Professional Documents

Culture Documents

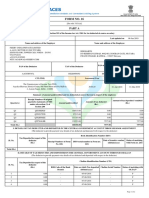

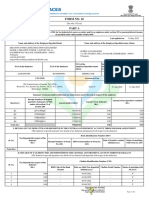

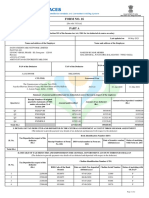

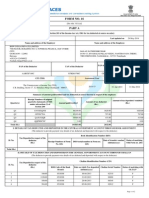

Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The Employee

Uploaded by

GjjnnmOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The Employee

Uploaded by

GjjnnmCopyright:

Available Formats

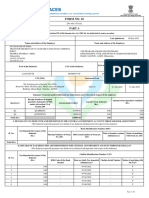

FORM NO.

16

See rule 31(1) (a)

Certificate under section 203 of the Income-ta Act, 1961 for taz deducted at source on Salary

- - -

---------t-------------

Name and address of the Employer Name, EmpNo, Bill Unit, Station and desig. of the Employee

-+--- -*---~- ----=-- - =. ----+.

Ministry of Railways, Govt. of India, Rail Bhawan DEV NARAYAN SAH, 52406419756, 2414600, BELA, AWM

- - - - - - - - - - - - . t - - - - - - - - - - - - - - .- -

PAN of the Deductor. TAN of the Deductor. PAN of the Employee.

--

PTNRO2504F ANOPS4828H

CIT (TDS) ASsessment Year Period

-

Address: From

2021-2022 01/APR/2020 31/0CT/2020

City: Pin Code:

PART B(Refer Note 1

----*

Details of Salary paid and any other income and tax deducted.

1. Gross salary

- -

(a) Salary as per provisions contained in sec.17(1) 1506068

(b) value of perquisites u/s 17(2) (as per Form No. 12BA, wherever applic|

-~~ ~----~ ----~-*

(c) Profits in lieu of salary u/s 17(3) (as per Form No. 12BA,wherever ap

- - - - - - - - - - - - - -

(d) Total |1506068

2. Less: Allowance to the extent exempt u/s 10

(a ) House Rent Allowance

(b)Education and Hostel Allowances For Child

(c) STANDARD DEDUCTION U/s 16(a) 50000

Total 50000

3. Balance (1-2 1456068

4. Deductions

(a) Entertainment allowance 0

- .

(b) TaX on Employment

- - - - - - - - - - - - - - - - - - - - .

5. Aggregate of 4 (a) and (b)

6. Income chargeable under the head. Salaries ( 3 - 5) 1456068

- - - -

7. Add: Any other income reported by the employee

Total

- - -

8. Gross total income (6 + 7) 1456068

t-----

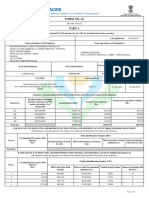

ame Emptio, Bill Unit, Station and desig. of the Employel DEV NARAYAN SAH, 52406419756, 2414600, BELA AN

---

- - - - -

9. Deductions under Chapter VIA

--------------

(A) sections 80C, 80CCC and B80CCD

Gross Amount | Deduct ible Amt

------------------

(a) section 80C

*****

(1)PF+VPF 61073

(2)GIS 300

Total

- - - -

61373 61373

(b) section 80Ccc

-----------------

(C)section 80CCD( 2) (GOVT CONTRIBUTION REBATE) 0

****:***--++--

---------------

Note T.

aggregate amount deductible under section 80C shall

not exceed T.5 lakh rupees

**::**---°----

------~------------t--------------*

- - - - - - - - - -

ggregate amount deduct ible under three sections, i.e., 8OC, 8occC and 8occD, shall not exceed 1.5 lakh rupees

-----t--. -+--

(B) other sections (for e.g. 8OE, 80G etc.) under Chapter VIA

Gross Amount| Qualifying Am | Deductible Amt

-----~---

-**-~>-----~-----

T

(1 ) DONATIONS 3047 3047 3047

Tota

3047 3047 3041

-t---~-----

10. Aggregate of deductible amounts under Chapter VI-

64420

T - ~ - -

11. Total income (8-10)

1391650

- - - - - - - - - - - - - -- ----

12. Ta on total income

| 227495

**------- -~--------

13. Edu Cess 4 t (on tax computed at S. No. 12)

9100

- - - - - - - -

14. Tax payable (12+13)

236595

15. LesS: Relief under sect. 89 (attach details) 0

---~--~-----. --.

16. Tax payable (14-15)

236595

* * * * * * * *

--4+ - - - - -

17. Total Tax Paid

74956

18. Tax payable/Refundable (16-17)

- - - - - - - - - - - - - -

161640

ARDIND KUMAR SHURLA son/daughter of RAJ BALLABH SHUKLA working in the capacity of ASST. PERS. orriCER-A

o hereby certify that a sum of Rs. 74956|RS. Seventy Four Thousand Nine Hundred Pifty Siz Only (in words) l

as been deducted at 5ource and paid to the credit of the Central Governnent. I further certify that the informat ion

iven above is true and correct based on the books of account, documents and other available recors

lace : RWP BELA Signatue of the personresponsible for

ate :10/07/2021

deduction,

Full

oEtaxnnal Ofic

Name:ARDIND KUMAR SHUKLA

Designation ASST PERS/ OFPICER-A

Raf vvhe Plant/Bela

You might also like

- Payslip For 16831 (2daf)Document1 pagePayslip For 16831 (2daf)omkassNo ratings yet

- Apply Occupational Health and Safety Procedures Iticor0021aDocument49 pagesApply Occupational Health and Safety Procedures Iticor0021aapi-247871582100% (3)

- BLJPM3369M 2014-15Document2 pagesBLJPM3369M 2014-15jackproewildNo ratings yet

- Scaffolding Safety: Erection of Mobile ScaffoldingDocument18 pagesScaffolding Safety: Erection of Mobile Scaffoldingmuzica muzNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form 16 Salary CertificateDocument9 pagesForm 16 Salary CertificateHarish KumarNo ratings yet

- Thyrocare Technologies Salary Slip April 2018Document1 pageThyrocare Technologies Salary Slip April 2018BIPINNo ratings yet

- BFJPJ5437H 2019-20 SignedDocument5 pagesBFJPJ5437H 2019-20 SignedUjjwal JoshiNo ratings yet

- Form16 Fiserv 2018-19Document8 pagesForm16 Fiserv 2018-19SiddharthNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Form 16 TDS certificate summaryDocument3 pagesForm 16 TDS certificate summarykumar reddyNo ratings yet

- Aofpc1472d 2020-21Document2 pagesAofpc1472d 2020-21uday digumarthiNo ratings yet

- CT20110377825Document13 pagesCT20110377825Raghuram DasariNo ratings yet

- Kansupriya@Deloitte - Com f162022 2023Document10 pagesKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNo ratings yet

- Green HRDocument50 pagesGreen HRsuryakantshrotriyaNo ratings yet

- Form No. 16: Part ADocument9 pagesForm No. 16: Part ArakehsNo ratings yet

- FORM 16AA TAX DEDUCTION CERTIFICATEDocument5 pagesFORM 16AA TAX DEDUCTION CERTIFICATEJagdish Sharma CANo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Securing London's Cultural Future: A Guide to Affordable Artist StudiosDocument34 pagesSecuring London's Cultural Future: A Guide to Affordable Artist StudiosJamie LynchNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaNo ratings yet

- SRS Business Solutions (India) PVT - LTD: Attendance Details ValueDocument1 pageSRS Business Solutions (India) PVT - LTD: Attendance Details ValueraghavaNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- A-Radha@dxc - Com F16Document9 pagesA-Radha@dxc - Com F16Radha PraveenNo ratings yet

- Ack 657377180240723Document1 pageAck 657377180240723SRIYA GADAGOJUNo ratings yet

- Final Swot & Ie MatrixDocument26 pagesFinal Swot & Ie MatrixakhshayamNo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Form 16 ADocument2 pagesForm 16 ANitya NarayananNo ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- UnknownDocument2 pagesUnknownSudip MondalNo ratings yet

- FORM 16 CERTIFICATEDocument3 pagesFORM 16 CERTIFICATEDebesh KuanrNo ratings yet

- Stephen Pheasant (Auth.) - Ergonomics, Work and Health-Macmillan Education UK (1991)Document369 pagesStephen Pheasant (Auth.) - Ergonomics, Work and Health-Macmillan Education UK (1991)FernandaFaustNo ratings yet

- RPT Pay SlipDocument1 pageRPT Pay SlipAllia sharmaNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedpadduNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023arun poojariNo ratings yet

- Salary Slip - Feb. 2019Document1 pageSalary Slip - Feb. 2019Akibkhan PathanNo ratings yet

- Form 16 TDS CertificateDocument9 pagesForm 16 TDS CertificateAmit GautamNo ratings yet

- Payslip 4 2021Document1 pagePayslip 4 2021Mehraj PashaNo ratings yet

- Form 16 TDS certificate for FY 2014-15Document2 pagesForm 16 TDS certificate for FY 2014-15RamyaMeenakshiNo ratings yet

- Ahxxxxxxxq q4 2022-23Document2 pagesAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNo ratings yet

- Updated Vstep Writing Test 2020 - B2 NewDocument9 pagesUpdated Vstep Writing Test 2020 - B2 NewRoyal Never GiveupNo ratings yet

- Form 16 2020 21Document6 pagesForm 16 2020 21Manoj MahimkarNo ratings yet

- Salary SlipDocument1 pageSalary Slipmimrantaj100% (1)

- Abrpb4480f Partb 2020-21Document3 pagesAbrpb4480f Partb 2020-21Subray N BanaulikarNo ratings yet

- Rel OracleDocument1 pageRel OracleAkhil RangarajuNo ratings yet

- Diverse Careers in Community PsychologyDocument361 pagesDiverse Careers in Community PsychologyRita Carmo EvangelistaNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- Pay Slip March 2017Document4 pagesPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedPrantik PramanikNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument2 pagesFORM 16 TAX DEDUCTION CERTIFICATEpiyushkumar patelNo ratings yet

- Salay Slip For The Period of Month Jan - 2018Document3 pagesSalay Slip For The Period of Month Jan - 2018Yogesh SankpalNo ratings yet

- 1 1000 Form16Document5 pages1 1000 Form16Rakshit SharmaNo ratings yet

- Private Company Salary SlipDocument1 pagePrivate Company Salary SlipRamesh BabuNo ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalNo ratings yet

- India Payslip January 2022Document1 pageIndia Payslip January 2022Mir KazimNo ratings yet

- Symbiotic Automation Systems (P) Ltd. Bangalore Pay Slip For The Month of March - 2017Document1 pageSymbiotic Automation Systems (P) Ltd. Bangalore Pay Slip For The Month of March - 2017Anindya BasuNo ratings yet

- Manish Dwivedi Nov-18Document1 pageManish Dwivedi Nov-18Anonymous 3P7aeUIW2No ratings yet

- M/s. Valmind IT Needs Private Limited Pay Slip: Gross Pay 12,083 Net Pay 11,333Document5 pagesM/s. Valmind IT Needs Private Limited Pay Slip: Gross Pay 12,083 Net Pay 11,333Tech-savvy GirishaNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementSagar Kumar GuptaNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Technical Support Executive Appointment LetterDocument4 pagesTechnical Support Executive Appointment LetterArvind SinghaniyaNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Form16 10-11Document4 pagesForm16 10-11voiceofindia811No ratings yet

- Bihar Police Prilimanary Exam DetailsDocument1 pageBihar Police Prilimanary Exam DetailsGjjnnmNo ratings yet

- Qiz Related To Mahtama GandhiDocument10 pagesQiz Related To Mahtama GandhiGjjnnmNo ratings yet

- Answer of Part - 1 Bihar BoardDocument1 pageAnswer of Part - 1 Bihar BoardGjjnnmNo ratings yet

- mcq-PART-1 - HISTORY MODERNDocument13 pagesmcq-PART-1 - HISTORY MODERNGjjnnmNo ratings yet

- BIODATA Navin SelfDocument1 pageBIODATA Navin SelfGjjnnmNo ratings yet

- All 1 Bihar Most Important QuesDocument6 pagesAll 1 Bihar Most Important QuesGjjnnmNo ratings yet

- Focus Tricks Part 1Document1 pageFocus Tricks Part 1GjjnnmNo ratings yet

- School Deaffilation List Know Which and When 2020 School Colleges Deaffilition Took Place Do You Know and WhenDocument46 pagesSchool Deaffilation List Know Which and When 2020 School Colleges Deaffilition Took Place Do You Know and WhenGjjnnmNo ratings yet

- Elite Mathematical Tricks Part 1Document1 pageElite Mathematical Tricks Part 1GjjnnmNo ratings yet

- Elite Mathematical Tricks Part 1Document1 pageElite Mathematical Tricks Part 1GjjnnmNo ratings yet

- ISO 8696-Gasto EnergeticoDocument8 pagesISO 8696-Gasto EnergeticoMaría GonzálezNo ratings yet

- Project Report On Performance ManagmentDocument5 pagesProject Report On Performance ManagmentClarissa AntaoNo ratings yet

- Vison 21 LTD ProjectDocument41 pagesVison 21 LTD ProjectANWARNo ratings yet

- Diablo Canyon A1608006 - Proposed Decision Revision 2 - 01 09 18Document78 pagesDiablo Canyon A1608006 - Proposed Decision Revision 2 - 01 09 18Rob NikolewskiNo ratings yet

- HR Practices of Marks and Spencer Selfri PDFDocument46 pagesHR Practices of Marks and Spencer Selfri PDFbalach100% (1)

- Diesel Electrician Test BatteryDocument25 pagesDiesel Electrician Test Batteryrailroad700No ratings yet

- LastthreemonthPayslip 2Document7 pagesLastthreemonthPayslip 2delicata.benNo ratings yet

- The Family and Economic Development PDFDocument9 pagesThe Family and Economic Development PDFmineasaroeunNo ratings yet

- Dawn Bread Internship ReportDocument65 pagesDawn Bread Internship ReportShahid BashirNo ratings yet

- Acctsys Formativ TriasDocument11 pagesAcctsys Formativ TriasMila Mercado100% (1)

- Article Equal Employment PracticesDocument9 pagesArticle Equal Employment PracticesHamza KhawajaNo ratings yet

- May 2015Document64 pagesMay 2015Eric SantiagoNo ratings yet

- Execution Without ExcusesDocument16 pagesExecution Without ExcusesVishnu Menon100% (1)

- University Malaysia Kelantan (UMK) : Course NameDocument18 pagesUniversity Malaysia Kelantan (UMK) : Course NameshobuzfeniNo ratings yet

- UP Manila HR Approves Job OrdersDocument2 pagesUP Manila HR Approves Job OrdersMaximusNo ratings yet

- Internship Agreement EnglishDocument9 pagesInternship Agreement EnglishKGS Quality ActionNo ratings yet

- Case Jetblue 1Document4 pagesCase Jetblue 1田思雨No ratings yet

- Human Resource Policies and Procedures Manual For The Public ServiceDocument163 pagesHuman Resource Policies and Procedures Manual For The Public ServiceAMANANG'OLE BENARD ILENYNo ratings yet

- HRM Case StudyDocument17 pagesHRM Case Studyadarose romaresNo ratings yet

- Iwg Workplace Survey 2019Document27 pagesIwg Workplace Survey 2019Annapurna HirematNo ratings yet

- Yuvna Gupta Eumind Article On Manual ScavengingDocument2 pagesYuvna Gupta Eumind Article On Manual Scavengingapi-541981758No ratings yet

- A Collection of The Central Acts and Ordinances For The Year 1969 Government of Pakistan Ministry of Law and Parliamentary Affairs (Law Divisian)Document243 pagesA Collection of The Central Acts and Ordinances For The Year 1969 Government of Pakistan Ministry of Law and Parliamentary Affairs (Law Divisian)charbagh.oepNo ratings yet