophia JunelleNo ratings yet

- THE Negotiable Instruments ACT, 1881Document54 pagesTHE Negotiable Instruments ACT, 1881Shradha PadhiNo ratings yet

- Negotiable Instrument ActDocument22 pagesNegotiable Instrument ActMIHIR1304No ratings yet

- Negotiable Instrument Act 1881Document31 pagesNegotiable Instrument Act 1881Mahesh KumarNo ratings yet

- Kajal GoudDocument9 pagesKajal GoudKajal GoudNo ratings yet

- The Negotiable Instruments Act Amendment and Key ConceptsDocument43 pagesThe Negotiable Instruments Act Amendment and Key ConceptsNidhi WadaskarNo ratings yet

- Negotiable Instruments: Presented By: Shaila Khan Vishnu Vijaya Kumar Vaibhav Tanwar UmmehaniDocument16 pagesNegotiable Instruments: Presented By: Shaila Khan Vishnu Vijaya Kumar Vaibhav Tanwar Ummehanishaila khanNo ratings yet

- Negotiable Instruments Act, 1881Document104 pagesNegotiable Instruments Act, 1881Tania SethiNo ratings yet

- Promissory NotesDocument5 pagesPromissory NotesHimanshu DarganNo ratings yet

- Negotiable InstrumentsDocument82 pagesNegotiable InstrumentsPraveen LalNo ratings yet

- Negotiable Instruments Law (Nil)Document4 pagesNegotiable Instruments Law (Nil)Micaella GrandeNo ratings yet

- Law Negotiable InstrumentsDocument25 pagesLaw Negotiable InstrumentsSushil Kartik KarmakarNo ratings yet

- Negotiable Instrument Act 1881Document75 pagesNegotiable Instrument Act 1881Siva Venkata Ramana100% (1)

- Unit 3 - Negotiable Intruments Act, 1881Document58 pagesUnit 3 - Negotiable Intruments Act, 1881Naman SethNo ratings yet

- Legal Aspects of Business: Negotiable Instruments Act 1881Document16 pagesLegal Aspects of Business: Negotiable Instruments Act 1881srikarNo ratings yet

- Negotiable Instruments Act, 1881Document30 pagesNegotiable Instruments Act, 1881pearlksrNo ratings yet

- Negotiable Instruments Act: Learning and Knowledge Management CentreDocument62 pagesNegotiable Instruments Act: Learning and Knowledge Management CentrezidhichoraNo ratings yet

- Bankingtheorylawpracticeunitiiippt 240307181015 7e5977faDocument29 pagesBankingtheorylawpracticeunitiiippt 240307181015 7e5977fadharshan0425No ratings yet

- Negotiable Instruments Act 1881: by K M ChandrakanthDocument41 pagesNegotiable Instruments Act 1881: by K M Chandrakanthsurya kiranNo ratings yet

- M3 NegotiableDocument92 pagesM3 NegotiableChetna VaghasiyaNo ratings yet

- The Reserve Bank of India Act, 1934Document10 pagesThe Reserve Bank of India Act, 1934FRANCIS TAKYINo ratings yet

- Unit II Banking and Insurance Law Study NotesDocument12 pagesUnit II Banking and Insurance Law Study NotesSekar M KPRCAS-CommerceNo ratings yet

- Negotiable Instruments ActDocument38 pagesNegotiable Instruments ActSonali Namdeo DaineNo ratings yet

- Negotiable Instruments Act ExplainedDocument23 pagesNegotiable Instruments Act ExplainedAishwarya PriyadarshiniNo ratings yet

- Promissory NoteDocument10 pagesPromissory NoteIsh ChavanNo ratings yet

- Unit 3 Negotiable Instruments Act 1881Document22 pagesUnit 3 Negotiable Instruments Act 1881yamoka2001No ratings yet

- Negotiable Instruments Act Lecture SummaryDocument4 pagesNegotiable Instruments Act Lecture SummaryEshthiak HossainNo ratings yet

- Legal and Regulatory LawsDocument110 pagesLegal and Regulatory LawsAniruddha JadhavNo ratings yet

- Sales - IJSMM - Introduction of Sales Automation - Mona ChadudharyDocument6 pagesSales - IJSMM - Introduction of Sales Automation - Mona Chadudharyiaset123No ratings yet

- Juice in IndiaDocument10 pagesJuice in IndiaSoumya MukherjeeNo ratings yet

- IRLL - IR Situation in IndiaDocument10 pagesIRLL - IR Situation in IndiaSoumya MukherjeeNo ratings yet

- Carbonates in IndiaDocument10 pagesCarbonates in IndiaSoumya MukherjeeNo ratings yet

- Company Law 2013Document65 pagesCompany Law 2013Soumya MukherjeeNo ratings yet

- Legal Env &contract Act - M1-M2Document52 pagesLegal Env &contract Act - M1-M2Soumya MukherjeeNo ratings yet

- Carbonates in IndiaDocument10 pagesCarbonates in IndiaSoumya MukherjeeNo ratings yet

- IRLL - IR Situation in IndiaDocument10 pagesIRLL - IR Situation in IndiaSoumya MukherjeeNo ratings yet

- Consumer Protection &COPRADocument33 pagesConsumer Protection &COPRASoumya MukherjeeNo ratings yet

- Juice in IndiaDocument10 pagesJuice in IndiaSoumya MukherjeeNo ratings yet

- Code of SS GazetteDocument116 pagesCode of SS GazetteBuddho BuddhaNo ratings yet

- Global and Indian Perspectives on Labour in the New Industrial Relations EraDocument14 pagesGlobal and Indian Perspectives on Labour in the New Industrial Relations EraSoumya MukherjeeNo ratings yet

- Sale of GoodsDocument27 pagesSale of GoodsSoumya MukherjeeNo ratings yet

- Conditions of Contract PAM v1998Document27 pagesConditions of Contract PAM v1998slingggNo ratings yet

- Chap 21 - Leasing (PSAK 73) - E12-12Document27 pagesChap 21 - Leasing (PSAK 73) - E12-12Happy MichaelNo ratings yet

- Btec HND in Business (Finance) : Assignment Cover SheetDocument27 pagesBtec HND in Business (Finance) : Assignment Cover SheetViệt PhongNo ratings yet

- Work ManualDocument116 pagesWork ManualSainaath RNo ratings yet

- Karnataka Stamp Act 1957 Schedule PDFDocument53 pagesKarnataka Stamp Act 1957 Schedule PDFRAJESH KUMARNo ratings yet

- BM Cia 1Document21 pagesBM Cia 1SAHILNo ratings yet

- NDRG Research PaperDocument6 pagesNDRG Research PaperTodd ClausenNo ratings yet

- Aptitude QN Set 4Document3 pagesAptitude QN Set 4priyajenatNo ratings yet

- Group-08 Sess-05 ACMEDocument6 pagesGroup-08 Sess-05 ACMEParashar ShivNo ratings yet

- Mortgage Banker Branch Manager in Denver CO Resume Gregory KahlerDocument1 pageMortgage Banker Branch Manager in Denver CO Resume Gregory KahlerGregoryKahlerNo ratings yet

- Country Commercial Guide 2014Document70 pagesCountry Commercial Guide 2014btittyNo ratings yet

- Financial CaseStudy Report FormatDocument17 pagesFinancial CaseStudy Report FormatPratik Wankhede100% (1)

- Four Green Houses... One Red HotelDocument325 pagesFour Green Houses... One Red HotelDhruv Thakkar100% (1)

- Problem Set: Capital Budgeting: RJW 4 Ed. Chapter 6Document1 pageProblem Set: Capital Budgeting: RJW 4 Ed. Chapter 6alan david melchor lopezNo ratings yet

- Night Audit Report for 10/01/23Document1 pageNight Audit Report for 10/01/23Vivek BhadviyaNo ratings yet

- FIN4715 Sectional A1 Group 8 - Group Project Report PDFDocument18 pagesFIN4715 Sectional A1 Group 8 - Group Project Report PDFJiarouNo ratings yet

- The Building - ChilehausDocument12 pagesThe Building - ChilehausRafael GonzálezNo ratings yet

- 11th English EM - 1st Revision Test 2023 - Original Question Paper - Cudalore District - English Medium PDF DownloadDocument4 pages11th English EM - 1st Revision Test 2023 - Original Question Paper - Cudalore District - English Medium PDF DownloadArihara SudhanNo ratings yet

- Three Point SystemDocument2 pagesThree Point SystemtrionjetNo ratings yet

- Philguarantee Vs VPECI and 3plexDocument1 pagePhilguarantee Vs VPECI and 3plexChaNo ratings yet

- The Pig and The CowDocument24 pagesThe Pig and The CowdikpalakNo ratings yet

- Who Is The Ostensible OwnerDocument10 pagesWho Is The Ostensible OwnerdeepakNo ratings yet

- How Credit Influences the Business CycleDocument129 pagesHow Credit Influences the Business CycleKim Ritua - Tabudlo40% (5)

- Equity ValuationDocument32 pagesEquity Valuationprince455No ratings yet

- BHARATH Et Al-2013-The Journal of Finance PDFDocument33 pagesBHARATH Et Al-2013-The Journal of Finance PDFpraveena1787No ratings yet

- Saliva Robin Jaycob M Statement of AffairsDocument6 pagesSaliva Robin Jaycob M Statement of AffairsRobin SalivaNo ratings yet

- 72 87 MC ProblemsDocument7 pages72 87 MC ProblemsLerma MarianoNo ratings yet

- 1.1 - Industry Profile: Chapter - 1Document75 pages1.1 - Industry Profile: Chapter - 1Deekshith NNo ratings yet

- Business Studies Class 12 Project 2014-15Document15 pagesBusiness Studies Class 12 Project 2014-15Raghav Aggarwal17% (6)

- H. R. 6433Document3 pagesH. R. 6433ABC6/FOX28No ratings yet

![New York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]](https://imgv2-1-f.scribdassets.com/img/word_document/661176503/149x198/6cedb9a16a/1690336075?v=1)